Bitcoin mining is a complicated and expensive undertaking. With a lot of computing power and a lot of luck you will find what you are looking for and can claim the so-called block reward of currently 6.25 BTC. Recently, however, miners had to convert exactly this back into US dollars in order to guarantee their financial liquidity.

Miners must sell Bitcoin in the summer

Due to the persistently negative market environment, some Bitcoin miners were forced to sell their holdings in the summer. Overall, between January and April 2022, miners parted with 20 to 40 percent of their found BTC. In May it was 100 percent.

read too

Industry experts are to blame for the increased energy prices, as well as the Bitcoin price that fell at the same time. At the same time, the hash rate fell by several EH/s. According to Bitfarms, the sale of the cryptocurrency was strategic.

Mining companies are accumulating again

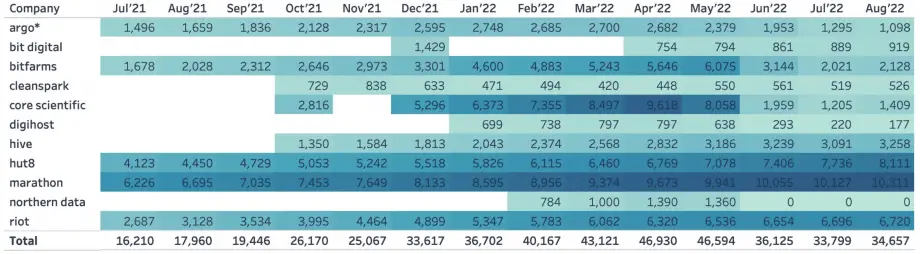

A different picture can now be seen. Miners seem to have more liquidity again, making selling BTC stocks obsolete. As the data in the following table shows, the majority of companies were able to record more BTC in their portfolios again from August.

The hash rate is also back at an all-time high. This decouples the willingness of the miners to invest from the course. While the former has been increased again, the latter has been creeping around the 20,000 mark for several weeks.

As a result, the difficulty also increased again. At the last adjustment on August 30, it rose from 28,352t to 30,977t. The Bitcoin Mining Difficulty indicates the degree of difficulty in mining. This means that you can use it to determine how complex it is to calculate a new Bitcoin block.

Do you want to buy cryptocurrencies?

Trade the most popular cryptocurrencies like Bitcoin and Ethereum with leverage on Plus500, the leading CFD trading platform (77 percent of retail accounts lose money with the provider).

To the provider