Review of Crypto Mining ICOs / White Papers: Hydrominer, Ice Rock Miner, and Envion. Fix a software problem with the hardware.

In November I was contacted by a marketing company working for Envion. They asked if I was interested in writing about Envion and their upcoming ICO. I replied that I had to check out their website and white paper first. I did, in addition to researching their competitors. I had questions. I sent them but never got answers. This made me even more interested in writing a review, so here it is.

Before reading other people, please note the following:

What is crypto mining?

For the purposes of this article, we define mining as a business process that generates cryptographic coins (such as bitcoin or ether) using powerful computers. This is the miners’ perspective. They purchase powerful hardware, connect to a network that runs a specific cryptocurrency, and run specialized software to perform a lot of calculations (which usually require a lot of electricity).

In this way, they process and validate transactions for the network and maintain their integrity (the more computing power for the network, the harder it is for a potential attacker to corrupt it). In return, the crypto network pays miners for their services in their own cryptocurrency. Long story short, it’s like someone is paying you to use the power of your computer to run their accounting software. And they also pay your neighbor and the dude in the next town for powering their computer, so it’s distributed across the computers to keep it safe. But it means that many computers are always running.

Only cryptographic networks based on a Proof of Work algorithm require mining, including the largest 2 (by market capitalization): the bitcoin network and Ethereum. There are also other algorithms (Proof of Stake, for example) that do not require mining as described here, so no raw computing power and high electricity consumption is required.

Originally, the bitcoin network was born from the idea of creating a decentralized payment system, running on thousands or millions of personal computers that perform mining. However, bitcoin rewards for mining are only paid to miners who perform the calculations faster. This has led to 1) a constant rush among miners who want the most powerful hardware to finish the math first and 2) miners joining forces in mining pools, to average the chances of receiving the mining reward (just such as lottery pools).

Therefore, “casual” mining on a laptop is no longer profitable and professional mining has become a highly specialized activity.

Business model of miners

The business model of a professional crypto miner looks like this:

This is a very common model for infrastructure investments in general, including power plants or hotels. The initial investment in the business must be profitably recovered from the revenues generated by the business. The basic assumptions underlying this particular mode are as follows:

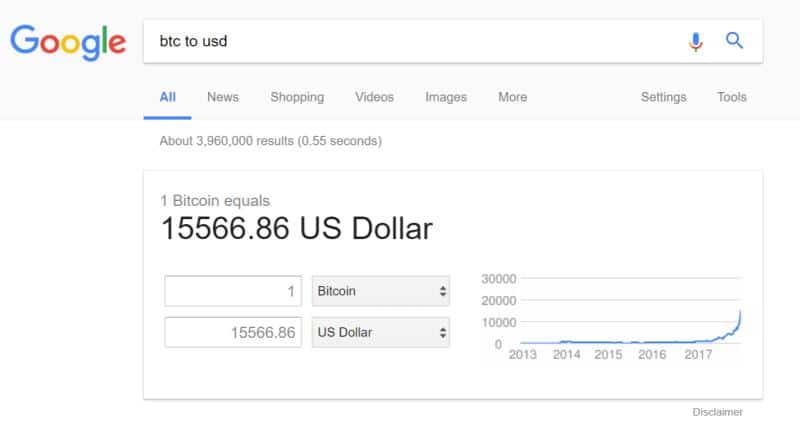

This means that the miner, like any other asset investor, must manage the risks arising from the above assumptions. Specifically: they should mitigate the risk of cryptocurrency price drops, make sure they keep electricity and maintenance costs low, and that their hardware is always powerful enough in the arms race to mine enough new cryptocurrencies. The term “risk management” basically means answering the following questions about something that may happen in the future that is different from now: how will change affect the business, can we prevent it, how much prevention would cost. For example: right now bitcoin costs $ 15k. In 1 month it can cost $ 5k or $ 50k. If it costs $ 5k, we can’t afford to pay the electricity bill. Can we prevent that from happening (one option would be to pay the bill in bitcoin)? How much would it cost (the lost profit if bitcoin stays at $ 15k or higher)?

Cloud mining

One way to manage risks is to transfer them to third parties, such as customers. Here’s how and why cloud mining works. Cloud mining is a service that professional miners offer to the public. Anyone can rent some of their processing capacity for a specific period of time to mine cryptocurrencies. Customers pay an agreed rate for hardware lease and cover operating costs and can keep all the coins the hardware was able to generate. This way miners can pass some or all of the risks to customers and have a stable cash flow to cover their capital and operating costs.

For potential customers, renting computing power from a third party must be more attractive than investing the same money directly in buying hardware and organizing mining operations. Furthermore, the benefits of cloud mining must outweigh the additional risks of having to trust a third party, the mine (a customer is paying for the computing power, but how does he really know what he’s getting?).

Is it even possible that cloud mining is a more attractive offering? Could be. One factor is centralization: the unit cost of building and operating a huge data center is less than running a small operation. Get better hardware prices when you buy in bulk. Fixed maintenance costs (hiring an engineer) can be spread over more computing power.

Most importantly, a cloud miner can have access to much, much cheaper electricity. Mining in Germany and paying retail electricity prices (around $ 0.36 / kWh) is not profitable at all. Mining in the former Soviet Union and paying just $ 0.03 / kWh is very profitable. This is what the 3 mining projects analyzed want to achieve: to provide cloud mining services at competitive prices based on access to low-cost electricity and low initial hardware costs.

Here is the review of 3 crypto mining projects: Hydrominer, Ice Rock Mining and Envion. I focused on their business model, their team, their experience and the token economy while also trying to answer where the value of each token comes from.

Hydrominer

Business model

Start mining operations within the existing hydroelectric power plant in the Austrian Alps. This idea has many advantages. The project is located in the EU, therefore in a very stable environment with a long tradition of compliance with contracts (such as energy purchase contracts for mining operations). Maintenance and repairs are easy as all sites are within a short distance. Electricity is very cheap for Europe (0.045 EUR / kWh), because it is purchased directly from a hydroelectric power station, without transmission or distribution costs. Electricity is 100% renewable and is available 24 hours a day, 7 days a week.

HydroMiner offers its own electricity-consumed cloud mining packages, where most other miners rate services based on computing power (“hash rate”) and operating costs. Maybe it’s easier to calculate the performance and compare the past performance to the current one, but in the end it doesn’t really matter. In the end, it all comes down to how many cryptocurrencies a cloud miner can generate per $ invested.

Team / Experience

The team is young, but for the crypto space they have a lot of experience with mining. The 2 founders started mining in 2014, the CTO in 2012. The most interesting thing is that HydroMiner already has 2 operational mining sites in Austria and they offer the opportunity to visit them.

Token

HydroMiner’s tokens, H2O, can be redeemed for the cloud mining services offered by the company. H2O is therefore a store credit that can be purchased in advance, with a discount. This is a very sensible and easy to understand approach. Buyers / investors shouldn’t expect to make a fortune with this ICO. However, if someone is already interested in cloud mining, this could be a good deal for both parties. The buyer eventually gets some cryptocurrencies (the end product of cloud mining) cheaper than the market price, and HydroMiner has risk-free capital for expansion.

Mining of ice rocks

Business model

Organize mining operations inside a secret post-Soviet bunker (!) Inside a mountain (!!), so you can benefit from one of the cheapest electricity prices in the world ($ 0.03 / kWh) and a low ambient temperature all year round (no cooling costs). This is arguably one of the most cost-effective mining projects. It is located in Kazakhstan, which is good when costs are an issue. But it could be a disadvantage when it comes to maintenance and repairs (hardware availability, reaction times) or when it comes to contractors and local authorities (unexpected additional costs or delays with permits, etc.).

Low-cost electricity is provided by a hydroelectric power station, so it is renewable and available 24/7.

Cloud mining is offered on a “hash rate” basis.

Team / Experience

The team is young and seems to have some personal mining experience. However, I couldn’t find any professional cryptocurrency mining or data center experience in their resume. Ice Rock Mining currently has no operational sites, the secret cave bunker is empty. I think this is the biggest risk in this project. Building and managing a data center inside a mountain is a difficult project for an experienced team and these guys are just starting out and have a lot to learn.

The first ICO round was done in November, so now we have to wait until the end of December (as per the roadmap) for the official launch. The first operational report is expected to be published by February 2018.

Token

Again, the tokens, ROCK, can be redeemed for the cloud mining services offered by the company. ROCK is also expected to be repurchased from Ice Rock Mining for a fixed price ($ 2 in February and $ 3 in May 2018). I have not seen any details of this operation, such as timing, volume, how many tokens will be repurchased, etc. This part sounds alarming. Phase 1 of the ICO offered ROCK at $ 1.2 in early November. Buying them back for $ 2 in early February means paying 166% more in 3 months, or 664% per year! Why should you do this? That’s probably more than the loan sharks would charge. The most recent famous example of such a business practice was Bernard L. Madoff Investment Securities LLC and Charles Ponzi shortly before.

Envion

Business model

Build mining sites inside standard shipping containers and ship them around the world, so they can be installed near affordable and / or renewable energy sources. This is their way of creating “The World’s Most Profitable Standard of Self-Expanding Crypto Infrastructure,” as they say on their website.

Envion claims to have a database of places in the world where you can connect to cheap electricity. In this case, the most cost-effective option is to select the one that provides the lowest total cost of extraction (electricity, maintenance, shipping costs, rent etc.), like Kazakhstan for example, and send all containers in this place. This would further reduce maintenance costs. So why would you ship containers all over the world?

I don’t like the idea of building the mine site in a central location and then sending it to remote sites, especially by sea. Think about traveling with just your laptop and all the sleeves and special padded bags. Now think about installing very specialized hardware worth $ 100-150k inside a shipping container, plug it all in and put it back on a truck, boat, truck and cranes it all the way through. I don’t think it will be plug and play. Rather connect, check what needs to be fixed, fix it, and then play.

The idea of powering cryptocurrency mining sites with renewable energy is fantastic. However, mining needs to be done 24/7 to be profitable. Installing mining containers on solar / wind farms and using their excess capacity will not be profitable at all, unless there is a secondary source of renewable electricity when the farm does not generate enough. Turns out the cheapest and most reliable renewable electricity right now comes from… yes, hydroelectric power plants.

Envion is really (too) hard selling the concept of decentralization. Mining operations are centralized due to the mining algorithms and rules (the code) that govern transaction fees for providing cryptocurrencies, etc. Miners centralize and create mining pools because the market makes it the most profitable approach, not because there is a crypto conspiracy. The decision to run decentralized operations around the world is fine, but this activity will not be competitive against the world’s HydroMiners and Ice Rock Miners. And, assuming these worldwide mining sites are competitive and increasingly put online, they are still owned by a single company: Envion. How decentralized is it?

Finally, the cooling system: “More than 40 times more efficient than traditional data centers, ENVION’s patented cooling system outperforms virtually any other data center.” I would say that if you have the most efficient cooling system in the world, fuck the mining business. Sell your license to other miners and to the Google and Amazons of the world.

It seems like an overly complicated approach to the problem that has a simple and straightforward solution. I prefer simple solutions, something like what HydroMiner and Ice Rock Mining offer.

Team / Experience

The team members have a lot of experience in finance, media, consulting, marketing and software development. I have to admit that their marketing and print material looks really good and very professional. However, I couldn’t find any background information in crypto mining, data centers, or logistics. Envion claims to have an operational mining container unit. Again, I could not find any photos or videos of a connected OU. The photos on their website show a mining container parked in front of a solar park, but it’s not connected to anything. There is a “mining dashboard” on their website, but there is no way to verify what it is actually showing.

Token

Envion (EVN) token holders will receive income from mining operations and will be eligible to vote. So EVN is a security and therefore restrictions apply to US and Swiss citizens (unregulated securities cannot be offered to the public). I couldn’t find any specific details explaining how revenue will be calculated, how it will be distributed, or how voting works.

I found a calculation that shows a 166% return on investment and how to turn $ 50,000 into nearly $ 900,000 in 5 years. There are no details regarding the assumptions and variables that run the financial model and generate these numbers. I have to admit it’s not even close to 664% Ice Rock, but it makes me wonder how close it is to Madoff territory.

The financial plan shows the profits for the next 5 years. I bet anyone that the mining business model will change in the next 12 months. Needs to. Otherwise, given the current trend, by 2020, the energy to mine bitcoin alone will exceed the electricity production of the entire world!

Dear Envion team,

I am really sorry that no one has responded to the email I sent regarding your ICO. Maybe you never received it, maybe you got lost. Just in case, I’ll paste it below, so you can read it now and hopefully reply. I am happy to include any information I receive from you later in this article.

“Envion, with the founder from the solar industry, presents a pure project (asset) financing approach. They want investor stock and try to pay dividends. So, I’m trying to find any type of business plan calculation that backs up their 161% ROI promises. A spreadsheet with assumptions (about cost, cryptocurrency price, performance, etc.) and a business model would be nice.

Here is a list of more specific questions:

And a more general, but fundamental question:

How long do they plan to operate? Because essentially this business model is solving a fundamental software problem (energy-intensive network consensus mechanism) with hardware. What if the software changes and completely solves this problem (proof of stake, proof of time-stake)? “

Fix a software problem with the hardware

As I said before, the mining business model needs to change. When the bitcoin network was launched, no one understood how much it would grow and grow or how many resources will be committed to mining. There are currently over 1,300 cryptocurrencies and tokens. Most of them use a Proof or Work algorithm and require mining. Bitcoin alone uses around 30 TWh of electricity per year. It’s a lot. More than Serbia and closer to Denmark’s energy consumption. It is ¾ of the annual electricity generated by the Hoover Dam.

But, to put things in perspective, the consumption of all data centers in the world in 2015 was around 416 TWh.

All as a result of the algorithm deciding that the winner (fastest miner) takes it all and rewards concentration, the “arms race” and excessive energy consumption. It’s a software or, more precisely, a governance problem that miners (including the ones above) are trying to solve with hardware.There are cryptocurrencies now out there that have negligible power consumption, for example Solar Coin.

Cryptocurrencies will evolve. Governance, rewards and incentives for maintaining the network will change. Inefficient brute-force mining will become obsolete but it won’t happen overnight. Different cryptocurrencies will transform at different rates. So the mining business model still has some life left. Maybe a year, maybe two. But I wouldn’t bet on 5 years.

If you like this article you may also be interested in the series I’m writing about cryptocurrencies for non-technical people like me. The first part is available here:

A lawyer friend asked me about bitcoin, blockchain, investments and bubbles

Don’t hesitate to post your comments or questions here, get in touch on Twitter (https://twitter.com/HiEnergyPeople) or Linked In (https://www.linkedin.com/in/michalbacia/)

_____________________________________________________________

Updated December 21, 2017

Envion replied to me on Twitter. I wasn’t happy with their answers, so I asked a few more specific questions. Here is the link: https://twitter.com/HiEnergyPeople/status/940535045013561344

You can follow the thread and all of Envion’s answers and my further questions in the comments.

I was also contacted by someone who is an investor in the cloud mining industry. The person wants to remain anonymous and fears that Envion will give the entire industry and ICOs a bad reputation. Here are just a few questions raised by this person. I think it makes sense to listen to industry insiders:

The 161% yield is practically impossible in mining. It just happens because of the skyrocketing currency earnings, in this case it would have been nice to keep the currency too.

The “technology” of the containers they present is ridiculous, it mixes s9 miners who need a maximum temperature of 40 C with GPU miners running at 70 C, this doesn’t work except in the cold winter.

They have a 100KW computer or 60 GPU in a container, that’s not much, we have a computer up to 200 GPU in a container and you don’t need special cooling or 50 holes in the container; 2 very large fans are fine

They fantasize about building 200 such units a month, insane, it takes 3 people and a full month to build ONE, and they need to know electricity and mining and work efficiently. You can’t find and organize people that fast or find the mining equipment or electrical equipment you need that quickly.

Envion claims to have pre-orders with manufacturers of asics, etc. It makes no sense, there is no such thing. Prices change twice a day and if you want to buy, pay and receive it, there is no need for a contract.

They claim they can purchase large quantities of asics. Impossible! The market is empty right now and always tight.

Their calculation is based on an asic cost of 1700 USD / pc. Current prices are 5000 USD plus VAT, plus freight etc. It goes without saying that their ROI calculation doesn’t work on that basis.

In their calculation they only have a hardware reserve of 25%. Reinvesting 25% of the mining proceeds will not work. We usually keep 65% of the proceeds to make a profit and to keep the hardware competitive.

They do the net calculation (without VAT). In fact, throughout Europe, Canada and many other countries, they will not be able to get VAT back because mining is not subject to VAT.

They present the business model as if each power plant were able to power its own containers. This is not possible because transformers and cables are expensive: the installation of a transformer, switches and cables costs 20 to 50K USD for a structure and can take 2 or more months.

As for the “mobile” mining solution: there is no point in moving containers, it is very expensive: transport, insurance and hardware problems after transport are frequent. Also there are problems with humidity and a lot of paperwork if you cross the country borders.

As a result, they didn’t answer questions on Telegram or elsewhere and deleted any accounts that asked critical questions.

Why do we say all this? They cannot deliver and will create many angry customers. It will anger Central European regulators and make the whole ICO market look ugly and impose more regulations.