Why invest in Bitcoin? According to Richard Branson the “Blockchain is an economic revolution” and highlights the huge industry around Bitcoin in particular. This recognition by business leaders shows you the scope of Bitcoin and its current potential, not only as a speculative asset, but also as an investment asset.

When you invest in an asset, you speculate on a price increase over time. You must feel that there is intrinsic value in the asset in which you have invested.

Read More into the Origin of Bitcoin – Bitcoin: Origins, Birth, Characteristics

As for investment funds and other major investors, they must see the value of Bitcoin. And they are right in this view. Bitcoin is the first cryptocurrency that was developed, it was the pioneer of the blockchain. The blockchain is the intrinsic value of Bitcoin, being such an innovative idea, it triggered a change of thinking in the financial sector. This is a sector that has used traditional procedures for years and it’s hard to change.

Bill Gates Quotes About Bitcoins

Bitcoin joins the group of financial instruments and shocks balances. There are high-level CEOs who attack Bitcoin and others who praise it.

JP Morgan CEO Jamie Dimon says Bitcoin is a “bubble” that will eventually explode, but former AOL boss Chamath Palihapitiya said: “It’s a huge deal, a huge case “. And in fact continues to say “I own Bitcoin in my hedge fund, I own Bitcoin in my fund, I own Bitcoin in my private account”.

In fact, despite the claims of Jamie Dimons, JP Morgan helps its customers buy and invest in Bitcoin. Bitcoin investment trusts are becoming readily available to clients and people are now getting exposure to Bitcoin through Bitcoin Investment Trust Shares!

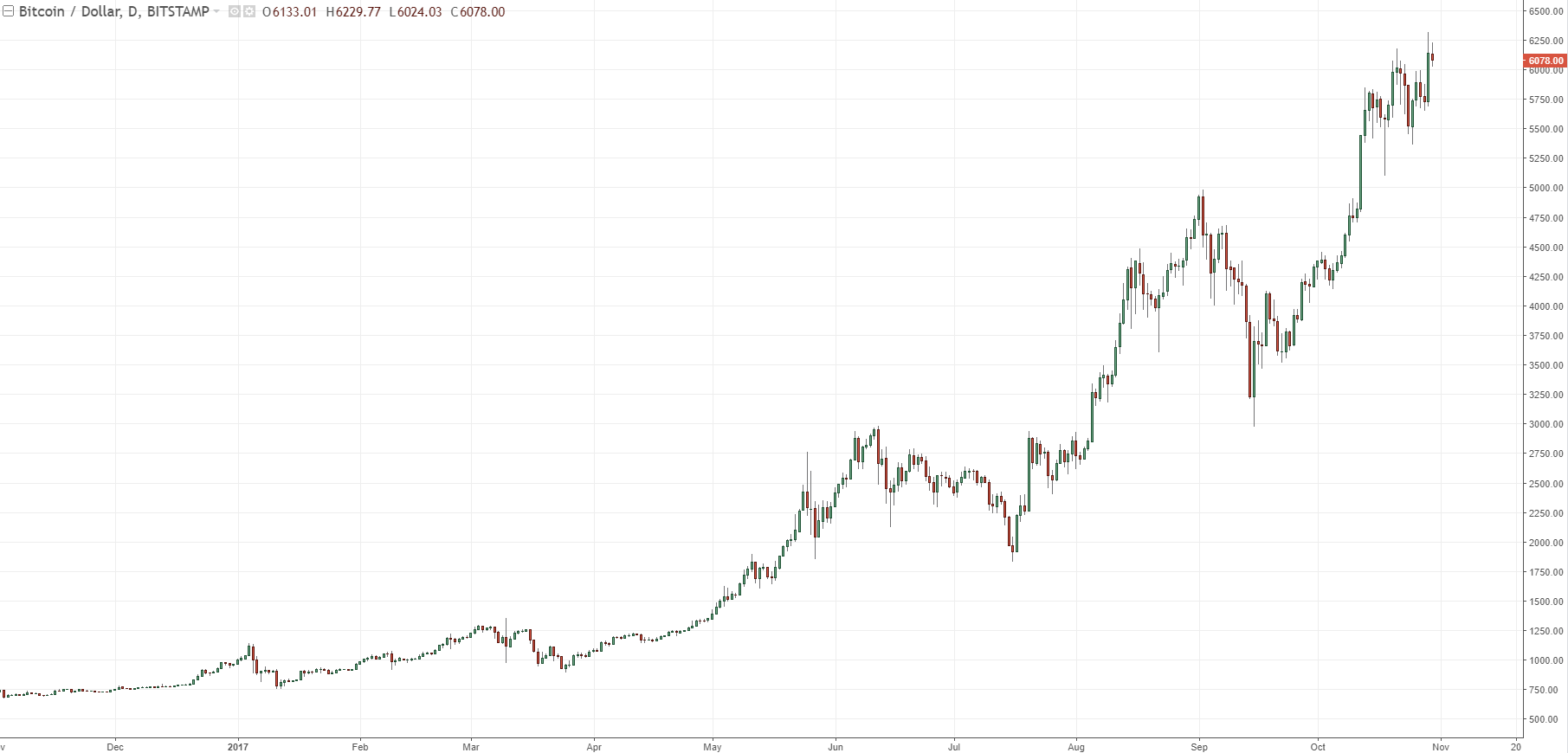

Bitcoin price growth

Bitcoin has experienced tremendous growth in 2017, surpassing all traditional investment instruments. With an increase of more than 700% in 2017, the trajectory of this market does not seem to slow down.

One of the biggest tips for beginners is, “The trend is your friend.” This means that you should not try to be the smartest person and try to choose a higher or a lower market. Go with the crowd, the crowd is finally the driving force of the market, so why not follow it?

Bitcoin has basically been rising all of its life. Like all markets, there have been periods of stagnation, but the trend has been on the rise. Trying to be “the person” who chooses the opposite trend will cost you in the long run.

Do experts advise investing in bitcoin?

Without making any value judgments, while remaining as objective as possible, no expert should advise you not to invest in bitcoin, because it is a real boon. Certainly bitcoin is not unanimous and many critics point to its extreme volatility as one of the biggest risks. But volatility itself is not such a bad thing. And it even turns out to be an ally who will exploit it.

There are more and more experts who understand the real issues of this cryptocurrency. And many of them are leading figures in the world of finance, and business.

Xapo CEO Wences Casares recently said during a conference that the price of a bitcoin would exceed the million dollar mark in a decade. For those who do not know, Xapo is the world’s largest bitcoin repository and Wences Casares, its president, is a prominent figure in the world of crypto currency. His announcement then left the whole assembly speechless. But to see more closely, this scenario is so unlikely. We even think that at the beginning of the adventure of bitcoin and crypto currencies, no one expected the situation we are experiencing at the moment. So the story could be repeated.

For the president of Xapo, the biggest blunder that we could commit today is certainly not to invest more than we can allow ourselves to lose in bitcoin. The most monumental mistake would be to not invest anything at all. Everyone should invest at least 1% of their wealth in bitcoin, and wait for the next ten years.

Although this is the most optimistic forecast of the course of bitcoin, Wences Casares is not the only expert who thinks it is necessary to hurry to invest in bitcoin.

Peter Smith the CEO of Blockchain and Jeremy Liew, boss of Snapchat, think so too; For the latter, the price of bitcoin over the next few years will most likely reach a value of $ 500,000.

For Mark Yusko, founder and chief investment officer of Morgan Creek Capital Management, the take-off phase of bitcoin has been successfully completed. The real feat he saw was to see bitcoin pass the $ 100 mark. It is now only a matter of time before the value of bitcoin reaches $ 40,000 or $ 400,000.

According to Mark Yusko, this growth of bitcoin will be essentially conditioned by three factors. As a first step, bitcoin will first have to be established as a store of value.

It will then have to be considered in the same way as gold. And finally, it is important that he can enjoy a “network effect”.

And on this last point, the chief investment officer of Morgan Creek Capital Management seems particularly confident. This network effect or the network effect already seems to be an acquittal for bitcoin.

As long as bitcoin continues to attract public interest, its growth will not stop.

Road-map, white paper and the evolution of Bitcoin

The bitcoin road map

The financial services sector is currently undergoing a period of change and major upheaval.

The use of cryptocurrencies is becoming more widespread and accepted as a legitimate currency for transactions. Japan has in particular conferred a bitcoin legal tender on its territory.

We are building mining markets and we are focusing our efforts on developing a mining company for the next 100 years.

BRM technology offers significant benefits and opportunities for its users.

- Cryptocurrency

These virtual currencies are known as “cryptocurrencies”. And as the name suggests, the currency is encrypted so as not to be counterfeit and encrypted data can not be overwritten or altered

- blasting

The creation of Bitcoin involves the verification and addition of recent global bitcoin transaction data to the public ledger of transactions, known as blockchain (distributed ledger). Virtual currency is offered as a “reward” or incentive in exchange for that. The process is called “mining” by analogy to gold mining.

- Ai Trade

At the forefront of advances in statistical methods of machine learning.

Development of deep learning techniques.

Make AI exchanges possible.

Arbitration AI trading system.

An AI system builds the “best exchange” available on a range of cryptocurrencies based on large amounts of accumulated data, and performs each step of the exchange correctly.

- Goal

BRM is the mining company par excellence. Its high-performance AI (Crypt Engine) trading system and its ability to exploit BTU at high speed, using real mining knowledge and bitcoin pitch implementation information, give it an unparalleled perspective on the crypto industry. -change.

Bitcoin: the white paper

After reading bitcoin’s white paper, it follows that:

This technology offers a system for electronic transactions without relying on trust. The experiment started with the usual setting of coins made from digital signatures, which allows a property control, but incomplete without a way to avoid double spending. To solve this, it has been proposed a peer-to-peer network using proof of work to record a public history of transactions that quickly becomes impractical for an attacker to change if the honest nodes control the majority of the processor’s power. The network is robust in its unstructured simplicity. The nodes all work at once with little coordination. They do not need to be identified, because the messages are not routed to a particular place and only need to be delivered at best. Nodes can leave and join the network at will, accepting the proof of work chain as proof of arrival while they are gone. They vote with their CPU power, expressing their acceptance of valid blocks by working to extend them and rejecting invalid blocks. All the necessary rules and incentives can be applied with this consensus mechanism.

Why is Bitcoin now considered a viable investment? How and why invest?

Invest in the BTC Vs Negotiate the BTC

The main difference between investing and trading is the time scale.

Invest in Bitcoin

As an investor, you are watching in the long run. We often talk about more than six months, but if you talk like big investors like George Soros or Warren Buffett, they will say that the long-term is 10 years and up. Warren Buffett is famous for saying “just buy something you would be perfectly happy to own if the market closed in 10 years”.

This is important for Bitcoin because if trade was interrupted, the currency can still be used to buy goods and services. Not only that, but the technology of the blockchain will last forever.

Negotiate Bitcoin

Negotiating something is about someone looking to take advantage of price fluctuations in a market. Management does not matter, simply it aims to create a profit in the short term.

Transactions can last for seconds or months, the more you keep, the more it becomes an investment rather than speculation. Trading can be very lucrative, with professional traders looking to produce 10% per month, but this forces them to be in front of a computer screen for most of the time. Compared to an investor who can simply buy the asset and has all the free time he wants. There are compromises for those who want to take advantage of both.

Suppliers like eToro offer copy services, where you can copy professional traders while investing in crypto funds, which will help you diversify your cryptocurrency portfolio.

Where to invest in Bitcoin?

Investing in Bitcoin is like investing in anything, there are many ways to profit from the growth of this cryptocurrency. You can invest in cryptocurrency itself, you can buy stocks in something that has an exposure to Bitcoin, you can derivatives of the cryptocurrency itself. These options are quite common to all assets, which matches your investment portfolio will depend on your needs.

Invest and own Bitcoins

You can own Bitcoins directly. Owning the asset requires you to open a portfolio, which can be complex, but there are now services that can help you throughout the process like buyvirtualcurrency.

Trade is the most common way to buy Bitcoins directly and there are two types of trading; Centralized Trade (CEX) and Decentralized Trade (DEX).

- Centralized exchanges have a central authority that controls the exchange, ensuring that transactions are executed according to the order.

- Decentralized exchanges are rarer because they associate a seller with a buyer and allow both parties to decide a price.

This type of investment is unregulated, exposing you to counterparty risk. If anything happens to your wallet or password, there is no central organization taking into account exchanges or portfolio providers, so you can lose your wallet of cryptocurrencies.

Invest in cryptocurrency funds

Cryptocurrency funds or Bitcoin investment funds are structured in the same way as mutual funds or exchange-traded funds (ETFs).

You can deposit your cryptocurrency in an account managed by an experienced manager or investment team. They can, on your behalf, exchange your cryptocurrency. They will take a profit commission and charge you a fee. This option is often used only by those with large cryptocurrency portfolios because the fees would wipe out a large portion of the profit for small account holders.

You can also buy shares in companies exposed to cryptocurrencies. This company can very well be an investment company that actively trades Bitcoin or other crypto-currencies.

Exposure to Bitcoin basically means that if the price of Bitcoin moves, your investment portfolio is affected, negatively or positively.

Invest in Bitcoin CFDs and other derivatives

Investing in Bitcoin derivatives is a widely used form of investment. This involves buying some kind of contract that accepts the purchase at a certain price. As a result, you do not actually own the underlying asset or the underlying cryptocurrency. CFD Bitcoin, contract on Bitcoin difference, can be bought and can be made profits on the fluctuation of the cryptocurrency.

Advantages of buying a Bitcoin CFD

- Leverage – You can use the leverage provided by the broker with whom you invest. This means that you do not have to deal with the full size of the position. When buying directly from Bitcoin, you must put all the capital in place, when you invest in Bitcoin CFDs, you only need to put a part. The broker will make up the rest depending on the leverage levels you choose.

- Regulation – As we have already pointed out, cryptocurrency exchanges are not regulated and therefore do not fall under any central authority or body. This automatically means that your investment has other risk factors to consider before price fluctuations.

- Higher Yield Potential – If you own Bitcoins directly and its value doubles, your investment will double. If you invest via CFDs and have a 2: 1 leverage, your investment can quadruple. In addition, caution is advised, with higher yields as the risks are. You can lose your investment faster.

- Reduced Fee – Cryptocurrency funds can be very expensive, charging high percentages on your return, while cryptocurrency exchanges can charge what they want in transaction fees. Buying through a broker is considerably cheaper, with brokers like eToro charging only a spread and no additional fees.

How to invest in Bitcoin – Step by step method

Coinlist’s preferred method of investing in Bitcoin is to use derivatives. You can use options, futures, but we recommend CFDs for beginners. One of the main reasons why we prefer CFDs is because the boot process is very simple and easy, making life a lot easier for beginners investing in Bitcoin.

Investing in Bitcoin is different from trading Bitcoin. Negotiating Bitcoin means that you are constantly in and out of the market. Investing in Bitcoin means that you are there in the long run. You are advised to forget it.

The process is as follows:

- Open a brokerage account.

- Finance with the amount you intend to invest in Bitcoin.

- Identify a level at which you are not ready to leave the market and define it as a point of exit from the disaster market

- Open a negotiation proportional to the size of your account. Place a stop loss at the point you defined above.

- Leave alone depending on your investment plan. An investment plan will be a predetermined period of time that you intend to keep or a predetermined level that you expect from the market, for example, $ 20,000 in the case of Bitcoin.

Invest in Bitcoin … but not only!

We have highlighted Bitcoin as a potential investment opportunity but there are many other crypto-currencies on the market that offer great growth potential.

Why diversify your cryptocurrency portfolio?

Diversifying a portfolio is imperative. It spreads your risk across different markets and means that if you encounter a problem and its price drops significantly, your other assets can cover its losses.

You should consider your investment portfolio as worth 100%. What percentage will you invest in which cryptocurrency? An example could be:

Bitcoin has the largest market share and is actively used as currency, so it is advisable to have a large portion of your Bitcoin portfolio. If you invest quickly in another cryptocurrency, it’s because you see a potential investment opportunity.