The first phase of the Ethereum merge is scheduled to begin on September 6th. With the merge, the Ethereum blockchain will change fundamentally, as the consensus mechanism of the network will be switched from Proof of Work to Proof of Stake. With such a complex upgrade comes some risks.

Nonetheless, the majority of the crypto world currently seems optimistic about the success of the upgrade. A successful merger has far-reaching consequences for the ETH ecosystem. You can read about the most important of them in our current issue of BTC-ECHO Magazine.

But the merger is not only having a profound impact on NFTs, DeFi and other ETH sectors. The upgrade has a particularly strong impact on the often little-noticed token properties, the so-called tokenomics, of the ETH token.

Tokenomics: The background

Tokenomics refers to understanding the properties of a cryptocurrency in terms of supply and demand and as such addresses the following questions:

- How many tokens are there?

- How many tokens will exist in the future?

- Will token buybacks be carried out?

- What is the token inflation rate?

- Are log earnings distributed to token holders?

Any answers to these questions can directly or indirectly affect the value of a cryptocurrency.

Since many investors have not yet fully understood how far-reaching the consequences of the merger are for Ethereum’s tokenomics, we will take a closer look at them below.

Ethereum inflation rate falls by around 90 percent after the merger

The number of new Ethereum coming onto the market will fall sharply as a result of the merger. In crypto jargon, this phenomenon is called “Triple Halving” called. In the case of Bitcoin, the halving describes an event that ensures that the number of new BTC coming onto the market is reduced by around 50 percent about every four years. Thanks to the halvings, the inflation rate of bitcoin fell over the years from over 11-12 percent in 2012 to 1.7-2 percent in 2020. The next bitcoin halving is scheduled for March 2024.

read too

In the past, this event has often led to an increase in the Bitcoin price, as the BTC selling pressure has decreased significantly as a result of the reduction in the inflation rate.

The term “triple halving” tries to clarify how much the merge affects the inflation rate of Ethereum.

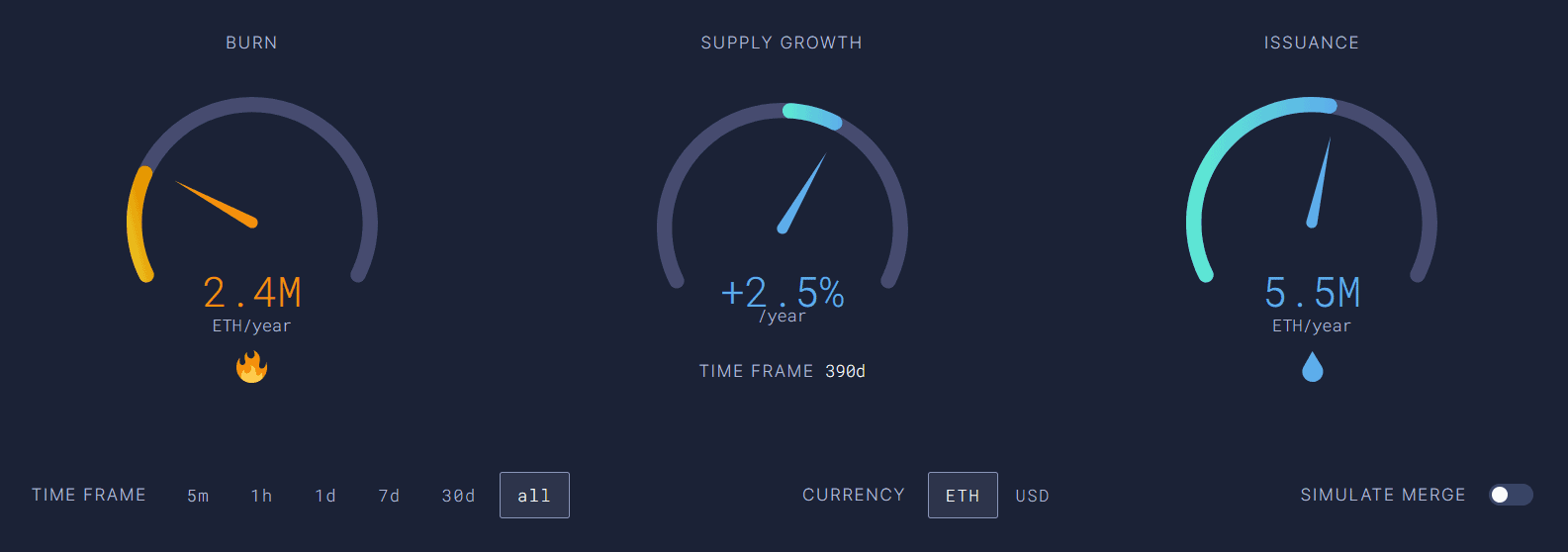

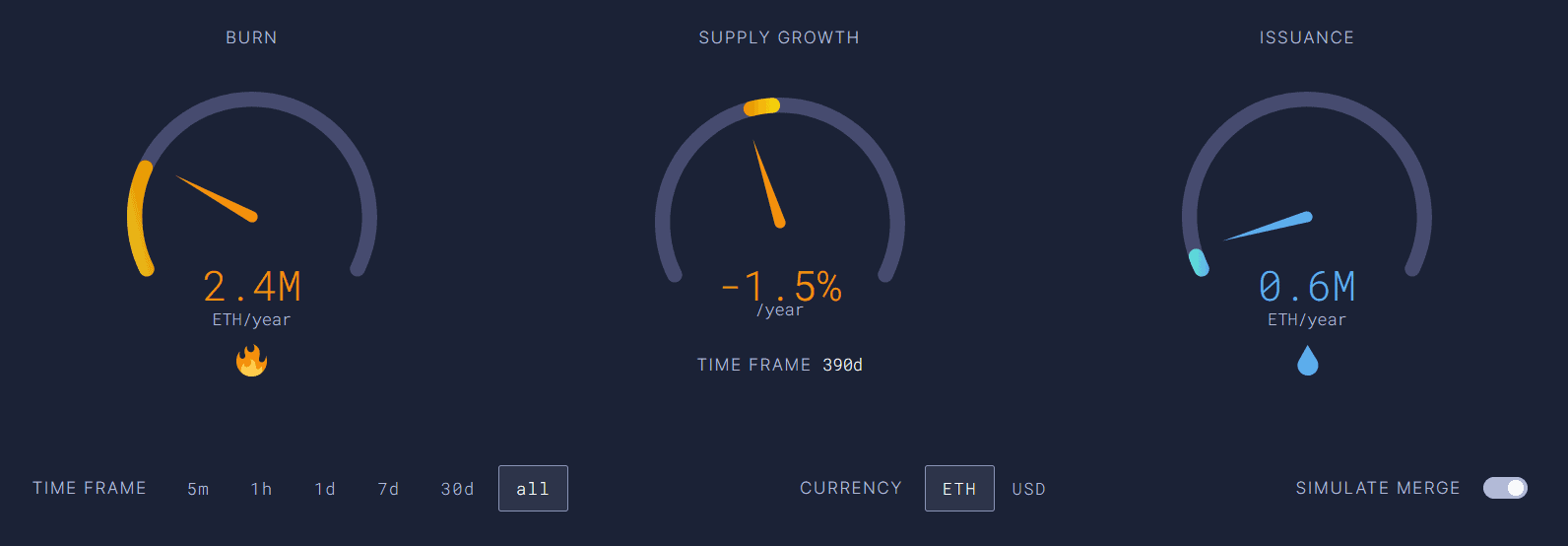

Almost 5.5 million new ether tokens are currently coming onto the market every year, which corresponds to an inflation rate of almost 2.5 percent.

Post-merge, the annual number of new ETH tokens entering the market drops to 0.6 million tokens, making Ethereum a de facto deflationary digital asset (see above).

Since Ethereum will no longer have to pay its miners to validate transactions on the network after the merge, it is effectively firing its highest-paid employees and exchanging them for new “staking officers” whose salaries are considerably lower.

It can be argued that this change comes at the cost of making the Ethereum blockchain less censorship-resistant – you can read more about that here. In terms of the inflation rate, this change is enormous and is equivalent to a triple Bitcoin halving.

ETH staking yields are rising

Currently, ETH stakers receive an annual staking return of around 4.1 percent. This return is likely to increase with the merge as block rewards for validating transactions previously paid to Ethereum miners will flow to Staker after the upgrade.

Leveraging the Ethereum network benefits post-merge ETH staking returns in three distinct ways:

- Block rewards paid to stakers for securing the ETH blockchain.

- Tips paid by users who want their transactions prioritized.

- MEV rewards paid by users for completing transactions in a specific order.

Crypto analysis firm messario.io therefore expects staking returns to increase to as much as 9 percent after the merge if activity on the Ethereum network remains the same.

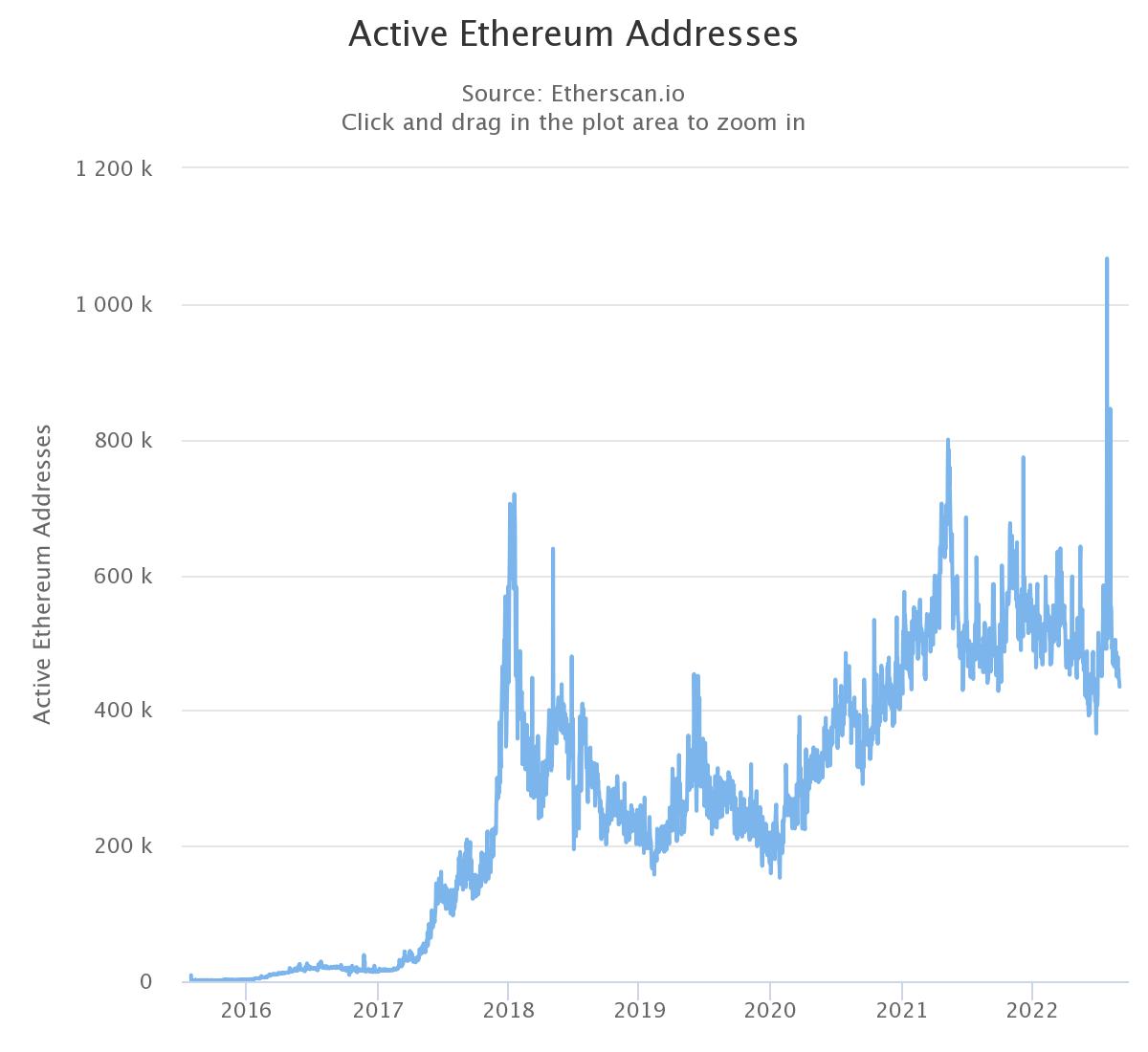

Development of active ETH addresses

Even though the number of daily active Ethereum addresses has decreased a bit over the last few months, you can still see that it has been in a steady upward trend since 2020.

Assuming that activity on the Ethereum network continues to increase or stay the same, messari.io’s staking return forecast seems quite realistic.

Conclusion

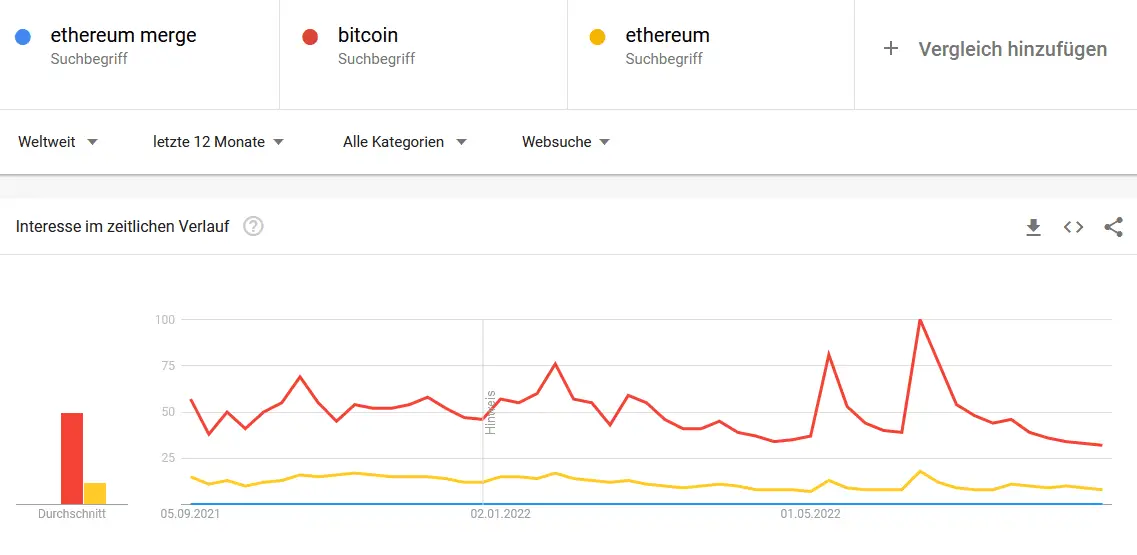

Probably, a large part of investors has not yet understood how much the upgrade will change ETH’s tokenomics. Data from Google Trends supports this thesis. On the one hand, interest in the Ethereum Merge has skyrocketed over the past few months, suggesting that more and more people are understanding the implications of the upgrade.

On the other hand, a comparison with the search interest in Bitcoin and Ethereum suggests that a large part of investors has not yet understood how far-reaching the effects of a successful merger are for ETH.

For these reasons, it seems unlikely that the market has already priced in the Ethereum Merge.

Disclaimer: The content presented on this page does not constitute a buy or sell recommendation. It is for information only.

Are you looking for the right hardware wallet?

In the BTC-ECHO guide, we show you the best providers for the secure storage of cryptocurrencies.

To the guide