Many still see no discernible value in cryptocurrencies. Head of the American bank JP Morgan, Jamie Dimon, recently even called Bitcoin a “decentralized Ponzi scheme”.

The world’s largest issuer of exchange-traded cryptocurrency products (ETPs), 21Shares AG, shows why this is not the case. The 21.co subsidiary released the seventh edition of its State of Crypto Report on October 5th. Here she presents possible assessment systems for crypto assets, from which it should become clear what Bitcoin and Co. are really worth.

Objective or relative?

According to 21Shares, there are basically two ways to assess the value of a cryptocurrency, internal (intrinsic) valuation and relative valuation. The internal evaluation relies on fundamental parameters such as cash flow, risk or growth. The value can be measured almost objectively.

The opposite is the case with the relative valuation of a coin or token, which depends heavily on sentiment, narrative or supply and demand. This counterplay results in a gap (“The Gap”) of fundamental value and price. Therefore, the smaller the gap, the more realistic the price.

According to 21Shares, in the absence of objective evaluation, asset prices tend to be very exuberant, comparable to the times of the dot-com or crypto-ICO bubble.

Crypto categorization

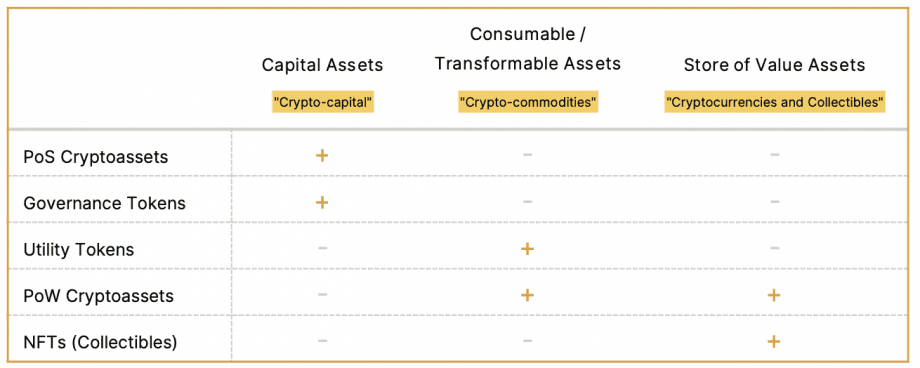

The authors of the report divide cryptocurrencies into five categories: Proof-of-Stake (PoS) blockchains, Proof-of-Work (PoW) blockchains, utility tokens, governance tokens, and NFTs (non-fungible tokens). These are in turn assigned to an “asset superclass”.

Proof-of-stake tokens, for example, could be considered “crypto-assets” due to the recurring revenue generated via staking rewards, according to 21Shares. Proof-of-work coins, on the other hand, would be more like a “crypto raw material” because of their energy-intensive production.

The main difference between utility and governance tokens in the latter is the participation in the network embodied in the token and the right to vote. Governance tokens should therefore be interesting for large investors in view of the fact that they behave very similarly to traditional shares in a company. The community of the decentralized exchange Uniswap recently voted for a new fee model in which token holders participate in the trading fees incurred by the platform – crypto dividends, so to speak.

The almost completely subjective value perception of the NFTs makes them pure collector’s items or stores of value, similar to a painting. They are therefore largely subject to a sentiment-driven valuation.

Similar to their equivalents from the financial world, well-known valuation methods can then be applied to these superclasses. A corresponding price for the respective crypto asset can then be determined from this. This fluctuates depending on the methodology, but provides information about a possible under- or overvaluation.

valuation

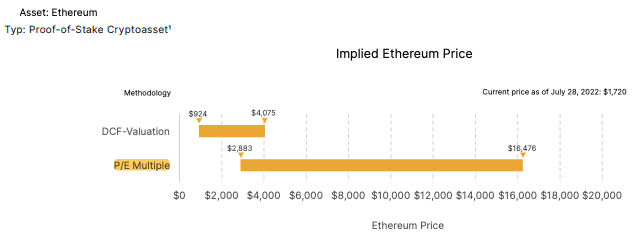

Ethereum, as a PoS asset, for example, could be priced between $923 and $4,000 based on a fundamental valuation methodology, according to 21Shares. On the other hand, if you evaluate it relatively, for example in comparison to an aggressively growing company like Tesla, an Ethereum price of up to 16,000 US dollars per token could be calculated.

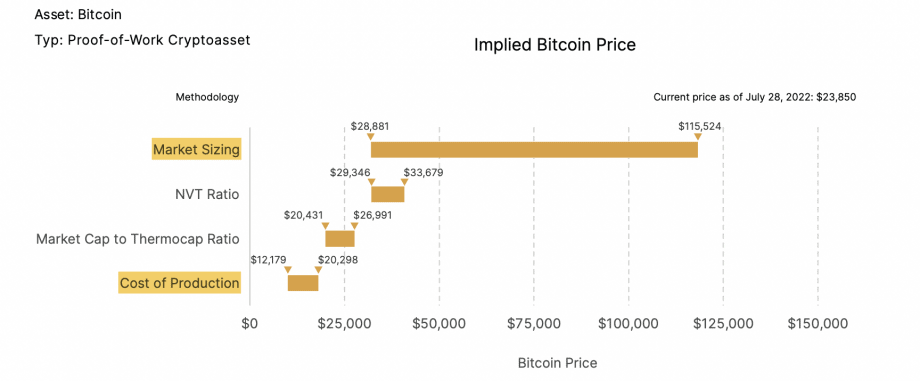

According to the authors, the fundamental price of the “crypto commodity” Bitcoin would be in the range between 12,000 and 20,300 US dollars, taking into account the current production costs. A relative price can be determined via “market sizing”, i.e. the size comparison to a target market. For example, at 20 percent of the gold market, Bitcoin would have a price of around $115,000 per coin.

A combination of the objective and relative assessment methods would be optimal in certain cases. According to 21Shares, a relative valuation is possible in almost all cases. However, the report also provides information about possible limits.

Realistic prices?

However, the prices given are conceivable. Especially when capital-rich institutions invest in the crypto sector. A small part of their portfolios would suffice. If the world’s largest banks allocate just five percent of their capital to the crypto sector, this would be equivalent to an investment of nine quadrillion US dollars. Triple crypto’s total market cap to all-time highs during last year’s bull market.

No wonder, then, that large financial institutions do not want to let this opportunity pass them by. Big names like BlackRock or Fidelity have long been available with large sums for the crypto sector. An industry-wide consensus on the valuation of cryptocurrencies, as suggested by 21Shares, would certainly help them.

Do you want to buy cryptocurrencies?

Trade the most popular cryptocurrencies like Bitcoin and Ethereum with leverage on dYdX, the leading decentralized exchange for derivatives trading.

To the provider