The U.S. Securities and Exchange Commission (SEC) has published a Bitwise presentation explaining why the market is ready to launch ETFs on bitcoin on a major exchange.

The cryptocurrency index company Bitwise pays attention to three main factors, reinforcing its arguments with relevant statistics.

The first is the spot market performance data. The average deviation of bitcoin quotes on 10 spot exchanges has noticeably decreased over time.

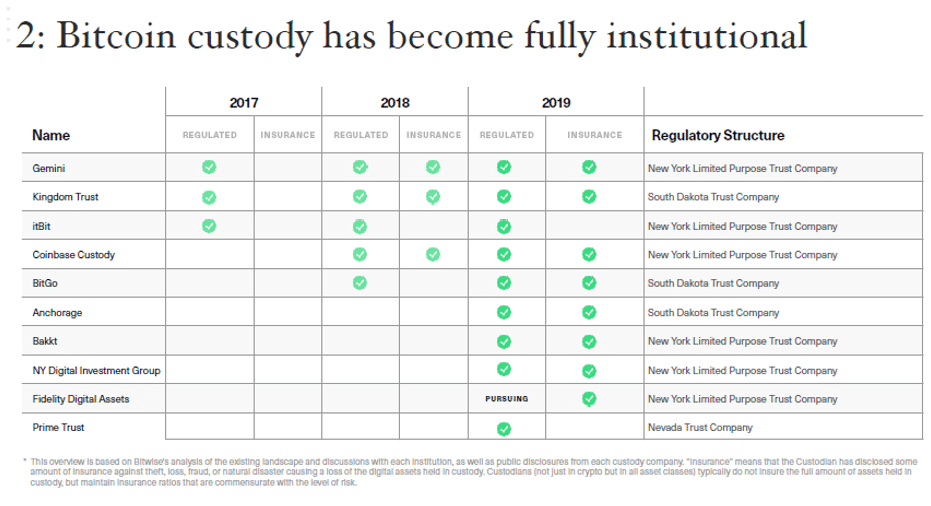

Further, Bitwise considers the emergence of a large number of institutional-level storage facilities to be one of the main arguments. This is especially true against the background of how hackers manage to steal crypto assets from exchanges and from individuals.

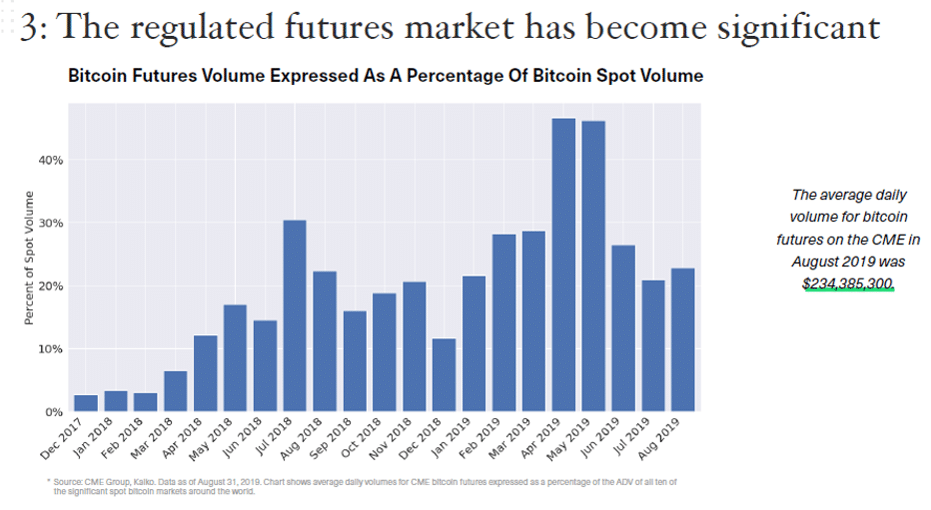

And as a third argument, Bitwise cites the growth in trading volumes of bitcoin futures.

“The current cryptocurrency market is not much like the market we saw a few years ago,” said Matt Hougan, head of research at Bitwise. “Today, companies like Jane Street and Fidelity dominate the cryptocurrency market, providing their institutional clients with world-class regulated digital asset vaults insured through Lloyd’s of London.”

However, publishing this material does not mean that the SEC agrees with Bitwise. Previously, the Office has repeatedly published similar presentations for educational purposes.

For example, yesterday the head of the SEC, Jay Clayton, said that Bitcoin would not receive listing on large exchanges until it was properly regulated.

The trading platform for institutional investors Tagomi gave its own comment to the SEC, saying that the development of the cryptocurrency industry as the authorities want it to be made possible thanks to a license from the New York State Department of Financial Services, which is issued to cryptocurrency companies.

“In our opinion, the possession of BitLicense means that the company properly ensures legal compliance,” said Tagomi representatives.

Bitwise is still waiting for a solution

in its application for the launch of ETFs on bitcoin, unlike VanEck and SolidX, which were withdrawn for the second time

your suggestion.