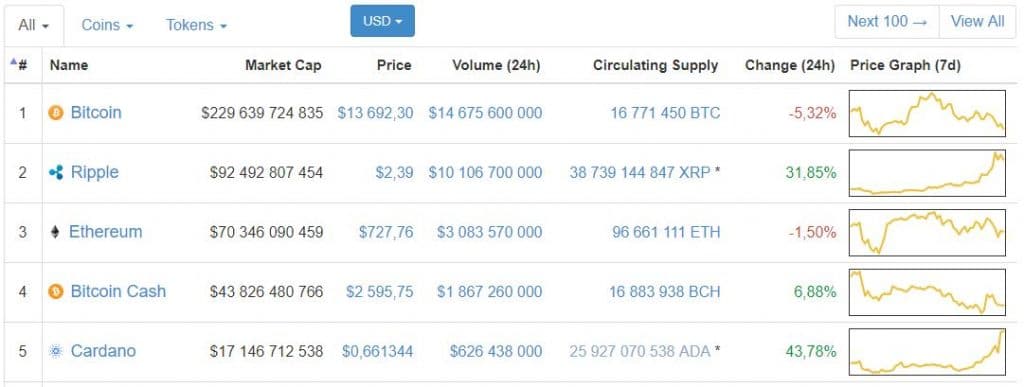

Bitcoin Cash has emerged as an alternative to Bitcoin and currently stands between the world’s third and fourth most valuable cryptocurrency by market capitalization, after Bitcoin, Ethereum and Ripple. The founders of Bitcoin Cash created the Bitcoin alternative on August 1, 2017 to combat increased wait times and transaction costs on the original Bitcoin network. Bitcoin Cash increases the number of transactions that can be processed per block.

In this guide “What is Bitcoin Cash? We will review the history of Bitcoin Cash, its current situation and its comparison with the original Bitcoin sometimes also called bitcoin core.

Why create Bitcoin Cash?

It’s no secret that Bitcoin has scalability and scalability issues. Also, all those who have recently tried to make a transaction with Bitcoin have had to be supreme network fees they have to pay.

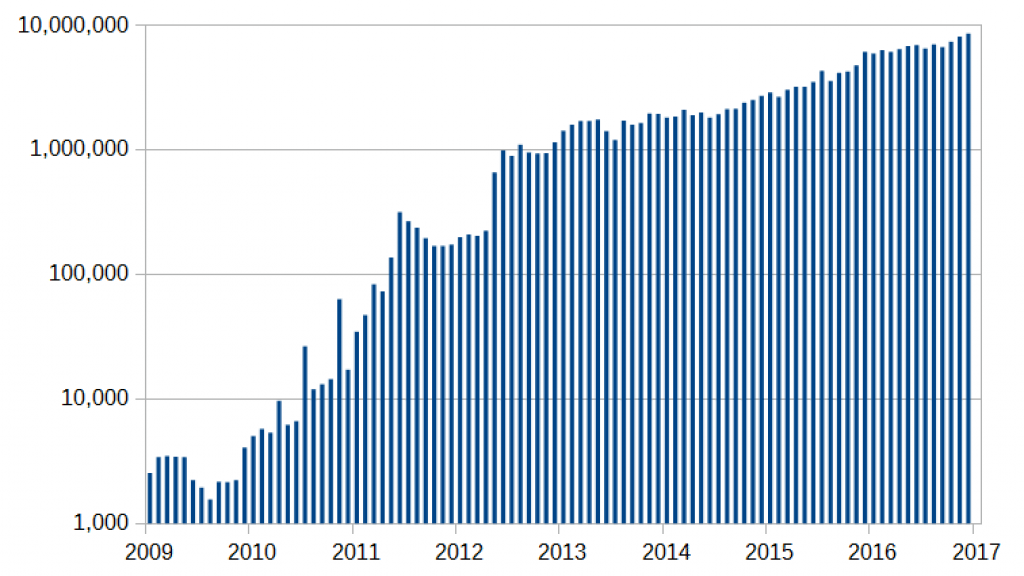

As the currency has grown in popularity, the number of transactions on the network has increased, and Bitcoin is currently pushing the limits of its blockchain. Nakamoto had certainly not anticipated such a success in his digital currency.

The main problem is that Bitcoin imposes a strict limit on the size of a block in its blockchain, the place where the transaction information is stored. Currently, blocks on the Bitcoin blockchain are limited to 1 MB.

Why would Bitcoin limit the number of transactions that the network can process?

Well, since Bitcoin uses a distributed ledger, every network user must download and keep a copy of the Bitcoin Cash transaction history. Allowing unlimited transactions would mean that the ledger would reach a huge size, and ordinary users would not have the computing power or the bandwidth to use the network.

If an unlimited number of transactions were allowed, Bitcoin would be under control of a few centralized organizations with enough processing power to handle tens of thousands of new transactions per second, and that will be too bad for the average user. Since Bitcoin was created to avoid centralized institutions, this is not an attractive option.

The 1 MB limit on block sizes currently in place means that the ledger of transactions (the ledger) does not grow too fast. New users can easily download the transaction history and join the Bitcoin blockchain. However, this block limit also means that there are more requests for transactions than there is space in the block to satisfy all of them.

As a result, Bitcoin miners charge a fee to prioritize and prioritize your transactions. If you decide not to pay the fees, as of November 2017, your transaction takes an average of just over 2 hours to be confirmed.

These fees and confirmation deadlines also seem contrary to Bitcoin’s mission to democratize payments. With money transfers, you pay a fee to a bank. For Bitcoin, paying fees to minors does not seem very different, although the fees are variable and generally lower than a bank transfer, but still it remains to be discussed, because to pay up to $ 20 fee for small transactions is not at all attractive.

The founders and the community of Bitcoin Cash think that the size of the blocks needs a limit, but the limit of 1 MB is arbitrary. Instead, they proposed a system with a block size of 8 MB, still reasonable for new users to download but big enough for the new system to accommodate a sufficient number of transactions per second to meet demand.

Hard Fork Bitcoin and birth of Bitcoin Cash

Before deciding to create a new currency, the people behind Bitcoin Cash appealed to the original Bitcoin community for an increase in block size. Proponents of the increase spoke of greater accessibility and increased room for maneuver for the growing Bitcoin user base.

However, there have been many opponents to this increase, including miners who are mostly interested in transaction fees, which could lead to a decrease in all blockchain mining and a drop in security in the blockchain. result. Opponents also believed that such an increase in network capacity would still result in storage, bandwidth and computing requirements beyond the reach of the average user.

While both sides reached a small compromise in the form of BIP 91 and Segregated Witness (the famous SegWit), which are improvements aimed at reducing the amount of information needed inside the block, the argument of increasing block size has been prolonged for more than two years.

Eventually, both sides decided to split up as a hard fork on the Bitcoin network.

The original bitcoin would continue to exist with its block limit of 1 MB. In addition, a new Bitcoin alternative, called Bitcoin Cash, would be created with a block limit of 8 MB. A hard fork means that Bitcoin Cash has kept the same transaction history than Bitcoin until the moment of fork (separation). If you owned Bitcoin before the hard fork, you continued to own this Bitcoin, but now you have received an equivalent amount of Bitcoin Cash coins on the new blockchain.

Although technically almost identical, the two networks are not interchangeable.

The new Bitcoin Cash implemented replay protection and other measures to create a hard wall between the bitcoin cash and bitcoin fork, meaning that transactions could only be made within the bank. fork and not through the networks. The two currencies share a common history until August 1, 2017, but they are then completely separated.

As a result, Bitcoin Cash has a different exchange rate than Bitcoin, and not all portfolios and stock exchanges supported Bitcoin Cash when it was launched. Yet by the end of August 1, Bitcoin Cash was the third most valuable cryptocurrency in the world, in terms of market capitalization, and it has maintained that position since November 13, 2017 (although Ethereum and Ripple are beginning to seriously to make him a shade since the end of December 2017).

For the beginning of his life, Bitcoin Cash has largely derived its value from speculation. Indeed he has been presumed heir to the throne as king of cryptos if and when the scalability crisis of Bitcoin will make it difficult to exploit. Bitcoin Cash’s fiercest supporters believe it will simply become “Bitcoin”, and the original Bitcoin will fade out as Bitcoin Legacy or Bitcoin Core.

On the other hand, critics of Bitcoin Cash see the project as a useless splitting of the community, dividing into factions a small group of people who love and understand blockchain technology.

Minors, those whose opinion really matters

In the end, discussions on forums and social media about the future of Bitcoin and Bitcoin Cash are less important for the success of the project than the miners’ decisions on the new currency.

As Bitcoin Cash is almost identical to Bitcoin, apart from the size of the block, the two forks would now be fighting over the power of the miners.

The miners had a choice: to try a new adventure, perhaps lucrative, with a higher risk or stick to the proven model of Bitcoin’s original mining network.

At first, Bitcoin Cash had problems because its difficulty level was still calibrated to the mining power of the original Bitcoin network. With the sudden decrease in the computing power of mining, it took up to 10 hours for the Bitcoin Cash blocks to be exploited quickly.

However, Bitcoin software (and therefore Bitcoin Cash) is written to adjust the difficulty of mining every 2,016 blocks. If more miners join the network, the difficulty will increase, so the block time will stay about the same (~ 10 minutes for Bitcoin and Bitcoin Cash). If there are fewer minors on the network, the difficulty will decrease.

The problem is that Bitcoin Cash did not have time to wait for 2,016 blocks to pass before the difficulty adjustment. Instead, they put in place an Emergency Difficulty Adjustment (EDA) that automatically changed the difficulty if the mining hashrate (hashrate is the computing power of all the mining computers on the network) is a tiny percentage of what was expected.

In the first few weeks of Bitcoin Cash, the difficulty of the block quickly decreased thanks to EDA. As a result, mining of Bitcoin Cash became more lucrative and miners began to migrate from bitcoin mining to Bitcoin Cash. Some of these miners were idealists, dedicated to the idea of the evolutionary Bitcoin Cash solution. Still, others were interested in acquiring Bitcoin Cash as an investment vehicle, with prices expected to rise. Finally, for some mining companies, Bitcoin Cash was a business opportunity, and they are constantly switching between Bitcoin mining and Bitcoin Cash depending on the most profitable sector.

SegWit2x and the future of Bitcoin Cash

After its initial launch and inflating its value, the value of Bitcoin Cash stabilized around $ 400 / BHC. Then in December, it rose rapidly to reach $ 3500 following the addition of this cryptocurrency on the most popular platform: Coinbase.