What is PoS (Proof of Stake) mining – PoS mining is a cryptocurrency mining algorithm that does not require the use of powerful computing equipment. It works on the principle of “money makes money”, which is a bit like a deposit in a bank. That is, the user’s income directly depends on the share of coins that he owns.

PoS mining is a cryptocurrency mining algorithm that does not require the use of powerful computing equipment. It works on the principle of “money makes money”, which is a bit like a deposit in a bank. That is, the user’s income directly depends on the share of coins that he owns.

PoS mining: what it is and how it differs from the PoW algorithm

The abbreviation PoS stands for Proof-of-Stake – proof of proportion. At its core, this is a method of cryptographic protection, in which the probability of a particular block forming a user in a blockchain chain directly depends on the proportion of coins that this participant owns. And since a reward is accrued for each block created, its potential income depends on the participant’s share. This method does not require the purchase of powerful computing equipment. In addition, a person does not need to pay for the light, which reels technique during classical mining.

If we talk about how PoS mining works, then everything is extremely simple:

- The user buys a certain amount of cryptocurrency, extracted by this algorithm of consensus.

- Acquired currency is transferred to the wallet and “frozen” (that is, a person does not spend anything on it).

- After some time, the user receives dividends in the form of new coins to his wallet. Interest is accrued on the basis of a bank deposit – the higher your initial share, the higher your monthly income.

According to the initial idea, the PoS mining profitability is determined by what part of the total number of cryptomonet a person owns. For example, the LEOcoin network provides for receiving 10–20% per annum:

- From 1000 to 4999 – 10%.

- From 5000 to 49999 – 15%.

- From 50,000 to 20%.

To start receiving interest, you need to buy 1000 or more coins. Here there are 2 important differences from the original principle:

- Interest rate is limited. That is, you do not have the opportunity to receive 50-60% per annum, provided you buy a huge amount of cryptocurrency. The platform initially sets certain limits on remuneration.

- The percentage is calculated not from the total share, but directly from the amount stored on the wallet. That is, you keep in a wallet, say, 2000 Leokokinov and get your 10% per annum for it, even if in practice this amount does not constitute a 10% share of the total number of issued coins.

Despite the above differences, the fundamental essence remains the same – you buy a certain amount of coins, and then you get interest for it.

The opposite of POS mining is the extraction of digital assets using the PoW consensus algorithm (Proof-of-Work or proof of work done). In this case, the reward of the “miner” depends on the power of his equipment and on how much the equipment takes part in the opening of the new unit. PoW mining requires additional financial costs:

- you need to purchase equipment ( farm or asiki );

- to furnish the room (the room should be well ventilated and, if possible, be soundproof);

- update electrical wiring, as the Soviet wires may simply not withstand the load;

- spend part of the monthly income to pay bills for the light.

In addition, there is always a risk that the coin being mined will sharply depreciate, and the purchased equipment (the cost of which is measured in thousands of dollars) will become unnecessary. Of course, cryptocurrencies mined on the PoS algorithm are subject to inflation, but in the event of their collapse, in any case, you will lose less money.

In general, PoW-mining is quite an honest mining method: everyone gets what he has worked for. However, he has a number of flaws:

- The total network capacity (hash rate) is systematically increasing, and with it the complexity of mining increases . Thus, after the time expired, the purchased equipment becomes too weak and ceases to generate revenue. Because of this, the user needs to periodically update the equipment, spending additional funds on it.

- In all cryptocurrencies on PoW mining, the reward for a block periodically decreases. This method regulates the issue of a specific digital asset. For example, now 12.5 BTC is issued for the Bitcoin block. Every 4 years there is a two-fold decrease in rewards. This tendency will lead to the fact that sooner or later the mining will become completely unprofitable, and the system will have a minimum of people who will confirm transactions (this is what new blocks are generated for).

- When using the PoW protocol, the probability of a so-called 51% attack is high. Its essence is that in the hands of one user or a group of persons more than half of the power of the entire network is concentrated. Such a high hashrate concentration allows the equipment to be used for malicious purposes. For example, owners of prevailing capacities can ignore blocks of other “miners”, distributing the remuneration among themselves.

For the above reasons, PoS mining is a more attractive alternative. Separately, it should be said that the share proof protocol more reliably protects the network from an attack of 51%. In order to make such an attack, you need to get more than half of the total amount of emitted cryptocurrency. Firstly, it is very expensive (tens or even hundreds of thousands of dollars may be required). Secondly, even if you focus on very cheap cryptocurrency, there is no guarantee that it will grow in the future. It is unlikely that a potential attacker would want to risk his money like this.

Examples of cryptocurrency mined using PoW and PoS protocols

On the Proof-of-work protocol, such digital assets are rendered:

- Bitcoin, Bitcoin Cash, Mazacoin ( SHA-256 encryption algorithm ).

- Litecoin, Auroracoin, Dogecoin ( Scrypt ).

- Bytecoin, Monero, DarkNote (CryptoNote).

- Dash (X11).

By PoS mining today such crypto coins are mined:

- LEOcoin;

- BlackCoin;

- ClubCoin;

- CoinMagi;

- ReddCoin;

- Diamond;

- NovaCoin.

There are also cryptocurrencies that combine both of these protocols:

- Peercoin;

- Emercoin;

- BitConnect.

As you can see, today, using the PoW protocol, many popular and expensive assets are mined (Bitcoin, Lightcoin, Monero, Dash). The Proof-of-Stake algorithm is used for the time being in low-priced coins that are in lower demand. But despite the low price, such Coin have good prospects for further growth, which opens up opportunities for potential owners to invest.

Separately, it should be said that in the near future Ethereum should go to the PoS – one of the most popular cryptocurrencies of today. Initially, such a transition was to take place in 2018, but for several reasons, it was postponed until 2019 without an exact date.

- Read more about transitioning Ethereum to PoS .

Stages and strategies of PoS mining

To start practicing po-mining, you need to perform the following steps:

- Choosing cryptocurrency. This stage should be approached as seriously as possible in order to choose the asset that will bring you the greatest return. It is necessary to read the general description of the coin, study its features, get acquainted with the opinions of analysts, evaluate the prospects for further growth, find out under what conditions interest is calculated.

- Install and synchronize the wallet for the selected digital asset. It is recommended to download such clients on the official website of this or that cryptocurrency. Consider that each repository necessarily goes through a synchronization stage, which can take from several days to a couple of weeks.

- After activating the wallet we buy currency on the exchange. As a rule, popular Coins on the PoS algorithm are traded on such sites as Bittrex, Cryptopia, Upbit. The most recent coins can be purchased on the official website of the project. The main thing is not to confuse cryptocurrency with tokens that are very similar to each other.

- We transfer the purchased cryptocurrency to the address of your wallet. Often, the interface of all wallets resembles the design of a Bitcoin Core wallet. That is, there is a “Get” tab, where the public identifier is located.

- We leave the coins in the wallet and wait for the interest.

Note that during POS mining, you need to constantly ensure that the wallet is active (usually this is indicated by the corresponding icon located at the bottom or at the top of the client). If the wallet for some reason will be inactive, it is recommended to restart it or, in extreme cases, restart the computer.

In general, one can extract coins using the PoS protocol using one of two strategies:

- Buying a popular cryptocurrency, which is already in the listing of several major exchanges.

- Acquisition of new Coins who are not yet traded on exchanges. As a rule, this can be done on the official website of one or another cryptocurrency.

In the first case, everything is extremely simple: you buy a currency that has already proved its viability (otherwise the exchanges would simply not add it to their listing). Here you can earn income in two ways:

- accrual of dividends on the amount stored in the wallet;

- the growth rate of the asset and its subsequent sale on the stock exchange.

The second way is more long and risky, but potentially more profitable. You buy the newest Coin who are not yet traded on the stock exchanges. The novelty of the coins allows you to buy them in large quantities at the lowest price. You will also start receiving interest according to the terms of the platform. However, you will have to wait until these lines are listed on at least one exchange. The main danger is that the purchased coin may never shoot and you will lose your investment. But if the cryptocurrency still has success, you are guaranteed a good profit, because you can sell the asset at a more favorable rate.

Practical example of PoS mining

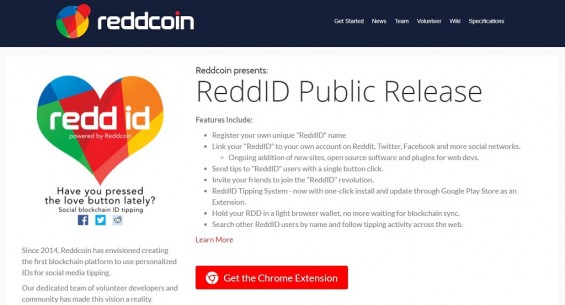

ReddCoin official website cryptocurrency

As an example, consider the cryptocurrency mining ReddCoin. As of December 8, 2018, it has the following indicators:

- the course is 0.001196 USD;

- total emissions – 28,808,713,174 RDD;

- market capitalization – $ 34.4 million;

- Declared yield – 5% per annum.

To start mining this asset, you need to perform the following steps:

- Go to the official website cryptocurrency reddcoin.com.

- Scroll the page down, find the Redd Wallet section and click the Learn More button.

- Download the wallet for your operating system (clients are available on Windows 32/64 bit, Linux and macOS).

- Install and synchronize wallet.

- We register on one of the exchanges that support the desired cryptocurrency. For example, you can use the site bittrex.com or cryptopia.co.nz.

- We replenish the balance of the exchange and buy the right amount of ReddCoin.

- We transfer coins to your wallet.

- We keep coins on balance and we receive interest charges.

Pros and cons of PoS mining

The considered method of mining Coin has its strengths and weaknesses. You can find them in the table below:

| Virtues | disadvantages |

| No need to invest in the purchase of expensive computing equipment. | PoS mining can not bring the desired income, if the selected currency will not grow in value. Not excluded, and the collapse of the cost. |

| No need to pay monthly bills for the light. | The primary sale of a new cryptocurrency can be carried out by scammers who tritely cut the bank and disappear, and you will be left with unnecessary coins. |

| Since many cryptocurrencies on the PoS protocol have a low price and growth prospects, this mining method is an excellent investment vehicle. | The acquisition of the newest coins may result in the fact that they never shoot and will not be added to the listing of exchanges. Thus, you can not receive income from their sale. |

| Cryptocurrencies mined on the PoS protocol are much better protected from an attack of 51%, because an attacker will have to spend a lot of money to get the vast majority of coins. It will simply be unprofitable for him. | Despite a good defense against an attack of 51%, there is still a chance that a large proportion of coins will accumulate in a limited group of people who will be able to impose their own conditions on the functioning of a crypto network. |

| In cryptocurrency networks operating on the basis of the PoS algorithm, a fixed commission is often applied, which does not depend on the amount of transfer. This reduces transaction costs. | The overwhelming majority of coins on the PoC protocol have a huge emission, measured in hundreds of millions of coins. Because of this, they have almost no chance of a sharp jump in price (as was the case for Bitcoin in December 2017). |

Summarizing the results of POS mining, we can say that this is a very promising method of mining cryptocurrency. Of course, it has a number of drawbacks, but it is more affordable for most users who cannot buy equipment for thousands of dollars. And the process of mining itself is not so expensive (you do not need to pay back the equipment and overpay for the world every month). At this stage, such a protocol is supported by not too popular and far from the most expensive coins, but this can change with the transition of Ethereum to PoS. It is possible that Vitalik Buterin’s cryptocurrency will set a new fashion that will shake the classic mining positions on video cards and asiki.