The cryptocurrency market continues its gradual recovery after the difficult year of 2018, not all digital coins managed to recover from shock to the end, but, according to many analysts, the regeneration process is in full swing.

The best results in 2019 were demonstrated by Litecoin, adding almost 400% to its value and, of course, Bitcoin, which was slightly behind, but still gained 300 +% in weight. In the first half of the year, the Bitcoin dominance index gradually grew, the ability to buy as much cheaper digital gold as possible attracted many investors. As a result, the price reached $ 13,880 even before the end of the first half of the year.

Today, various sources flash information that Bitcoin is preparing for a deep correction up to 8500 and even up to 5500. Is this the case and when to wait for a new “native”? Analysis of key factors from analysts of the PrimeXBT trading platform.

Dominance index

Perhaps, it is worth starting with the most controversial factor that scares the market – this is an increase in the Bitcoin dominance index amid falling value. The only interesting and logical observation of the index suggests that when bitcoin loses dominance, the season of altcoins begins and they grow in price more progressively than the main coin and vice versa. This is very clearly visible on the chart.

Otherwise, the dominance of bitcoin occurred both against the background of a drop in its value, and against the background of growth. There is no logic in the invented divergence, therefore, we will not linger on it for a long time, we’ll drown further.

Regulation and Institutions

Since the second half of 2018, crypto enthusiasts, like celestial manas, have been waiting for large institutional investors to come to the market, and those in turn have been waiting for the start of market regulation. Since investing large capital in a sector that is literally teeming with fraudsters and market manipulations is a highly risky business, it required a world-famous operator who would provide investors with a secure infrastructure for trading and storing digital assets. The initiative was taken over by ICE, the operator of the New York Stock Exchange, who developed the Bakkt platform for trading deliverable Bitcoin futures and custody services. Despite numerous launch delays, including due to regulatory issues, the “cryptans” waited until the platform launched on July 22, 2019, and the first futures will be delivered as early as September 23. Deliverable futures contracts aim at regulated pricing plans. This was stated by the chief operating officer of the company Adam White:

“We believe that pricing should take place in a fully regulated market and we plan that, thanks to Bakkt, it will move to the futures, and not to the spot markets where pricing is taking place now. This change will help regulators “worry” that Bitcoin ETFs will rely on the prices of unregulated spot exchanges. “

The launch of Bakkt brings not only large investors to the market, but also gives additional incentives to regulators to clean up the industry and help it to take the legal footing, which will take the cryptocurrency market to new heights. No less long-awaited ETFs from VanEck and SolidX, ETFs from the Winklevoss brothers and other tools that magnetically attract large capital to the market will receive a green light on launch.

Moreover, Bakkt is not the only product from the giants of the financial market. One of the world’s largest asset managers, Fidelity Investments, which administers $ 4 trillion worth of assets (2.5 times more than Russia’s GDP), launched Fidelity Digital Assets, a platform for providing custodial services for cryptocurrencies, this spring.

The advent of the institutionalists alone does not mean anything. The important thing is how exactly they will use cryptocurrencies in their investment portfolios. Surely, have you heard the term “digital gold” and the reports on the correlation of the rate of bitcoin with gold? Is this really so, or do traders take what they want to be valid?

Bitcoin = Gold

According to eToro research, over the past four months, against the backdrop of increasing economic and political disasters in the world, the number of transactions with Bitcoin on the platform increased by 284%, and the number of transactions with gold by 73%. It is possible that investors began to perceive BTC as a protective asset along with gold. For clarity, the company provides several key dates confirming the correlation of assets:

● May 13, 2019: The introduction of China’s reciprocal trade duties against the United States worth more than $ 60 billion increased the number of open positions on gold on the platform by 108% during the day, and positions on bitcoin by 139%.

● June 25, 2019: After the negotiations between Donald Trump and Xi Jinping, trade duties were postponed, after which the positions on gold and bitcoin increased by 26% and 40%, respectively.

● August 13, 2019: the United States postponed the introduction of new trade duties in the amount of $ 300 billion until December 15, which led to an increase in the number of positions in BTC by 123%, and in gold by 60%.

Just the other day, China introduced retaliatory measures against the United States in the amount of $ 75 billion, and bitcoin again reacted with growth, like gold.

Of course, bitcoin does not yet show the same dynamics as gold, but the mere fact of its adoption as a protective asset suggests that investors believe in cryptocurrency and will continue to increase its percentage in their investment portfolios. Institutional money, which in the near future will begin to flow from traditional markets to digital, can not only strengthen the position of cryptocurrencies, in particular Bitcoin, but also send them to new heights. Do investors want this? Let’s consider further.

Investor Opinion

According to a survey among Chinese investors conducted by BableFinance, more than 30% of respondents are confident that in the coming year, the price of bitcoin will reach $ 30,000 per coin. 26.9% of investors believe that the price will be in the range of 15,000 to 20,000 dollars. 15.7% of respondents expressed hope for a cost in the region of 20,000 – 25,000 dollars.

84% of respondents expressed optimism regarding the prospects of bitcoin, which caused the desire to invest in the main cryptocurrency. For 31.3% of survey participants, the share of crypto assets in portfolios is more than 50%, for 12% of investors this indicator is in the range of 41-50%, and for 10.8% of cryptocurrency investors occupy from 31% to 40% of the portfolio.

Current situation

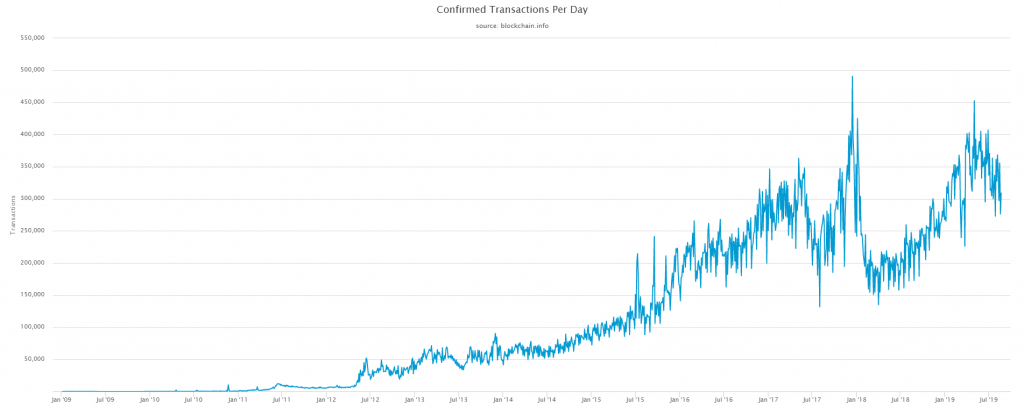

The number of transactions with Bitcoin is growing and has already reached the values of 2017, when 350 to 450 thousand transactions were performed per day. The liquidity of an asset indicates an increased demand for it, which provides support to it.

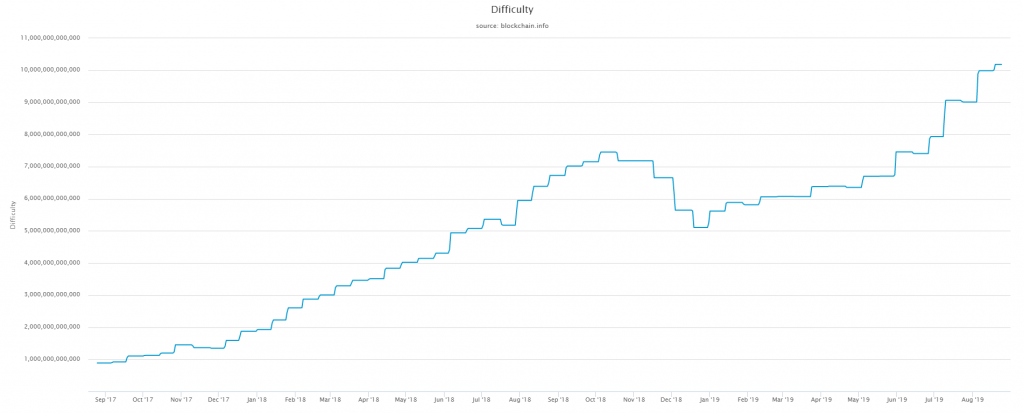

Unlike real gold, digital has a limited offer and is protected against inflation by halving (halving the rewards to miners for mining blocks). Each time, it is becoming more and more difficult to mine bitcoin, which makes it increasingly scarce, and according to the laws of market trade, a deficit causes an increase in value as long as there is demand.

In conditions of global instability and growing demand for cryptocurrency from investors, we believe that the next few days the price is still “walking” in a narrow range, after which it will rush to re-test the level of $ 13,000 and, in case of breakdown, will go to $ 15,000 and above. If buyers fail to win this battle, the price will fall short to the range of $ 9000- $ 8500 and after sellers take profits will rush up again. With any outcome in the short term, bitcoin has strong support from investors who are looking for new opportunities and assets not only to save money, but also to make good profits. That is why, we believe that growth in the medium term (during the year) and long term is inevitable.

Tips for traders from PrimeXBT

Amid uncertainty in the markets due to trade wars between the US and China, as well as the vague policy of the US Federal Reserve, it is important for traders to have at their disposal a wide selection of financial instruments. With the introduction or transfer of trade duties, the refusal to lower rates or the easing of monetary policy by the Federal Reserve, financial markets are in a fever. Traders must make decisions instantly and transfer funds from one asset to another.

PrimeXBT trading platform offers traders margin trading with leverage up to x500 currency pairs in the Forex market, cryptocurrencies, leading world indices, precious metals and commodities. At a time when the situation in the financial markets is aggravating, it is necessary to open long positions in defensive assets, the Japanese yen, the Swiss franc, gold and, as we have found out today, in bitcoin. When the situation stabilizes, defensive assets can be shortened, but at the same time you can buy risky assets, for example, stock indices, the EUR / USD currency pair, oil and other assets.

Leverage, the absence of errors when opening a position by any volumes, due to aggregated liquidity, as well as the recent decrease in trading commissions and fees for transferring positions to the next day, make it possible to maximize profits both for long-term investors and intraday traders.

Since not everyone has the opportunity to trade independently, PrimeXBT announced the launch of a joint investment fund management module as part of a partnership with Covesting. Covesting-module allows inexperienced traders and investors to invest in funds that were created by professional traders. Experienced traders, in turn, using invested capital, significantly increase their income.

Follow the situation in the financial markets with PrimeXBT analysts and take advantage of unique offers

companies today.