How to Invest in DeFi: Main ways Invest in DeFi projects and tokens – DeFi is a sought-after destination for investment opportunities today. Decentralized finance offers many useful functions similar to traditional ones (only by purpose, not by execution principle). But it is also a wide space for profitable investment manipulations. The Bitcoinminershashrate.com editorial team offers a guide to investing in DeFi tokens, from which you will learn about all the possibilities, advantages and disadvantages of this type of investment.

The content of the article

What is DeFi and what DeFi projects are

DeFi (Decentralized Finance) – decentralized finance, this is a sphere that is being formed to compete with the imperfect traditional financial system, characterized by a large number of intermediaries, long and costly operations, the need to verify identity, etc.

The first step towards replacing the traditional system was Bitcoin, and DeFi is the next step. The sphere differs in that it is managed by the community to the maximum and does not require participants to entrust their funds to third parties or services – they are all stored on users’ own wallets.

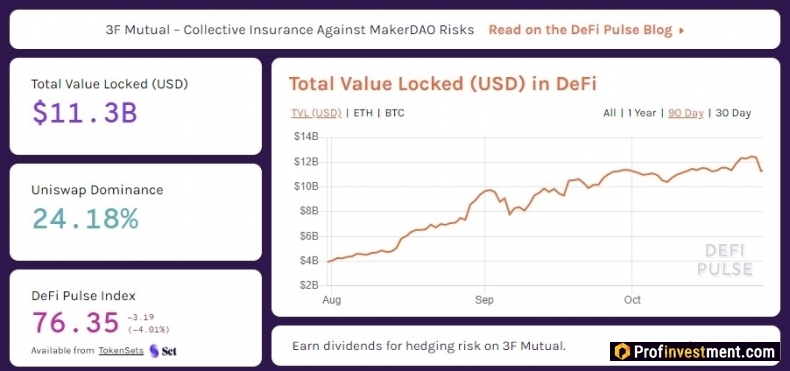

DeFi market leaders are, of course, looking to attract new entrants to their projects and protocols, so there are already a number of ways in which token holders can generate income. The decentralized nature of the systems and the lack of KYC / AML requirements have already attracted millions of users – currently, more than 11 billion dollars are blocked in the protocols of decentralized finance, and this amount is growing every week.

The main types of DeFi projects:

- Landing page – decentralized lending between users. Completely anonymous and no credit check. The loan is issued on bail. Asset providers earn on interest.Examples: Maker, Compound, Aave.

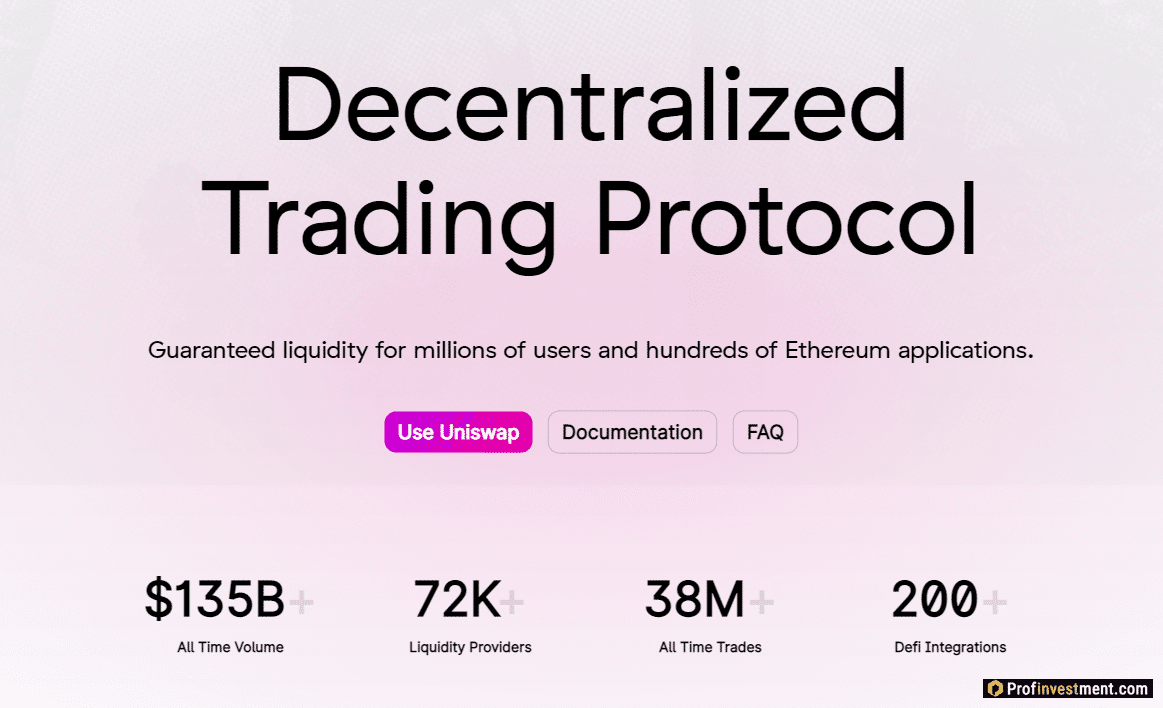

- DEX are decentralized exchange platforms. Automated markets for asset trading, where liquidity providers also receive additional rewards.Examples: Uniswap, Curve, Balancer.

- Assets – the formation of synthetic tokens based on the embedded cryptocurrency, reflecting the value of external assets. Thus, you can, for example, trade on the Ethereum blockchain, tokenized bitcoin, gold and anything else that has a certain price.Examples: WBTC, Harvest Finance, renVM.

- Derivatives – work with decentralized contracts for the purchase or sale of cryptocurrency, or for some events. Examples:Syntetix, Nexus Mutual, Erasure.

- Payments are systems that form convenient ways of making any payments between users or services on a decentralized basis. Examples: Flexa, Lightning Network, xDAI.

As in the case with traditional financial products, here the user has the opportunity to receive active or passive income. In the first case, it is necessary to regularly perform certain operations, for example, to trade. In the second case, the participant does not actively trade, but at the same time receives a stable income from his crypto assets.

Investing in DeFi

Let’s consider the main proven ways of how you can invest in DeFi and make a profit.

Income farming

Profitable farming is a way of investing in which the user puts his funds into the protocol and receives a reward for this in the form of native tokens of this protocol. This is quite simple at first glance, but if you want to get the maximum income, then you will need to study different strategies and periodically move funds between protocols, looking for the most profitable options. The boom of profitable farming (pharming) began when the Compound protocol began distributing Comp tokens to active users.

Examples of platforms:

Resources for finding the highest pharming profitability : https://www.coingecko.com/en/yield-farming; https://defiyield.info/; https://coinmarketcap.com/yield-farming/.

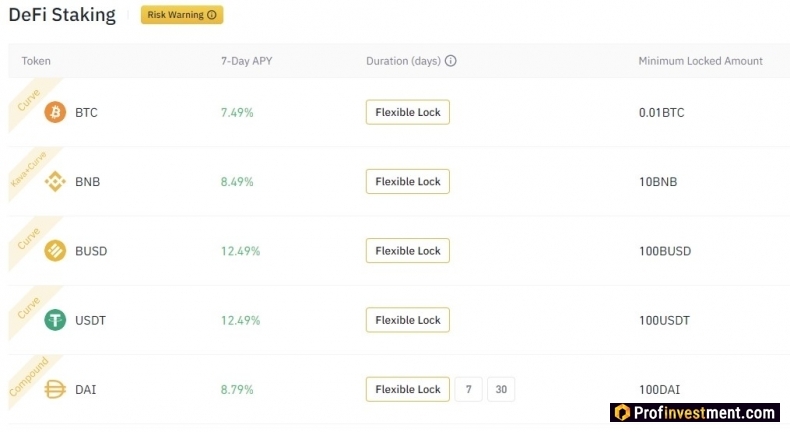

Staking

In Proof-of-Stake networks, validators are responsible for confirming transactions; they generate blocks of verified transactions and put them on the blockchain. From the client’s point of view, staking is like a savings account – you need to block a certain amount in the account in order to receive passive income from it. DeFi has the concept of investor-managed staking pools using decentralized PoS protocols.

An example is Binance’s DeFi Staking platform https://www.binance.com/ru/defi-staking

Binance DeFi Staking acts on behalf of the user to take part in certain decentralized finance projects, and also performs the functions of receiving and distributing income. In fact, this is an aggregator, where the user only needs to make a couple of clicks, and the system will do the rest. For holding certain coins on the account for at least 1 day, the user receives earnings based on the amount and duration of the holding.

Buying tokens with the expectation of an increase in price

Classic investing according to the principle “buy cheaper – sell more expensive” also takes place in DeFi. However, there is one difficulty – the volatility of new tokens is simply off scale, it is much higher than that of top cryptocurrencies. You can both make thousands of dollars in one day and lose the same amount. Therefore – caution and again caution.

Examples of currently promising tokens for investment :

- LINK. Token of the ChainLink project, which provides highly secure and reliable smart contracts.

- UNI. The token of the Uniswap decentralized trading platform is a leader in its field.

- MKR. The token of the Maker credit platform described above, which allows you to participate in governance.

- SNX. The platform token for creating synthetic assets Synthetix Network.

- COMP. Compound credit protocol governing token.

(The list is not an investment recommendation . It is based on the market capitalization of certain projects – an important indicator of community trust).

Interest deposits in credit pools (landing page)

In decentralized lending, lenders and borrowers interact through a distributed system. The borrower takes out a loan at interest, leaving the collateral. Investors, on the other hand, invest their funds in the general pool and earn on interest. Both operations use DApps, smart contracts and other DeFi protocols. Most of the operations are automated and free from the risk of human error. Interest rates are freely determined based on supply and demand for a specific asset.

Examples of platforms:

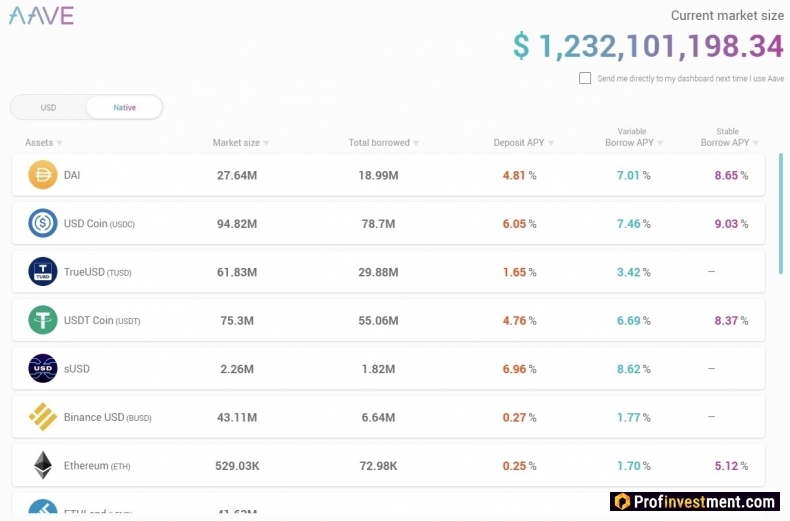

- Aave. An open source protocol powered by Ethereum to create money markets. It is most popular for lending and borrowing, although it has other functions. The work is carried out on the basis of a dual model of tokens: aTokens and AAVE (formerly LEND).

Aave

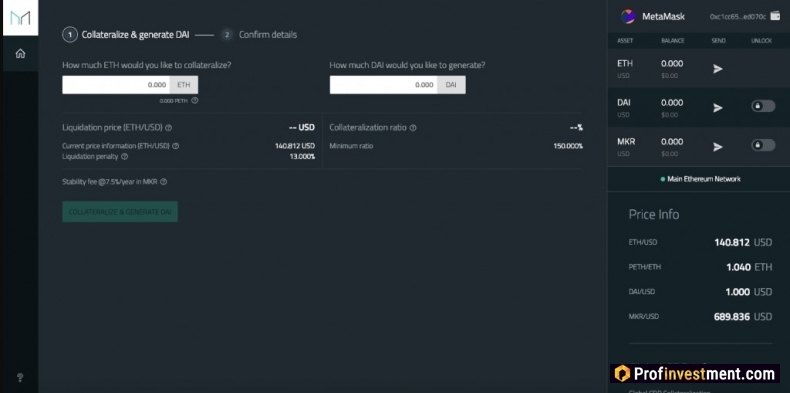

Aave - Maker. One of the most reputable decentralized lending and borrowing platforms. It was originally founded as a way to eliminate the problem of high cryptocurrency volatility. Uses the DAI stablecoin pegged to the US dollar.

Maker

Maker

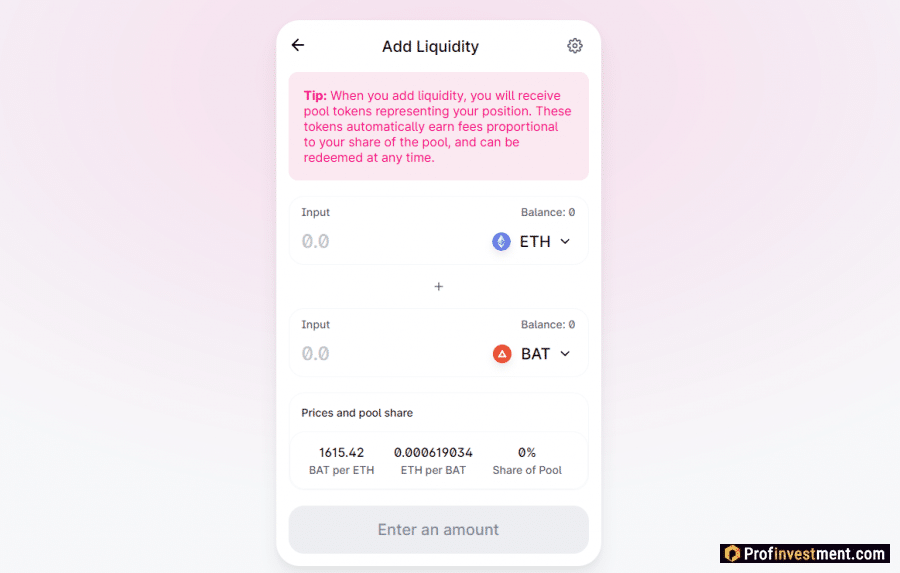

Leverage on DEX

Margin trading, or trading with leverage, is the provision of borrowed funds to the user against the security of his own. Credit funds can be used exclusively for trading on the same site. In DeFi, users play the role of creditors. They provide their assets to other users (traders) and receive interest from this, while the risk of losing funds even with a trader’s unsuccessful trade is minimized, thanks to special security mechanisms.

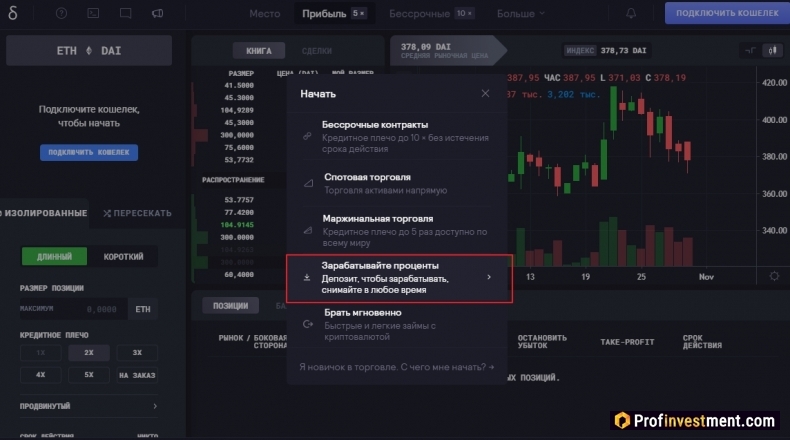

An example is the dYdX decentralized crypto exchange .

It is enough to make a deposit to start receiving interest income in the same second. The variable interest rate ensures that the lender always receives the optimal rate of return based on market conditions. dYdX aggregates spot and credit liquidity from multiple third party exchanges. Leverage up to 4x is supported.

What you need to know before you start investing. Potential risks

Before making your first investment in DeFi, check out a few tips.

Make sure that the project is not fraudulent, and that it has been verified by well-known audit companies (Quantstamp and OpenZeppelin) and there are no critical vulnerabilities or bugs. If you yourself understand smart contracts, then you can view them yourself – honest projects always upload open source code. Also, make sure the contract breaks through on Etherscan or another blockchain explorer.

Social networks and blogs can provide valuable information. Check if there is a project on sites like DeFi Prime, DeFi Pulse, DeFi Market Cap. Only authoritative protocols go there.

Do not trust attractive names, they can hide behind shitcoins and scamcoins, or simply the expectation does not correspond to reality.

Don’t invest more than you can afford to lose. This is the main rule of the investor, and not only in relation to DeFi, but absolutely to any asset. Do not take out loans for these purposes, do not make purchases with a credit card and do not go into debt. On this topic, one can cite as an example very sad posts on Reddit, where people have lost everything: the first, the second.

If you are going to invest for a long time, then provide for secure storage, for example, a hardware wallet.

Finally, diversification is key. You cannot put all your eggs in one basket. This ensures that you do not lose everything at once due to unexpected market movements or technical problems.

Expert opinions

Jay Hao, a veteran and seasoned technology leader and CEO of OKEx, predicts that decentralized finance technology will remove transaction barriers, increase efficiency, and ultimately have a significant impact on the global economy as a whole. He repeatedly wrote about this on his Twitter: “Despite the shortcomings in the development process of DeFi, our responsibility is to help them grow.”

4) And, I would like to support #DeFi by volunteering as a multisig key holder for $SUSHI.

The development of #DeFi is a big event to the entire crypto industry. Despite the flaws in its development process, it’s our responsibility to help it grow.https://t.co/FassdTqbBM

— Jay_OKEX_CEO (@JayHao8) September 6, 2020

Cosmos and Tendermint co-founder Ethan Buchman believes DeFi has potential, but lacks transparency. As he put it in an interview: “In traditional finance, you can be deceived, but you do not know how, but in DeFi you can also be deceived, but it is clearer how.” Experimenting with DePhee is fun, but there is still a long way to go to a sustainable financial system.

Vitalik Buterin on his Twitter regularly speaks negatively about DeFi, or rather, about the excessive profitability they provide.

Some people: let’s create easy-to-use global-access financial infrastructure and use mechanism design and smart contracts to create new forms of social organization!

Other people: YAY yield farming 135%!!!1!There’s a tension here that we should be talking about more.

– vitalik.eth (itVitalikButerin) July 1, 2020

Nicholas Pelekanos, head of trading at NEM, commented: “DeFi is gaining a lot of attention in the crypto community as a disruptor of the traditional banking system, as evidenced by the recent Messari report.” dollars in BTC were tokenized on the Ethereum blockchain to participate in the DeFi protocols).

$500M worth of #Bitcoin has been ported over to Ethereum in 2020

With only 0.3% of all bitcoin on Ethereum and DeFi booming, the opportunity for decentralized bridges between the two chains is hard to ignore. $KEEP $REN pic.twitter.com/tLGWlaIuFZ

– Messari (@MessariCrypto) September 1, 2020

How to buy DeFi project tokens

There are several ways to purchase DeFi project tokens for investment:

- Centralized exchanges. Such an opportunity is provided today by almost all popular platforms: Binance, Huobi, CEX IO, Kraken, Bitfinex, Coinbase, Currency, etc.

- Decentralized exchanges. Modern DEXs, powered by liquidity pools, support all tokens that exist on the Ethereum blockchain. Examples of such sites: Uniswap, Curve, Sushiswap, 0x Protocol, Balancer, Kyber Network.

- Wallets. Wallets such as Argent, Trust Wallet, Coinbase Wallet support various DeFi tokens and applications, and also allow you to safely store assets without trusting the safety of keys to a third party.

Advantages and disadvantages

Pros:

- The possibility of obtaining high profits.

- Promising area.

- Many interesting innovative projects.

- Interest from large exchanges, wallets and other projects.

Minuses

- High level of risks.

- There are many fraudulent projects.

- Technological preparation and deep study of the topic are required before starting work.

Conclusion

Finding a protocol that fully meets all the selection criteria is not easy. Especially take into account that the DeFi sphere, and even more so investing in it, is still in its infancy. There are many experiments and innovative ideas in it. Some are destined to achieve universal acceptance, and some will not stand the test of time. If you want to invest in DeFi, then pay attention to studying different types of projects and invest no more than you can afford to lose.