Quo vadis Bitcoin? With another sell-off on the Bitcoin market, the cryptocurrency No. 1 dispels hasty hopes of an imminent trend reversal. At the start of the week, BTC did a belly landing and was down 8 percent. With that, a unit of the digital gold costs $18,765 at the time of writing.

Now Bitcoin is getting perilously close to the previously established local bottom at $17,708 that the cryptocurrency set on June 18 of this year. What’s next?

Realized Price: The majority of investors are in the red

A look at the realized price shows that the Bitcoin market is actually in the darkest hour of the bear market. The indicator is calculated by dividing the value of all bitcoin at the rate at which they were bought by the number of BTC in circulation.

In other words: If the current BTC price is below the realized price, the majority of all investors are in the red. Historically, realized price has been a pretty good support level; however, the price may trade below this demarcation line for a while, as illustrated in this chart by On-Chain College sees.

Strong support marks in sight

On days like this, it’s also worth looking at the longer-term trend. As Bitcoin analyst “Stockmoney Lizards” writes on Twitter, the smoothed 150- and 200-day moving averages are historically good support levels. Especially the areas between the average values were worthwhile entries in the past.

Hashrate defies the bear market

However, the general bearish mood is countered by a healthy network. The hash rate in the Bitcoin network is reaching a new all-time high these days. At 232 exahashes per second EH/s, Bitcoin’s accumulated computing power on September 17 has never been higher than it is now – and that in the bear market.

In other words, this may be a market sell-off. But the network is more firmly in the saddle than ever.

Macroeconomic environment creates uncertainty

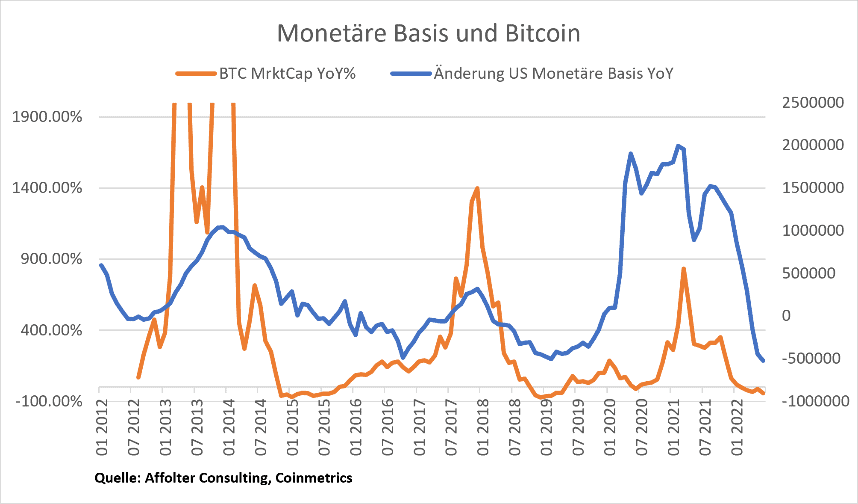

However, an immediate trend reversal cannot be derived from the indicators mentioned above. Because the macroeconomic situation still does not bode well: contrary to what was previously assumed, Bitcoin reacts negatively to rising inflation rates and higher interest rates. As consultant Jonas Affolter from Affolter Consulting writes in a guest article on BTC-ECHO, investors do not (yet) see the cryptocurrency as protection against inflation, but as a so-called risk asset and react to economic uncertainty by selling off the asset.

In the long term, according to Affolter, bitcoin could well grow into a protection against inflation – at least if one does not take the increase in consumer prices but the phenomenon of monetary inflation as a benchmark. The correlation between BTC market cap and USD money supply cannot be overlooked.

In the guest post, Affolter writes:

BTC is clearly an inflation hedge against monetary inflation, i.e. inflation driven by central banks.

However, it could be a while before central banks expand the monetary base again. Until then, the macroeconomic environment is more against than for a quick recovery in the Bitcoin market.

Do you want to buy cryptocurrencies?

Trade the most popular cryptocurrencies like Bitcoin and Ethereum on eToro, the world’s leading social trading platform.

To the provider