Take a look a all the necessary info surrounding Asa Canaan Avalon 721 (hashrate, profitability, payback, specifications, and best Mining Coins) – In 2017, the computer world was covered by a new wave of mining popularity. Cryptocurrency mining intensified after the Bitcoin exchange rate quickly went up. Some users tend to think that only video cards are used for mining, as they suddenly began to disappear from stores. But this is not entirely true, for 5 years now, mining BTC using a GPU is economically disadvantageous. For Bitcoin mining, ASICs are used – special multiprocessor installations specifically designed for cryptocurrency mining. They are more powerful than video cards thousands or even millions of times.

Avalon 721 is one example of an ASIC miner for mining BTC. It is made by the Chinese company Canaan Creative. It was introduced in October 2016 and has gained great popularity. What the Avalon 721 is capable of, will help to find out its review.

Specification Avalon 721

- Performance: 6 TH / s (trillions of hashes per second);

- power consumption: 850-1000 W ;

- number of processors: 72 ;

- processor model: A3212

- chip manufacturing process: 16 nanometers ;

- power connectors: 8 6-pin PCI-E connectors ;

- dimensions: 34×13.5×15 cm ;

- weight: 4.3 kg ;

- allowable temperature range: -5 – +40 ° C .

A feature of Avalon 721 is support for working in a cluster. ASIC interfaces allow you to combine up to 5 devices into a single farm, thus providing a performance of more than 30 TX / s.

Due to optimization, the consumption of new revisions of the Avalon 721 decreased from 1 kW to 850 watts. Therefore, when buying, it is worth specifying when the proposed device is manufactured. Indeed, an increase in energy efficiency by 15% reduces the time to reach net profit.

Avalon 721 Profitability

Many novice miners are worried about whether to invest in an ASIC. After all, these devices are not cheap, and cryptocurrency rates are characterized by inconstancy. Of course, no one can give 100% guarantees, but at present there are no prerequisites for serious concern. The Bitcoin exchange rate is still showing an upward trend, and its drawdown to the level of about $ 2000 a couple of days ago was short-lived.

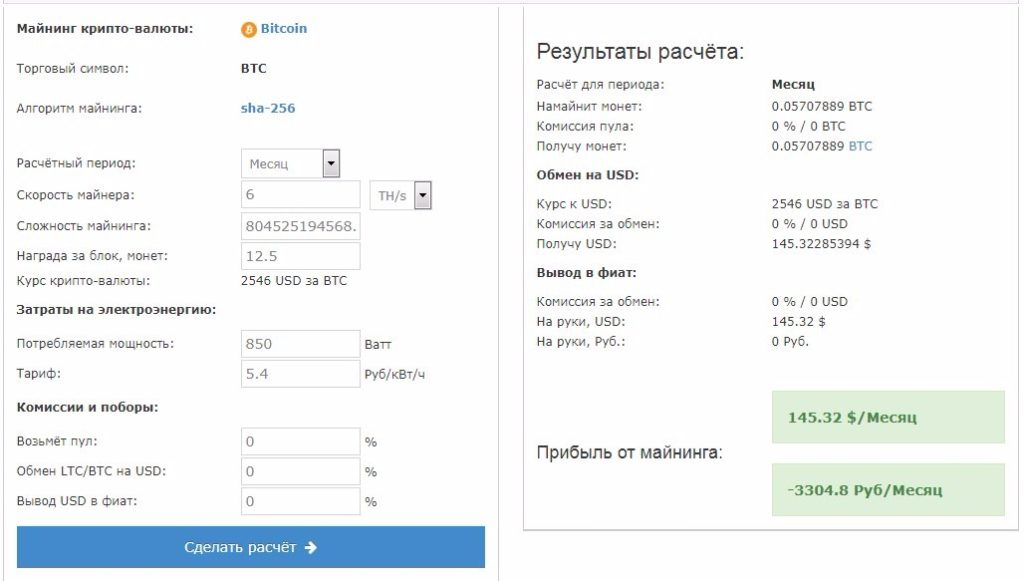

If we consider the profitability of the Avalon 721, then the trend looks very attractive. In December 2016, the Avalon 721 monthly revenue was about $ 37. With the growth of BTC, this figure also grew, and at the time of writing the review, the performance of 6 TX / s means a profitability of about 0.06 BTC per month. At a rate of 2500 USD for 1 BTC, the yield will be about $ 150 per month .

Of course, we should not forget about electricity, which Avalon 721 consumes a lot. Around the clock operation of the device requires approximately 615 kWh of electricity per month. If you calculate according to Moscow tariffs (about 5.4 rubles or 9 cents per kWh), ASIC will spend $ 55 on energy, and net profit will be slightly less than $ 100.

Considering that the price of the Avalon 721 miner starts now at around $ 900, profitability of $ 100 / month means the installation reaches net profit in about 9 months. This is very attractive, because even last winter, the estimated payback period was about 2 years.

Avalon 721 or Antminer S9: which is better

Despite the fact that time has passed since the release of Avalon 721 and Antminer S9, people continue to discuss what is better. It would seem that the performance of the review hero is half as low (S9, depending on the version, produces 12-13 TH / s), therefore, it is not the best solution. But not so simple.

First of all, it should be borne in mind that the Avalon 721 consumes about 850 watts, and the Antminer S9 – 1400 watts . Thus, along with profitability, electricity bills will also grow.

The second point is the cost of the devices. After the growth of the BTC rate, the Avalon 721 price increased from $ 700 to about 900. The Antminer S9 has risen in price more significantly, its cost now reaches $ 2,800-3,000. Therefore, the Avalon 721 will come to self-sufficiency faster, especially with expensive electricity . The purchase of two Avalon 7 ASICs is more efficient than the purchase of one Antmainer.

Judging by the reviews, the overall build quality of the Avalon 721 is higher than that of the competitor. His fans are also much quieter, thanks to lower rates of energy consumption and heating. Therefore, for home mining, it looks more interesting. Avalon 721 noise can be avoided by installing it on a closed insulated balcony, while the noise from Antmayner will be heard even from behind the door.

Heir – Avalon 7

Not so long ago, Canaan Creative introduced an updated version of Avalon 7, with a model number of 741. It costs about the same, but develops a performance of about 7.3 TH / s. Thus, profitability increased to about 0.07 BTC or $ 177 per month.

Conclusion

Avalon 721 is currently one of the most attractive ASICs for home mining. It is a reliable tool for obtaining a stable income provided that Bitcoin maintains or grows.

Given that the BTC rate is not falling, and interest in this cryptocurrency is growing, buying ready-made coins based on the growth rate is not as profitable as mining them with Avalon 721. After all, there are a lot of fraudulent exchange portals on the network, but to find a good rate Bitcoin purchases are not easy.

Asik mining

ASIC mining is the extraction of cryptocurrencies using a device specially created for this purpose – the ASIC miner. This mining is the same as regular mining, that is, decryption of the blockchain, block mining and so on.

The difference is that the calculations are done not using video cards or other devices, but using special chips.

Before the advent of ASIC mining, coins were mined mainly on video cards. There were other types of mining, for example, mining on processors, but they quickly became unprofitable.

Video cards brought good profit, so farms began to appear for the extraction of cryptocurrencies from several devices that are still in use today.

Soon loomed two main problems that concern miners today, namely:

- An increase in the complexity of mining the block, which is why large capacities have become required.

- Excessive power consumption, growing in proportion to increased capacity.

These problems required an innovative solution.

The Chinese company Butterfly Labs was the first to offer it: in the summer of 2012, it began to accept pre-orders for devices based on microchips developed for Bitcoin mining. These were the first ASIC miners.

A month and a half after the announcement of BFL, Asicminer appeared in the south of China, offering similar products. Following her is also the Chinese Avalon.

So China became the progenitor of ASIC mining.

How not to be mistaken with the choice of ASIC?

Whatever we purchase, we always focus on some specific criteria that our purchase must satisfy. When purchasing the device described today, there are also a number of factors that are worth paying attention to.

- Firstly, it is necessary to take into account the power of the asik or its hashrate. The effectiveness of your work will depend on this. True, it is worth considering that the price of a more efficient device will be higher;

- The second important point is the energy consumption of the equipment. Mining is a very energy-intensive process, and there is nothing to be done about it. But before investing, you need to consider the power of your network – is it enough for the operation of a particular model;

- And finally, an important factor is the price of your acquisition. It should be borne in mind that with an increase in interest in production and an increase in the cost of BTC, prices for related equipment also begin to rise rapidly.

With the fall of excitement, the reverse process occurs. Well, new, more powerful models, of course, also at first unpleasantly amaze with numbers on the price tags.

The largest manufacturers of miners

- Coin Terra is an American company, one of the most famous. At present, its most popular product is Terra Miner IV (2 Thesha). The cost of the device is relatively low, about 6 thousand dollars, power consumption is in the region of 3 kW / h. In general, the device is worthy in terms of characteristics and price / quality ratio, but There is one “but” – it is quickly sold out and it is not so simple to purchase it.

- KnC Miner (unfortunately the company went bankrupt) is also a cool manufacturer, no longer American, but European (Sweden). The Neptune device (3 Thesha) stands out from its line, as it uses the latest technology. We can’t say anything concrete about energy consumption. As the manufacturer assures, it is half as much as the previous model. The price of the miner is quite high, $ 13,000, but there is every reason to believe that such an investment will pay off and bring a significant profit to the owner.

- Butterfly Labs is a large and well-known company, but with a somewhat dubious image. The fact is that the release of miners announced in 2012 was carried out only after a year and a half, and users who made pre-orders received, as a result, not very up-to-date equipment, because the competitors had not been idle all this time, and managed to launch their more advanced ones on the market models. Butterfly produces not ready-made devices, but something like cards for assembly worth $ 2,200 (600 Gh). It is easy to calculate that 3 Tesh will cost 11 thousand.

- BTC Olympus – also has its own line of miners. I would like to draw your attention to the Poseidon model (3 Tesh). The device consumes little power and costs relatively little – $ 8,000.

Is it possible to assemble an ASIC miner yourself?

Today, the question of how to make asic for cryptocurrency mining yourself is gaining more and more popularity, because ready-made solutions, which are usually sold on the foreign market, are expensive and not available to many Russian users.

Consider the main problems that you may encounter when building your own miner on asic.

Before starting to consider the basic question of how to make asic yourself, let’s go a little deeper into technical terminology. Asic is a chip that is designed specifically for hash counting.

It is ten times more productive than any flagship video card. Accordingly, the demand for it among miners is quite high.

So, consider a simplified diagram of how to make asic:

- Buy microcircuits. Let’s start with this point precisely because most often it is it that causes great difficulty for those who want to make an asic miner on their own. Unfortunately, there are no manufacturers of such boards in Russia, therefore, in order to get the desired element, you will need to contact the foreign market or re-buy from the one who already has it. Also, remember that there are two types of asic: for the scryp algorithm and SHA-256. Accordingly, only certain currencies can be mined on each of them.

- Get software. Before you make asic, you need to get the appropriate software. Again, this may cause problems. Typically, manufacturers who supply ready-made miners attach them to the device. If you order individual microcircuits, then most likely you will not have such privileges.

- Find a power source. Speaking about how to make a miner yourself, you should not forget about the energy consumed, because asic require 2-3 times more electricity than video cards or processors.

- Assemble the housing and provide cooling. In the process, the miner generates a large amount of heat, so you need to think in advance how you will get rid of it. For this, it is necessary not only to install a powerful cooling system, but also to prepare a housing that would contribute to better ventilation.

In addition, there are still a huge number of nuances that should be considered.

Despite the fact that the relevance of the topic of how to assemble your miner from asic remains high. Such technical manipulations are quite complex and require special knowledge.

And if you do not want to puzzle over how to make asic yourself, it is better to purchase a ready-made installation.

So still an ASIC or a farm?

Each of these methods of production has its own significant pros and no less significant cons.

- Quick start;

- Rare software update;

- More resistant to breakage;

- It requires nothing but a wire for the Internet and a power supply;

- Unpretentious in transportation.

- Any cryptocurrency is available for mining, which allows you to get large profits from time to time with constant monitoring of the market;

- Less noise during operation;

- Available accessories;

- The ability to realize and return the invested funds at any time (if not all, then at least part).

This we have argued in favor of both options. Now about the shortcomings.

- It is difficult or even impossible to repair;

- A limited list of algorithms for mining;

- It is noisy;

- It quickly becomes obsolete, illiquid.

- It’s hard to sell

- Self-assembly takes a lot of time;

- Constant software updates;

- Greater risk of breakage;

- Difficulties with transportation.