The switch from Ethereum from Proof of Work to Proof of Stake is expected to take place on September 15th. The result of years of work will soon bear fruit and will forever change the second largest cryptocurrency by market capitalization.

There are also some risks associated with such a complex blockchain upgrade. Still, the majority of the crypto world is optimistic about the success of the upgrade right now.

You can find out exactly how the merge is changing the Ethereum blockchain and the consequences of the historic upgrade to Ethereum 2.0 in our current issue of the BTC-ECHO magazine.

There are still some misunderstandings circulating in the crypto space about the ETH Merge. For this reason, the following are five of the most common misunderstandings – and what they are all about.

1. Transaction fees will decrease

One of the biggest misconceptions about the merge is that the scaling problem of ETH will be solved overnight by the merge. However, this is wrong.

The Ethereum merge will not immediately solve the problem of high transaction costs. The Ethereum Merge initially only changes the consensus mechanism of the ETH blockchain.

However, the merge paves the way for a series further upgrades (Surge, Verge, Purge, Splurge)who want to tackle the scaling problem in the coming years.

However, what is likely to change immediately after the merge is that Ethereum Layer 2 scaling solutions will become more cost-effective.

For example, upgrades like the EIP-4844, which lowers transaction costs on Layer 2 networks, can only be implemented on a proof-of-stake Ethereum network. The adoption of Ethereum L2s is likely to benefit from the merge.

2. Stakers sell Ethereum after the merge

In the meantime, over 13.38 million ethers are being staked, which are worth almost 22 billion US dollars. These cannot currently be transferred, which means that the total supply of Ethereum will inevitably be reduced. Staked ethers thus directly contribute to the ETH price rising if the ether demand remains the same or increases.

Many therefore fear that Ethereum 2.0 will bring a flood of previously non-tradable tokens onto the market – but this assumption is also a mistake.

Ethereum stakers cannot sell their ethers immediately after the merge. Stakers can only access their ETH 6 to 12 weeks after the upgrade. The Ethereum development team made this provision on purpose to prevent a sudden sell-off from happening.

3. The Ethereum Merge will never happen

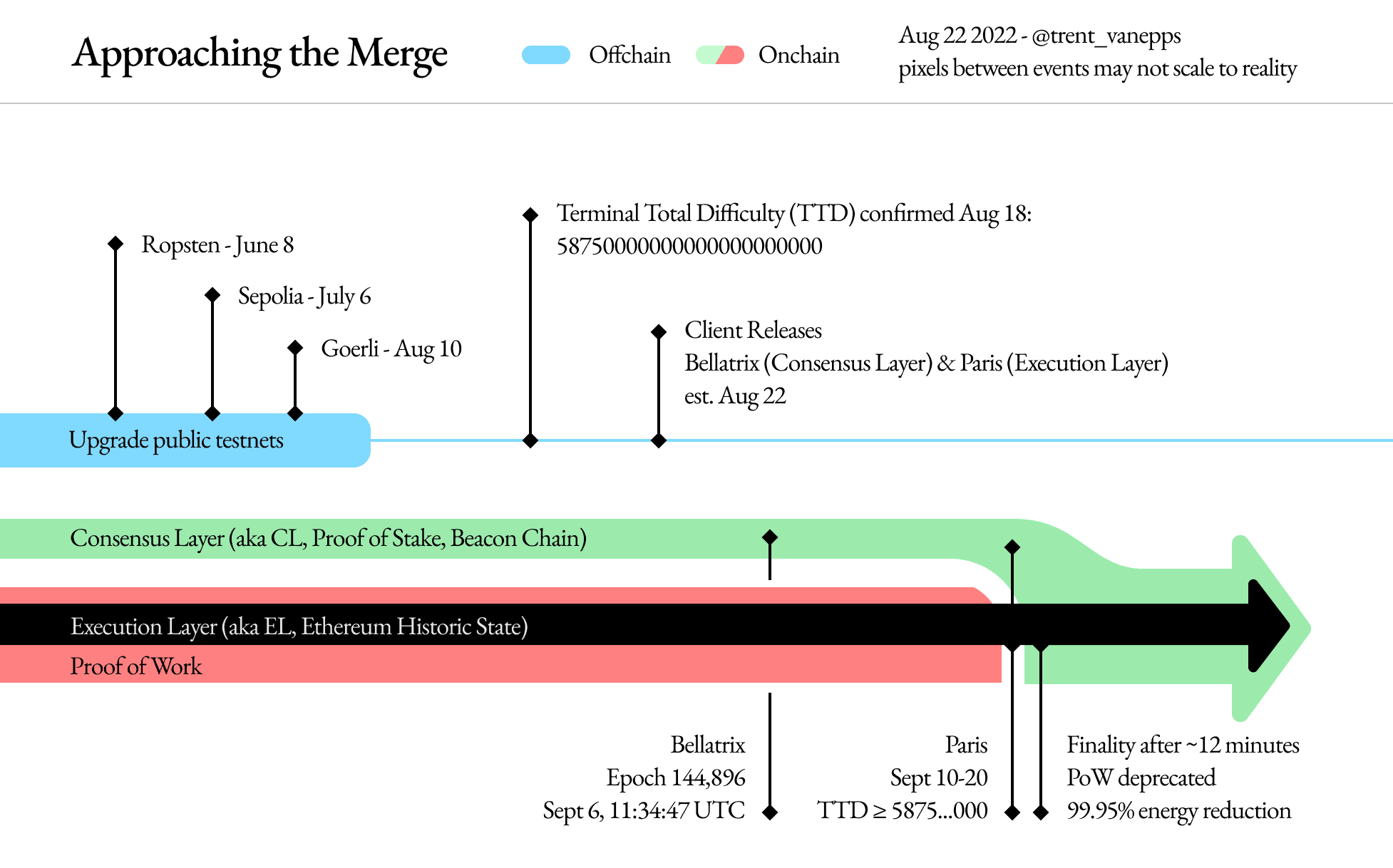

Another argument of many Ethereum critics, which has persisted in recent years, is the accusation that the Ethereum merge will never take place. However, this argument is also history, at the latest with the introduction of yesterday’s Ethereum Bellatrix upgrade.

The Bellatrix upgrade marks the first phase of the merge and initiates the upgrade on the Beacon Chain (Ethereum Proof of Stake Chain). As of yesterday, Bellatrix is a done deal and will be carried out on September 6th.

After that, with Paris, the second phase of the merge upgrade, the current Ethereum Poof of Work (PoW) blockchain is to be switched to Proof of Stake between September 10th and 20th. The exact time is already fixed on the Ethereum blockchain, but ultimately depends on how quickly the miners mine blocks on the current proof of work chain. Nothing stands in the way of the merge.

4. A mining revolution breaks out

The upgrade will switch the consensus mechanism of the Ethereum blockchain from Proof of Work (PoW) to Proof of Stake (PoS). Put simply, the ETH network will be backed by investors and their capital in Ethereum instead of miners.

No longer miners, but validators confirm transactions, process them in blocks and attach them to the ETH blockchain.

To the detriment of many ether miners, this threatens to end a multi-billion dollar industry. Some investors are therefore concerned that miners will try to manipulate the ether blockchain to prevent the merge.

However, this concern is also unfounded. The date of the merge is fixed and the miners have practically no possibility to change anything about it. Technically, the Ethereum developers have agreed that instead of a specific block number, the so-called Terminal Total Difficulty (TTD) method should be used to initiate the merge.

As a result, miners cannot easily manipulate the timing of the merge to gain an advantage. The only option they have to influence the merge is to go offline – but that would mean forfeiting the remaining mining rewards.

In addition, the largest Ethereum mining pool has already announced that it will switch to Proof of Stake. It is therefore extremely unlikely that miners will influence the merge on a large scale.

5. DeFi applications will stop working

Another topic that mainly concerns the DeFi community is the concern of a crash in the DeFi sector. With hundreds of DeFi protocols being copied to the new Proof of Stake chain during the merge, some investors worry that there may be issues with the process.

Technically, however, the merge just means that block validators decide to create a new block based on a modified consensus mechanism (Proof of Stake).

This code change only affects the Ethereum protocol and does not apply to individual applications. Both Layer 2 blockchains and DeFi protocols are not affected in any way by the merge.

Looking to buy Ethereum (ETH)?

This is possible via eToro, among other things. eToro offers investors, from beginners to experts, a comprehensive crypto trading experience on a powerful yet easy-to-use platform. We took a close look at eToro.

To the eToro review