The virtual world is not at all a safe green meadow like the standard desktop background of the old Windows XP operating system. The crime situation on the Internet is no better than on the streets of a big city. And the blockchain sector attracts a huge amount of anti-social elements. Of course, a cybercriminal cannot inflict direct damage on your physical health.

At least for now, because brain implants are already being tested, allowing a person to directly connect to the Global Network. It is difficult to imagine all the possible consequences of the implementation of this project. But now we will not talk about this, but about modern filibusters, who replaced sailing boats with supercomputers, and about the methods of their attacks on distributed payment networks. The topic of this review is what the 51 attack on cryptocurrencies is, methods of protection and possible consequences.

What is 51% attack?

No matter how ingenious and useful a new invention is, there will always be people who will use it for evil to others. Most often for the sake of profit, but sometimes just because of an unhealthy psyche. And cryptocurrency is not an exception here.

The decentralization and anonymity of the blockchain is often used to conduct illegal transactions or to clean the pockets of reckless investors who invest their money in scam projects. As soon as the token holder neglects security measures when working with the blockchain, his private keys will be fished out and all the money will be stolen. But the crypto network itself, no matter how powerful it may be, is not an island of security at all.

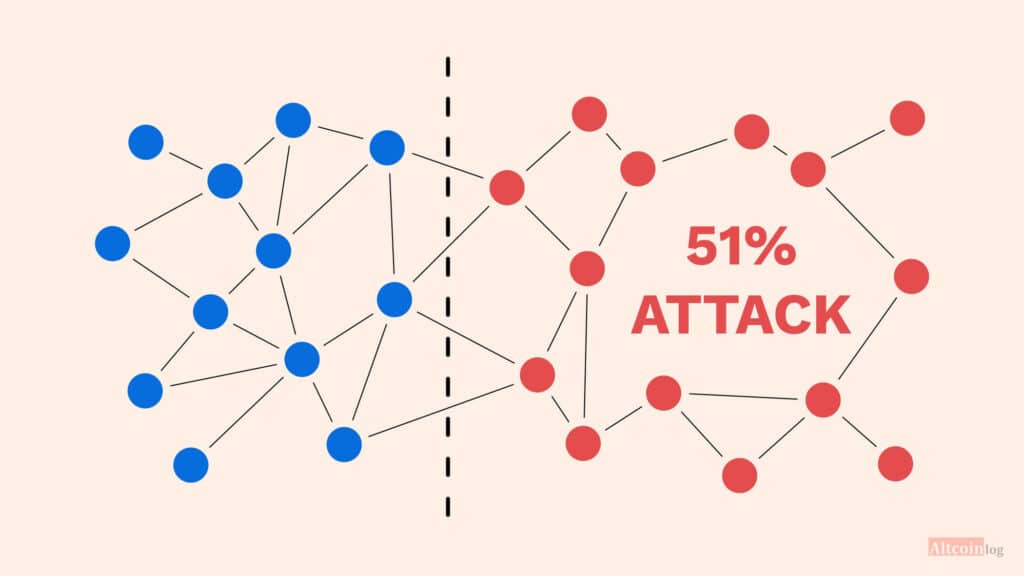

Attack 51 percent Is a nightmare for developers and all members of the community of a particular peer-to-peer network powered by POW. How it works?

The technical side of the issue

To carry out a 51 percent attack, an attacker must:

- Spend money on the main blockchain.

- Create a detached version of the blockchain that does not include this transaction and transfer it to the network. This thread should be as long as possible on the main blockchain.

- Successful double spelling will undo all previous operations, returning the spent assets to the hacker.

Now let’s reveal the details of the process.

How does a double spend of cryptocurrency happen?

Signed Bitcoin transactions are queued for processing in a local pool. Miners take them for verification to form a block of transactions. To successfully include a block in a chain, it is necessary to solve a complex mathematical problem. The older the cryptocurrency and the higher the computational complexity, the more computing power will be required. This is how hashing happens. The chances of finding and closing a block increase in direct proportion to the amount of resources of a miner (or a group of miners). Before being added to the ledger, the finished block is sent for validation by other mining workers. Honest miners will immediately reject the block, which includes “bad»Transactions.

The blockchain is built in such a way that without a digital signature, no one can make a transfer. But a hacker who has taken possession of a sufficient amount of computing resources can create his own version of the chain without sending it to others for verification. This is how attack 51 takes place. The blockchain branches out without sanction, honest miners work on the normal version, and the malicious one develops separately, not being broadcast to the main network. A hacker performs a perfectly legal operation, for example, a crypto exchange, in a valid version of the chain, without including data about it in his own, isolated branch. There he spent the money, but now he still has it, and the defective branch continues to grow and eventually overtakes the valid blockchain in length. And now trouble has come …

The cryptocurrency network is built on a democratic model of self-government, and, therefore, the majority dictates their will to the minority. The longest chain is considered correct. When a hacker opens access to his own version of the blockchain, according to the protocol, all other miners are forced to switch to it, because this block chain is larger.

«top redThe hacker chain is recognized as a valid distributed ledger. Financial transactions not included in this blockchain are canceled. But the money has already been spent and someone is out of luck, and an attacker can spend the crypt again. Bitcoin 51 attack is a successful double-spend, it is only possible if the criminal has control over most of the network’s computing resources.

How likely is a 51% attack?

Well, now you have a beginner’s hacker’s instruction on how to rob any POW cryptosystem. Although blockchains that do not use miners are not at all protected from 51% attacks. There, trusted nodes are engaged in generating blocks, and they can also be taken under control. The question is how much it will cost and what you can get from it. That is, in the expediency of such an action. For reference: Bitcoin network hashrate 120.26 EH / s, the most powerful ASIK Bitmain Antminer S19 Pro develops 110.00 Th/s… One exahesh contains a million terahesh. We determine by simple calculations, in order to control 51% of the computing power of the bitcoin network, you need to have 545455 ASIKov… On the manufacturer’s website Bitmain Antminer S19 Pro costs $ 2,400, and all lots are already sold out.

No, of course, it is much more convenient to rent computing power on the nice hash service, but it will also cost a lot. You need to pay about 14 bitcoins per day for 1 ekshash, and it’s not a fact that there are enough miners on the platform. At the time of this review, the total proposal was 422 PH / s (0,422 EH / s).

In addition, there are technical difficulties in organizing the process, which cannot be dealt with without serious technical knowledge. So a 51 percent Bitcoin attack is unlikely. An attacker cannot even rent a sufficient amount of capacity, let alone purchase and set up production on his own. But weaker crypto networks are not at all insured against 51% attacks.

How much will it cost to attack other coins?

Let’s calculate how much it costs to attack 51 cryptocurrencies based on the SHA256 algorithm. Network hashrate Litecoin Cash (LCC) is 6.7 PH / s. You can buy capacities on the nice hash platform for 0.08 BTC ($ 900). LCC Coin (not to be confused with LTC!) costs $ 0.00350909 and is traded on four exchanges.

The daily turnover per day is approximately $ 27,000. An attack on this altcoin is quite real, but it is unlikely to bring much benefit. As soon as the exchanges sense that something was wrong, they will close the trade and, having spent the coins once, the hacker simply cannot do it again. The network itself will either go bankrupt altogether, or will resort to drastic changes.

How developers protect cryptocurrency from attacks (hard fork)

After a successful 51 attack on the etc network was carried out, the developers of this cryptocurrency proposed a number of the following measures:

- Establish team interaction with mining servicesto ensure a stable hash rate.

- Strengthen network monitoring to detect anomalies.

- Work more closely with exchanges to create “white lists of addresses” and adjust the time of confirmation of transactions with this cryptocurrency.

- Implement Permapoint solutionsthat will thwart attempts to reorganize the blockchain without compromising the consensus algorithm.

In addition, the following issues will be put to a general vote:

- Implant solution PirlGuard, which allows you to fine for creating a separate chain and provides for notarization of the blockchain by master nodes.

- Switching to an algorithm Keccak-256 or RandomX;

- Creating a reserve amount of ETC tokens.

A whole series of 51% attacks on ETC have been carried out quite recently. The approximate amount of damage is US $ 5 million.

Interesting facts from the history of the cryptoindustry

Incidentally, the Ethereum Classic network has already been hit by 51 percent attacks last year. But then the “white hacker” did not set himself the goal of stealing coins. He was just trying to draw the attention of the developers, but for some reason serious measures to prevent the danger were never taken.

Six years ago, a crypto mine Ghash.io held over 50% of the network capacity of the first cryptocurrency, but then voluntarily went to reduce the hash rate.

When hackers carried out a 51% attack on the network in 2018 Bitcoin gold, the administrations of the six largest exchanges demanded compensation from the project team for damage caused by the negligence of the developers. But they never got the money.

Last year, Bitcoin Cash was attacked by the two largest pools to prevent theft of reserve coins that were unlocked after another hard fork.

Conclusion

It would seem that the easiest way to do a hard fork is to eliminate the consequences of a 51% attack on the network. But the creator of Bitcoin Core Gregory Maxwell and other authoritative members of the blockchain community strongly disagree with this. Here’s what Maxwell tweeted:

“When people talk about a 51% attack, they mean falsification of the generally accepted transaction history. But the launch of a mechanism to limit the ability of one entity to gain control over the network will most likely lead to a complete abandonment of traditional mining. Increase the minimum number of confirmations if someone slips a double transaction. Fake decentralized systems change the rules without asking the token holders and this is much more frightening than the likelihood of a costly attack. ” It is difficult to disagree with his words.

Subscribe to our resources and read comments, sometimes smart people write smart things there.

Related materials: