C.R.E.A.M. Finance – overview of the ERC-20 token and the DeFi platform, schedule, course, price, prospects, where to buy and trade. C.R.E.A.M. Finance – opening a financial system built on smart contracts. It is a decentralized lending platform based on Compound Finance and an exchange platform based on Balancer Labs with liquidity mining capabilities.

The project was originally launched on the Ethereum blockchain, but switched to Binance Smart Chain (BSC) from September 1 due to its speed and cost-effectiveness.

CREAM is the control token of the Cream platform. Its owners can vote to support new assets, add or remove liquidity pools, change other parameters of the site. CREAM is rewarded to liquidity providers in pools and voting participants on management issues.

On September 16, 2020, the token was added to the listing of the Binance exchange for trading in CREAM / BUSD and CREAM / BNB pairs. We offer an overview of the functionality and prospects of the project from the editors of Bitcoinminershashrate.com.

#Binance will list Cream Finance $CREAM 💥

🔸Binance will open trading in CREAM / BNB and CREAM / BUSD pairs on September 16, 2020 at 16:00 (Moscow time)

🔸Users can already replenish CREAM balance in preparation for trading pic.twitter.com/Sa8TNzcga3– BinanceRussian (@BinanceRussian) September 16, 2020

The content of the article

Cream price chart (CREAM)

Binance CREAM / BUSD chart:

Specs

| Name | Cream |

|---|---|

| Ticker | CREAM |

| Standard token | ERC-20 |

| Blockchain | Ethereum |

| Total emission | 9 000 000 CREAM |

| Current issue as of 02.10.20 | 422 973 CREAM |

| Course on 10/02/20 | 47,9 $ |

| Market Capitalization as of 02/10/20 | 19 538 080 $ |

| Official site | https://app.cream.finance/ |

| Blog | https://medium.com/@CreamdotFinance |

| https://twitter.com/CreamdotFinance | |

| Exchanges | Binance, Balancer, Uniswap, Cream Swap |

| Founder | Jeffrey Huang |

Cream platform overview

Opportunities that the Cream project provides to DeFi users:

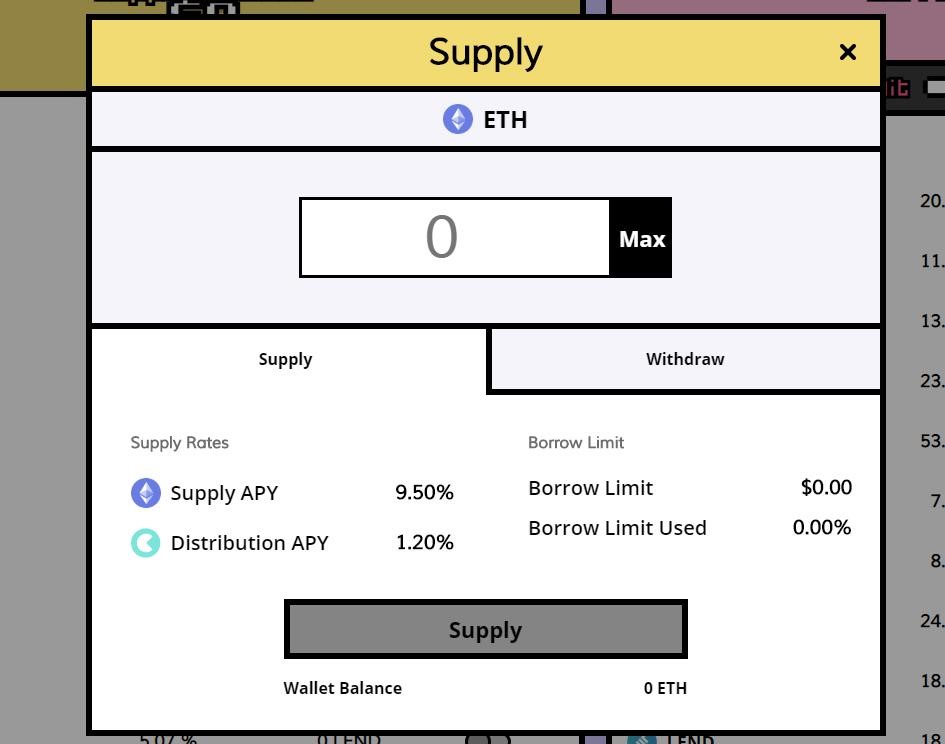

Cream Lending

Among DeFi projects, the trend is now to provide peer-to-peer lending services. Therefore, the CREAM team has also developed a similar tool. At the moment, the ecosystem allows you to borrow assets:

BAL, COMP, USDC, USDT, ETH, CRV, YFI, LEND, BUSD, REN

Additionally, with the launch of CREAM on Binance Smart Chain, users can streamline XRP, BCH, LTC and TRX transfers by linking CREAM to Binance via the BEP2 standard.

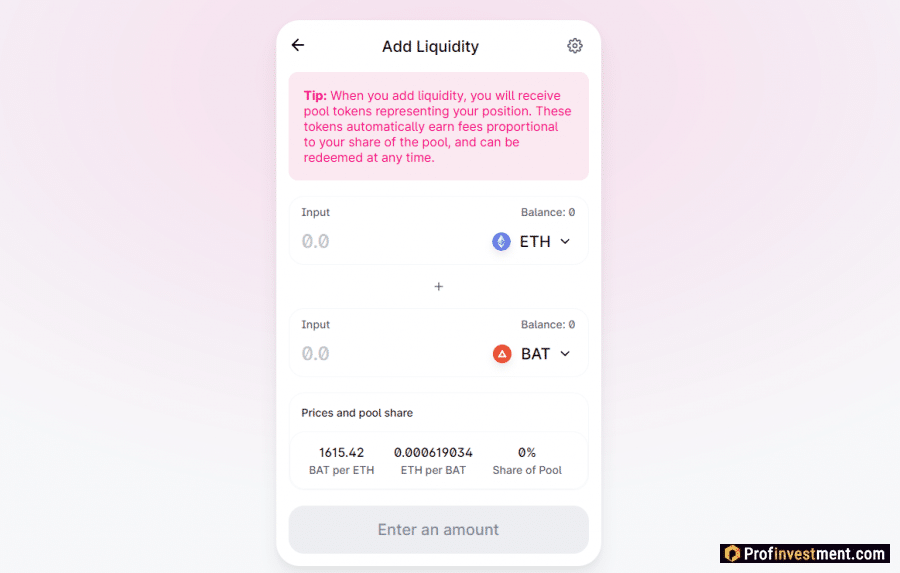

Cream Swap

Cream Swap is AMM, which is an automated market maker, which was launched on September 8th. Based on the Balancer protocol. Swap is expected to become an improved analogue of the current models used, for example, in Uniswap, as fees and gas fees in the Ethereum network are constantly growing.

Users who deposit assets into liquidity pools on the Cream Swap platform or create pools are rewarded with tokens. In addition, commissions on this site are lower than on Uniswap (0.25% versus 0.3%), of which 0.20% is paid to liquidity providers, and the remaining 0.05% is sent to the CREAM network. To incentivize users to provide liquidity, CREAM will distribute 3,000 CREAM tokens daily for pools that include pairs with CREAM and 500 for other pools.

On the page https://app.cream.finance/pools you can see a list of all available pools and their current state.

creamY USD

New AMM from September 24th, which includes dynamic pools, consolidated liquidity, one-way liquidity and everything based on stablecoins.

At the time of launch, creamY USD supports the following tokens: crUSDC, crBUSD, cUSDC, crUSDT, USDT, USDC, BUSD, yCRV, TUSD, yUSD, yTUSD, cUSDT yUSDT, yUSDC. In the creamY USD Swap section, you can exchange them with low slippage and low commissions – the exchange fee is 0.035%. All commissions go directly to CREAM and can be used by developers at their discretion to develop the platform.

CREAM Management Token

CREAM is an ERC-20 standard token with a total emission of 9,000,000. Allows holders to participate in platform management – to vote on adding and removing various liquidity pools, introducing new supported currencies, improving platform parameters, etc.

On September 20, 2020, 67.5% of the total Cream Finance (CREAM) tokens were burned. 6,075,000 CREAM burned out, 2,925,000 CREAM remained.

🔥🔥🔥🍦🍦🍦🍦🍦🍦🍦🍦🔥🔥🔥

It is done. 6,075,000 $CREAM burned. 2,925,000 remain.

🔥🔥🔥🍦🍦🍦🍦🍦🍦🍦🍦🔥🔥🔥https://t.co/EeVNlHfuxe https://t.co/4tRA3KnrZV pic.twitter.com/iSRCXJfZFx— Cream Finance 🍦 (@CreamdotFinance) September 20, 2020

Users have the opportunity to earn CREAM tokens when they provide liquidity to existing pools or take part in governing votes.

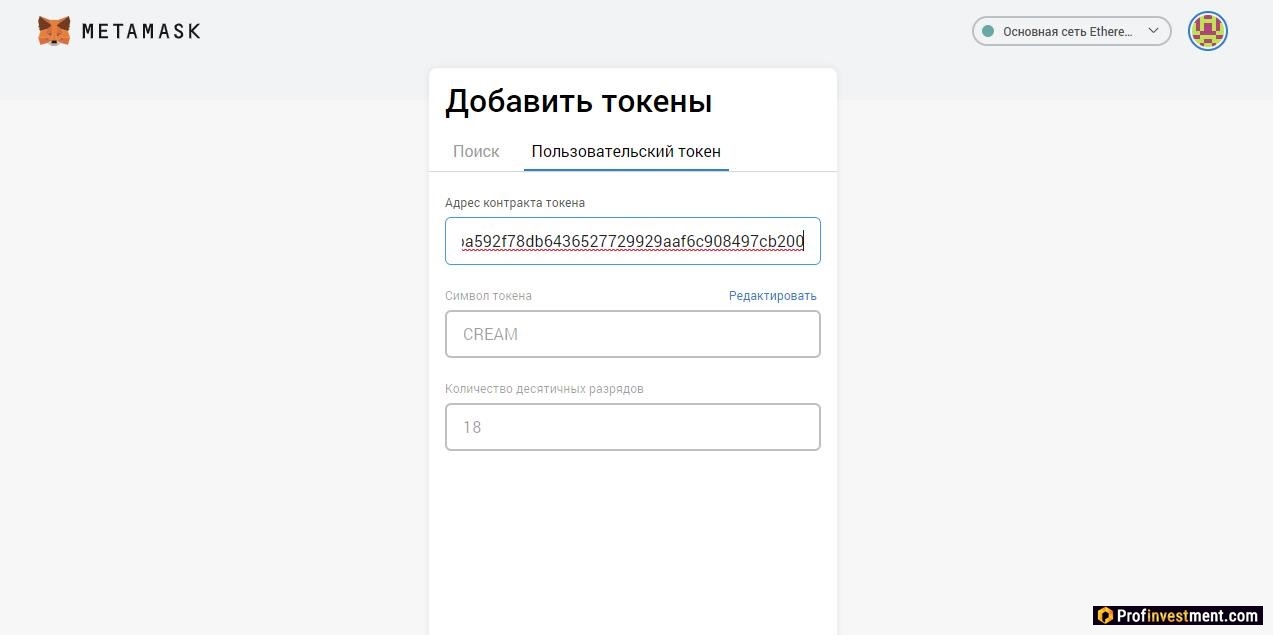

Where to store CREAM

As an ERC-20 token, CREAM can be stored in the Metamask browser wallet, which supports all coins hosted on the Ethereum blockchain. To do this, you first need to manually add the token to the list. The contract address can be found in the browser https://etherscan.io/token/0x2ba592f78db6436527729929aaf6c908497cb200

Through Metamask, you can connect to the Cream ecosystem to deposit or withdraw any supported assets.

Where to buy, sell, trade CREAM

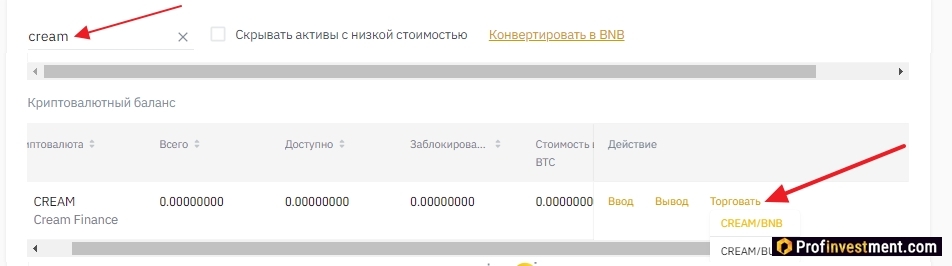

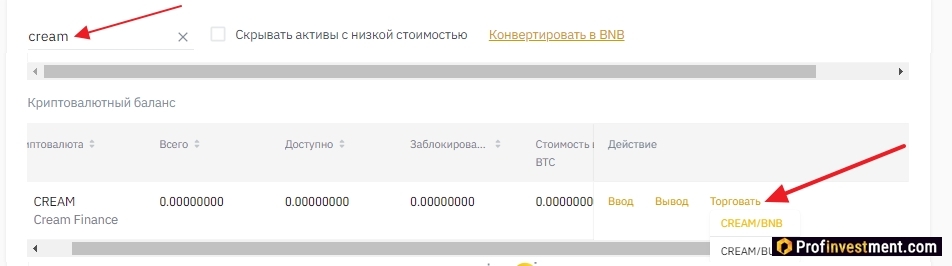

The token has been listed on the Binance exchange starting September 16, 2020. Therefore, you can easily purchase it here. To do this, log in to the site binance.com and top up your account balance with BNB or BUSD coins.

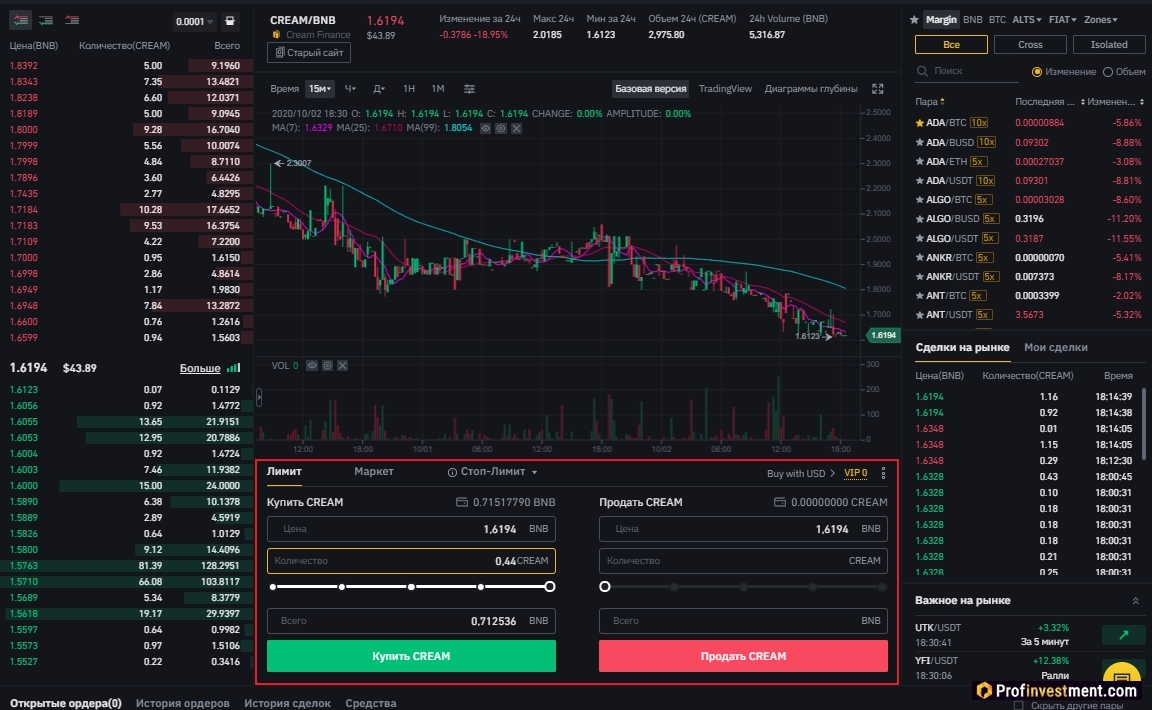

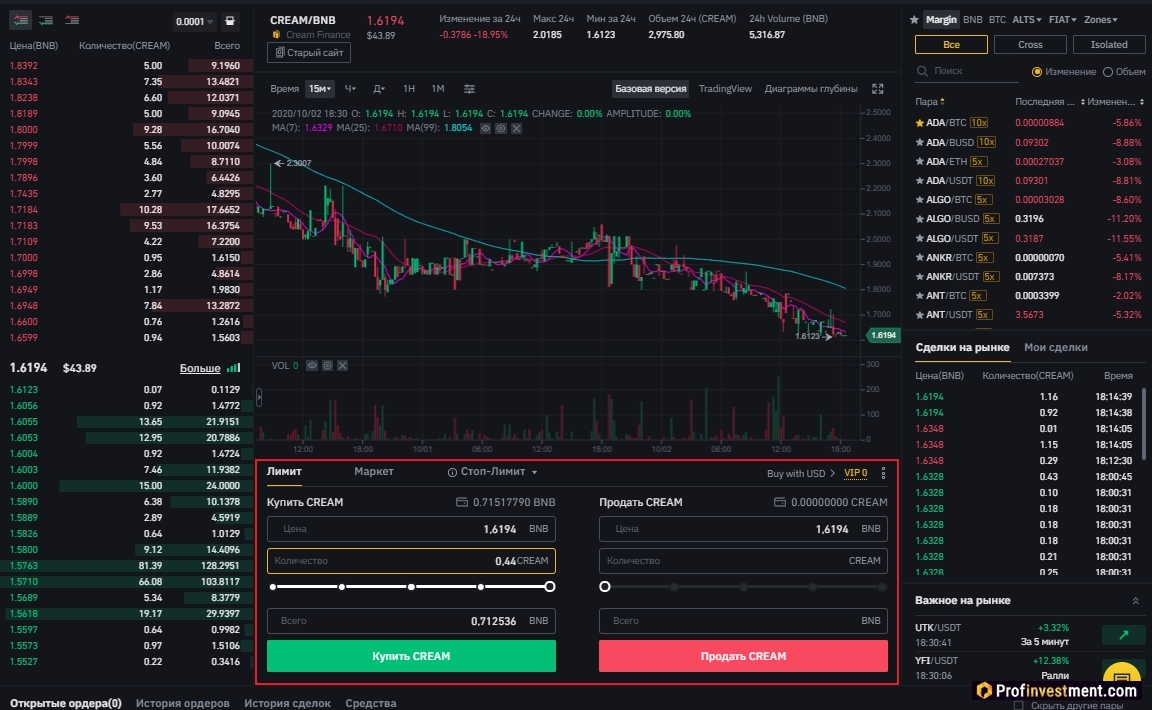

Then go to the spot wallet, find the desired token and click “Trade”. Choose a trading pair that is convenient for you.

Create a buy order in the trading terminal. Subsequently, it will be possible to sell tokens in the same way. This operation does not require account verification.

Advantages and disadvantages

Pros:

- The functionality includes all the basic options that DeFi users need.

- Moving to the Binance chain with slower Ethereum.

- The team is actively communicating on social networks.

- Well-known developers (previously created the social platform Mithril on the Ethereum blockchain, also worked on OmiseGo).

Minuses

- Slightly erratic development, updates are released spontaneously. There is no roadmap.

- As the founder himself admits, the team does not audit the pieces of source code borrowed from other platforms.

Conclusion

Although Cream is a relatively new platform in the DeFi space, it can be observed that the volume of assets on it increases every day. The Swap product has also attracted quite a few new users from other decentralized exchanges thanks to its lucrative fees.

If you look at the blog updates Medium, it will become clear that the Cream Finance team is very closely monitoring the DeFi space and intelligently selects those elements that are popular with other projects, for example, Compound Finance, Balancer, Curve Finance and Uniswap, only in their platform they will further improve them.