Revolut Review: Here is an unbias approach or guide about the advantages disadvantages, reasons for why you would want to use this card and also the supported currencies – One of the main ideas of international cards Visa and MasterCard was the convenient conversion of money between different currencies. A German traveled in 1995 to France, Spain, Italy – everywhere he pays with his own card, withdraws local currency from ATMs and does not bother. Alas, in real life all banks charge 1-5% for the conversion to the Central Bank rate – but there is Revolut with the exchange rate at the Central Bank rate!

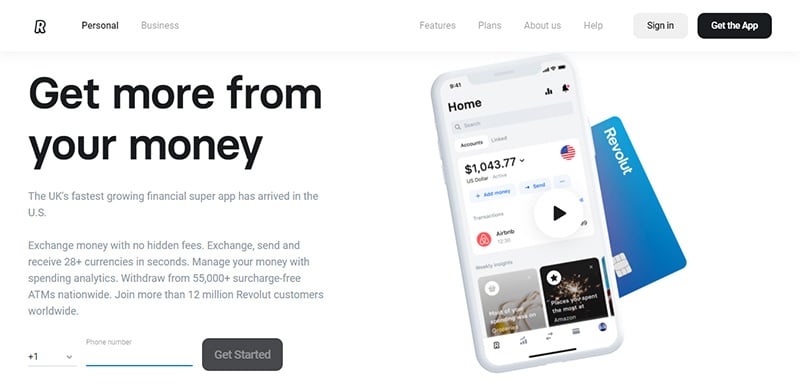

Can Revolut Be your new banking Preference?

Are you tired of relying on multiple platforms to handle different aspects of your money? If so, then Revolut may be the answer.

Revolut offers a one-stop shop for all finance matters, providing everything you need to store, send, invest and properly spend your money. You will also love the freedom to spend and transfer money abroad without the hassle and extortionate fees.

That sounds good? Then stay tuned as we take a closer look at Revolut. This mobile app promises comprehensive support for both personal and business accounts.

Revolut can be one of many international payment platforms. However, it offers several outstanding features, making it one of the fastest growing financial apps on the market.

Enough preamble; let’s dive into the details of this review …

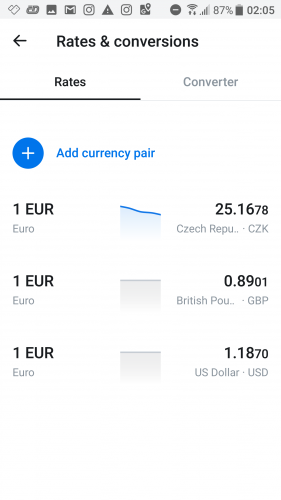

Revolut Supported currencies

In the system, you can maintain wallets in a number of currencies, and then spend them in currencies of almost the entire world. Revolut works as of April 30, 2018 with these currencies, I have highlighted in bold the most important ones for readers:

- AED, AUD, CAD, CHF, CZK , DKK, EUR , GBP, HKD, HUF, ILS, INR, JPY, MAD, NOK, NZD, PLN, QAR, RON, SEK, SGD, THB, TRY, USD , ZAR – to create wallets and replenish them by bank transfer;

- CHF, CZK , DKK, EUR , GBP, NOK, PLN, RON, SEK, USD – to create wallets and replenish them with a card online;

- AED, ALL, AMD, AOA, ARS, AUD, AZN, BAM, BBD, BDT, BGN, BHD, BMD, BND, BOB, BRL, BSD, BWP, BYN , BYR, BZD, CAD, CHF, CLP, CNY, COP, CRC, CVE, CZK , DKK, DOP, DZD, EGP, ETB, EUR , FJD, GBP, GEL, GHS, GIP, GNF, GTQ, HKD, HNL, HRK, HTG, HUF, IDR, ILS, INR, IQD, ISK, JMD, JOD, JPY, KES, KGS, KHR, KRW, KWD, KYD, KZT , LAK, LBP, LKR, MAD, MDL, MGA, MKD, MMK, MNT, MOP, MUR, MVR, MWK, MXN, MYR, MZN, NAD, NGN, NIO, NOK, NPR, NZD, OMR, PAB, PEN, PGK, PHP, PKR, PLN, PYG, QAR, RON, RSD, RUB , RWF, SAR, SBD, SCR, SEK, SGD, SRD, THB, TMT, TND, TOP, TRY, TTD, TWD, TZS, UAH , UGX, USD , UYU, VEF, VND, VUV, WST, XAF, XCD, XOF, XPF, ZAR, ZMW – for payment, cash withdrawals and more.

This means that you can get yourself a wallet in euros or in kroons, to replenish it even by a bank transfer from a bank account in euros, or with a card. The card, of course, is best of all – it is instantaneous and without commission.

Funding by bank transfer takes place to a UK account, therefore there is a commission. It is especially high for an international transfer in kroons – for example, at Fio they charged me 200 kroons for such an international transfer, regardless of the amount.

You cannot create wallets in rubles, hryvnias, tenge and other CIS currencies, but you can spend in them. This is logical, Revolut is now generally available only to EU residents. Previously, he was in Russia, but soon left due to the inadequate market for bank cards and their extortionate fees. One “but” additional commission is imposed on operations with illiquid currencies: 1.5% for the Russian ruble, 1% for the hryvnia. Revolut has only one more illiquid currency – the Thai baht, which also has an additional 1.5% commission.

Revolut review: an overview

As we just hinted, Revolut is the fastest growing digital bank and offers an impressive amount of built-in features and add-ons, but where did it all start?

Founded in 2015 by Vlad Yatsenko and Nikolai Storonsky, a former trader, Storonsky raised Revolut out of frustration over the unfair conversion rates that came with sending and receiving money abroad. What started out simply as a prepaid card and app quickly expanded to include a wide range of features. Now more than 5 million users worldwide use this platform to manage their day to day finances.

The multi-currency debit card and free app is designed to put money management back in the hands of the account holder to help you better understand your finances and ensure you get the most out of your money.

This means there are no unfair currency exchange fees. With Revolut, you always only use the real exchange rate.

So, while Revolut is essentially a digital payment service, the volume of services it provides makes it much larger. So, if you want to better understand your money, business owner or freelancer after a secure way to send and receive business transactions, Revolut comes in handy.

Main functions

Revolut is controlled only through the phone. Install the application, create wallets in the required currencies through it, replenish them in the same currency by bank transfer or online card.

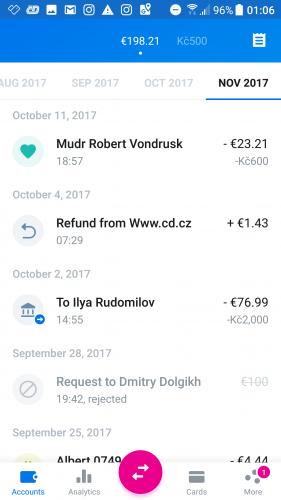

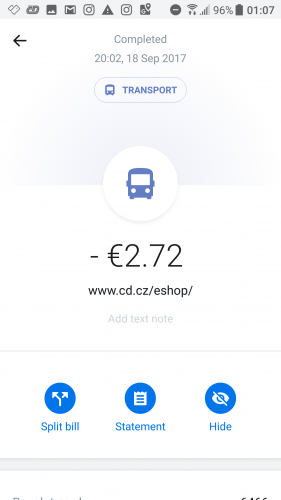

The main page contains a list of your wallets, you can scroll through the list of operations and open the details on them:

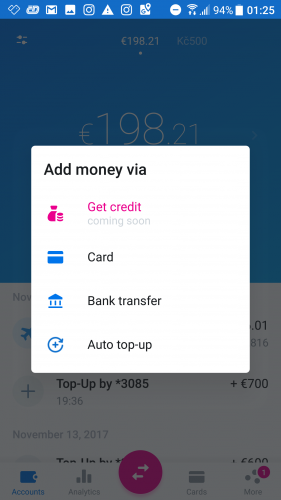

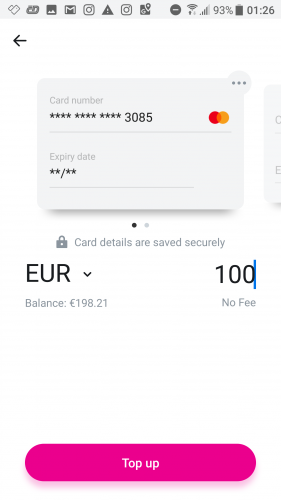

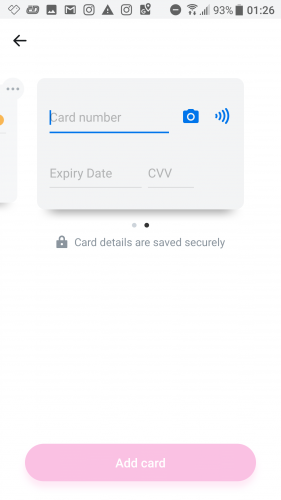

The “Top up” button is used to replenish the wallet: by bank transfer, card or auto-replenishment by card, if there is not enough money on the balance to complete the operation. Card data does not even have to be entered manually, you can take a picture of the card with a camera.

You can manage to send money to your wallet from a card or account in a different currency, but because of this you will get an extra conversion and the effect of Revolut will clearly disappear.

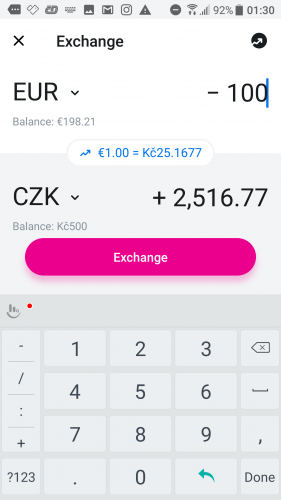

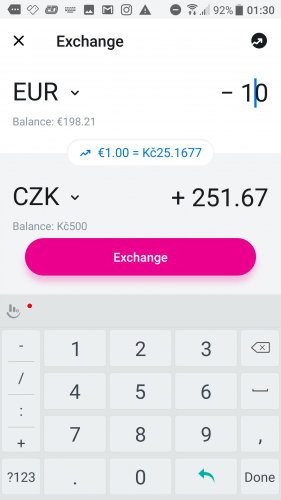

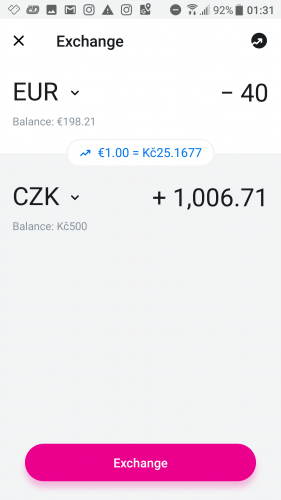

The “Exchange” button allows you to exchange currencies between different wallets. A very useless feature, only if you do not spend money in wallet currency and therefore do not want to pay an additional 0.5% on weekends:

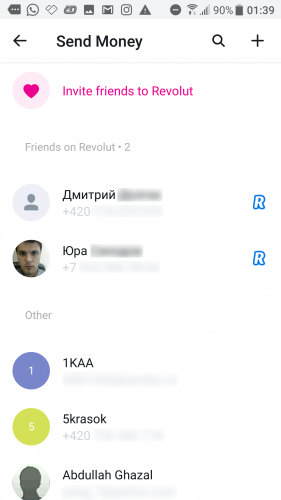

The big pink button with arrows at the bottom – transferring money to Revolut users, requesting money from them, splitting an account into several people, withdrawing money to a bank account:

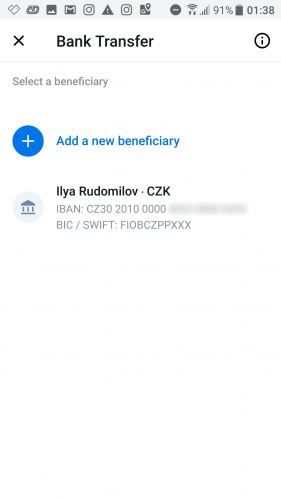

Attention, even with this withdrawal of money to a bank account, all the benefits of Revolut are valid. You can withdraw money from your euro wallet to an account in kroons at the exchange rate of the Central Bank! I struggled with entering the IBAN for more than one day –

it turned out that despite the auto-formatting, you should press the spacebar. Perhaps, in new versions of the application, this error has been fixed, but keep this in mind.

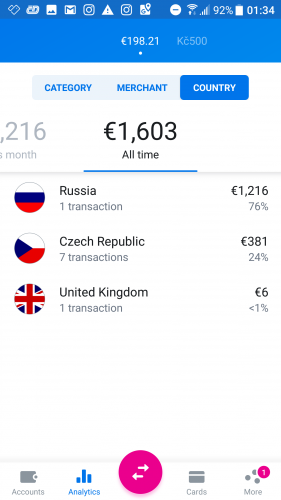

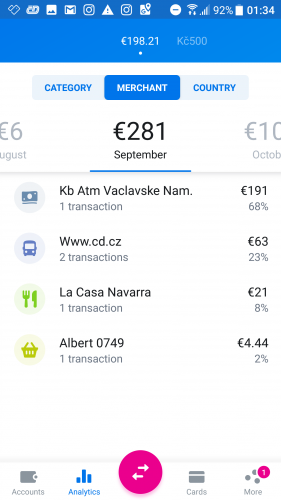

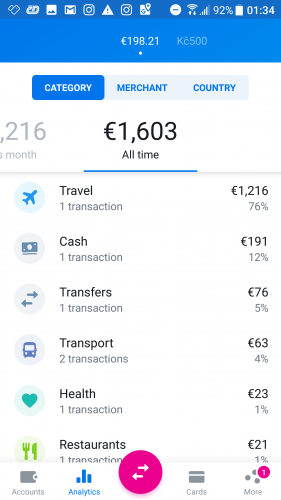

The second tab at the bottom, “Analytics”, automatically collects data by type of expenses (they are embedded in payment terminals during installation), firms and countries:

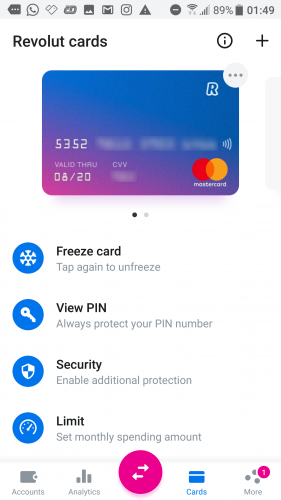

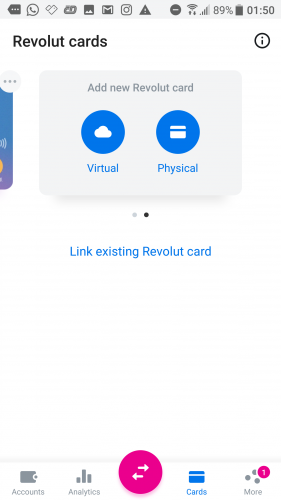

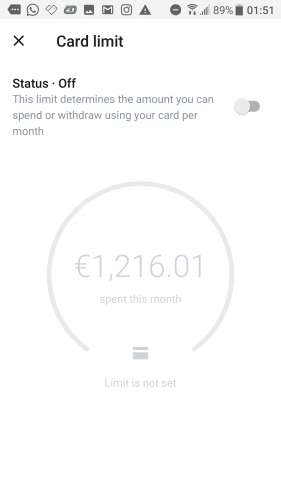

The most delicious is on the third tab, “Cards”. On it you create new virtual cards, order physical ones, block and unblock them in one click, set limits. For the physical card, I paid only 6 € shipping. The second card is already paid, again 6 €.

The last tab contains a button for contacting support, enabling a Premium plan for 7.99 € per month, calculators, data on the tariff, limits and security settings. Among the security tools, a number of original functions are available:

- geo-referencing – if someone tries to pay with your card far from your phone, the operation will be refused;

- prohibition of transactions using the magnetic stripe;

- prohibition of contactless transactions;

- ban on withdrawing money from ATMs;

- ban on online purchases.

It is worth noting that on a free plan, support is available on weekdays from 6 to 22 hours, and on weekends – from noon from 18 hours. The rest of the time you can’t even send a message!

Revolut Pros and Cons

Revolut Pros

- It’s very quick to set up: you can create an account within minutes, and from setup to approval, you rarely have to wait more than a couple of days.

- No credit checks are required to create an account.

- You get access to a free multicurrency checking account with the ability to store up to 30 different currencies.

- You do not bear any commissions for using the card abroad.

- The app is very user friendly.

- You will have unrivaled control over all aspects of your finances.

- There is no overdraft, so there is no risk of accidentally falling into the red.

- You get access to 24/7 customer support.

- Savings are easy with Revolut’s “storage” feature.

- Excellent fraud prevention tools

- The budget feature works well to keep track of not only how much you are spending, but where you are spending to identify areas where you could tighten your belt.

Revolut Cons

- Unlike some of Revolut’s competitors, such as Monzo, it is not currently a fully licensed bank. So, if something goes wrong, you are not covered by the Financial Services Compensation Scheme (FSCS) up to £ 85,000. However, you do get some degree of protection because Revolut is regulated by the Financial Conduct Authority (FCA).

- Foreign currency exchange rate fluctuates on weekends.

- The number of free cash withdrawals is limited.

- There is no possibility for personal consultation as at the time of writing Revolut has no existing branches.

- There is no way to create a joint account.

Revolut is a seemingly ordinary MasterCard or Visa card in virtual or physical form, which can be used to pay around the world. But, attention, the conversion between currencies on weekdays is carried out at the exchange rate , and this is the Central Bank rate with a deviation of only hundredths of a percent! Exchanges are not traded on weekends, so Revolut charges a 0.5% commission in addition to the Friday rate. To receive a card, you must be an EU resident – from the very first days in the Czech Republic, students can register with Revolut.

What not to do with Revolut

Like any great solution, Revolut has a number of dangers:

- try not to use conversion on weekends – 0.5% will be charged for this, and 3 illiquid currencies have an additional commission: 1% for the hryvnia, 1.5% for the Russian ruble and the Thai baht;

- do not replenish the balance from credit cards – this is an additional 1%;

- when replenishing your balance, use the same currency in which you have created a wallet;

- in order to avoid double conversion when withdrawing money and making payments, always choose to conduct a transaction in local currency – in the eurozone it is euro, in the Czech Republic it is crowns, in Russia it is rubles, etc.

In addition, do not forget about the general rules for the effective use of cards for international payments. Ideally, you should read the Revolut FAQ , it is very easy to write .

Where Revolut can come in handy

The Revolut card is useful to anyone who at least sometimes spends money not in the currency of their income or savings. Having only, for example, euros on the card, you can profitably pay both offline and online in pounds, zlotys, rubles, hryvnias, etc. Say no to stupid recalculations on UK Amazon, US eBay and other sites!

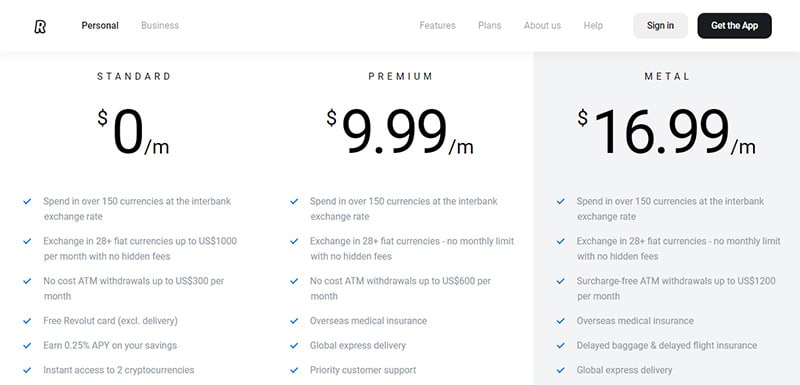

Revolut Review: Revolut Pricing

Getting started with Revolut doesn’t have to be expensive. In fact, depending on the specific feature you are looking for, you can create a personal or business Revolut account today, completely free of charge!

The first step is to choose the plan that suits you, so let’s take a look at the plans offered, how much they will cost you, and what you can expect in return:

Standard account: (free)

- You can spend in over 150 major currencies (euros, US dollars, pounds sterling, etc.) using the interbank exchange rate.

- You can exchange money in 28+ fiat currencies up to $ 1,000 per month (no hidden fees).

- Free ATM cash withdrawals up to $ 300 per month

- Free Revolut card (there is a shipping fee)

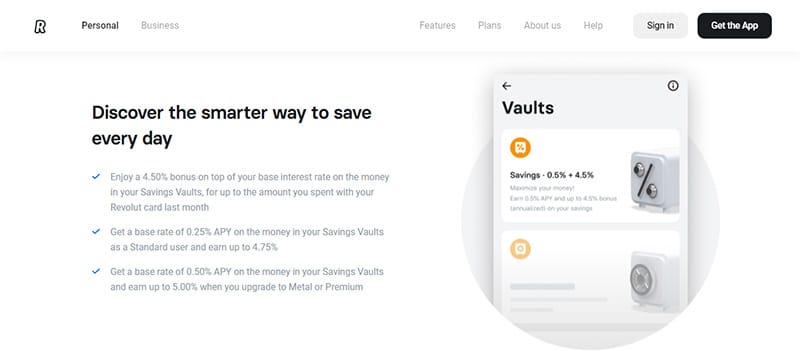

- Get 0.25% per annum on your savings

- You get instant access to two cryptocurrencies (e.g. bitcoins)

- You get a Revolut Junior account for one child.

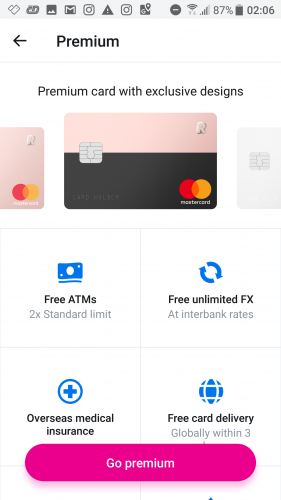

How Muh is Revolut Premium Plan: ($ 9.99 per month)

You get everything in a free package, plus:

- Free ATM withdrawals up to $ 600 per month

- Foreign medical insurance

- Worldwide express delivery

- Customer support priority

- You will receive 0.50% per annum on your savings.

- You get a premium card with an exclusive design.

- You will receive disposable virtual cards.

- Access to the LoungeKey Pass

- You will receive free lounge passes for you (and another) if your flight is delayed by less than an hour.

- Revolut Junior is designed for two children.

How Much is Revolut Metal Plan: ($ 16.99 per month)

You get everything above, plus:

- Free ATM cash withdrawals up to $ 1,200 per month

- Delayed baggage and delayed flight insurance

- Exclusive Revolut Metal card

- You will receive free lounge passes for you (and up to three friends_ if your flight is delayed less than an hour.

- You will receive Revolut Junior accounts for five children.

- Once a free SWIFT transfer every month.

The above plans are for personal accounts. Let’s say you need a business account. In this case, the prices are different again and the structures get a little deeper as they can be increased or decreased according to the growth of your business. T here is a separate set of options for freelancers.

Do not worry; even with a Revolut business account, you can still get started for free. However, there are three paid options: Grow, Scale and Enterprise plans, which increase in price accordingly. To find out more and see what works best for your current business, visit Revolut pricing for more details.

Revolut Review: Transfer Fees

One of the standout features of Revolut is its affordability, offering free money transfers within your foreign currency exchange limit. This is great if access to available exchange rates is not your main reason for using Revolut. As if you relied heavily on cross-currency bank transfers, you may face a 0.5% commission on the amount exchanged if you exceed your limit.

For this reason (along with others, of course) various service plans are useful. If you are likely to be transferring money regularly, choosing one of Revolut’s premium accounts gives you the ability to do so at a low cost.

Generally, you can expect the Revolut exchange rate to be much more competitive than the exchange rates of exchange offices and most other card providers. However, it’s worth noting that Revolut rates vary on weekends. During this time, you can expect a rise from 0.5% to 2.5%.

Revolut Review: PAYMENT

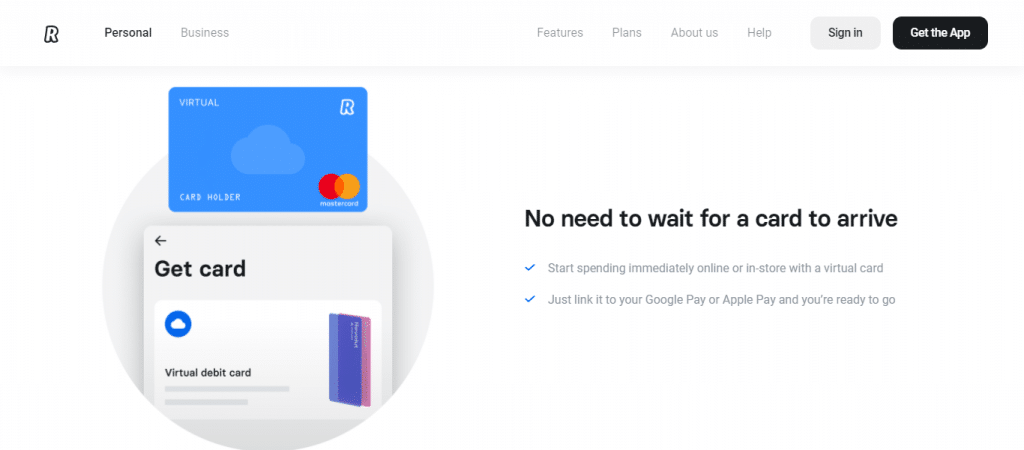

Whether at home or abroad, Revolut lets you pay your way with a virtual or physical card . Both are free (no transaction fees), but you will have to pay postage if you choose a physical card (which depends on the shipping method you choose).

Revolut Review: Physical Map

You receive a prepaid Mastercard or Visa card with contactless capabilities (which one will be assigned to you depends on your location). You can use this at ATM machines as well as most retailers both at home and abroad. You can top up the card with your national currency or exchange it for another currency. If you choose the latter, you will lock in the current exchange rate, which means that if the rate falls, you can still use it without a problem!

Alternatively, you can use your card abroad as is. Revolut will automatically apply the correct currency with the correct exchange rate at the moment.

In any case, you need to set a PIN for your physical card so that payments can be made using a chip and pin and a magnetic stripe card.

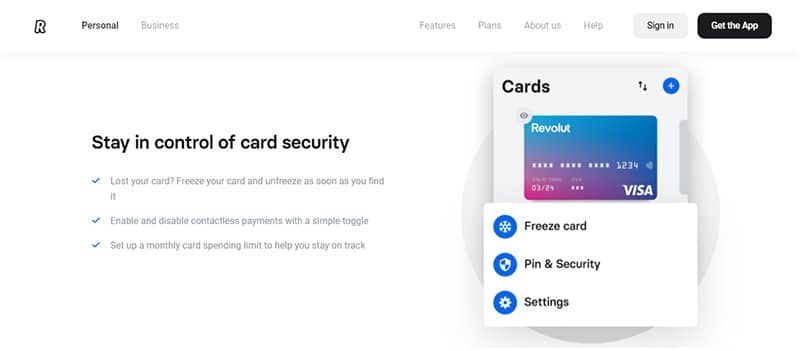

Revolut’s exceptional security settings allow you to lock your card at the touch of a button through the app. You can also disable cash withdrawals and e-commerce transactions if you suspect that your card is being fraudulently used.

Revolut Review: Virtual Map

Like the physical card, the virtual counterpart connects to your account in the Revolut app. Where, again, you can easily manage your virtual card.

A virtual card can be ordered free of charge, and it takes almost no time to install it, but, of course, without a physical card there is no pin code, and therefore it cannot be used to withdraw cash from an ATM.

In addition, the virtual card lacks some of the other security features that accompany a physical card, including:

- Disable magnetic stripe payment

- Location-based security

- Disable contactless payments

- Disable ATM cash withdrawals

- Disabling an e-commerce transaction

However, there are some advantages to choosing a virtual card, especially if you spend most of your spending online. A virtual card can protect you from online card scams as they are deleted every few months and replaced with a new one.

Let’s say you have chosen the “Metal” plan. In this case, you get access to an unlimited number of disposable virtual cards, that is, the card data will change after each transaction. This makes it very difficult for hackers to track your payment information online and infiltrate your payment details. Not to mention, even if an untrustworthy website leaks your card details, you will remain safe from fraud as your card information is no longer correct.

Revolut Review: features

When it comes to features, Revolut truly outshines its competitors. It offers users a wide range of benefits, breaking down its features into several categories that differ depending on whether you are using a personal or business account. However, some features overlap both scoring styles.

However, let’s start by looking at the features available to personal account users:

Score:

- Linked Accounts: With Revolut’s Open Banking Services, you have unrivaled cost control. Simply connect all your external bank accounts to the Revolut app to get an overview of your finances in one place.

- Budgeting and Analysis: You can set monthly budgets based on real-time analytics. This is where you get a complete picture of the health of your accounts, which works wonders to keep you on track for a month. What’s more, the app uses smart technology to predict your spending habits based on past use. With this information at your fingertips, Revolut provides personalized, helpful budget optimization tips.

- Cards: From setting spending limits to freezing a lost or stolen card, and with an award-winning anti-fraud system, you have complete control over your card settings. Revolut also offers a unique disposable card for when you shop online or somewhere in a new or unfamiliar place. As the name suggests, these cards can only be used once. Then, after the payment is made, the card details change, so your account will never be hacked. And – you can use these disposable cards in over 150 countries with competitively low exchange rates.

- Junior Accounts: Introduce kids to money management with the Revolut Junior Account. They are made for children, but fear not, they are completely controlled by you, the parents. You can track their spending, freeze and unfreeze their card, and it comes with a kids app that helps kids understand money management better.

- Pockets: Don’t think about bills and expenses by creating money pockets ahead of time. When you get paid, the correct amount of these expenses is automatically transferred from your account to your pockets. Gone are the days when you had to worry about accidentally missing a payment.

Wealth:

- Stocks: Are you thinking of investing in stocks? If so, you will be pleased to hear that Revolut allows you to do this commission-free and within the limits of your monthly benefit. To help, the app also provides access to global market news so you can keep up to date with your favorite companies and the status of their stocks.

- Crypto: Revolut makes investing in cryptocurrencies convenient and easy, which is ideal if you’re still a beginner. The app makes it easy to exchange Bitcoins, Ether, Stellar – just to name a few – and you can do it in over 30 currencies. For more experienced crypto investors, you can set up price alerts and automatic exchanges to stay one step ahead.

- Commodity Markets: From gold and silver to other precious metals, you can quickly and easily start exchanging these commodities from the Revolut app.

- Vaults: Have you noticed something? If you are nodding while reading this, consider putting your money in Revolut’s vault and saving up for whatever you want. You can save money in over 30 currencies, including cryptocurrencies and merchandise. Plus, if you’re saving money for an event with friends or family, you can open up a group vault to pool your savings.

- Replacement Parts Reviews: Revolut rounds your card purchases to the nearest whole number. This difference is then stored in your vault, where it is safely hidden away for a rainy day. Or, depending on your plan, you can convert the excess change into cryptocurrency, turning it into an investment. The app also lets you multiply your spare change by ten times their original amount before it goes to your savings – which works wonders if you need a push to save more!

- Money Transfers: Wherever you are, you can pay without any hidden fees. With over 30 currencies to choose from and using the interbank exchange rate, transferring money has never been easier.

- Group bills: Never fiddle with paying your share of bills with group bills again. Track, pay and split bills instantly from one place. Whether you are paying your share of the monthly rent or making a one-time payment, simply enter your share and Revolut will figure out how much you owe. And if you owe money, the app will send you a polite reminder, saving you from unpleasant conversations.

- Subscriptions: This feature provides you with a simple overview of all your subscriptions, direct debit and recurring payments. If any outdated subscriptions go unnoticed, you can quickly block them with one tap, which will help reduce costs.

Additionally Features of Revolut

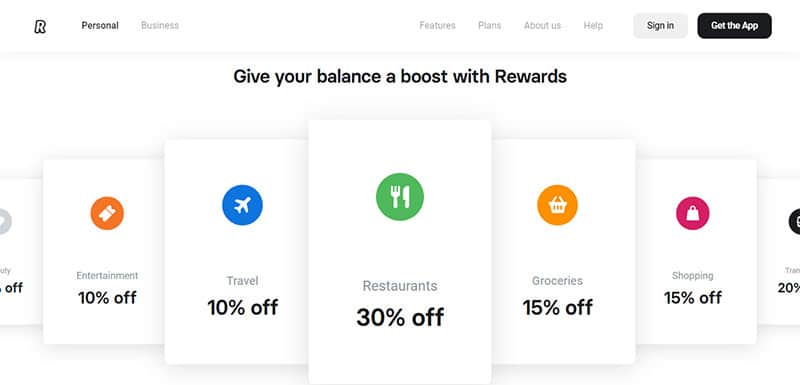

- Rewards: You’ll love exclusive cashback deals from a number of popular brands. This reward scheme not only brings you cash back, but also creates personalized offers based on your shopping habits.

- Donating: It’s easy to donate to your favorite charity, and with no hidden fees, they’ll receive 100% of your gift. Revolut partners with a number of internationally renowned charities and offers a variety of donation options, including temporary gifts and recurring payments.

- Insurance abroad: Pay for insurance only for the days when you are abroad, thanks to the unique Revolut geolocation technology. This insurance covers both emergency dental insurance and medical travel insurance, and reimbursement is quickly paid into your Revolut account.

- Device Insurance: For just £ 1 a week, you can get cell phone insurance wherever you go for all accidental damages. This includes damage out of warranty and can be transferred to multiple mobile devices.

There are also a number of additional features designed to support business owners, allowing them to accept payments at fantastic prices from anywhere in the world. And with payments the next day, you don’t have to wait days or weeks for your funds to be credited.

As a Business Revolut account owner, you can take advantage of the features listed above. Moreover, you can also open multi-currency accounts. This allows you to make international transfers in 28 different currencies.

All business transfers are made at the real interbank exchange rate. You can also use Revolut analytics to track all your inbound and outbound expenses and control company expenses.

In short, a Revolut business account allows you to track, send, request and receive money securely and at the best possible prices anytime, anywhere.

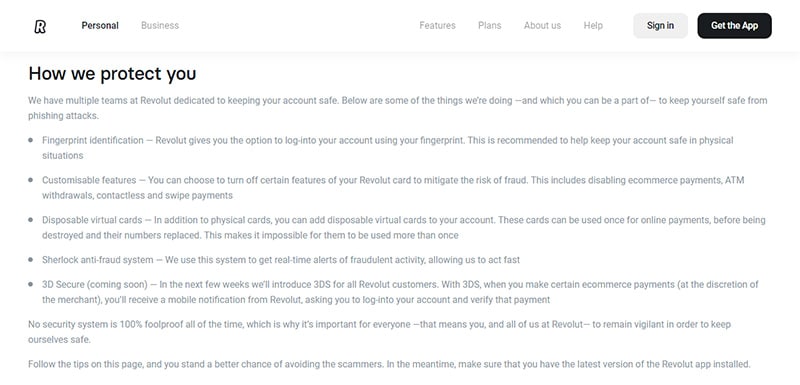

Revolut Security

Revolut has pretty much covered all the basics to offer you a safe and professional service when it comes to security. Some of the more notable security measures include:

- Fingerprint Authentication: You have the ability to securely log into your account using your unique fingerprint.

- Customizable Features: For example, you can disable features such as e-commerce payments and withdrawals if fraud is suspected. You can also quickly freeze your card with the click of a button.

- Disposable Virtual Cards: You can change your card details after every online payment, greatly protecting you from online fraudsters. Even if someone steals the card credentials, these types of cards can only be used once, so they are practically useless if they fall into the wrong hands.

- Sherlock’s anti-fraud system: This provides real-time alerts of fraudulent activity.

Revolut Review: Customer Support

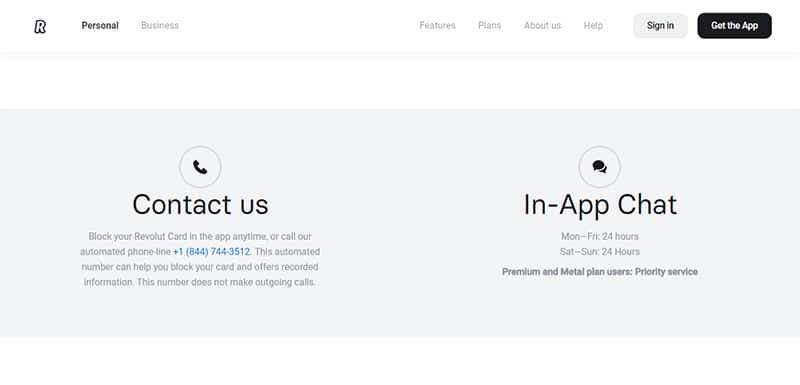

While 24/7 customer support was once a premium feature, Revolut has now opened it to all customers. So, wherever you are, you can launch the Revolut app and talk to a support agent about any issues you have.

For an instant reply, the in-app chat function can be located at the bottom of the screen. Or, for less important questions, you can email Revolut support at any time. Users also have full access to the Revolut community. Here you can chat with other Revolut users and experts. This is the perfect place to exchange tips and advice! Or you can consult the online help center. Here you will find answers to frequently asked questions, as well as many helpful tips for users.

Revolut Review: App

When it comes to Revolut, as you’ve probably guessed by now, the app is at the center of everything you do. This is where you go to manage all aspects of your finances. The app itself is free to download and offers an easy-to-use interface.

Revolut customers can use Apple Pay, Google Pay , contactless payments, or chip and PIN payments with a physical card. All your actions send notifications to your phone (or Apple Watch if you download the Apple Watch app), making it easier to keep track of events.

From the home screen of the app, you can navigate to one of four areas;

- Your accounts

- Cards

- Linked accounts

- Junior accounts

Or you can go to other areas of the application. For example, checking your investments, sending payments, setting up shared accounts, accessing additional features, or even receiving rewards.

Navigating the Revolut app is intuitive. With very little time, you can familiarize yourself with where everything is. It’s really as easy as a few clicks to take action or view an account, making it incredibly accessible for all types of users.

Revolut Review: registration

If you want something simple, Revolut has everything you need to get started. They say that opening a bank account can be done in less than a minute. Without time-consuming paperwork, this process is much less complicated than registering with a traditional bank.

The entire registration process can be done through the app. You just need to verify your phone number. Once your details are complete, you will be prompted to make a deposit from your existing account, which essentially acts as an initial security check.

You will then be asked to send an identity document in the form of an uploaded image of your passport or driver’s license. Typically, you will receive confirmation of your identity via text message within a few minutes.

Once setup is complete, you can choose your preferred subscription plan, order cards and start spending.

Are you ready to start using Revolut?

Now that we’ve come to the end of our Revolut review, there’s no denying that Revolut is offering shoppers something truly unique. It is clearly more than just a platform for transferring money abroad. In fact, its services are so varied and polished that it can serve as someone’s only account if you want to.

This is a fantastic option for young people who are still learning how to save money. Its extensive set of control features provides a safe introductory experience. What’s more, it offers some of the most competitive exchange rates on the market, making it an ideal choice if you are making a lot of transfers between currencies.

Are you planning to open a Revolut account? Or do you think you will choose one of Revolut’s competitors like Transferwise ? Anyway, please let us know in the comment box below. We can’t wait to hear from you!