Alpha Finance lab: overview of the token and the DeFi platform, features, prospects. Alpha Finance Lab – a laboratory that specializes in research and innovation in the decentralized financial space (DeFi).

The main goal is to create products that solve the current problems in this area and help users maximize profitability through decentralized cross-chain operations that blur the boundaries. From October 10, 2020, Binance Exchange (binance.com) listed the ALPHA token and opened trading in ALPHA / USDT, ALPHA / BUSD, ALPHA / BTC, ALPHA / BNB pairs.

Initially, users will be able to take advantage of Alpha Lending, an algorithmic interest rate protocol powered by Binance Smart Chain. Alpha Lending supports cross-chain assets.

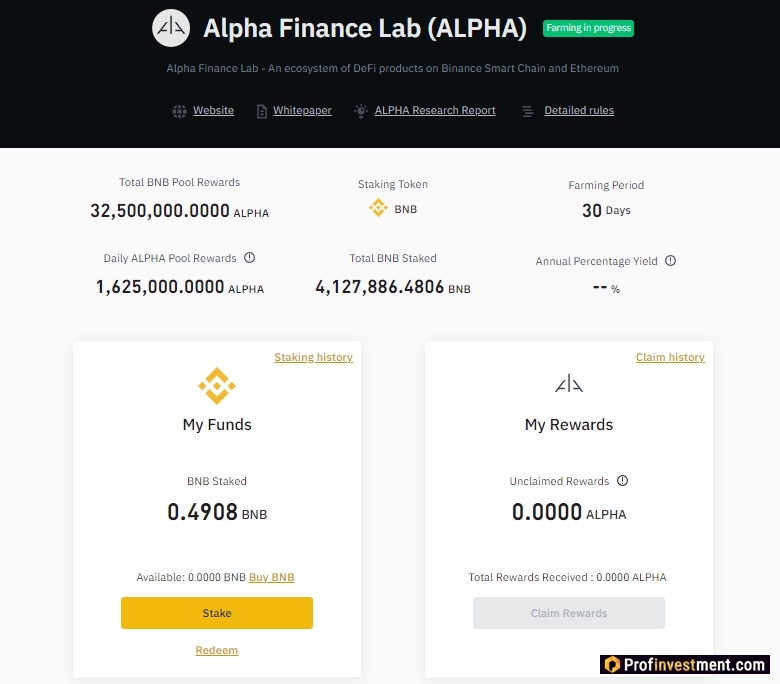

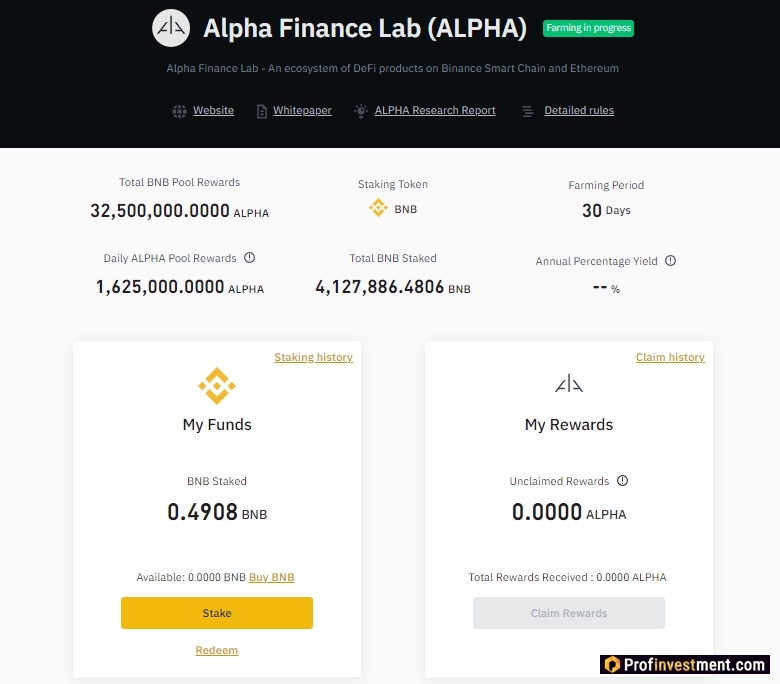

ALPHA Is the main token in the Alpha product environment. Used for staking, liquidity rewards, governance and protocol security. ALPHA was launched simultaneously on Binance Launchpad and Launchpool – you can participate in a classic token sale or farm coins by staking BNB, BUSD and BAND on Launchpool.

.@AlphaFinanceLab is the first-ever project to double launch on #Binance!

Launchpad:

🔸 #BNB balance recording starts at 2020/09/30 0:00 AM (UTC).

Launchpool:

🔸 Use $BNB, $ BUSD or @BandProtocol $BAND to farm $ALPHA tokens at 2020/09/30 0:00 AM (UTC).https://t.co/OlkOeCvaEC pic.twitter.com/VDysvpJxrD

– Binance (@binance) September 29, 2020

We offer an overview of the protocol and token from the editorial staff of Bitcoinminershashrate.com.

Alpha Finance protocol architecture

The content of the article

Specification information

| Name | Alpha Finance Lab |

|---|---|

| Ticker | ALPHA |

| Token type | BEP-20 |

| Blockchain | Binance Smart Chain |

| Total emission | 1 000 000 000 ALPHA |

| Official site | https://alphafinance.io/ |

| Blog | https://blog.alphafinance.io/ |

| Whitepaper | https://github.com/AlphaFinanceLab/alpha-lending-smart-contract/blob/master/documents/Alpha%20Lending%20Whitepaper.pdf |

| https://twitter.com/alphafinancelab | |

| Exchanges | Binance |

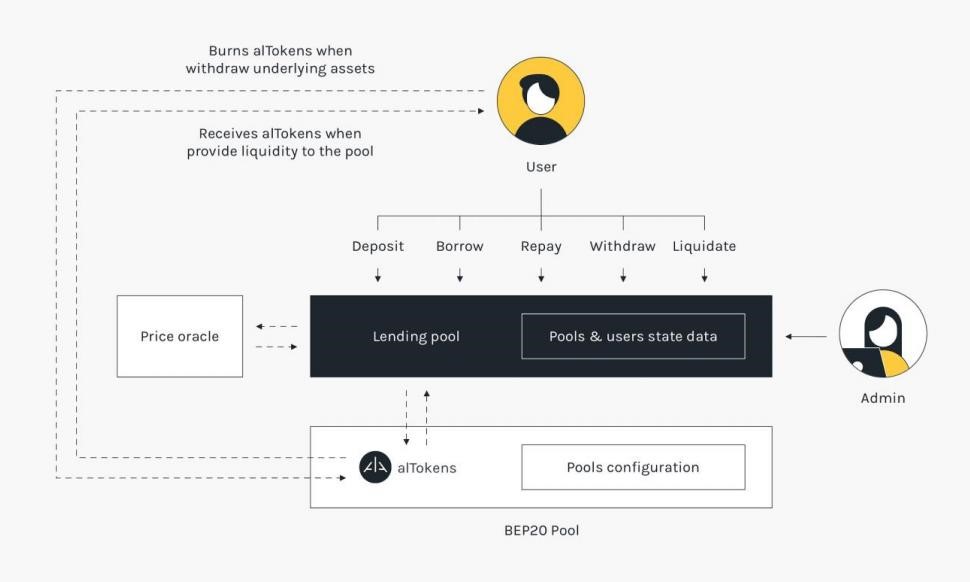

Alpha Lending platform includes the following main components:

- Credit pool… The main contract of the protocol, which by all states and ensures the interaction of users with the credit pool (deposit, credit, repayment, withdrawal of funds, liquidation).

- Credit pool configurator… Responsible for the settings of the lending pool and BEP-20 token pools. The settings mainly include the calculation of interest rates.

- alTokens… The creation and burning of alTokens is governed by a special contract. alToken represents a user’s credit position or a share of the deposited amount in the total liquidity of a particular asset.

- Price Oracle… Orakur BandChain for requesting the last determined asset price from the BandChain protocol.

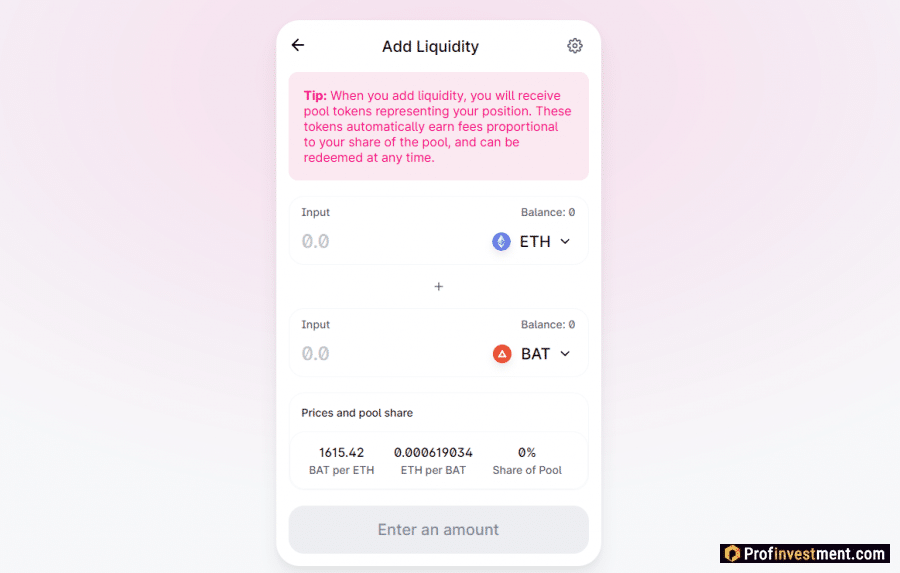

Basic principles

The user invests in one of the pools supported by the Alpha Finance protocol. After that, the cryptocurrency is added to a single pool of liquidity. This is all the liquidity that is available for this asset to borrowers and lenders. It grows over time as deposits are made and interest rates are generated by borrowers.

Mutually deposited assets (eg BNB), the user receives alTokens (eg alBNB). It is a tokenized representation of a user’s credit position. Over time, alToken can claim a larger amount of the underlying asset than was originally contributed. Liquidity is growing at the expense of interest charged to borrowers. The number of alTokens that each user receives is calculated individually based on the amount of the deposit, the total number of alTokens and the total liquidity.

To take out a loan, the user must first deposit their assets (among those supported for this purpose) as collateral. At the same time, he also receives alTokens, indicating his share of liquidity in the protocol. It is noteworthy that even if the tokens are used as collateral, interest continues to accrue on them, as other participants borrow the underlying asset from the asset pool and pay interest on the loans.

A participant can withdraw funds only if there is sufficient total available liquidity for this and if the state of his account (the ratio of collateral to credit) then remains at the required level. alTokens are burned when withdrawing the underlying asset.

There is a liquidation mechanism that ensures the safety of liquidity providers’ deposits. If the protocol sees that the credit position is in poor condition (the collateral does not cover a sufficient share of the borrowed funds), then it can liquidate the position by selling the collateral. This situation may arise due to the volatility of market assets.

Dynamics of interest rates

Interest rates for borrowers and lenders are calculated using a special formula based on utilization rates. It looks like this:

Utilization ratio = Total loans / Total liquidity

Since the utilization rate reflects the demand for borrowing an asset, the higher it is, the higher the interest rate. The rate is individual for each asset and is constantly being adjusted.

5-10% of the interest rate on loans is allocated to the pool reserve, constituting a certain insurance fund.

The rate on deposits depends on the rate on loans and is calculated using the formula:

Interest rate on the deposit = Interest rate on the loan * Utilization rate

Alpha Finance Lab (ALPHA) token and its receipt

ALPHA is the main utility token that will be distributed as a reward among users of Alpha Finance Lab products for providing liquidity or securing the protocol, as well as participating in governance voting.

The Alpha Finance Lab (ALPHA) will launch simultaneously on Binance Launchpad and Launchpool:

- The token sale will take place in the form of a lottery from September 30 to October 8, 2020, taking into account user BNB balances.

- BNB, BUSD and BAND staking on Launchpool for 30 days starting September 30, 2020.

We are very excited to announce that Alpha Finance Lab will be the next project to launch $ALPHA tokens on both @Binance Launchpad and Launобзобзchpool! #Binance #DeFi https://t.co/k2raLpGy6C

TL;DR 👇

— Alpha Finance Lab (@AlphaFinanceLab) September 29, 2020

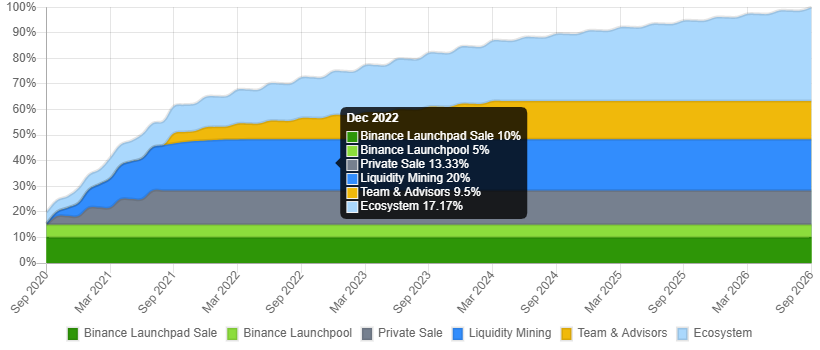

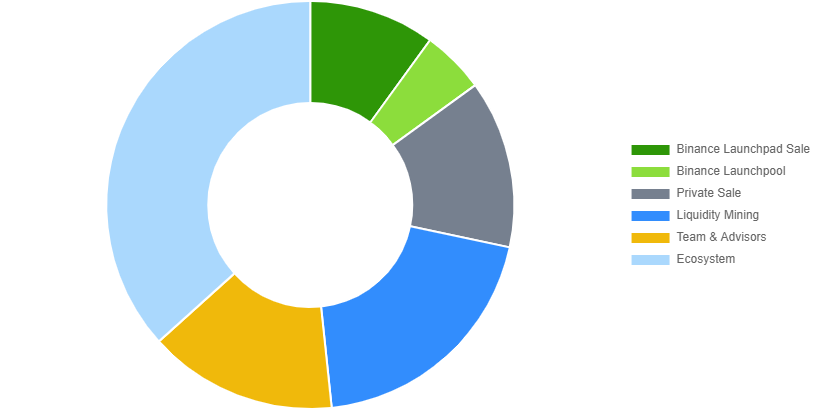

Token distribution

Advantages and disadvantages

Pros:

- An innovative lending platform that combines all the DeFi trends.

- Cross-chain asset compatibility.

- Placing the platform on the Binance Smart Chain to avoid the disadvantages of the Ethereum blockchain.

- Tokens on Binance Launchpad.

- Distribution of tokens for staking at Launchpool.

Minuses

- Most of the products are still in development.

Conclusion

Alpha Finance Lab plans to remove a number of restrictions that are present in the defi-sphere today. Most DeFi products can only interoperate in the Ethereum ecosystem, while other blockchain platforms are also growing at a rapid pace. To get away from the scalability problem in the first place, developers begin to master other chains for decentralized finance. It will benefit everyone, including users.