DeFi Token Exchanges | Review of exchanges for buying and selling decentralized finance tokens – In the wake of the demand for DeFi projects, the demand for their tokens is growing. Many people are in a hurry to buy promising assets in the hope of increasing their profits – this does not always lead to a positive result, since the sphere is extremely volatile.

The editorial staff of Profinevstment.com offers an overview of exchanges for trading DeFi tokens, where you can buy and sell them most quickly, conveniently and profitably.

| Stock exchange | Verification | DeFi tokens | A type |

|---|---|---|---|

| Binance | Not | LINK, UNI, MKR, UMA, YFI, SNX, ALPHA, NBS, BAKE, BCPT, BURGER, SPARTA, WING, CREAM, SWRV, OAX, PERL, INJ, BEL, XVS, BZRX, SUN, MFT, WNXM, AST, ORN, REQ, CAKE, RCN, IDEX, FLM, DIA, CRV, TRB, SRM, BTS, JST, KAVA, BNT, YFII, RUNE, BAL, NMR, SUSHI, LUNA, BAND,RSR, REP, KNC, LRC, ZRX, REN, COMP | Centralized |

| Currency | Yes | LINK, COMP, UNI | Centralized |

| Bitmex | Yes | YFI, LINK, DOT | Centralized |

| Huobi | Not | DOT, LINK, UNI, YFII, YFI, CRV, SUSHI, BAND, BAL, AAVE, KNC | Centralized |

| CEX.IO | Yes | WTBC, YFI, UMA, LINK, DAI, SNX, COMP, MTA, MUSD, SUSHI, CREAM, KNC, BAL, CRV, BUSD, REN, BAND | Centralized |

| EXMO | Yes | DAI | Centralized |

| Coinbase | Yes | BAL, UMA, WBTC, DAI, COMP, BAND, KNC | Centralized |

| Kraken | Yes | LINK, DOT, PAX, DAI, KAVA, COMP | Centralized |

| Bitfinex | Not | YFI, DAI, DOT, COMP, BAL, KNC, PAX | Centralized |

| Uniswap | Not | WETH, DAI, FARM, WBTC, CORE, LINK, UNI, PICKLE, YFI, COMP, MKR, SXP и другие | Decentralized |

| Curve Finance | Not | DAI, WBTC | Decentralized |

| Balancer | Not | BAL, SNX, UNI, CREAM, WBTC, IDEX, DAI, MKR, REN, LINK, YFI, YFII, PAX, SUSHI, UMA, WETH и другие | Decentralized |

| SushiSwap | Not | YFI, LINK, DAI, USDC, LEND, SUSHI, COMP, SNX, CRV, BAND, UNI, SRM, WBTC, UMA and others | Decentralized |

The content of the article

What are DeFi tokens and why are they needed?

Due to its popularity, DeFi tokens are listed on most cryptocurrency exchanges – but what is their value, why are people investing in them?

Most tokens, including such well-known representatives as Synthetix, Compound, Maker, etc., offer the following opportunities to asset owners:

- the right to vote in the management of the system;

- payment of commission fees within the network;

- staking;

- collateral for derivatives or synthetic assets.

More generally, people are now buying DeFi tokens mainly for price speculation. Tokens can increase their value both instantly and in the long run. This is a high-risk tool that, with the proper degree of skill and luck, can bring multiple profits.

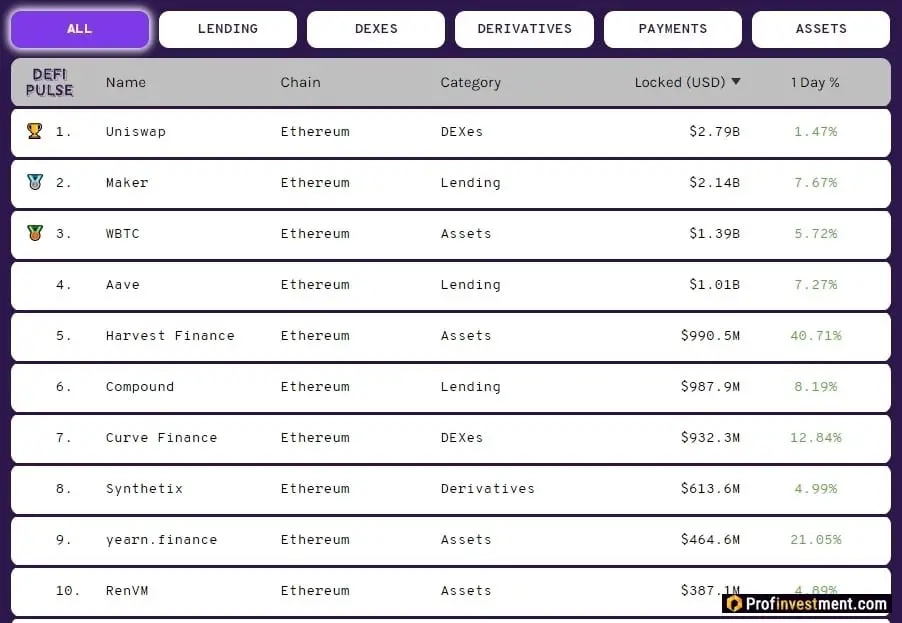

Popular DeFi tokens that can be bought on exchanges

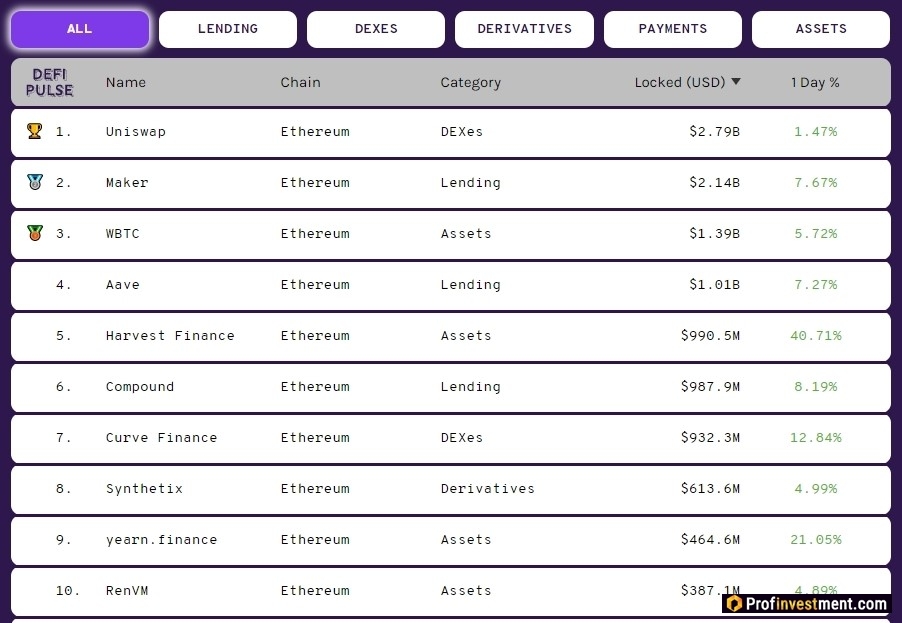

Consider the decentralized assets that currently have the greatest potential and are actively used for trading:

- Uniswap (UNI). The proprietary token of this decentralized exchange allows users to manage fees, treasury and the protocol in general, change the list of default assets, work with the Ethereum Name Service, etc.

- Maker (MKR). The governing token of the stablecoin creation platform. The main role is participation in voting.

- Wrapped Bitcoin (WBTC). A tokenized bitcoin used extensively in a variety of DeFi protocols to increase liquidity.

- Aave (LEND). A token for controlling the credit protocol, giving the holders a vote.

- Harvest Finance (FARM). A cash flow token for an autonomous hedge fund Harvest to generate additional profits.

- Compound (COMP). An asset to help decentralize protocol governance.

- Curve Finance (CRV). Acts as a reward for liquidity providers and allows you to capture the value of pools.

- Synthetix Network (SNX). Designed to create synthetic assets.

- yearn.finance (YFI). Management token in the credit protocol aggregator.

- RenVM (REN). Plays a role in the safety of the Ren ecosystem.

There are three main reasons why DeFi is becoming such a popular industry. The first is the expected implementation of Ethereum 2.0, which should address most of the scalability issues that are currently holding back the acceleration of Decentralized Finance. The second is the functional utility of the protocols. Decentralized applications are gaining traction on the web. The third is growing institutional interest. Today it is difficult to find a large corporation that would bypass such a promising direction with attention (and investments).

Token selection criteria

Being in the top is not a guarantee that an asset will increase in value. There are several more criteria to help you choose a really high-quality product. Perhaps the main one is the idea. Only a truly promising project can ensure further development and promotion. Learn more about the development team, community, future plans. Study the White Paper and assess the relevance of the idea itself in the current conditions and in the future. So, for 2020, projects related to cloud solutions and financial technologies are most popular from the very start.

Some analysts, such as the former Messari product manager Qiao Wangbelieve that DeFi tokens are the best investment opportunity for the next ten years. However, there are many low-quality projects in the industry that have no prospects, so it is important to be careful about the choice.

Exchanges for buying or selling tokens

Let’s talk about exchanges for trading DeFi tokens. All of the sites listed below have been verified by millions of users and have a solid reputation. Choose the ones that best suit your personal needs.

Centralized

1 Binance

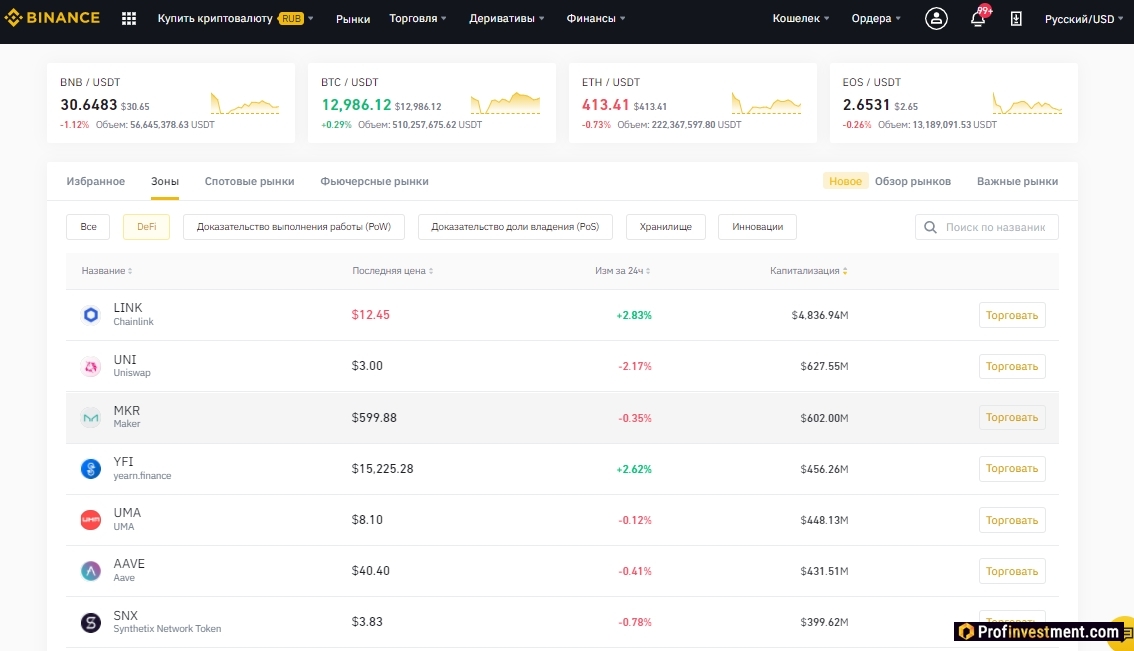

In recent weeks, the centralized Binance platform has been actively working with DeFea tokens of projects – it conducts IEO, launched the Binance Launchpool pharming platform, adds new assets to the listing, and developed the Binance Smart Chain blockchain specifically for deploying decentralized projects.

DeFi tokens for trading: YFI, YFII, DOT, FIL, REN, LINK, UNI, MKR, UMA, AAVE, SNX, COMP, ZRX, LRC, SUSHI, KAVA, CRV, FLM, CAKE, INJ, CREAM, WING, BAKE , ALPHA, etc. It is also worth noting that the exchange launched the DeFi Coin Index (ticker DEFIUSDT) at the end of August. At the beginning, it rose to $ 1189, after which it fell, and is now trading relatively stable at $ 525. The index is available for trading on the Binance Futures futures platform.

2 Huobi

Huobi is also one of the popular crypto exchanges that are following current trends. At the moment, it offers new opportunities for people who are passionate about the DeFi sphere. A special section has been opened for convenient management of decentralized finance. Also, the management is actively investing in this sector.

Examples of DeFi tokens for trading: UNI, AAVE, WBTC, UMA, CRV.

3 Currency

The Currency tokenized asset exchange also supports a number of DeFi tokens. Its development director Nikolay Markovnik reminds clients of the possibility of hedging risks using leverage, since no types of fundamental or technical analysis can be applied to DeFi assets.

Examples of DeFi tokens for trading: LINK, COMP, UNI. More tokens are planned to be added if community needs are identified.

We’re happy to announce that DeFi tokens Compound and Chainlink are available at Currency.com for you!🔥

Trade LINK/USD, LINK/USDT and COMP/USD, COMP/USDT on exchange and LINK/USD, COMP/USD on leverage 1:2 to Cryptos group now.>#LINKUSD > #LINKUSDT >#COMPUSD >#COMPUSDT pic.twitter.com/GT91XhGkwi

— Currency.com (@CurrencyCom) October 14, 2020

4 Coinbase

Jacob Horn, Product Manager at Coinbase, believes DeFi is an integral part of today’s open financial system. These tools are censorship resistant, programmable, unbiased, and accessible to anyone with an Internet connection. At the moment, the exchange is focusing on increasing the adoption of DePhi in the world.

DeFi tokens for trading: LINK, YFI, UNI, MKR, UMA and others.

Why is DeFi so important? Jacob Horne, a product manager at Coinbase, hosted a lunch and learn as part of our Winter 2019 hackathon. pic.twitter.com/8XiNnQ2fWl

— Coinbase (@coinbase) December 11, 2019

5 Kraken

Cryptocurrency exchange Kraken announced in the summer that it will take an active part in the field of decentralized finance (DeFi), in connection with which many DeFi project tokens have been added to the platform. In the wake of interest in this topic, the developers do not plan to dwell on this and monitor the market for new promising projects.

Examples of DeFi tokens for trading: DOT, FIL, YFI, SNX, CRV, COMP, KAVA, KNC, STORG and others.

Decentralized

6 Binance Dex

The Binance DEX decentralized exchange allows you to trade DeFi assets and other cryptocurrencies without storage, that is, the user’s private keys for accessing the wallet are stored. The platform supports more than 130 trading pairs, mostly assets hosted on the Binance Chain blockchain, and is most actively used for trading the TWT token (this is an asset of the Trust Wallet, officially supported by the Binance exchange).

Examples of DeFi tokens for trading: TWT, RUNE, AWC, CAS and others.

7 Uniswap

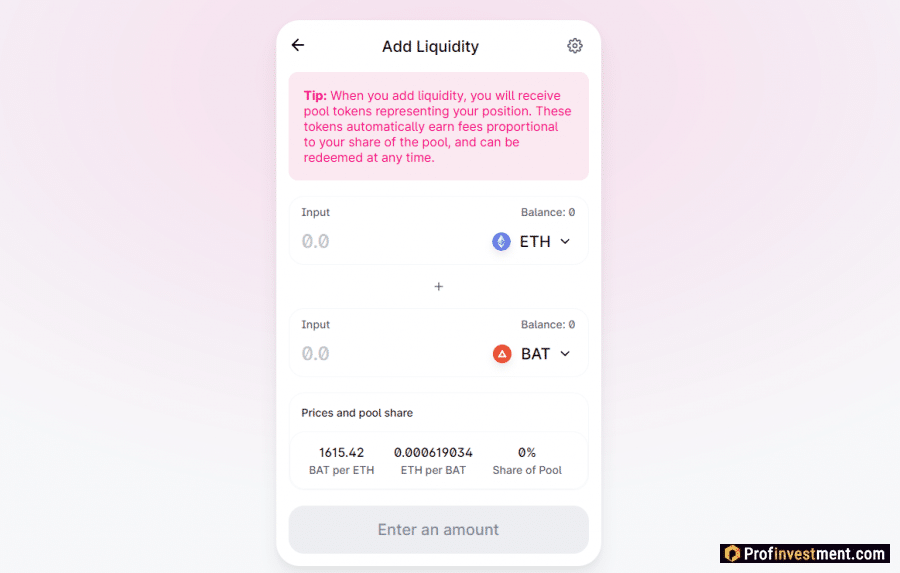

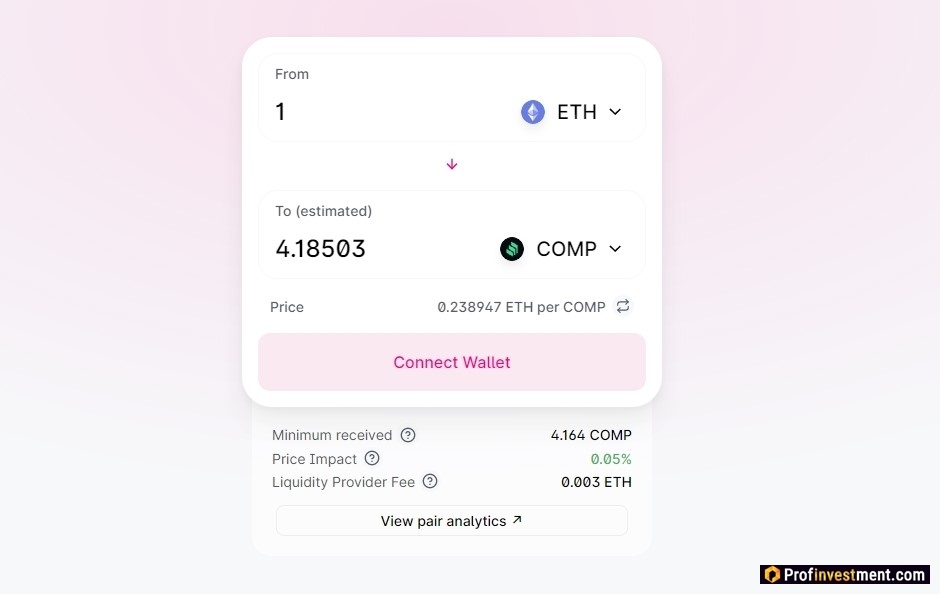

The Uniswap decentralized platform operates on the principle of an “automatic market maker”. Participants deposit funds (ERC-20 tokens) into liquidity pools, thus automatically generating markets based on supply and demand. For the supply of liquidity, the exchange rewards users with its own UNI token.

Examples of DeFi tokens for trading: COMP, LEND, REN, SNX, UMA

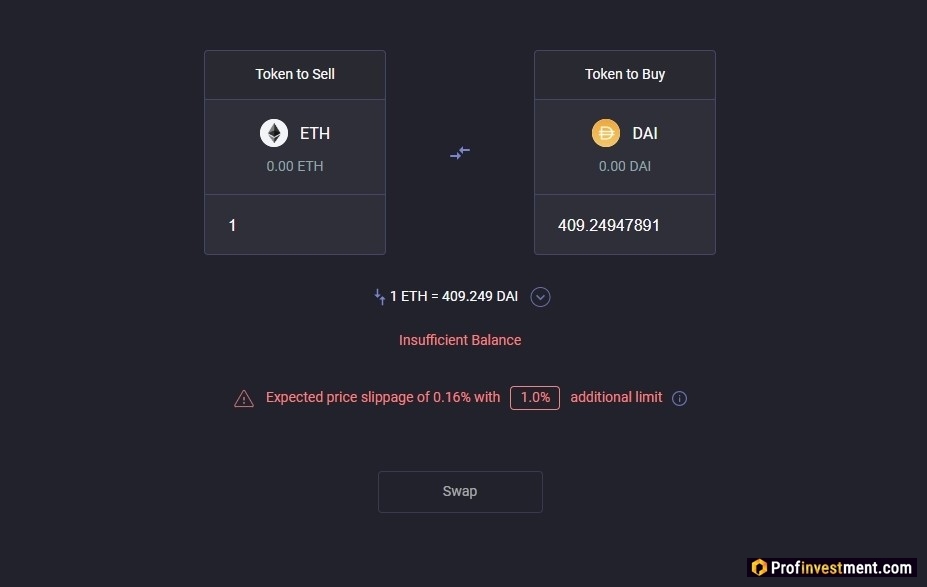

8 Sushiwap

A project created on the basis of Uniswap and working on the same principle, with a slight difference in the methods of rewarding the participant (once the liquidity contributed continues to receive the reward indefinitely, although over time it will be diluted and reduced). Sushiswap positions itself as a platform fully focused on decentralization in all aspects of work.

Examples of DeFi tokens for trading: YFI, SUSHI, DAI, WBTC, UNI

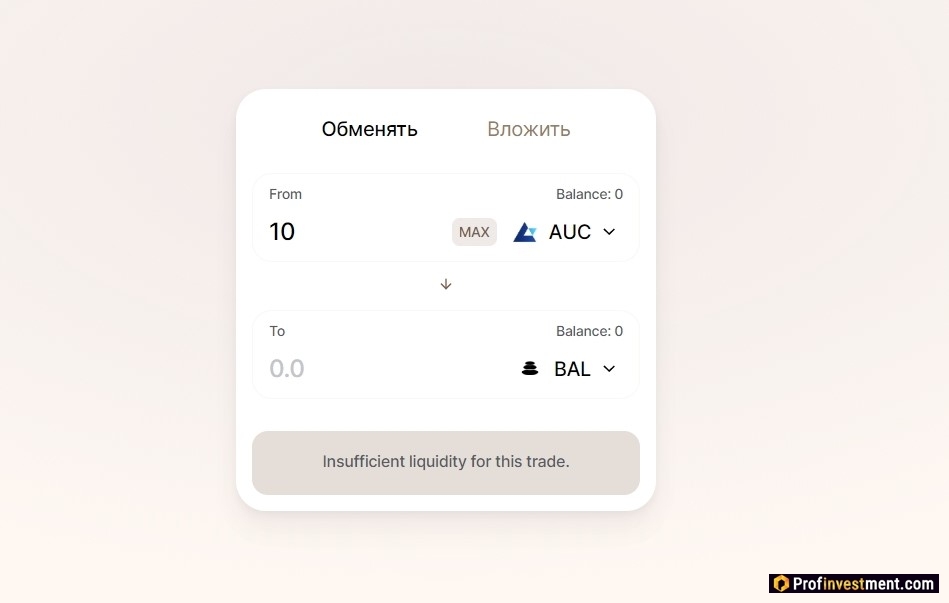

9 Balancer

Playground, which also works with liquidity pools. It is fundamentally different in that the user himself indicates in what ratio he wants to contribute his assets, while in the previous ones they are automatically distributed 50/50. There are various types of pools including Smart Pools with profit optimization.

Examples of DeFi tokens for trading: WBTC, BAL, CREAM, MKR, LINK

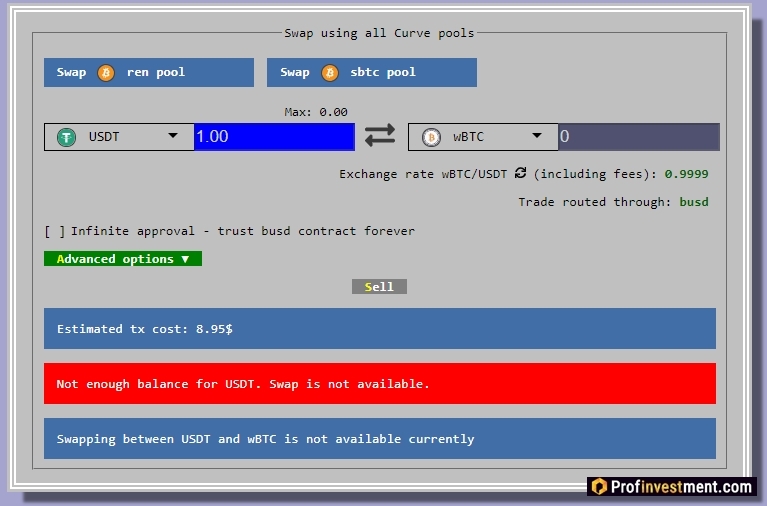

10 Curve Finance

The Curve Finance exchange supports a large number of different stablecoins, allowing them to be exchanged under specific conditions and rewarding CRV tokens for adding liquidity to specific pools. The main features of trading are low commissions and low slippage. One of the best places to trade stablecoins.

Examples of DeFi tokens for trading: PAX, USDT, DAI, USDC, renBTC

Conclusion

The future of DeFi looks promising, and it should come as no surprise that almost all exchanges provide conditions for trading DeFi tokens, as well as introducing additional functionality to facilitate this process. We certainly still have a lot to expect in the decentralized finance space.