Everyone always wants to know when the bull run starts. Not bad, then there is a lot to earn. Analyst Adger Jooren dived into the charts. He looked at bond prices and the Dow Jones index and compared those trends to the bitcoin price.

Bitcoin bull run starts at every second summit

The blue line in the graph above is the price of the Dow Jones Index. That is the oldest and largest stock index in the US. The orange line is the price of bitcoin.

By studying both courses a pattern is visible. Every time the Dow Jones reaches a top, collapses and then shoots over the same top, a bitcoin bull run starts.

You can see that from the green, horizontal bars. At the start of each bar, the Dow Jones reaches a peak, then collapses and looks up the same peak more often. The moment the price breaks through that peak value, the bitcoin bull run starts. That moment is shaded with a green sphere.

We see this back in 2012, in 2016 and actually now again. It is still guessing whether in 2019 this will really be the prelude to a bull run, for that we have to dive a little further into the depth.

Proceeds from bonds lag behind, capital flight

But where does that money come from? How is it possible that the stock market (Dow Jones) and bitcoin receive an injection of liquidity?

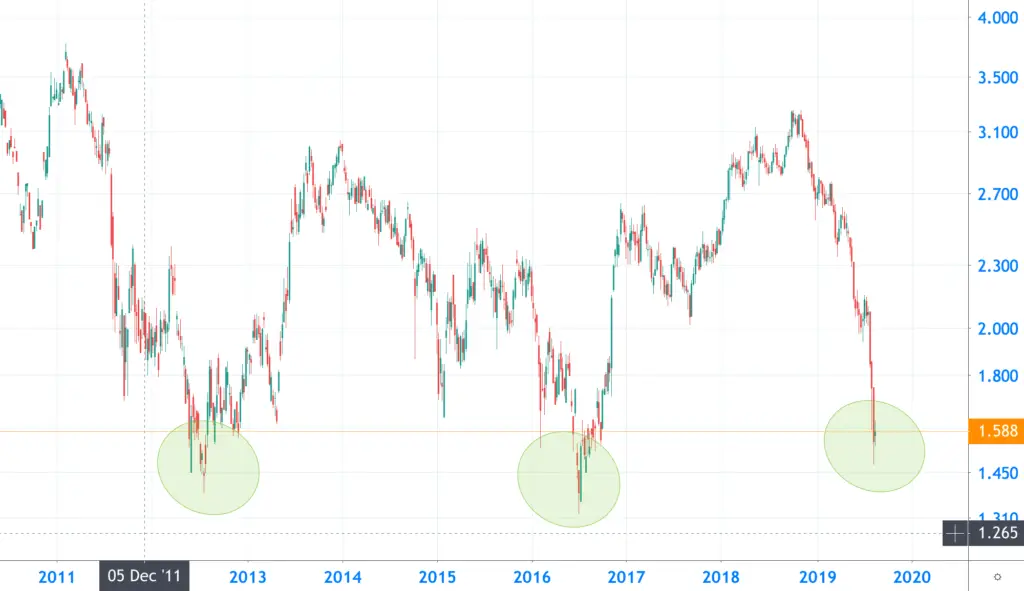

Analyst Jooren has found another connection. The graph above shows the proceeds from 10-year government bonds. This is not the market value of a bond, but the actual dividend. An important difference.

When interest rates on savings accounts go down, investors look for a way to retain value, or even to earn on capital. Traditionally, investors and institutional parties first look at bonds because they are considered safe. But if enough parties want to have bonds, that will only drive up the price. You therefore pay more for bonds and the dividend paid cannot keep up with this price increase. The return per bond then falls.

Capital is a difficult choice

During periods of economic expansion, bond prices and the stock market move in the opposite direction, as they compete for the same capital.

That capital must therefore make a choice: low return on bonds, or switch to the slightly riskier stock market. Because the yield on bonds has fallen so fast, it is of no use to buy new bonds and the capital is diverted to the stock market.

You can see that in the graphs above. The green spheres in the bond graph represent the low point of the return on bonds. And those moments correspond to the green bars on the Dow Jones chart, here the course breaks through the previous summit.

Where are we standing right now?

All major central banks have announced interest rate cuts. It is of no use to leave money in your bank account, since it does not produce anything. Money has been flowing to real estate and to bonds for a while. The last green sphere on the bond graph shows that the yield on bonds is very low at the moment.

In terms of timing, that green sphere corresponds to the third green bar of the Dow Jones chart.

Analyst Jooren:

According to the indicators, we are on the eve of a new bitcoin bull run. Add to this that Bakkt also goes live next month, and it is even easier for institutional investors to invest in bitcoin. Who knows, institutional investors might skip a number of steps (such as the stock market) because they can now invest directly in bitcoin.

This article was written in collaboration with Adger Jooren, an analyst at BTC Direct.