According to a new report from the CryptoCompare portal, exchanges continue to dominate the cryptocurrency market with problems with meeting current regulatory requirements and ensuring data security.

Despite the fact that over the past month some of the most trusted exchanges were able to win part of the market, less reliable or “low-quality” sites do not plan to take positions. According to the CryptoCompare report, they account for more than 60% of the trading volume in the segment as a whole. Exchanges rated “D” and “F” were added to this category.

For example, Coinbase, which received the highest AA rating, still accounts for much less trading volume than LBank with a “D” rating. At the same time, the average transaction size on LBank is 15 times higher than on Coinbase.

To evaluate cryptocurrency exchanges, the analytical group used such metrics as geographical location, legal compliance, company quality and the data provided.

“Our recent reports demonstrate the need for reliable data in a fast-paced industry,” said Charles Hayter, CEO of CryptoCompare.

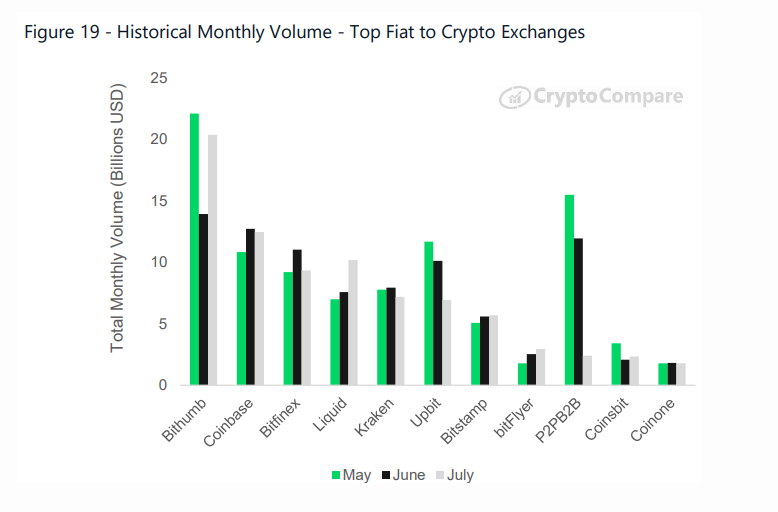

According to the report, the largest crypto-fiat platform is Bithumb. Its trading volume in July amounted to $ 20.4 billion, which is 46.4% higher than in June. Coinbase came in second with $ 12.5 billion (2% lower than June), and Bitfinex took third place with a monthly trading volume of $ 9.35 billion (15.2% lower than June).

Exchanges with exclusively cryptocurrency pairs accounted for 84% of the trading volume ($ 497 billion), crypto-fiat – 16% ($ 93 billion). Data are comparable to the previous two months.

Among other things, analysts focused on the situation around the BitMEX cryptocurrency derivatives exchange. Earlier it became known that the company was the subject of an investigation by the US Commodity Futures Trading Commission (CFTC), as a result of which investors began to actively withdraw their money from the platform. According to CryptoCompare, about $ 73 million was actually withdrawn from the exchange, however, trading volumes in general remain unchanged.