Oh no, bitcoin is going down!

No, that was Matic’s chart. That fell by no less than 70 percent last night. Compared to Matic, the bitcoin rate seems stable. Can the course for old and new still go towards the top?

Koers breaks (finally) out of the trend line

You look at the bitcoin rate from the end of October until now. Each candle represents an hour on the graph.

The bitcoin rate has finally broken out of the falling trend line. The bitcoin had not been able to break through the line for weeks. But it happened yesterday, and that is a positive signal. This may mean that the downward trend of recent weeks is over, and that the rate is finding its way up again.

Another possibility is that the price has to test the trend line again. That means that bitcoin looks up the trend line again, and bounces up from there. That is only positive, because that confirms the outbreak.

A new fall below the trend line is worse news, which means that the falling trend is continuing.

An extra party for New Year’s Eve?

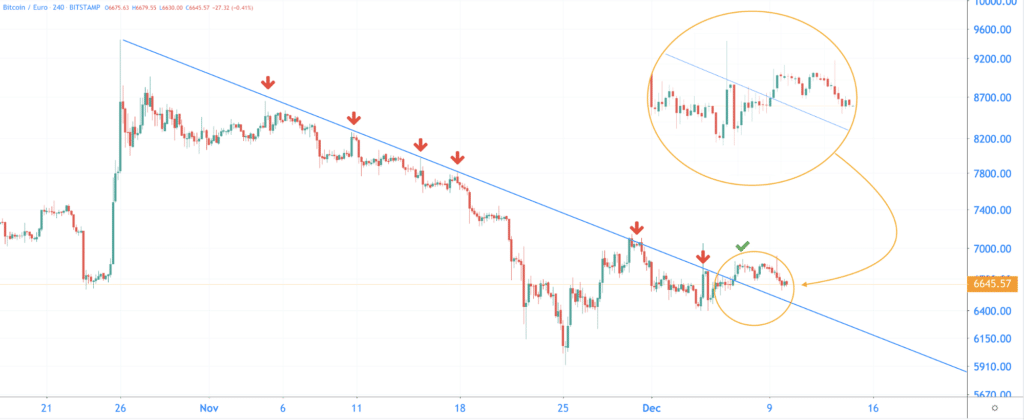

Now we zoom out a bit on the graph. You can see the bitcoin rate from June 17 through now. Each candle represents four hours.

In the somewhat longer term, the price of bitcoin is still moving between two falling trend lines, on the graph in orange. These trend lines run parallel, which is why you call this a channel. Does the course for old and new still break out of that channel?

Bitcoin has been in a positive momentum since the end of November. You can see that on the graph below by the rising trend line in blue. Does this trend line continue to offer support? Then the race can make an attempt to break out of the canal before New Year’s Eve. To be precise on December 29.

We have zoomed in on the same situation on the graph below. You see the channel and the rising trend line:

In the long term, still according to schedule

If we look at the very long term, bitcoin is still on schedule. The graph below shows the bitcoin rate from the end of 2013 to the present. Each candle represents a week. Note, the graph is now expressed in US dollars. That is because you can look further back on the graph with this currency.

The line that runs right through the graph is the 100-week Moving Average. A Moving Average is the moving average of a certain period. You can see the line as a moving resistor or support.

If you look at this Moving Average, the rate seems to be a certain pattern:

- First bitcoin from the Moving Average breaks down. You can see that in the red cross.

- The rate then forms a bottom. The bottom of 2018 was 2,700 euros.

- Finally, the price breaks again through the trend line, but then upwards. You can see that from the green arrow.

- Bitcoin then finds its way up again.

It seems that bitcoin now follows the same path as last time. But it remains exciting! The price is still moving around the Moving Average, and has not yet made a clear move upwards.

First golden cross since 2016, good times ahead?

We will stay with the Moving Averages for a while. The 50-week Moving Average now rises above the 100-week Moving Average. You call such a cross a golden cross, and that is a very good sign for the long term.

The last time that happened was in the week of May 23, 2016. That was the prelude to the big move up towards the summit of 16,600 euros. From that point to the top the rate rose by no less than 4,395 percent! Can we now expect such an increase?

Want to know more about Moving Averages? Then view this page.

What are our expectations for bitcoin?

Despite this positive analysis, we try to remain objective. That is why you read no less than two different scenarios in this very last part of the analysis. Something for everyone!

Bullish

In our positive scenario, the price continues to follow the rising trend line. Bitcoin will reach the top of the channel at the end of the year, at around 7,400 euros. Does the course break out there too? Then we can focus our eyes again on the summit of 2019, around 12,200 euros.

Bearish

But what if bitcoin drops? Then the course drops to the bottom of the channel. A value of 5,600 euros is then even possible.