overview, cryptocurrency pharming on the Binance Launchpool platform: Reef Finance – a liquidity aggregator and a smart profitability mechanism that, on a decentralized basis and with a low entry threshold, helps investors assess the level of risk and start making profits.

As envisioned by the developers, Reef will aggregate liquidity from DEX, centralized exchanges, liquidity pools and other sources into one global pool.

REEF Is a Reef Finance utility token that is used for management, payment of protocol fees, staking in pools, and profitable farming. From December 23, 2020, REEF is presented for earnings on the Binance Launchpool platform, and on December 29, it will be listed on this exchange. The Bitcoinminershashrate.com editorial team has studied this project and offers an overview of its main functions and characteristics.

The content of the article

general information

Key features of Reef Finance

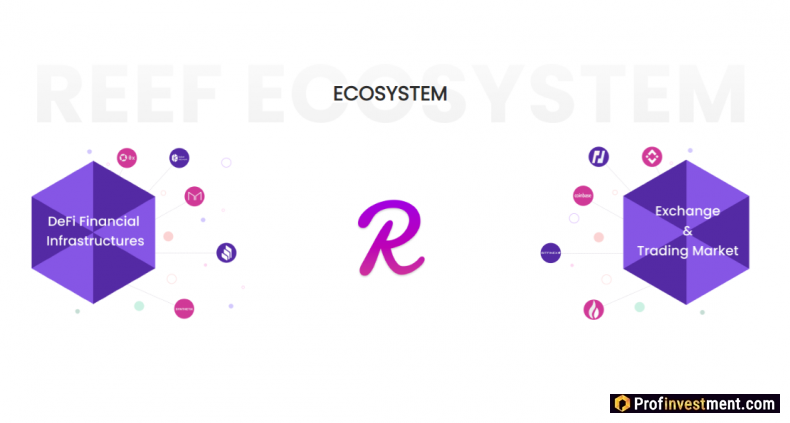

Reef is a smart DeFi liquidity aggregator and profitability engine that any financial protocol can integrate into. Provides cross-chain integration between top DeFi protocols. Three key components of the platform:

- global liquidity aggregator;

- smart pharming aggregator;

- intelligent asset management.

These three components complement each other and provide users with a one-stop marketplace for DeFi services.

Global liquidity aggregator

Global liquidity aggregator

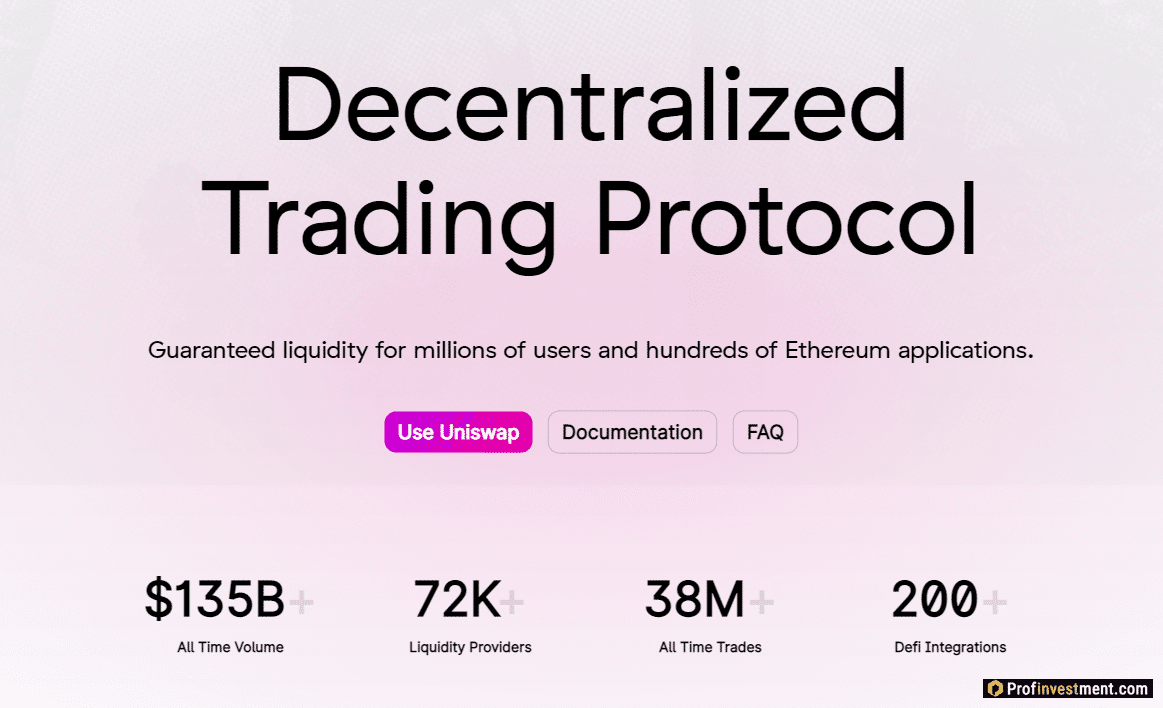

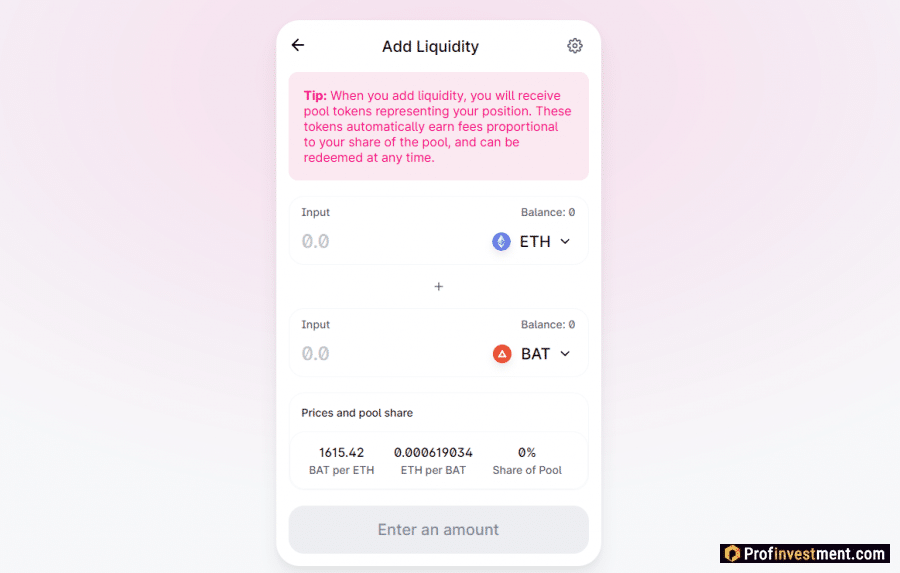

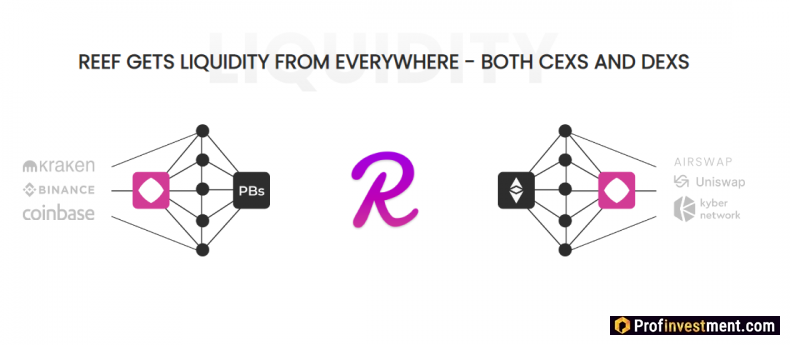

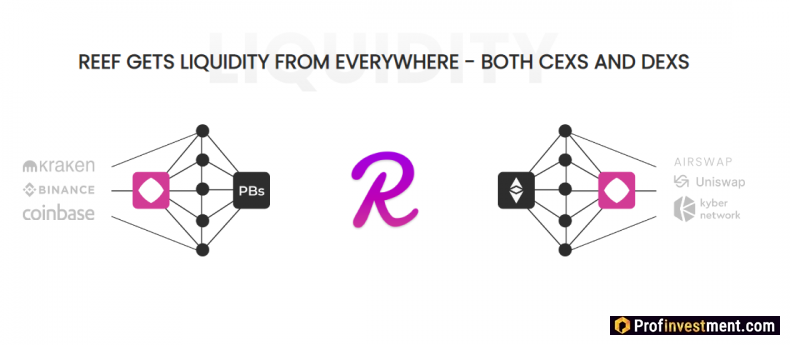

There are already many liquidity aggregators on the market, but most of them trade either through centralized exchanges like Binance and EXMO, or decentralized exchanges like Uniswap and Balancer. Both options have their drawbacks, and Reef strives to find the best option for the user by combining both options for liquidity sources.

Users will be able to directly trade their assets through the aggregate liquidity received from both centralized and decentralized exchanges. Integration will be ensured by a fully distributed and autonomous protocol, successfully interoperable with other DeFi protocols on major smart contract platforms (Ethereum, Polkadot, etc.).

Multi-farming aggregator

The second important component of the Reef protocol is a machine learning aggregator for profitable farming. At the start, it will support the following assets: stablecoins USDC, USDT, TUSD, DAI, BUSD; synthetic tokens (c-tokens, y-tokens), hybrid tokens (wBTC, etc.). These assets can be used for lending and borrowing based on the interest rate set by the community vote. Lending will be secured from the user’s liquid assets provided to the platform.

Farming with Reef is expected to provide the highest level of profitability while being convenient for all categories of users.

Intelligent asset management

The third aspect of Reef is a set of portfolio management functions that act as add-ons to the core functionality. Since DeFi markets can change very quickly compared to traditional financial markets, assets must be constantly balanced. At Reef, users will be able to easily rebalance their portfolio of assets through a modern user interface from a desktop or mobile device.

In addition to manual asset management, Reef will use an artificial intelligence engine to present critical information or make recommendations based on an individual situation.

Working for Polkadot, Reef Finance adopts the security model and a number of other ecosystem features from this platform. Polkadot focuses on interoperability and allows different blockchains to interact with each other while maintaining the functionality of each. Polkadot’s flexible initial base architecture is powered by Substrate, a fully open infrastructure project that can be used to create connections between blockchains.

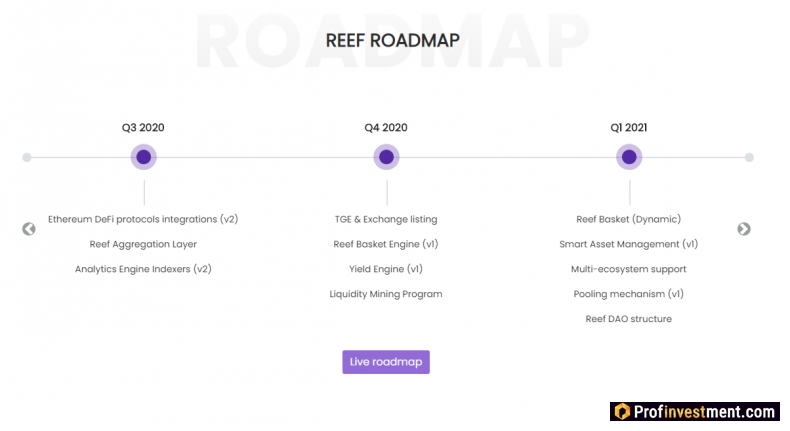

Further development

For the first quarter of 2021, it is planned to work out the structure of the Reef DAO (a decentralized autonomous organization responsible for project management), support different ecosystems, launch the first version of the merge mechanism, launch the first version of intelligent asset management and the basket mechanism.

Token REEF

The token will be used to manage and implement some of the work functions on the Reef platform. The right to vote for changes to the protocol is achieved through staking, which is also profitable. Since Reef is powered by Polkadot, the bridge between the blockchains is a separate parachain. The collators in charge of verifying the parachains are elected by the PoS vote and rewarded with the return on the Reef pool.

The right to vote is given to users so that they:

- selected collators to run the parachain;

- voted on the terms of distribution of returns;

- voted for the structure of the basket (commissions, composition, creation; perhaps, in the future, participants will be able to create their own baskets);

- select pool attributes (for example, dynamic interest rate calculation).

REEF tokens are also proof of the participant’s proportional ownership of the pool’s liquidity. When a participant adds liquidity, he receives a reward in proportion to the deposited amount of assets.

REEF on Binance Launchpool

Since December 23, 2020, the token is presented on the Binance Launchpool; You can get it by adding assets for staking to the following pools:

- BNB: 360,000,000 REEF will be distributed (60% of the volume on Binance Launchpool)

- DOT: 180,000,000 REEF will be distributed (30% of the total

- BUSD: 60,000,000 REEF will be distributed (10% of the total

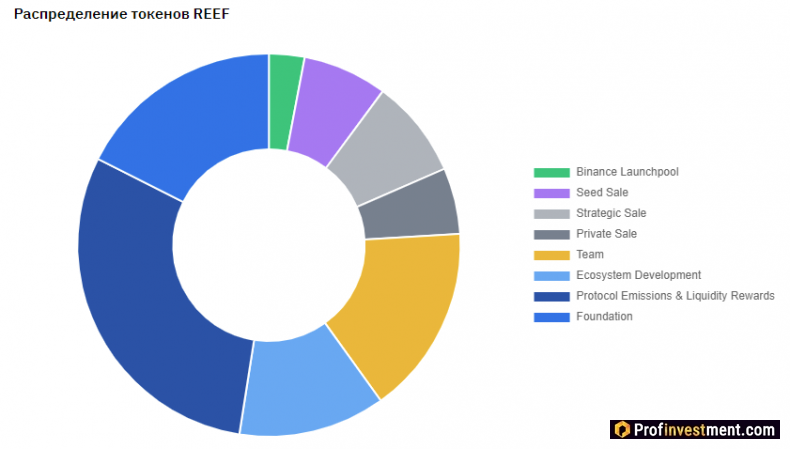

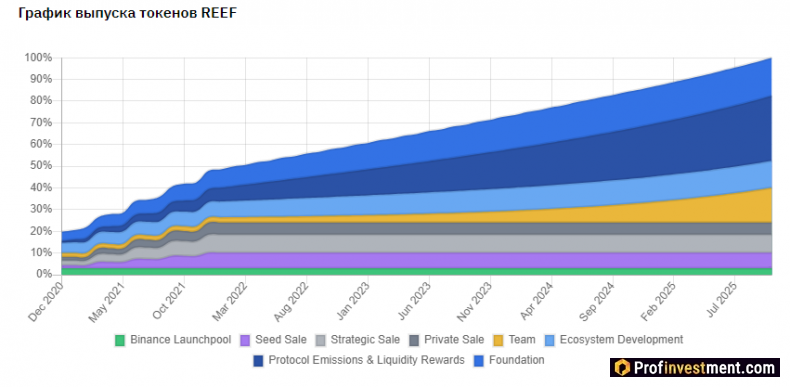

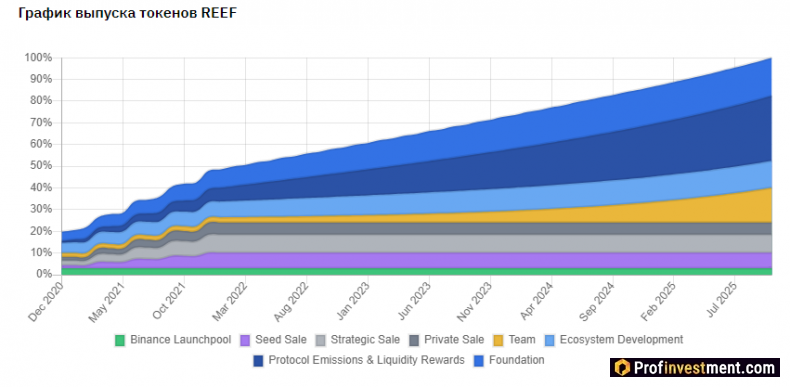

The total emission of tokens is 20,000,000,000 REEF. At Launchpool, it was decided to distribute 600 million REEF (3% of the issue).

You do not need to pass KYC to participate in farming. There is no maximum amount limit.

Advantages and disadvantages

Pros:

- An innovative idea of combining CEX and DEX liquidity.

- The ability to maximize revenue through intelligent asset allocation.

- A tool for rebalancing a portfolio of assets.

- External support

Cons

- At the moment, no project functions have been launched yet. Their gradual implementation will begin only in the first quarter of 2021.

Conclusion

Reef Finance looks like an unusual and promising project; working on the basis of the Polkadot protocol provides additional benefits in the form of a high level of flexibility, compatibility and scalability. It should be noted that a large number of serious investors have already shown interest in the project, including Bitcoin.com, Woodstock, Genesis Block, Master Ventures, etc. The developers are actively blogging on Medium, where they report news, post introductory information and guides. In particular, you can find a REEF farming guide on the Binance Launchpool there.