In 2017, everyone with a good plan and some text on a white piece of paper seemed to be able to raise millions for an ICO. After the bull run was over, it looked like the ICO market would mature. That was also the conclusion of an August 2018 Elementus report.

Analyze ICOs for two years

Charlie Custer from LONGHASH carried out good research into the current status of the ICO mark, his conclusion is: The market is not maturing, we are just going the other way.

He examined every ICO from 2018 up to and including the end of August 2019, using data from ICO Watch for this. This allowed him to exclude data from IEOs and STOs. A short explanation of all these abbreviations:

- ICO: Collect Initial Coin Offering, bitcoin or ethereum in exchange for project tokens

- IEO: Initial Exchange Offering, basically the same as an ICO but somewhat regulated because the fundraising goes through a large stock market such as Binance.

- STO: Security Token Offering, ICO type but then for token shares. Is covered by regulations of local regulators. In the Netherlands that is the AFM and in the US that is the SEC.

Fewer and fewer ICOs

As you can see below, the number of projects has decreased considerably. At the beginning of 2018 there were more than 150 a month but in 2019 the ICO seems to be almost extinct. The data from the graphs below comes from ICO Watch and LONGHASH. The vertical axis represents the number of ICOs.

Also fewer and fewer dollars

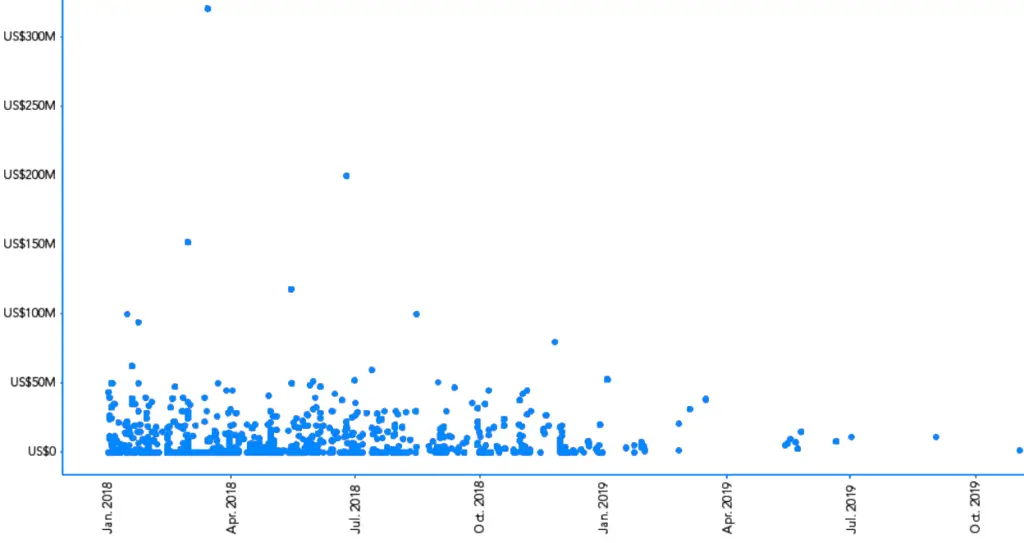

This, of course, also applies to the funds raised per ICO. In the graph below, each dot represents one ICO. It is especially interesting to look at the 50 million dollar limit. In 2018, there were fourteen projects that collected so much. Only Contentos in 2019. Maarja, that ICO ended on January 3, 2019.

If you are wondering who that lonely ICO is at the top, that is Dragon Coins, this project raised no less than $ 320 million. 421 projects were stuck at 0 dollars.

Custer also compared the absolute numbers. In 2018, a total of more than $ 7.6 billion was collected. He expects that “only” $ 338 million will be collected in 2019, a decrease of more than 95 percent.

Debit regulation for fewer ICOs

He draws the cautious conclusion that the decreasing number of ICOs may be due to the tightening of regulations. Not only in the US, but all over the world. Many governments reacted quite fiercely in 2018 to want to protect consumers against themselves.

De Nederlandsche Bank (DNB) and the Netherlands Authority for the Financial Markets (AFM) also had their ideas about this. Not surprisingly, many consumers were really taken in by scams and teams that left with the northern sun after receiving the funding.

Competition of exchanges

Custer therefore foresees a grim future for ICOs. He does not expect that this way of fundraising is still viable and that ICOs may not even exist in 2020.

Certainly also because exchanges are committed to IEOs. This is because not only the fundraisers earn money, but also the exchanges themselves. An additional advantage for these exchanges is that you can often only participate in an IEO if you use their own coin. And this again leads to a rising course.