Aave – a lending platform, originally known as ETHLend, but with a radically redesigned strategy. If ETHLend provided the opportunity for direct credit relations between lenders and borrowers, then with the release of the Aave protocol, a decentralized pool-based strategy began to work. We offer an overview of this platform from the editors of Bitcoinminershashrate.com.

The credit pool works as follows: users create liquidity by investing cryptocurrencies in the pool. Other users can take advantage of these funds by leaving others as collateral. Loans are not selected individually – for all there are the same conditions, which are adjusted depending on the current state of the pool. All operations are controlled by smart contracts.

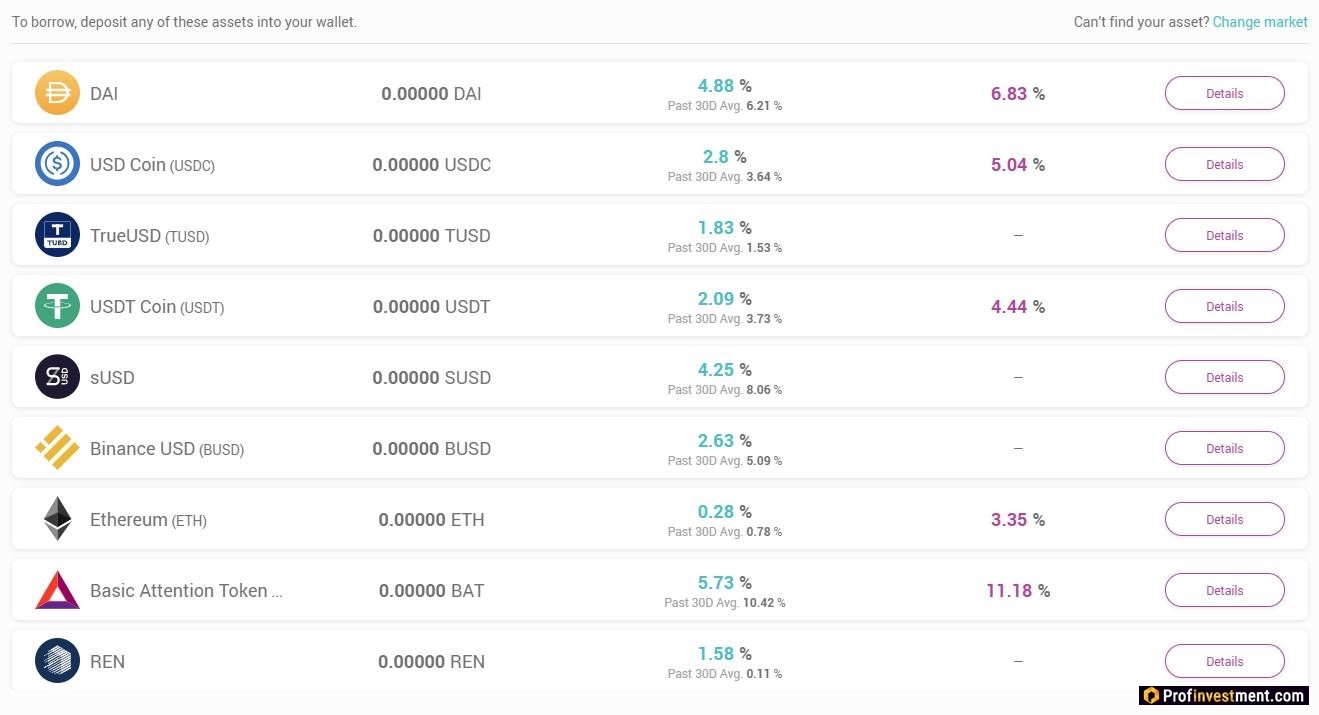

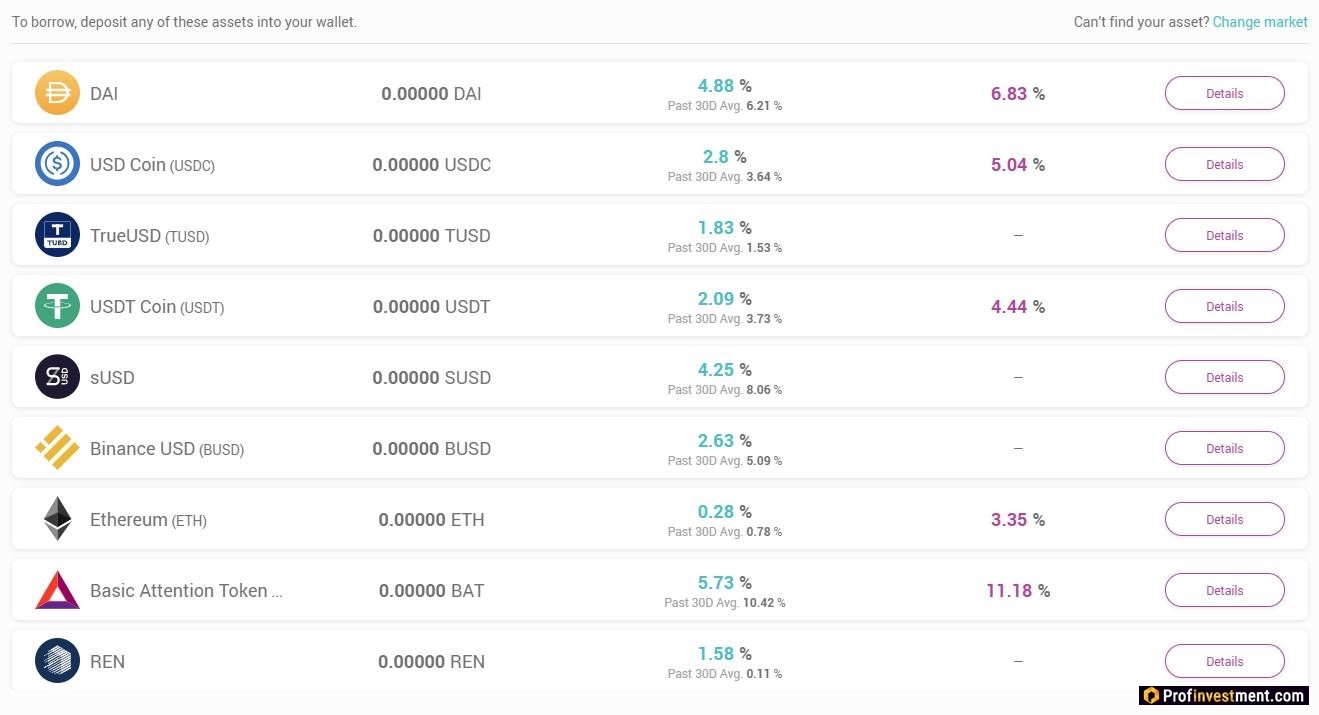

The interest rate is determined algorithmically for both borrowers and lenders. It depends on the ratio and value of the funds currently available in the pool.

LEND is a token created to control the protocol. Its owners can vote for certain changes in the project. All voices are hard-coded and the actions that follow are invariably performed. You can trade the LEND token on the Binance cryptocurrency exchange. Pairs are presented: LEND / BTC, LEND / BNB, LEND / USDT, LEND / BUSD, LEND / ETH.

#Binance Lists December Community Coin – #ETHLend (LEND)@ ethlend1 https://t.co/mXVFgg9yOD

– Binance (@binance) December 12, 2017

The content of the article

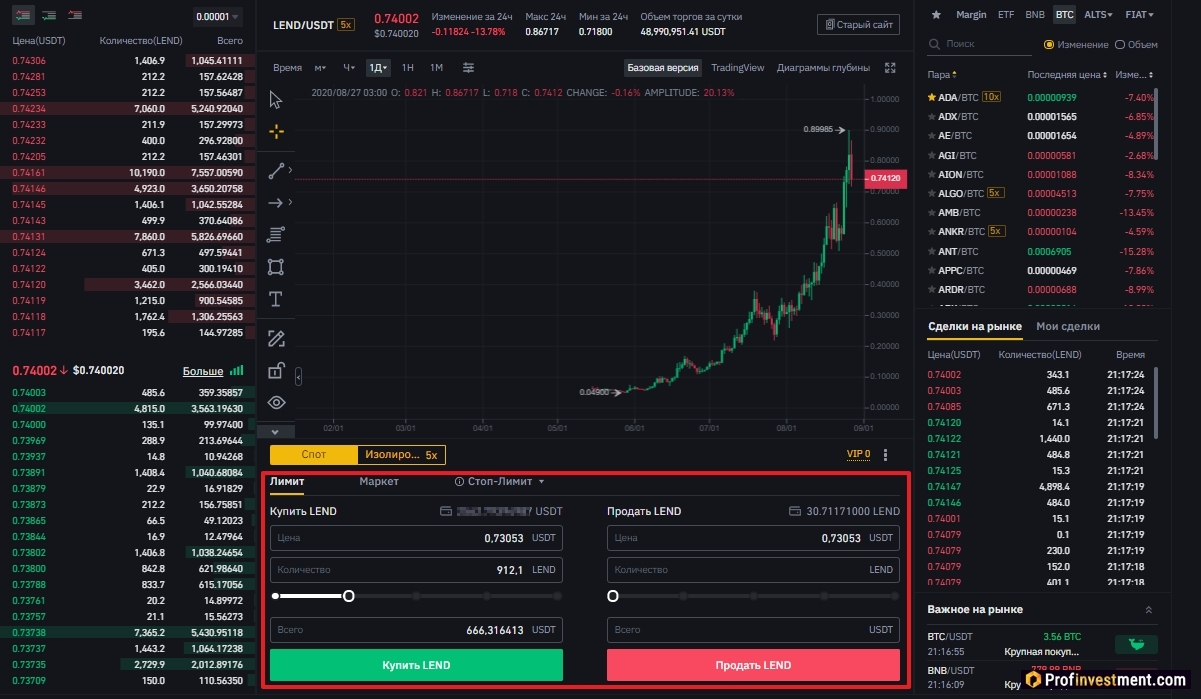

Aave (Lend) Chart and Price

LEND / USTD chart on cryptocurrency exchange Binance:

general information

[bsfp-cryptocurrency-table style=”style-2″ scheme=”light” coins=”selected” coins-selected=”LEND” currency=”USD” title=”Характеристики криптовалюты Compound (COMP)” show_title=”1″ icon=”” heading_color=”” heading_style=”default” bs-show-desktop=”1″ bs-show-tablet=”1″ bs-show-phone=”1″]

| Name | Aave |

|---|---|

| Ticker | LEND |

| Token type | ERC-20 |

| Blockchain | Ethereum |

| Total emission | 1 299 999 941 LEND |

| Current issue (as of 27.08.2020) | 1 256 361 931 LEND |

| Course (as of 08/27/2020) | 0,84 $ |

| Market Capitalization (as of 08/27/2020) | 1 056 622 843 $ |

| Official site | https://aave.com/ |

| https://twitter.com/AaveAave | |

| White Paper | https://github.com/ETHLend/Documentation |

| Source | https://github.com/aave |

| Exchanges | Binance, HitBTC, AEX |

What opportunities does Aave offer

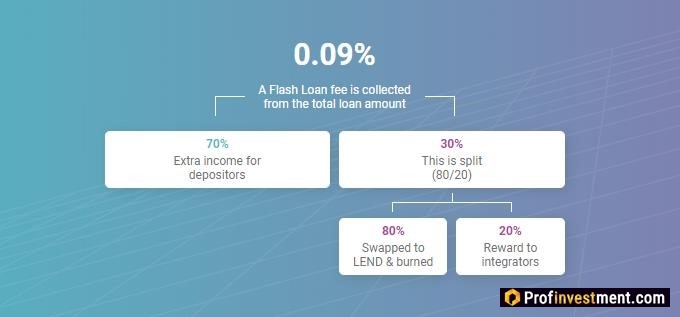

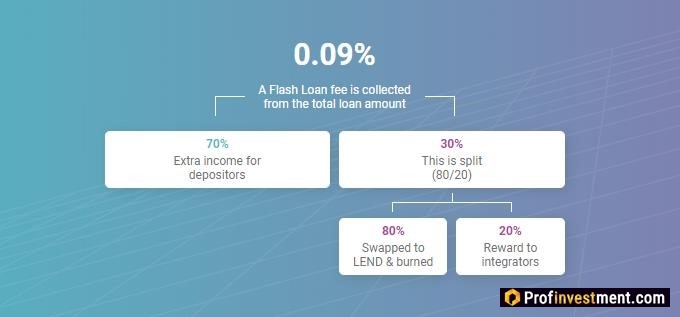

Flash Loans

Flash Credits are one of the main features of Aave… Usually DeFi lending requires collateral, most lenders (like MakerDAO) allow users to borrow up to 75% of the collateral available to protect against market volatility.

In turn, Flash Loans work through a smart contract, with the help of which you can borrow funds without collateral with the condition that the loan will be returned within one transaction (one block). The method is used by traders to make money on arbitrage, since it makes it possible to borrow funds for free without limit until the loan is repaid.

It is quite difficult for a beginner, and the developers recommend using this method of lending only to those who are well versed in Ethereum, programming and smart contracts.

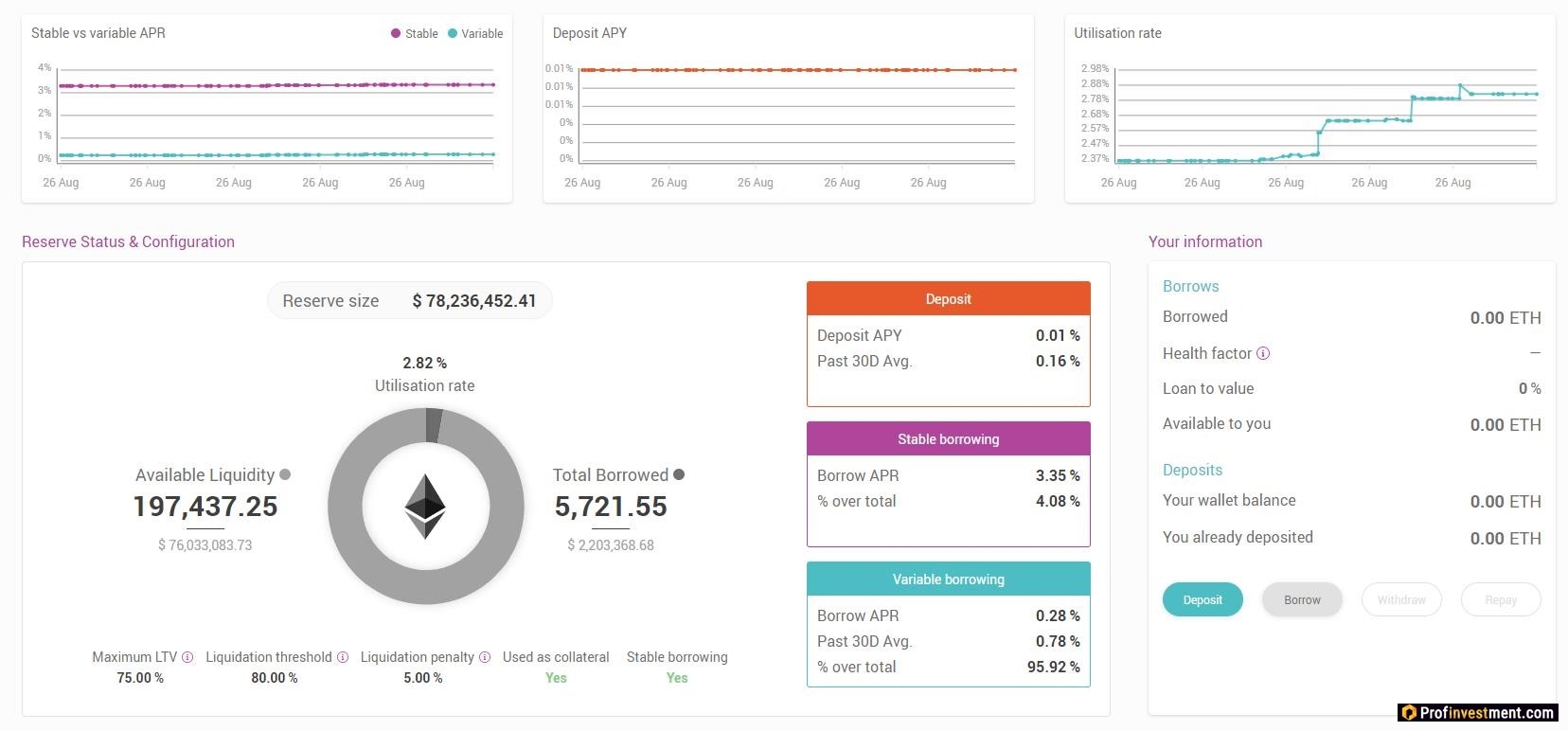

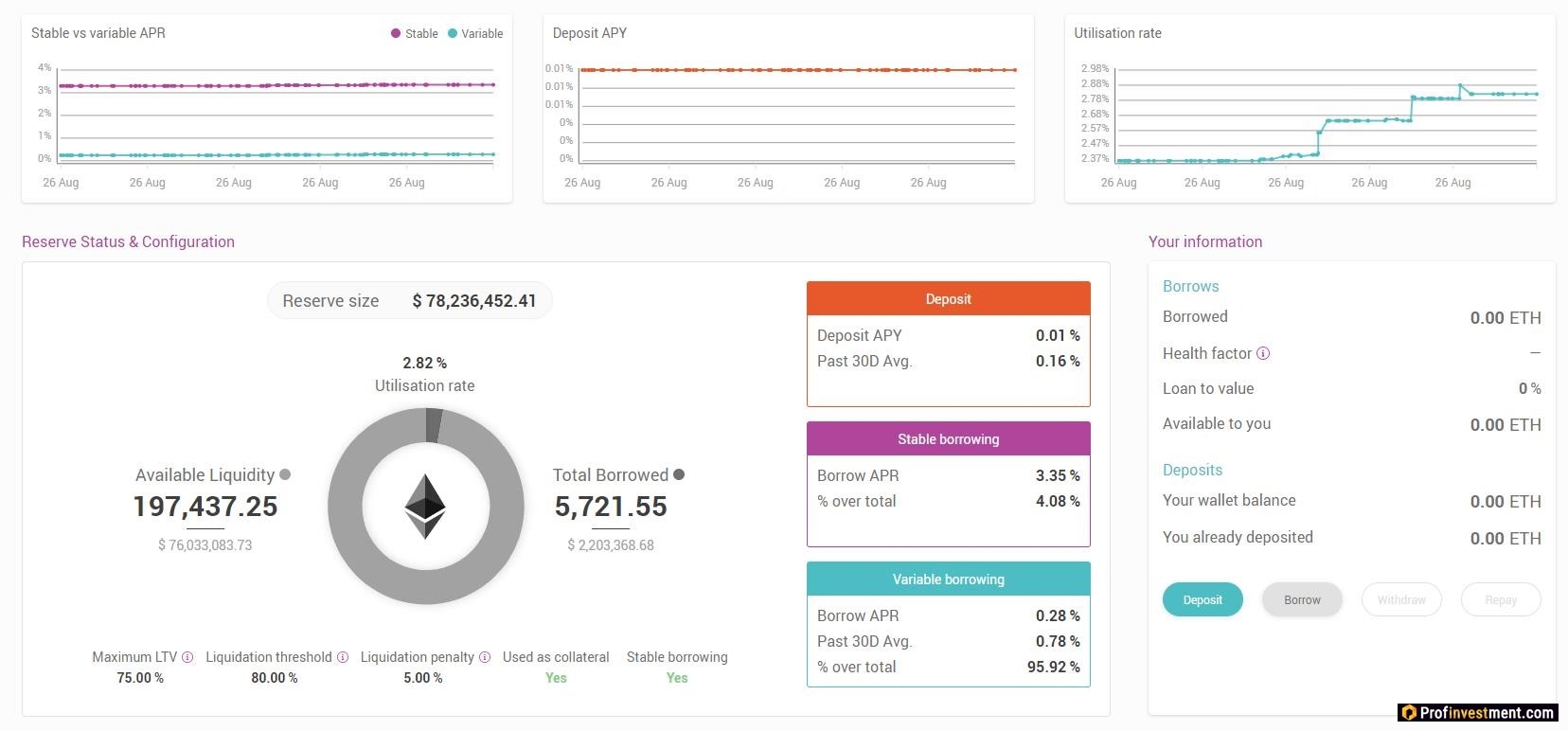

Flexible interest rates

The interest rate strategy on the Aave platform is calibrated to maximize operational optimization and mitigate risk. Interest rates on loans depend on the utilization rate of a particular cryptocurrency. It is based on the indicator of the availability of cryptocurrency in the pool:

- If there are enough funds, then low rates are set, which stimulate lending.

- If funds are scarce, liquidity providers are charged with high rates to encourage them to invest.

A nice feature of Aave is the ability to switch at will between fixed and variable interest rates, choosing the most profitable option at a particular moment. With this flexible structure, Aave has been in high demand since deployment. At the same time, fixed interest rates are not exactly fixed, but rather simply more stable and less prone to market fluctuations.

How to make money on deposits

You need to connect to the pool using any decentralized wallet, for example, the browser-based Metamask. There must be funds on the balance sheet. Then click the “Deposit” button next to the asset that you want to deposit (coins and tokens running on the Ethereum blockchain are supported). When the transaction is completed, you will start earning interest. In this case, the contributed tokens are converted into an equivalent amount aTokens.

ATokens holders receive continuous income based on the following metrics:

- 70% commissions from flash loans.

- Interest rate on loans. Average borrowing rate multiplied by the currency utilization rate. On the main page or in your personal account, a specific current rate for the required token is always indicated.

You can also go to the page of any coin to view the history of changes in the interest rate.

There is no minimum or maximum limit, but if the deposit is too small, then there is a risk that the transaction costs of the process will exceed the profit. For one asset, a one-time deposit is allowed at either a stable or variable rate, but not both at the same time. You can withdraw funds at any time without any penalties.

How to get a loan

Aave lending allows you to get working capital without selling your assets. To get a loan, you must deposit any asset that will be used as collateral. Then go to the Borrowing section and click Borrow for the asset you want to receive. Set the amount you want (the maximum amount depends on the available deposits used as collateral).

Choose a fixed or variable rate – you can change it later at any time by simply going to the dashboard and clicking the change APR type button for the desired asset.

The interest rate depends on the ratio of supply and demand for the asset. At the same time, the stable remains the same as it was at the moment of taking, and the variable is constantly changing. There is no fixed loan repayment period. The main thing is to maintain the so-called “health factor”, an analogue of LTV, at the proper level.

Purpose of the LEND token

The native Aave token – LEND is an ERC-20 token with a total supply of about 1.3 billion, of which one billion was sold during the ICO. It was originally used as a utility token for the ETHLend platform, which helped lower fees, improve interest rates and LTV.

However, when ETHLend was replaced by the decentralized platform Aave, the LEND token received additional uses, including platform management. Token holders have the right to vote on the proposals of the development team regarding the key parameters of the system.

Where to store LEND

Any wallet that supports ERC-20 tokens will do. The list of such wallets is quite large, for example:

- MyEtherWallet web wallet

- MetaMask browser extension

- Desktop and mobile Exodus

- Hardware Trezor, Ledger, KeepKey

- Desktop and mobile Atomic Wallet

Choose options with a proven track record and high levels of security.

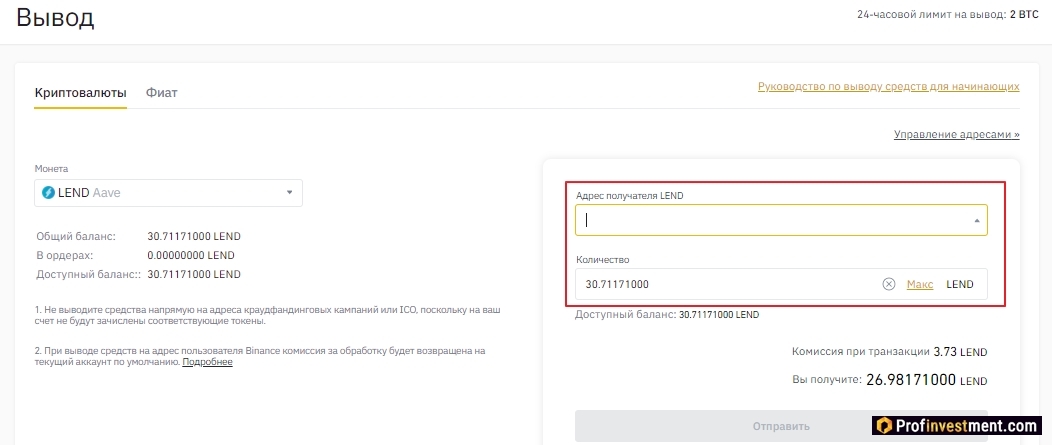

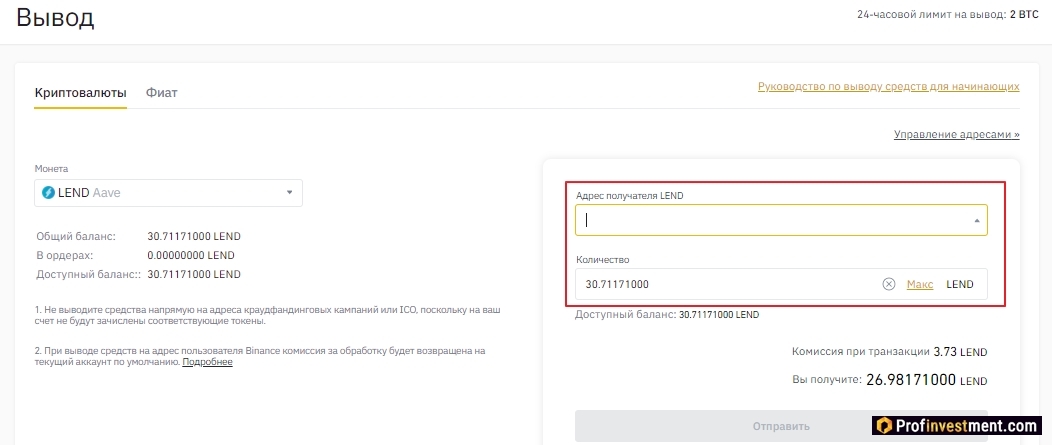

Where to buy / sell LEND

You can buy the LEND token on the Binance, HitBTC and AEX exchanges. As an example, consider buying an asset on Binance – this is the most popular and demanded crypto-exchange with wide functionality and the ability to buy cryptocurrency for fiat (after verification).

The process looks like this:

- Create an account at https://www.binance.com/ru or log into an existing one.

- Top up your account if needed. On our site you will find material with a detailed analysis of all methods of depositing and withdrawing funds to Binance.

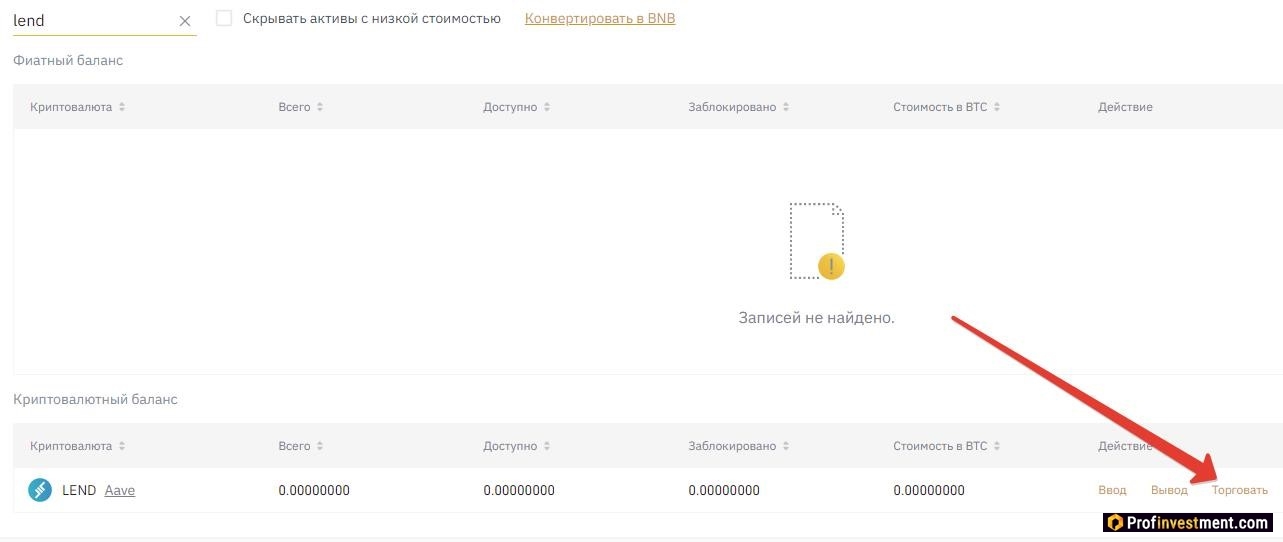

- Go to the “Spot Wallet” section and use the search bar to find the LEND token we need.

- Click the “Trade” button.

- Choose which currency pair is right for you. At the moment LEND is trading in pairs with BTC, BNB, ETH, BUSD, USDT.

- Select the type of order (the market allows you to instantly buy an asset at the market rate, and the limit order allows you to specify your price, and then the purchase will be made as soon as the rate reaches this mark).

Having received tokens, try to immediately withdraw them to an external wallet for further storage, if you do not plan to continue operations with them in the near future. Storing on an exchange is not considered safe.

Advantages and disadvantages

Pros:

- Favorable interest rates with a flexible choice between fixed and variable.

- Decentralization with LEND tokens giving participants the right to vote.

- A fairly large selection of coins and tokens for lending / deposits.

- A promising idea in modern realities.

Minuses

- Difficult to learn for beginners.

- There is no Russian language.

Perspectives

The Aave protocol is one of the most popular in the DeFi lending industry today. This is due to a large selection of cryptocurrencies, support for many wallets for connection, and a flexible system of interest rates. The mechanism of smart contracts allows you to avoid many risks and inconveniences that are inevitable when interacting with traditional banks.