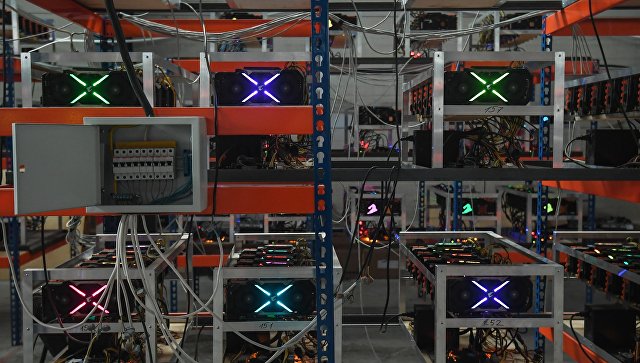

In 2020, mining is going through hard times, due to the general stagnation in the cryptocurrency market, a significant decrease in its capitalization, an increase in the complexity of mining major cryptocurrencies, as well as the emergence of a large number of ASIC devices that have collapsed the profitability of mining farms on most cryptocurrency assets.

However, mining is still a profitable activity, provided you have access to relatively cheap electricity.

Cryptocurrency mining prospects

Predicting the future of cryptocurrencies is a thankless task, somewhat reminiscent of fortune-telling on coffee grounds, but, nevertheless, there are certain indicators that you can rely on when studying the issue of mining prospects.

Analysis of the future of mining

When analyzing the possible future of mining, it is necessary to take into account the following factors:

- The growing difficulty of mining the most profitable cryptocurrencies;

- Are there any prospects for increasing the capitalization and value of the main cryptocurrencies produced by mining;

- Plans of leading manufacturers of mining equipment for the production of new miners and for which coins;

- Legislative perspectives regarding the cryptocurrency sphere, which can both facilitate mining and complicate the opportunities to engage in this activity;

- Suppliers’ plans to increase the cost of electricity, or to provide discounts to miners, as persons engaged in production activities. Due to the relatively low cost of electricity in most post-Soviet countries (including Russia, Ukraine and Belarus), the prospects for mining do not look so bad;

- At what real price can the equipment be sold in the future in the event of an even stronger drop in profitability;

- What plans do the developers of the main cryptocurrency platforms have for their further development, will there be a transition to other algorithms for the functioning of the blockchain and how this will affect the profitability of miners;

- The general state of the global financial system, which significantly affects cryptocurrencies.

All these factors affect the payback time of the equipment and the overall profitability of the mining business. Let’s try to figure out in more detail whether it is worth investing in cryptocurrency mining now.

Possible problems for the coming year

In the near future, it is expected that many popular cryptocurrency platforms will be updated, as well as important decisions affecting the general state of the cryptocurrency market.

The upcoming Ethereum update will definitely reduce mining profitability. Making a positive ETF decision can significantly improve the health of the cryptocurrency market and, thereby, increase the profitability of mining.

The bitcoin rate, which fell significantly in 2018, largely repeats the situation in 2014-2015, when bitcoin fell sharply after it took off in 2013. It is difficult to predict when the next rise will come, but it is possible. If it comes again, the cryptocurrency mining business is likely to become profitable again.

Is it worth starting mining in 2021, how not to lose money

The decision on whether to start mining this year needs to be made, taking into account the factors affecting the cryptocurrency market and the available financial opportunities. Given the unpredictability of the exchange rate in the long term, it is not worth taking loans for such a business.

The most reasonable decision to invest in mining would be to allocate an amount that is not so important in the short term and the implementation of mining for the long term or for trading on exchanges.

Mining 2021 – the essence of the process and prospects

In 2021, the most profitable cryptocurrencies to mine according to Whattomine (if we take into account the seven-day mining period) are:

- For AMD cards: ether, ether classic, monero and other coins on the Nicehash platform and with variations of the Cryptonote algorithm;

- For Nvidia cards: bitcoin gold, vertcoin, monacoin, coins on Lyra2REv2 and others.

All these coins give a profit of about 100%, so it cannot be said that mining is now unprofitable. Most of these coins are constantly present in the top cryptocurrencies used for mining, so you can plan that such a business will consistently generate income.

Business development plan, what you need to know when investing money

When calculating a business plan for the development of a mining business, it is worth taking into account the factors indicated above, it will approximately be determined which cryptocurrencies will be the main ones for mining and to understand in more detail their prospects, including the complexity of mining.

Few technical details

When mining any cryptocurrency that is mined using a proof of work (PoW) algorithm, the complexity of mining must be taken into account. This indicator is associated with a growing increase in network power and algorithms for the functioning of blockchains of different cryptocurrencies, in which the block generation time should be performed in approximately the same time interval.

Mining difficulty

When the profitability of any coin increases, many miners “jump” to it, hoping to get a large profit. Often they do not win anything at the same time due to the fact that while they mine enough coins to exchange their rate will drop.

You can insure against this when using the Nicehash program, but at the same time you need to be ready to pay a commission and use not the most optimal video card settings to achieve compatibility with most mining algorithms.

As a rule, in the long term, miners receive less income from mining popular coins due to the increasing complexity of the network. This factor must be taken into account when calculating the profit from a mining farm for the long term. There are many resources on the Internet that allow you to study the difficulty graph for each specific cryptocurrency, and approximately understand how much profitability will decrease.

Let’s try to develop a mining business plan with calculating the cost of the farm and taking into account its payback.

Minimum investment in mining

The amount of the minimum investment in a mining business is related to the following factors:

- The cost of a mining farm, which can consist of one rig for 6 cards of the GTX1060 or RX570 level, or, on a large scale, will be approximately a multiple of the cost of one rig with such video cards or other components;

- The cost of rent and security, which is different in each specific case, for example, for mining a hotel, you need to plan a periodic payment, and in the case of home use, the rent is zero;

- The cost of electricity per month, which is desirable to take into account when starting a mining business, because it is better to exchange cryptocurrencies for money without haste;

- The cost of paying for Internet access.

If serious investments are planned in the mining business, then it is worth considering the possibility of using mining hotels that provide security and maintenance of equipment, which justifies the payment for their services, as well as think over a business mining plan in special containers.

When calculating a mining farm, you can take as a basis the cost of one rig, as a conventional unit used in mining. A typical rig might be configured like this:

- Motherboard ASRock H81 PRO BTC R2.0 – cost about $ 100;

- Processor for socket 1150 – about $ 80-90;

- 4GB DDR3 RAM – about $ 40

- Power supply unit for 1000-1200 watts with a certificate of at least Gold – about $ 80;

- 6 video cards GTX1060 for 6 gigabytes or 6 video cards AMD RX570 | 580 with 4/8 gigabytes of memory with six risers – from 1900 dollars and more;

- Body / frame, cables, wires, surge suppressor – about $ 40.

The total cost of such a rig will be approximately $ 2340. You can save somewhere, buy better equipment somewhere. but the order of prices for the new rig will be something like this.

Taking into account the existing profitability of mining ether and other similar cryptocurrencies in terms of profitability, according to Whattomine, the daily income for such a business will be about $ 2.5 with an electricity cost of $ 0.06. Based on this data, mining a farm from one typical rig will pay off. 936 days.

Whether it is a lot or a little, everyone decides for himself. When planning investments in cryptocurrency mining, you need to consider fluctuations in their growth. Now the ether rate is about 300 dollars, and at the beginning of the year it cost on average 1000 dollars. After upgrading the network and improving the technical characteristics of the Ethereum platform, it may grow back to this value and even more.

There are many factors that allow us to hope for the further growth of cryptocurrencies, which will make the payback period much shorter, but no one can know for sure.

The relevance of mining on Asiks in 2021

If you calculate a farm using ASIC equipment, then you need to take into account that the profitability of old ASICs is now very low, and new ones are likely to be profitable only in the next few months.

In this case, you need to take into account the time factor associated with the supply of new equipment, customs clearance, the cunning of Chinese sellers and more …

Specialized crypto farms

Given the significant volatility of the cryptocurrency market and its unpredictability, it is virtually impossible to calculate the prospects for mining and the profitability of ASICs in 2021. Everyone can independently calculate the profitability of buying ASICs, but, in any case, it is necessary to take into account the factor that they cannot be reprogrammed to other algorithms, which can be done with mining farms on video cards. In addition, a video card can always be sold at residual value, and few people need ASIC devices. Based on this, the prospects for mining on video cards look more rosy.

Thus, the answer to the question of what the future holds for Bitcoin mining, which is entirely based on ASIC devices, seems to be quite clear. The purchase of old ASICs for Bitcoin mining can be justified only by the presence of confidence in the prospects for the growth of cryptocurrencies and the ability to wait for this event for a long time.

Given the current situation in the cryptocurrency market, the prospects for mining for the coming years are currently rather vague. But, with a high degree of probability, it can be predicted that cryptocurrencies will continue their development and will increasingly penetrate all spheres of human activity: the future calls and mines ….

This will inevitably lead to an increase in their popularity and financial attractiveness. Therefore, mining can be regarded as an investment in the future, in which cryptocurrencies, as one of the classics said, will be used not only by everyone …

Subscribe to our resources, write and read comments, sometimes smart people write smart things there.

Subscribe to news AltCoinLog in Vkontakte

Related materials: