Bitcoin (BTC) is fighting back bravely above the psychologically important $20,000 mark and is even trading at $21,900 at the time of going to press. Given the overall macroeconomic situation, however, investors cannot yet believe that they are off the hook.

However, if you look at chart technical indicators, you can be cautiously optimistic. Here are five bottom indicators you should know.

RSI: trend rising

The RSI (Relative Strength Index) is probably the most well-known momentum indicator of all. It puts current market events in relation to longer-term trends. The result is a number between 0 and 100. Values between 0 and 50 are considered good entries, since the asset is oversold according to the indicator, i.e. undervalued.

The RSI is currently trading at 42.28 – 6.8 percentage points above the “floor” at 39.56.

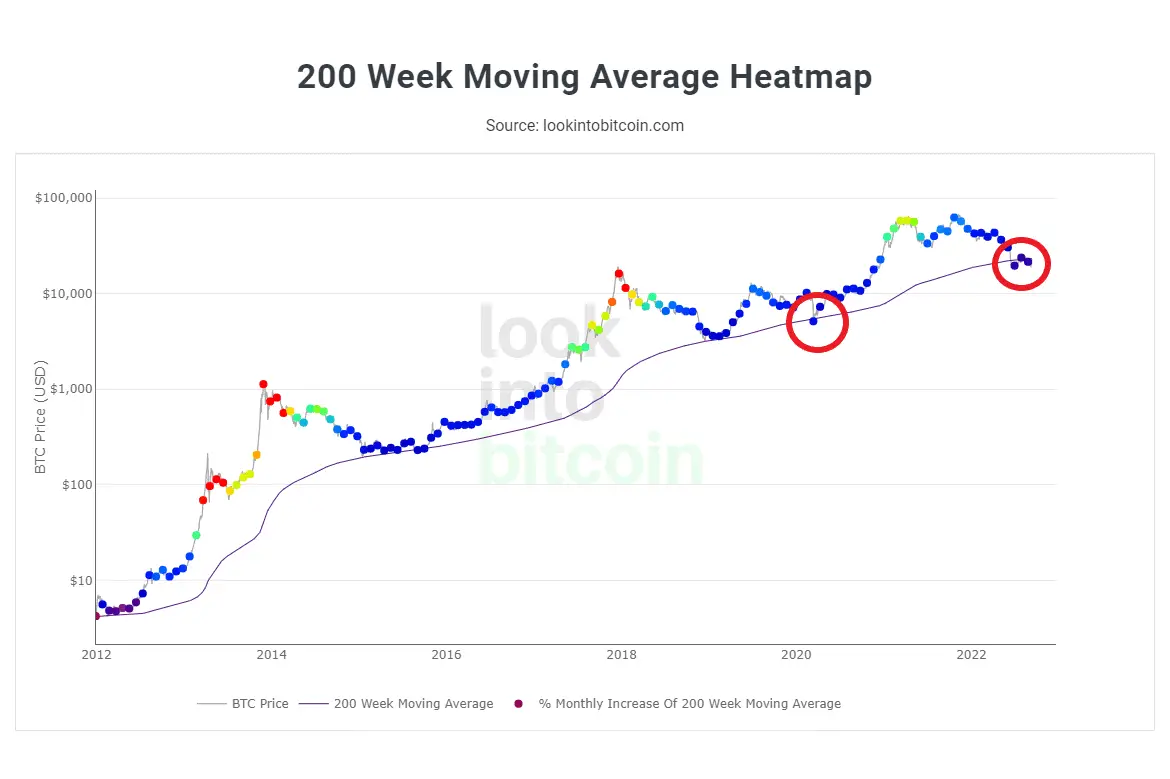

200-week moving average: so far so good

Moving averages are a good tool for comparing short-term price action to the long-term trend. Above all, long-term averages such as the 200-week moving average provide reliable ground signals. The BTC price has only fallen below the average twice so far. This indicator also shows a clear oversold.

read too

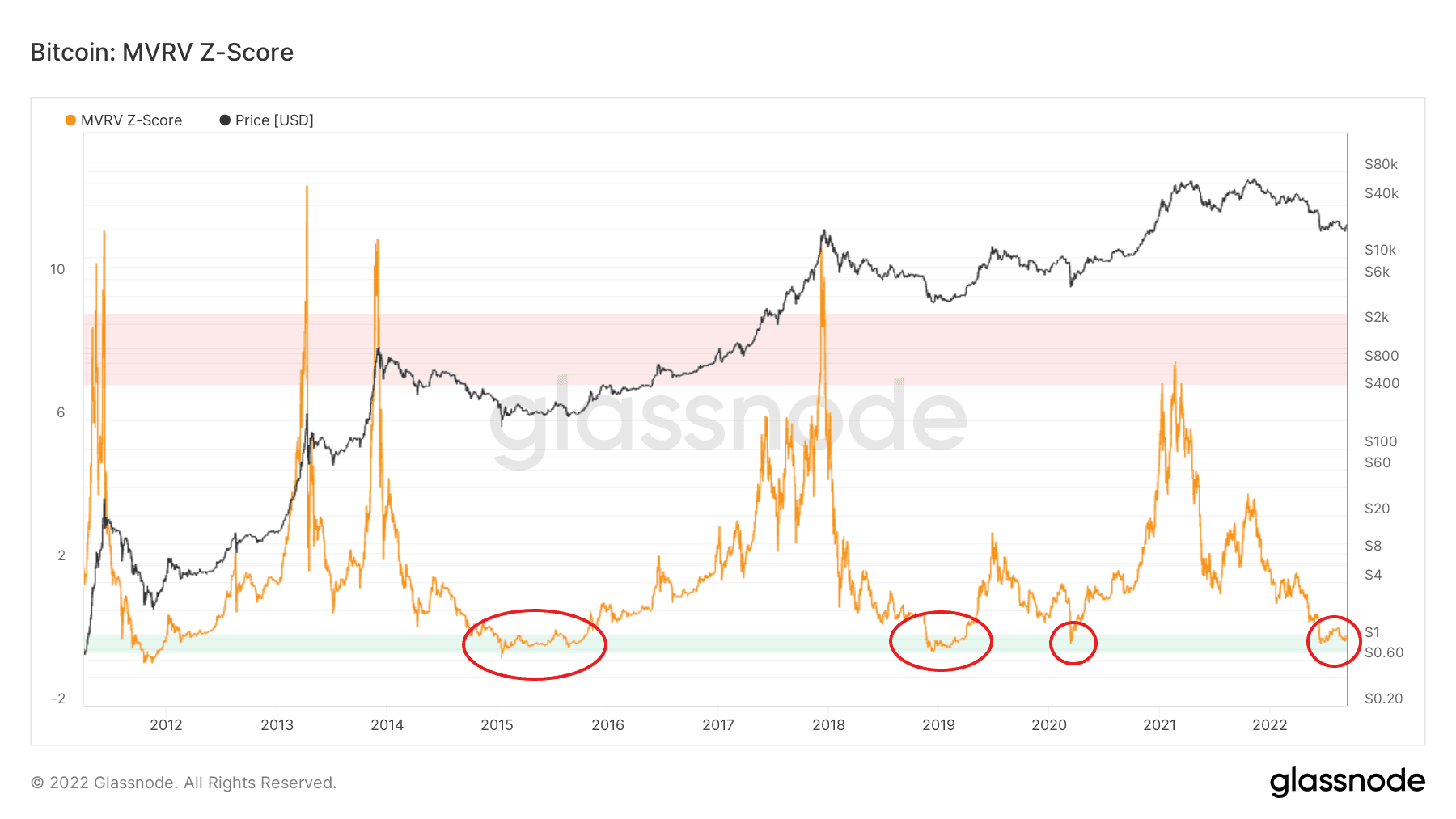

MVRV Z-Score: Diagnosis underestimated

Determining the “fair” value of a bitcoin is anything but trivial. However, the MVRV S-Score gives a fairly accurate picture when it comes to indicating over- or undervaluation. Technically, the indicator only relates the market capitalization to the realized market cap. The latter measures the value of all BTC at the time of their last issuance. If the ratio is low, one can speak of an undervaluation.

The MVRV Z-Score is currently in the green “Buy Zone”. But as you can see from past bear markets, the indicator can linger there for a while. It is therefore too early to give the all-clear.

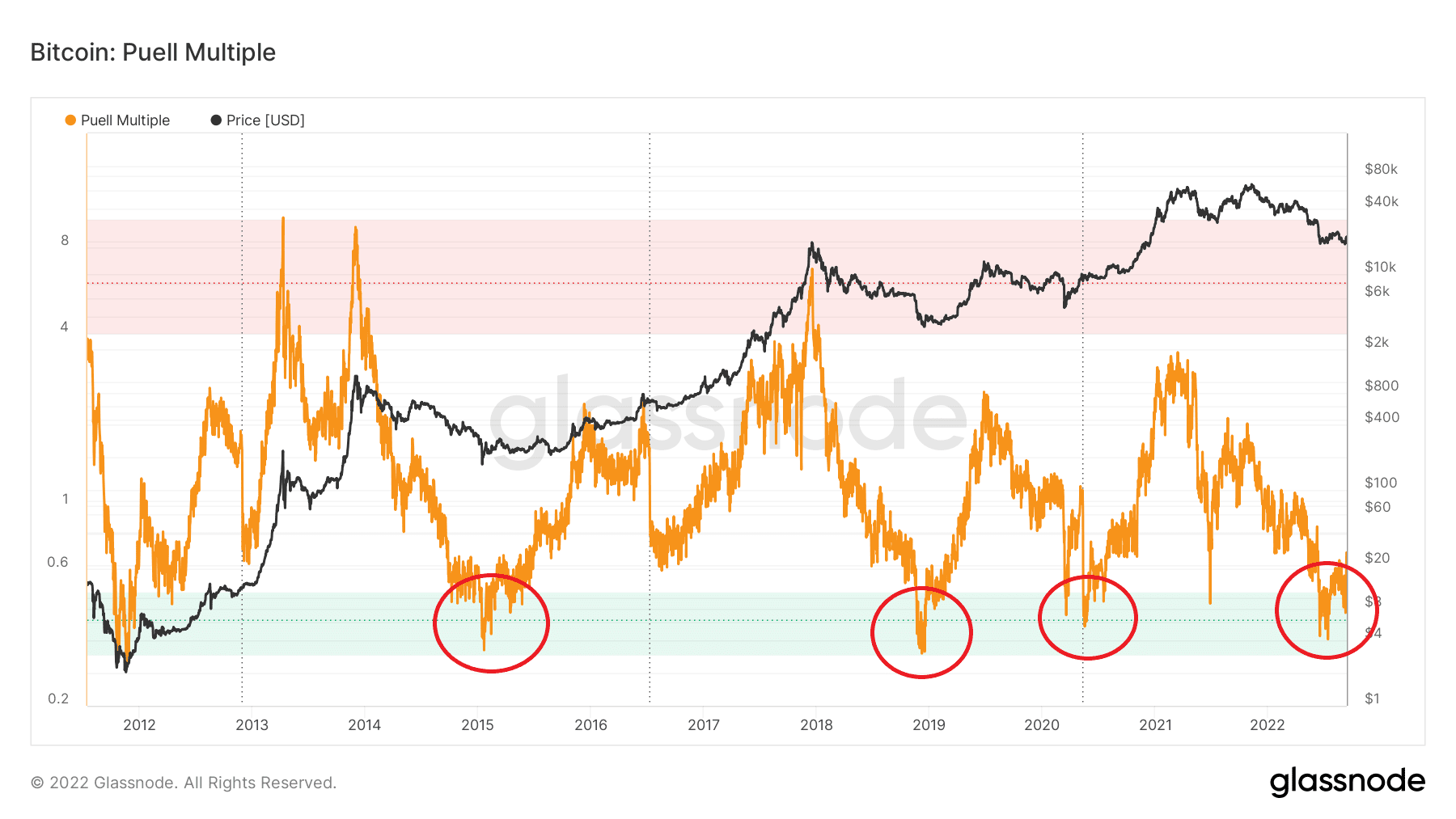

Puell Multiple: Miners make a mess

The Puell Multiple is obtained by dividing the USD value of the BTC issued daily by the 365-day average of the same. If the value is in the red field, miners earn an above-average amount; if the value is in the green field, they tend to earn less.

Past bear markets have shown that once the Puell Multiple turns green, a bounce to the upside is likely.

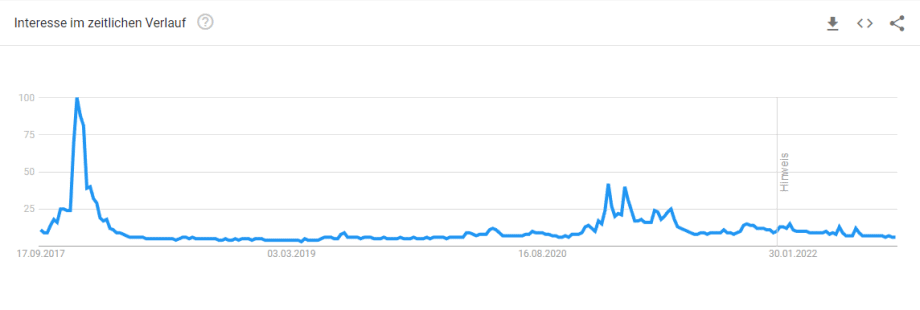

Google Search Volume: Nobody cares about Bitcoin anymore?

Bitcoin has disappeared from the scene. again. Because regularly – mostly in the bear market – the public no longer has an eye for digital gold. Most recently, the search volume for the pair of terms “Buy Bitcoin” was as low in September 2020 as it is today.

However, savvy momentum traders see the mainstream’s attention deficit as worthwhile entry points.

Disclaimer: All content presented on the website is for information purposes only and does not constitute a buy or sell recommendation. It is not to be understood, either explicitly or implicitly, as a guarantee of a specific price development for the financial instruments mentioned or as a call for action. The acquisition of securities or cryptocurrencies involves risks that can lead to the total loss of the capital invested.

Do you want to buy cryptocurrencies?

Trade the most popular cryptocurrencies like Bitcoin and Ethereum with leverage on Plus500, the leading CFD trading platform (77 percent of retail accounts lose money with the provider).

To the provider