Wrapped Bitcoin – overview of the token and platform, how it works, where to buy or sell, on which exchanges it is traded – Wrapped Bitcoin: a platform that issues WBTC (ERC-20) tokens, the value of which is 1: 1 backed by the value of Bitcoin. WBTC is actively used to work with various DeFi protocols, foAr example, Kyber Network, Ren, Compound, Dharma and dozens of others.

Thus, users are transferring bitcoin liquidity to the Ethereum blockchain and significantly expanding the range of interaction with the top cryptocurrency. Since Bitcoin does not have so many decentralized credit and trading protocols, this solution seems to be optimal.

The Bitcoinminershashrate.com editorial staff will tell you about how the Wrapped Bitcoin platform works, how WBTC tokens are issued and used.

The content of the article

Wrapped Bitcoin Chart and Price (WBTC)

WBTC / BTC price chart on Binance cryptocurrency exchange:

general information

| Name | Wrapped Bitcoin |

|---|---|

| Ticker | WBTC |

| Standard token | ERC-20 |

| Blockchain | Ethereum |

| Current issue as of 11.10.20 | 95 766 WBTC |

| Course on 10/11/20 | 11 363 $ |

| Market Capitalization at 11/10/20 | 1 088 076 339 $ |

| Official site | https://wbtc.network/ |

| White Paper | https://wbtc.network/assets/wrapped-tokens-whitepaper.pdf |

| https://twitter.com/WrappedBTC | |

| Exchanges | Binance, Balancer, Uniswap, OKEx, Huobi Global и др. |

How Wrapped Bitcoin works

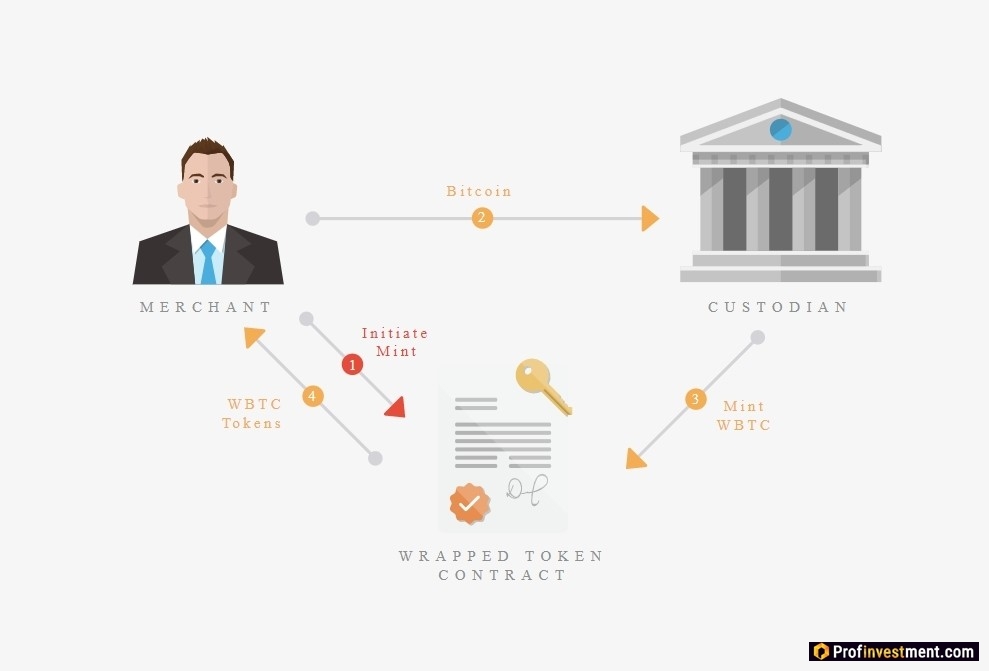

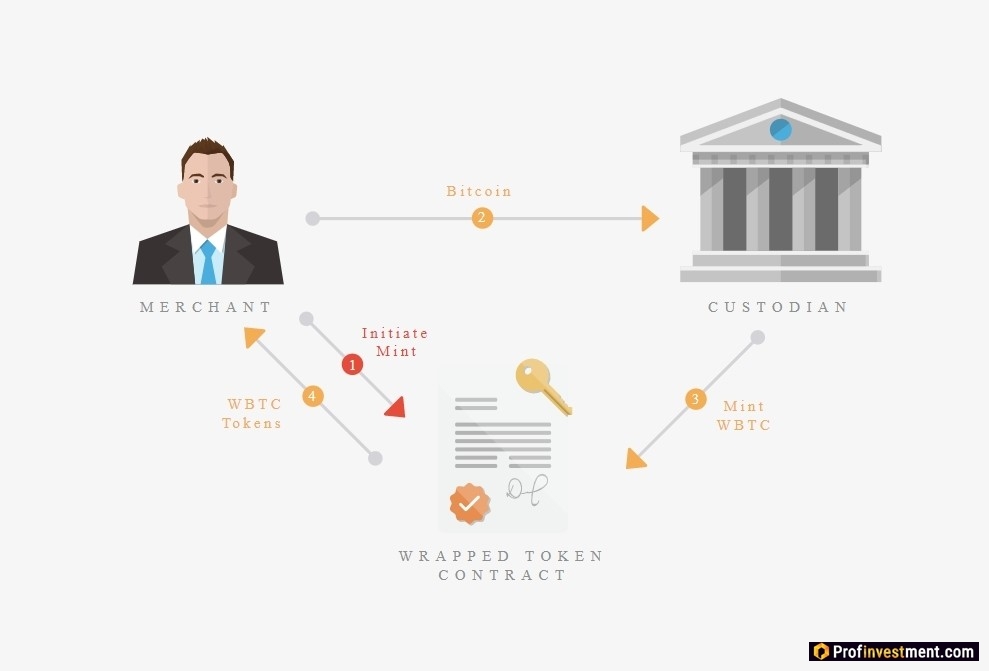

The Wrapped Bitcoin ecosystem includes four main categories of actors:

- Custodians / Custodians. Organizations that hold assets that support w-tokens. Specifically, the bitcoins supporting WBTC are held by BitGo.

- Merchants. Responsible for regulating w-tokens – issuing and burning them.

- Users. Anyone who carries out any transactions with WBTC and other w-tokens on the Ethereum network.

- Members of the WBTC DAO. Responsible for changes to the protocol, adding or removing custodians, controlling conditions for traders and users.

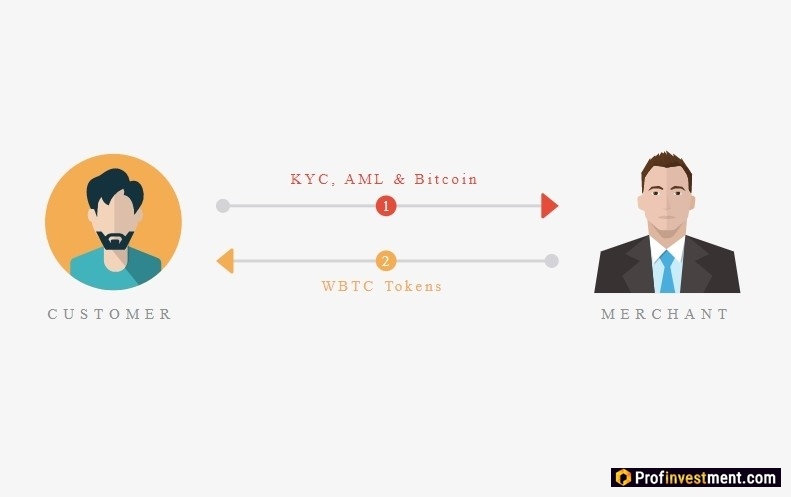

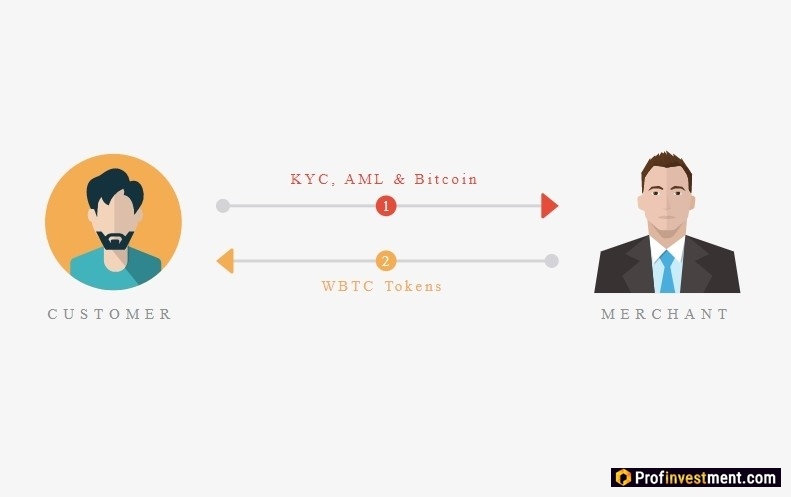

The essence of the process is as follows. Users who have BTC and want to convert it to WBTC interact with merchants. They start the process of minting (issuing) or burning tokens based on user verification. Custodians (in particular, BitGo) hold real BTC and issue WBTC on the Ethereum blockchain. If WBTC is burned, then BTC is returned from the custodian to the user.

Many popular DeFi applications on Ethereum require the use of collateral – blocking some crypto assets in order to borrow other crypto assets. However, this network imposes some limitations. With the introduction of bitcoin, the protocols are gaining liquidity and thus can generate more collateral for decentralized applications. Wrapped Bitcoin also allows BTC holders to use the asset for additional income on protocols like Compound without losing the value of their investment.

For whom the project was developed:

- Organizations. Exchanges, wallets and payment services can now handle different transaction formats without any problems. WBTC combines the advantages of Ethereum and Bitcoin while making it easier to process tokens using only Ethereum nodes.

- Traders. Decentralized exchanges are usually limited to ERC-20 tokens and therefore suffer from low liquidity and insufficient trading volumes. Thanks to WBTC, users can significantly increase their flexibility in managing funds. The Ethereum network processes transactions faster than the Bitcoin network, so moving assets between exchanges is faster.

- Decentralized applications. Now Bitcoin payments can be used in credit and exchange protocols, prediction markets, and more.

Compared to real BTC, Wrapped BTC does not have its advantages and the same degree of reliability, so the behavior of people and organizations plays a key role in managing the system. To increase the level of trust and transparency, the project is regularly audited and publishes all in-system transactions and checks. Users can independently check how many bitcoins were sent to the WBTC address on the Bitcoin network, and then make sure that this data matches the WBTC tokens on the Ethereum blockchain. In the same way, you can track the process of burning WBTC when exchanging them back for bitcoin.

The managers of the WBTC DAOs make decisions about significant protocol upgrades and adjustments, and who will be the vendors and custodians who run the system.

WBTC acquisition process

Minting WBTC tokens for Bitcoin is not difficult. The user interacts with the seller and receives exactly the same amount of WBTC as he gave BTC. Tokens are transferred to the user after they have been verified.

In the opposite direction, the user can give WBTC in exchange for BTC, creating a ransom request. WBTC is burned, and a similar amount of bitcoins are transferred to the user.

Operations are carried out directly with the participation of partners: https://wbtc.network/dashboard/partners, for example, CoinList.

Advantages and disadvantages

Pros:

- Additional liquidity on the Ethereum blockchain and all its services.

- Greater freedom and flexibility in financial management for BTC holders.

- The ability to receive additional income from Bitcoin using Ethereim credit protocols.

- Transactions are significantly faster and cheaper than on the Bitcoin network.

Minuses

- Coin security is dependent on a third party company (BitGo).

- Less security, no BTC.

Where to store WBTC

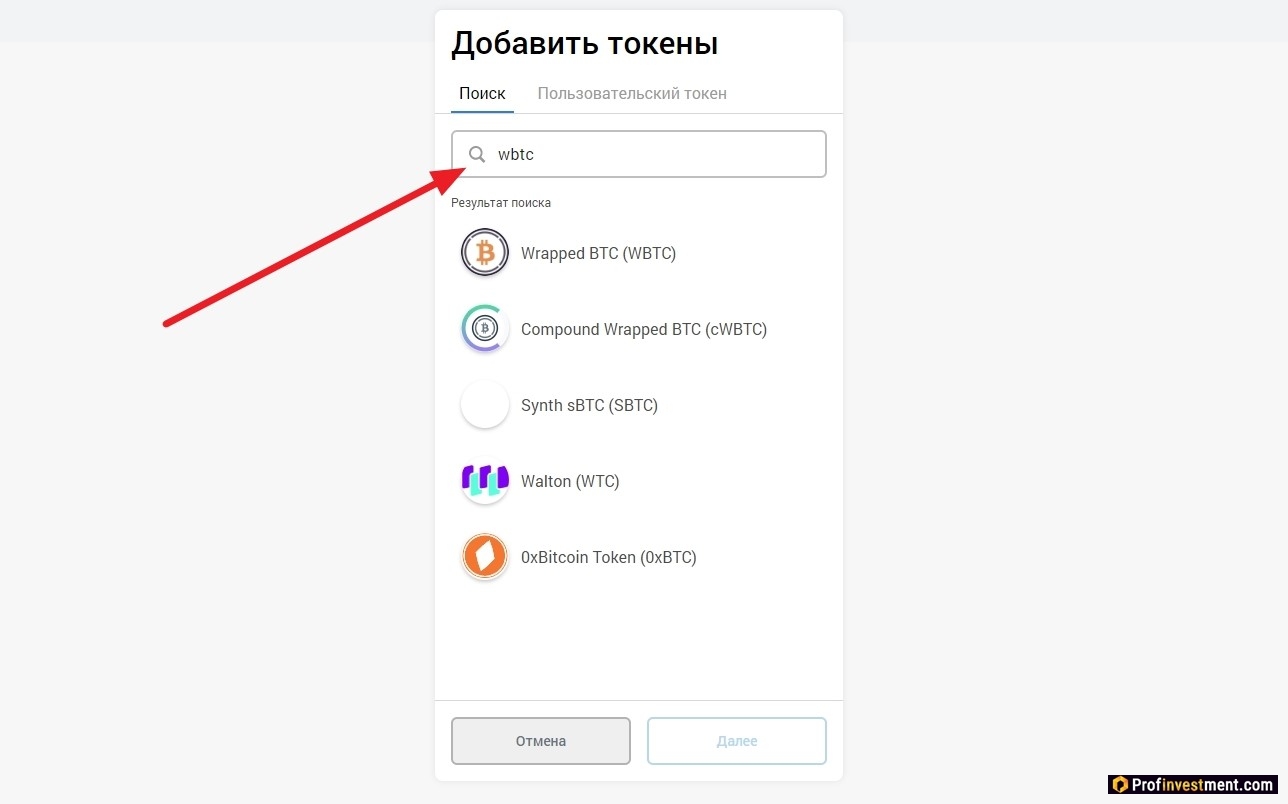

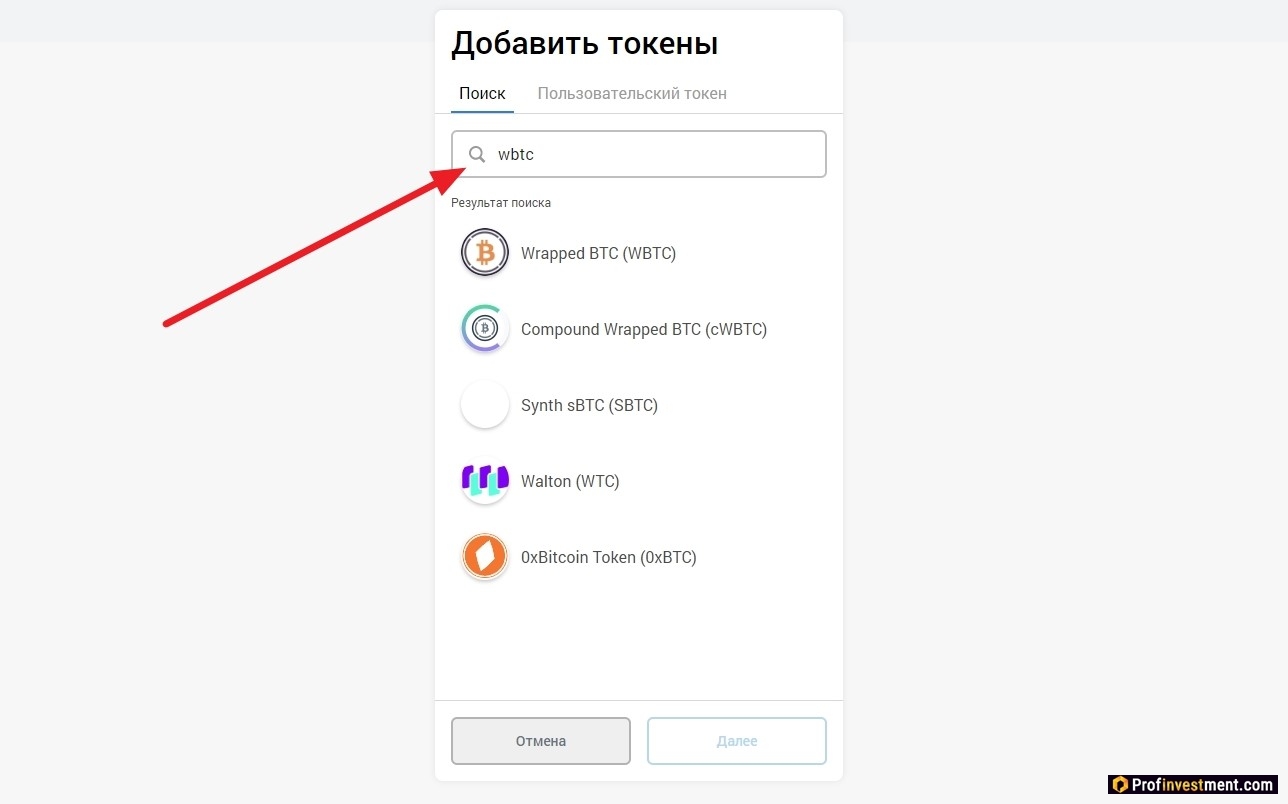

WBTC is an ERC-20 token and can be stored in wallets that support this type of asset. The Metamask browser wallet is perfect. Install it on your Chrome browser, create an account and save your recovery phrase.

Then, since only Ethereum is available in the wallet by default, click “Add Token” and manually search for WBTC. Now you can send and receive this token using Metamask.

Where to buy, sell, trade WBTC

The token is traded on several decentralized exchanges as well as Binance. So, to purchase it using the Binance exchange, you will need:

- Create an account on the marketplace and protect it using two-factor authentication.

- Make sure that there is one of the coins on the balance, in pair with which Wrapped BTC is traded (at the moment it is ETH or BTC).

- Go to the spot wallet, find WBTC and click “Trade”, then select the desired trading pair (WBTC / ETH, WBTC / BTC).

- Go to the trading terminal and create a buy order.

Conclusion

Wrapped Bitcoin allows you to add Bitcoin holders to the DeFi community. Of course, this significantly helps the development of the decentralized finance ecosystem. Users are able to take advantage of the greater free and lower transaction fees of the Ethereum blockchain, as well as access a rapidly growing volume of financial applications.