Uniswap is a decentralized cryptocurrency exchange (DEX), one of the most popular in the DeFi infrastructure. UNI is a service token of the project, which provides its holders with distributed management capabilities, as well as earning money on profitable farming. After its initial launch in 2018, Uniswap launched a V2 version in May 2020, and it is possible there will be a V3 launch by mid-2021, which will make the platform faster and more reliable.

In March, the market capitalization of the UNI token rose sharply, which allowed the project to enter the top 10 cryptocurrencies by this indicator. The Bitcoinminershashrate.com editors will tell you which exchanges are suitable for trading Uniswap (both for exchanging for other cryptocurrencies and for buying / selling for fiat).

The content of the article

Exchanges where you can trade Uniswap

UNI cryptocurrency is supported by almost all popular trading platforms. If you prefer to buy on decentralized exchanges, then it is most reasonable to choose your native Uniswap platform, and if on centralized ones, then Binance, which has established itself as the most reliable and functional.

Binance

Binance Exchange holds a leading position in terms of trading volume and the number of users. The site includes a wide range of trading and investment functions, which is regularly updated. All the necessary trading tools are present that allow you to receive active and passive income. You need to verify your account only if you plan to work with fiat, withdraw more than 2 BTC, or use some auxiliary functions.

- Official site: binance.com

- Established: 2017

- Daily trading volumes: $ 27,494,000,580

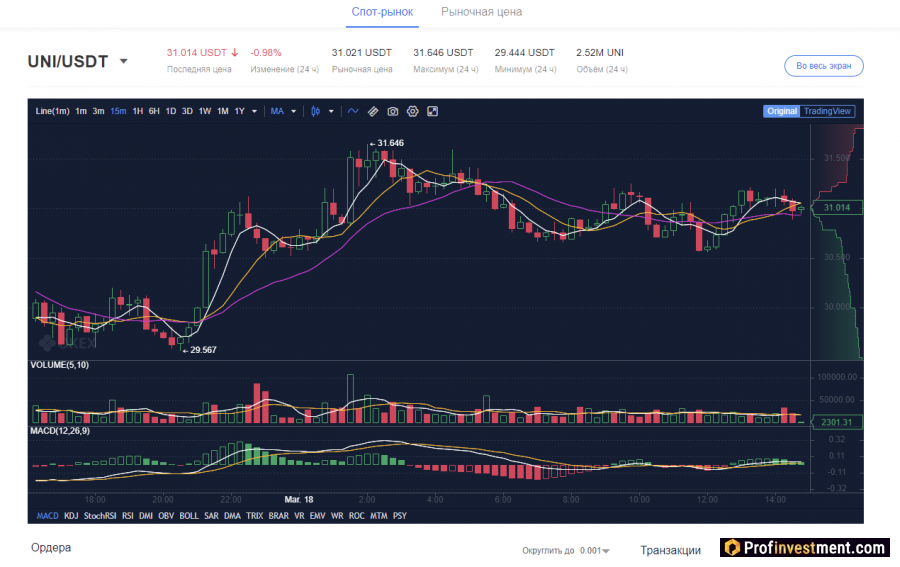

- UNI trading pairs: UNI / USDT

- Verification: not required

- Additional functionality: p2p, passive earnings, futures, margin trading

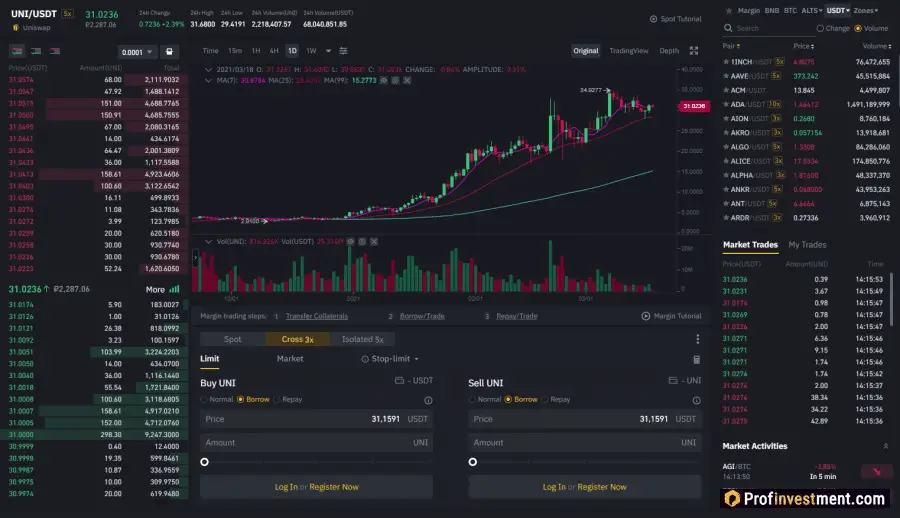

UNI can only be traded on Binance in tandem with USDT, and the daily volume of funds in this market exceeds $ 68,000,000. A classic or advanced trading terminal is available, margin trading with up to 5x leverage (for a given pair). It is possible to quickly convert one asset to another, as well as to quickly buy cryptocurrency from a bank card.

Uniswap (v2)

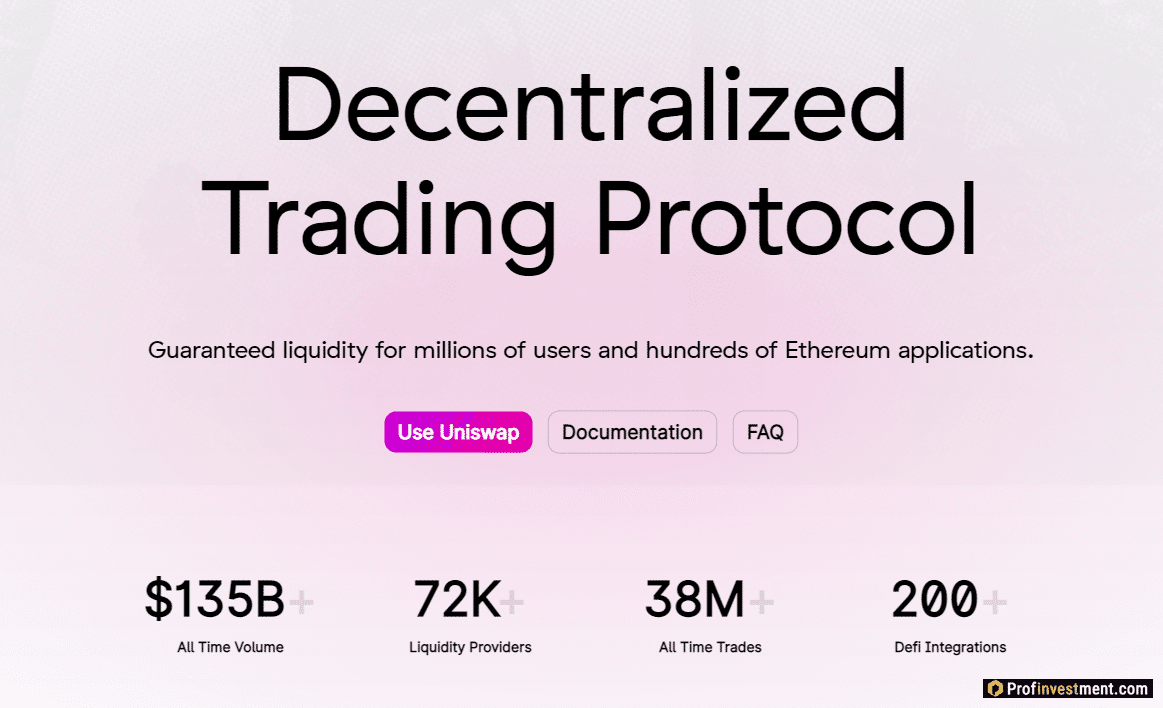

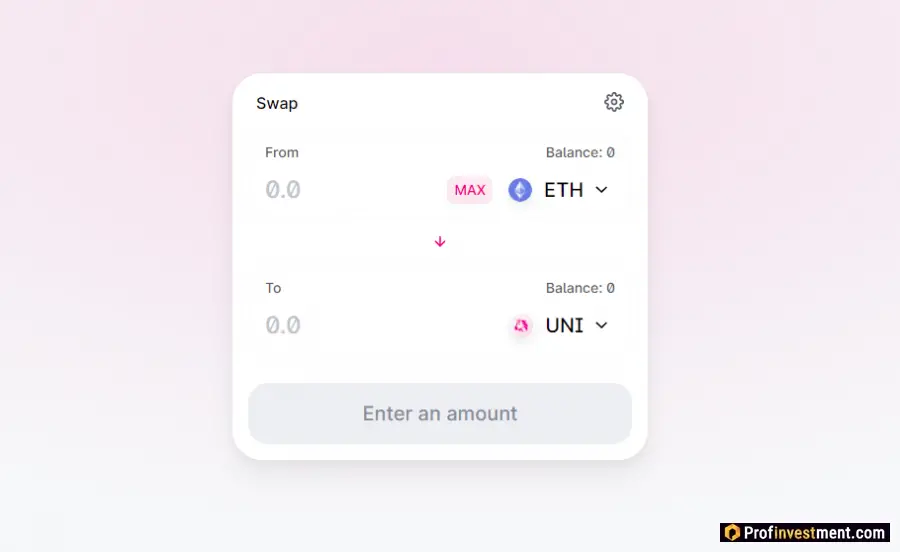

Uniswap is a decentralized exchange that is an automated liquidity protocol implemented using smart contracts on the Ethereum blockchain. Eliminates the need for trusted intermediaries, which increases censorship resistance and maximizes decentralization. The software is open source.

- DEX official website: https://app.uniswap.org/#/swap

- Established: 2018

- Daily trading volumes: $ 1,059,925,555

- Trading pairs with UNI: UNI / USDT, UNI / ETH and any assets working on the Ethereum blockchain

- Verification: not needed

- Additional functionality: liquidity supply, profitable farming, decentralized management

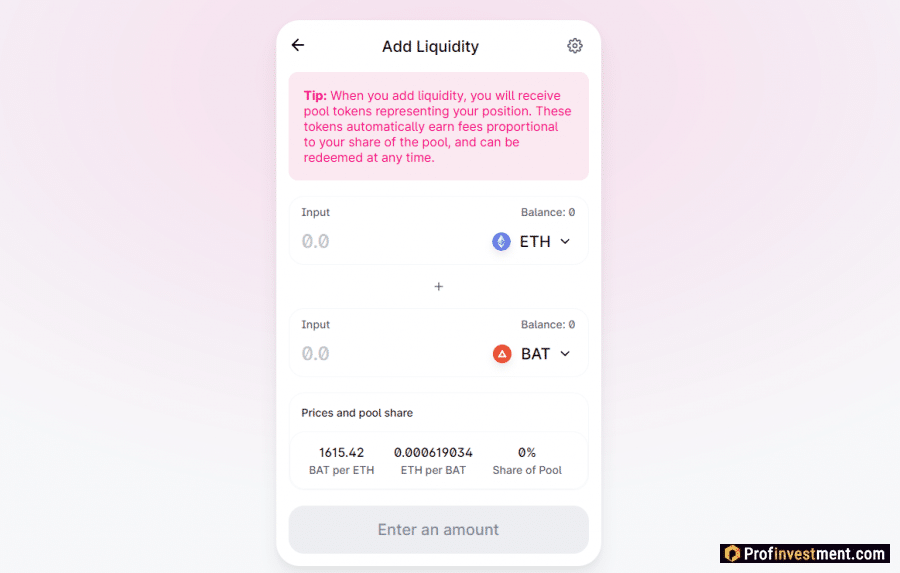

Each Uniswap smart contract manages a liquidity pool consisting of a number of two ERC-20 tokens. Anyone can become a liquidity provider (LP) for the pool. To do this, it is enough to deposit an equal amount of each base token and receive in return the pool tokens, which give the right to receive a proportional share of income when trading in the pool, and can also be exchanged for the base assets back at any time.

OKEx

OKEx was created as part of OKCoin when the US banned a number of blockchain transactions and the company decided to create a subsidiary platform by registering it in Hong Kong. OKEx today represents a whole financial ecosystem, striving to catch up with Binance in functionality. But the top priority is security – technologies such as distributed clusters and server load balancing are used to protect users.

- Official website: https://www.okex.com/

- Established: 2018

- Daily trading volumes: $ 6,113,936,293

- Trading pairs with UNI: UNI / USDT, UNI / BTC

- Verification: required

- Additional functionality: futures, options, margin trading, perpetual contracts, lending, DeFi, mining.

OKEx supports purchases from bank cards, trading with leverage up to 1:10 is available. It offers a fairly wide selection of coins for buying, selling and exchanging – over 240. There are applications for PCs and mobile devices that provide full functionality of the exchange. One of the advantages of the site is low trading fees, from 0.06% to 0.08% for the maker and from 0.08 to 0.1% for the taker.

Sushiwap

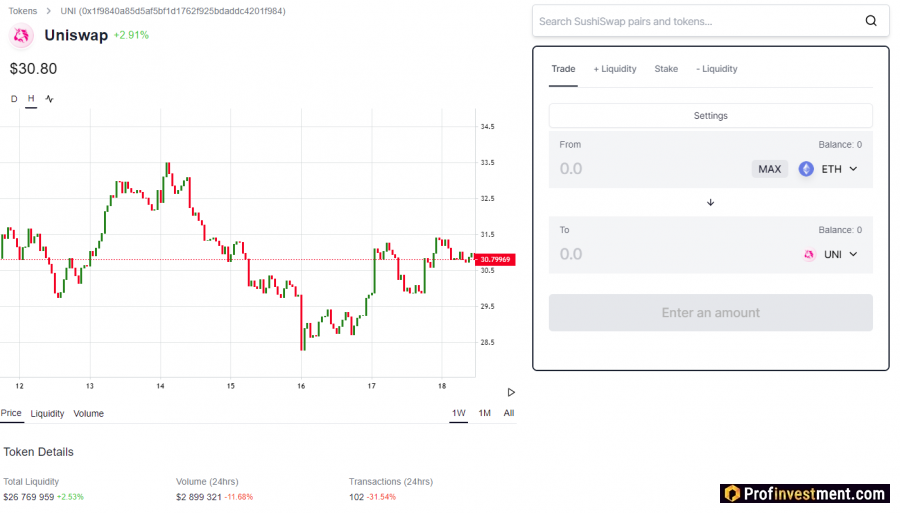

Like Uniswap, SushiSwap is a decentralized exchange (DEX) with an automated market maker currently running on the Ethereum blockchain. The project is run by a community whose members vote on all major protocol changes. The executive (referred to as the “chef”) of 0xMaki is responsible for handling issues related to day-to-day operations and overall business strategy.

- Official website: https://exchange.sushi.com/#/swap

- Established: 2020

- Daily trading volumes: $ 250,687,733

- Trading pairs with UNI: UNI / USDT, UNI / ETH and any assets working on the Ethereum blockchain

- Verification: not needed

- Additional functionality: liquidity supply, decentralized management, profitable farming, lending soon

SushiSwap is a fork of Uniswap, and early adopters could transfer their existing liquidity from the old exchange to the new one. At the moment, in addition to regular swaps, the exchange supports such functions as the pharming of various tokens, including UNI, staking of the SUSHI token, and soon it is planned to connect a credit protocol based on BentoBox.

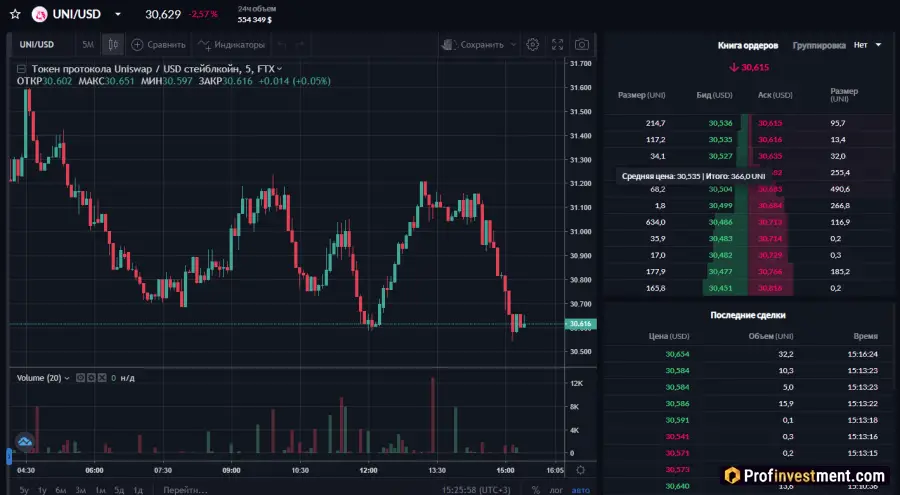

FTX

FTX Exchange is a multifunctional platform for trading and making money on digital assets. Supports several hundred cryptocurrency pairs, as well as other instruments (leveraged tokens, stocks). Leveraged trading, futures, prediction markets, staking of some cryptocurrencies are available. In addition, 11 fiat currencies are supported. If the application is for mobile phones.

- Official website: https://ftx.com/

- Established: 2019

- Daily trading volumes: $ 656,261,919

- Trading pairs with UNI: UNI / USDT, UNI / USD

- Verification: not required until $ 1000 is withdrawn from the account (in total)

- Additional functionality: futures, indices, options, OTC, various passive income options.

FTX also offers a tool for developing your own trading strategies, Quant Zone. If other users use it, then the creator receives passive income from commissions on transactions. The project has its own FTT token, which is used as collateral and gives the right to a share of the profits of the exchange’s insurance fund. It also allows you to save on commissions.

Other crypto exchanges for trading Uniswap (UNI)

In addition to the above, you can trade the Uniswap token (UNI) on the following CEX and DEX exchanges:

- Huobi

- Currency.com

- Cex.io

- Coinbase

- Bitfinex

- Kucoin

- Bithump

- Kraken

- Poloniex

- Biki

- Bitmax

- Balancer (DEX)

- PancakeSwap (DEX)

- 1inch Exchange (DEX)

- OpenOcean (DEX)

Uniswap Token (UNI) Outlook

The potential launch of Uniswap V3, as well as general market sentiment, play a decisive role in the asset’s price. In many respects, the market environment is looking pretty good, which confirms the health of both Bitcoin and altcoins. With a high degree of probability, it will continue to strengthen.

When Uniswap V2 was launched, it literally blew up the UNI market. Therefore, it is quite possible that the situation will repeat itself with V3.

What predictions do the experts give:

- Tradingbeasts predicts that the average UNI price will rise from month to month, reaching $ 36 by the end of 2021 (+ 21% from the current level).

- Walletinvestor predicts that the asset price will rise to $ 81 over the next year.

- There are also forecasts that promise a price position of $ 18-19 throughout 2021.

Most experts agree that the long-term strategy for investing in Uniswap looks promising, but short-term profit amid price surges can be expected in the period immediately after the launch of the Uniswap V3 exchange.

Conclusion

Since launch, the exchange and the Uniswap token have grown in popularity and continue to move in a positive direction. Analysts are mostly forecasting the growth of UNI’s value, with exact numbers varying between $ 30-100 in the coming months. This is a significant increase when you consider that 2020 closed at $ 4.6 per UNI. Given the community’s interest in the project and the positive outlook, Uniswap could be an excellent long-term investment. But, of course, any predictions must be treated with caution. Uniswap exchanges create all the conditions so that you can easily buy or sell an asset at the right time.