Bitcoin lost almost $ 200 in value in fifteen minutes. And that is crucial, the bitcoin rate is below the psychological level of 8,000 dollars. In recent days it seemed as if the price had found a bottom, but today the opposite was apparent. Below you can see the exchange rate in US dollars. At just before 10:00 the value went below 8,000 dollars (7,200 euros):

Bearish scenarios come again from the stable

And if the price goes a little less, the bearish scenarios will come again. Or in other words, analysts expect the price to fall even further. For example, a Dutch analyst on Twitter expects the bitcoin exchange rate to fall back to 4,200 dollars in the first quarter of 2020 in the worst case. That then forms the real bottom, from where the exchange rate can rise again.

Bitcoin prediction:

If $ BTC loses $ 7880 on the daily, price will trade to 5950-6666 and bounce towards $ 7200-7700

Here it will be 50/50 scenario A / B

A: Bitcoin bottoms in Q4 2019 near $ 6K

B: Bitcoin will bottom in Q1 2020 between $ 4.2K and $ 5.2K pic.twitter.com/WBYg69a4Wn– Bitcoin ?ack (@BTC_JackSparrow) November 19, 2019

Analyst Willy Woo is also bearish about the short term. Woo uses data from the bitcoin network and compares that data with the bitcoin price. According to Woo, miners stop mining bitcoin because the price is falling. To prevent more losses, miners are selling their bitcoin, which means (even) more sales pressure on the market. According to Woo, the price of bitcoin may therefore fall more in the short term. Click on the Tweet to read the entire thread:

NEVER gone into a halving price in BEARISH, miners already capitulating adding sell volume. Historically we front run with a BULLISH setup, miner capitulating only after halving when revenues are slashed. This is a unique setup. Quite bearish leading up to the event. pic.twitter.com/20748Zv8aQ

– Willy Woo (@woonomic) November 18, 2019

Sentiment turns around, is that a good buying moment?

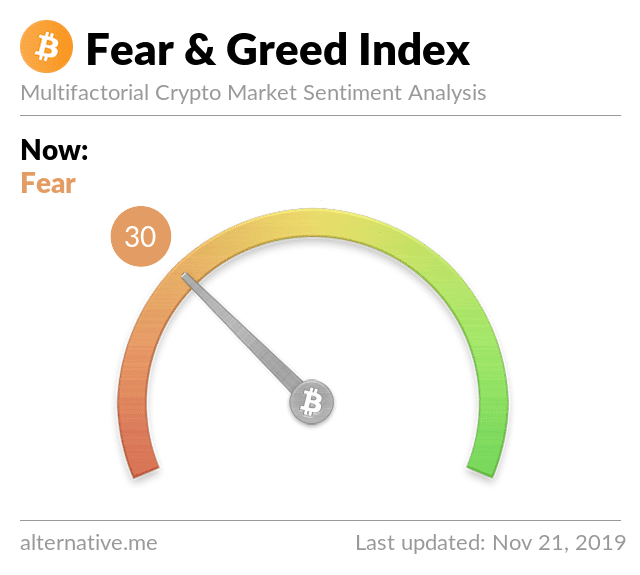

But you can also see it the other way around. When sentiment on the market is negative, that can also be a good buying moment. You can see how that piece of reverse psychology works via the Fear & Greed Index. This is an index figure that indicates how market sentiment is. A low figure indicates that fear reigns in the bitcoin market. The price is falling and investors are negative about the future. A high mark indicates greed. The rates are rising and one bullish tweet after the other appears.

At the moment, the index is 30, which means that investors are (too) afraid. That can be a moment to trade against the market by buying bitcoin. That is of course at your own risk, the price of bitcoin is and remains unpredictable. Always do your own research before you buy or sell a cryptocurrency.