How to make money Defi Decentralize Finance: Pros and Cons, profitability, and best coins for profit and a lot moreDeFi is opening up more and more passive income opportunities. Some of them are more complex, some are, on the contrary, very simple and accessible even for beginners. The editors of Bitcoinminershashrate.com propose to consider the main current methods of making money on decentralized assets.

Let’s talk about such methods of earning money on DeFi as:

- profitable farming;

- investing in DeFi tokens;

- staking;

- P2P lending;

- liquidity supply;

- leverage on DEX.

Each of them has its own pros, cons and features.

The content of the article

Earnings on profitable farming

With the emergence of various decentralized financial protocols, yield farming has exploded in recent months.

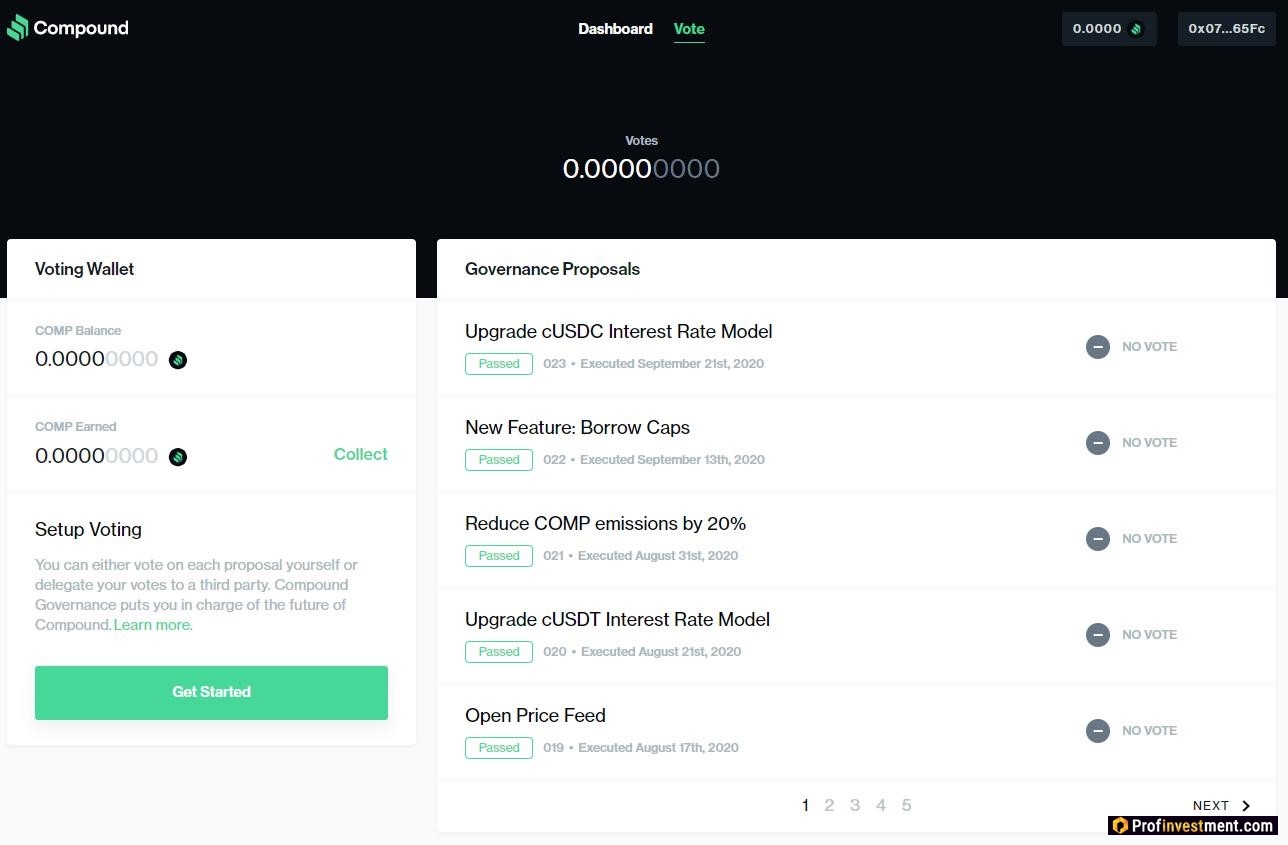

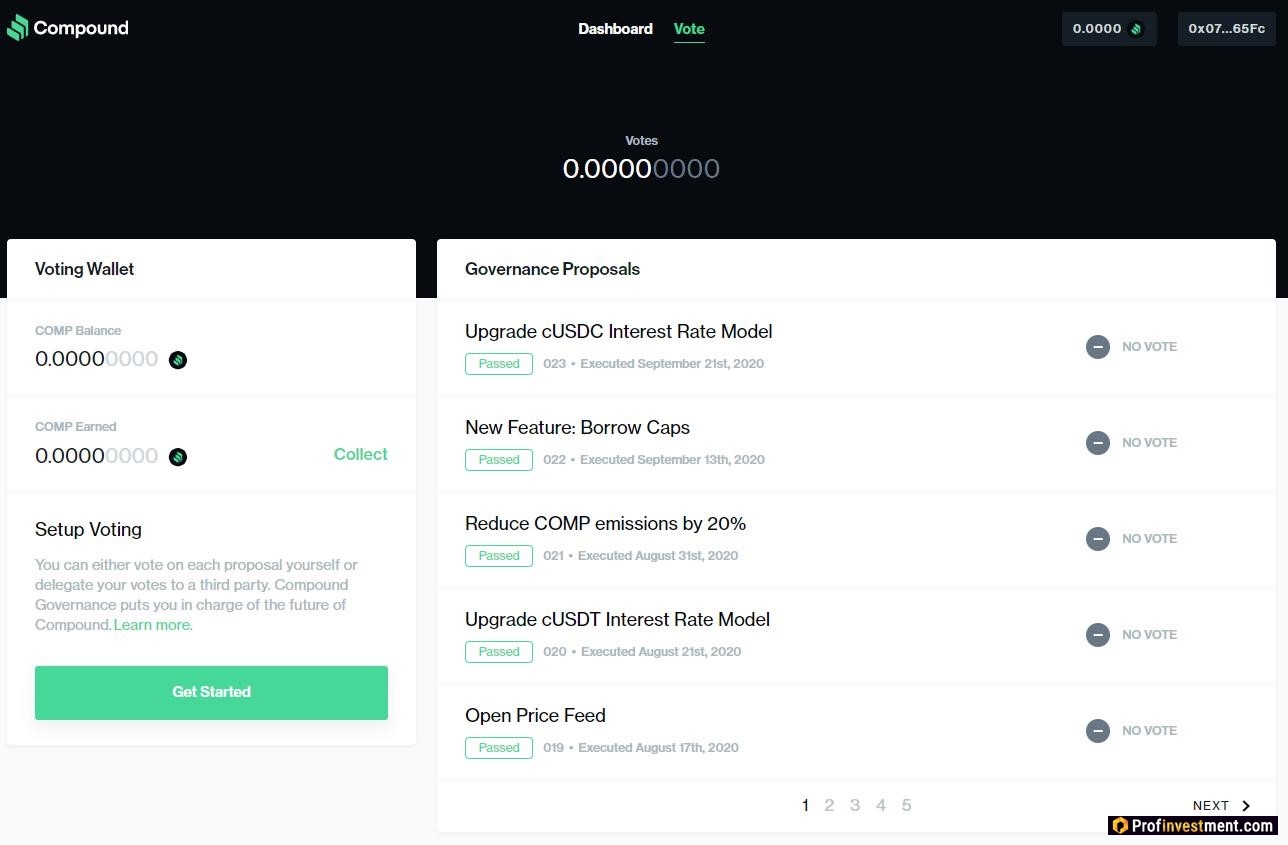

At its core, this is a process in which the user receives native and control tokens of a particular protocol as a reward for being active in it (liquidity supply, deposits, loans, trading). This concept gained popularity thanks to the Compound protocol, which began distributing COMP tokens to users who contributed funds to the platform or took out decentralized loans. Thus, the project encourages users to perform certain operations.

Most cryptocurrency protocols are based on decentralization; if in bitcoin or ether it is achieved through mining, then projects built on Ethereum achieve decentralization by transferring control to protocol users using tokens.

This is exactly what the Compound developers did. They issued COMP tokens, giving users control over the protocol. COMP is distributed in proportion to user activity and represents an additional bonus for using Compound only. Immediately after the release, the token increased significantly in price. The community quickly realized that using the platform could bring benefits. This phenomenon is called profitable farming. This farm led to a sharp inflow of capital to Compound – almost half a billion dollars was added to the protocol in the week in mid-June.

Other sites that provide an opportunity to engage in profitable farming:

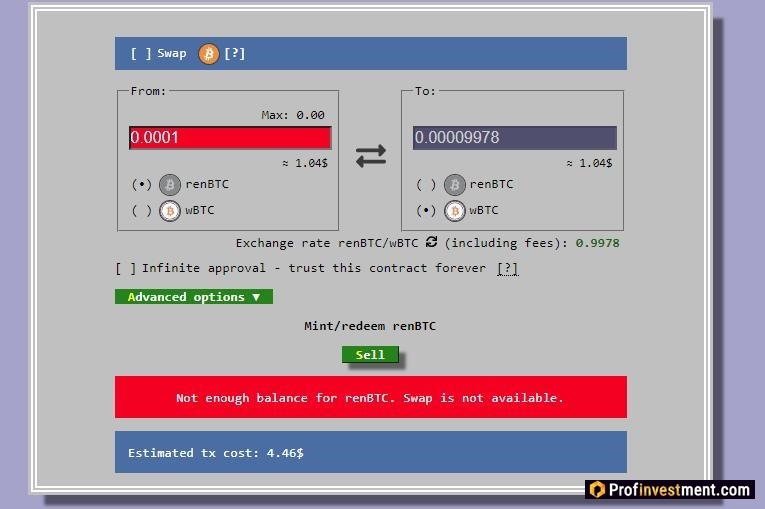

- Curve. Provides the opportunity to receive income in CRV tokens by depositing collateral in any of the seven available liquidity pools. Including there is a pool working with tokenized bitcoin – Ren Protocol. The sUSD and sBTC pools provide additional incentives in the form of SNX and REN.

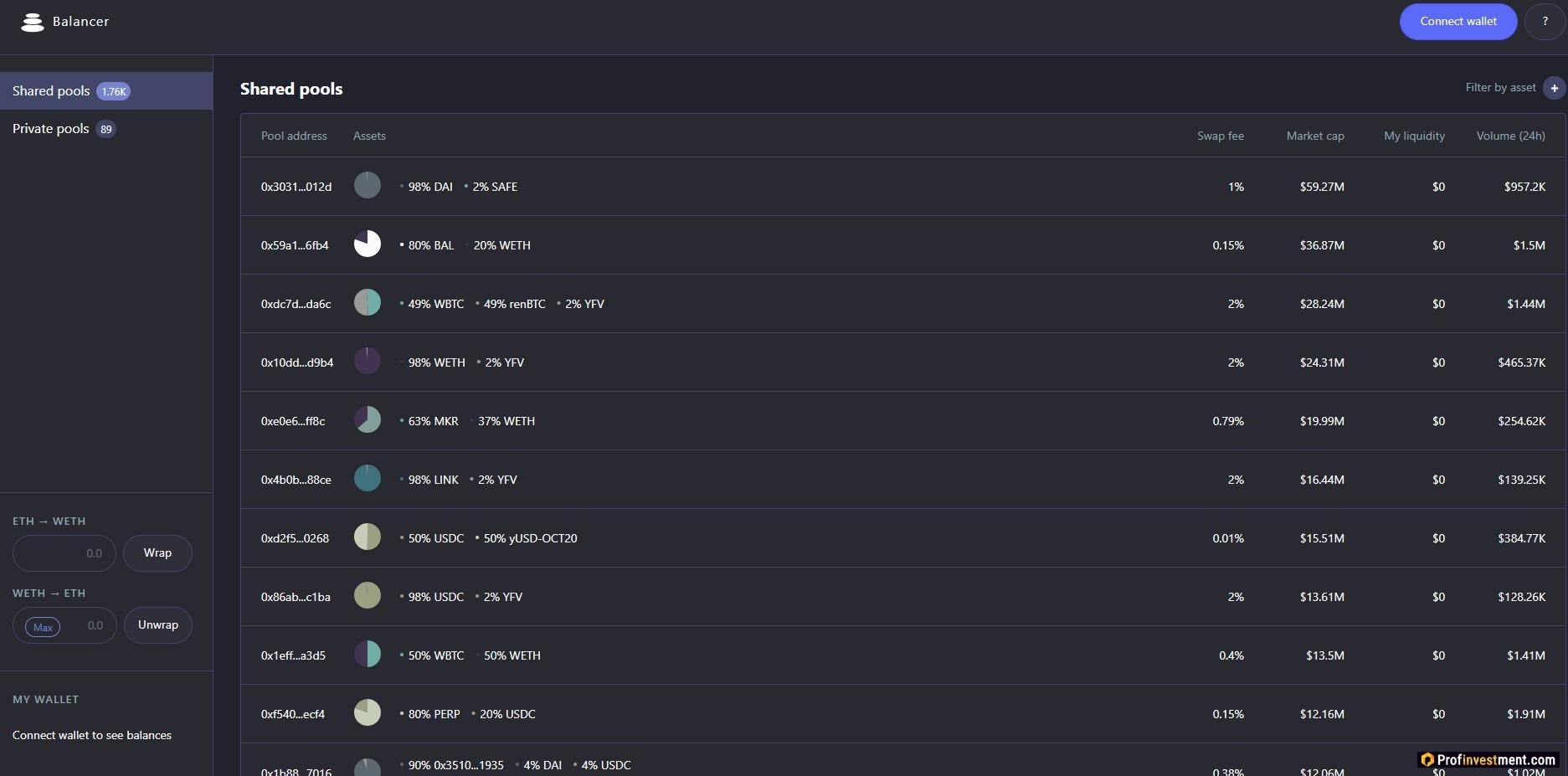

- Balancer. Allows you to earn BAL management tokens by depositing funds into liquidity pools. There is a table on the site where you can at any time see which pool is the most profitable, what volumes and commissions it contains. Pools are either private or public. Some pools help mitigate volatility risks, such as DAI / USDC, sBTC / WBTC or sETH / WETH.

Advantages and disadvantages

Pros:

- You can get some good additional income.

- Many of the “bonus” tokens are very promising and can grow in value.

- Eligibility to participate in decentralized protocol management.

Minuses

- Technical risks of smart contracts.

- Volatility risks and income volatility.

- Binding to the use of specific protocols.

Earnings from investing in DeFi tokens

Another way to make money on decentralized assets is to play on price growth. The peculiarity of the sphere now is that in a few hours after the release, the token can rise in price by hundreds and thousands of percent, and then also rapidly fall in price or continue to grow. It is not surprising that the field of investment is in great demand.

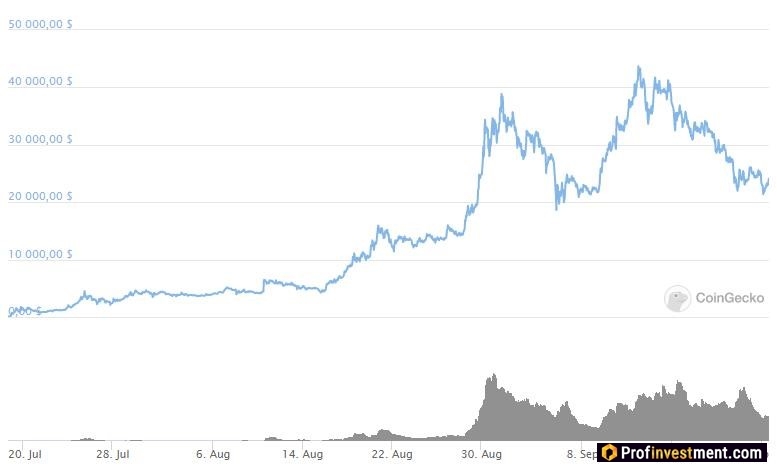

The most striking example is the YFI token of the Yearn.Finance platform, which grew by 130,000% from July to September 2020.

Now it continues to be extremely volatile, fluctuating in the +/- $ 3000 range every day, which provides a lot of opportunities for market speculation. There are other similar examples – UMA (UMA), Unitrade (TRADE), Ocean Protocol (OCEAN) tokens.

Thus, by buying a promising DeFi token for a small amount, you can increase your investment thousands of times. But at the same time, no one canceled the risks. Not every project is expecting steady growth, especially since now there are more and more such projects; many of them are known to be fraudulent.

To choose a token with good potential, you can pay attention to a couple of criteria:

- Product availability. It is desirable that the project has some kind of functional platform or application.

- Limited emission. The lower the total volume of coins, the higher the likelihood that its price will rise. For example, the emission of the above-mentioned YFI is only 30,000.

- Adding to exchanges. As a rule, tokens skyrocket immediately after listing on exchanges – this convinces users that the project is not fraudulent.

However, it is worth noting that it is best to buy DeFi tokens at the moment of their appearance on small platforms, since after listing on Binance or other market leaders, the price usually stabilizes or gradually decreases. On the other hand, small exchanges do not strictly monitor the quality of coins added to the listing.

Advantages and disadvantages

Pros:

- The chance of quick and high earnings.

- Interaction with new high-tech projects.

Minuses

- High risks.

- It is not easy to find a really promising token.

- The decision must be made instantly, as the course can take off or collapse very quickly.

Earnings on staking

Staking is a traditional way of passively making money on cryptocurrency, which has been relevant for several years. It is now attracting special attention due to the fact that Ethereum plans to switch to the proof-of-stake protocol soon. And among the top 30 other major currencies by capitalization, there are already several blockchains supporting stake rewards.

The essence of staking is that assets are not moved, but blocked directly on the user’s wallet. The bets of individual participants form a single staking pool. This provides operational support for the network, and also reduces the number of coins in circulation, preventing inflation and depreciation.

Different coins offer different yields, you can find options with a yield of 20% per annum. This is significantly more attractive than traditional bank rates and crypto landing rates. But there are also risks, mainly associated with price volatility. And since the reward is paid in the same coins that are locked, this further increases the risk in the event of a market crash.

Coins with a large market capitalization and low volatility are safer to bet, while coins with a small market cap are more risky, but the expected return on them can be noticeably higher.

Advantages and disadvantages

Pros:

- An old and proven method. Often compared to stock dividends.

- Safe enough if you choose reputable coins.

- Quite good profitability.

- Staking counteracts inflation.

Minuses

- Rates reduce market liquidity.

- A fall in the rate can eliminate potential profits.

- Not all PoS coins are compatible with the methods of the DeFi ecosystem.

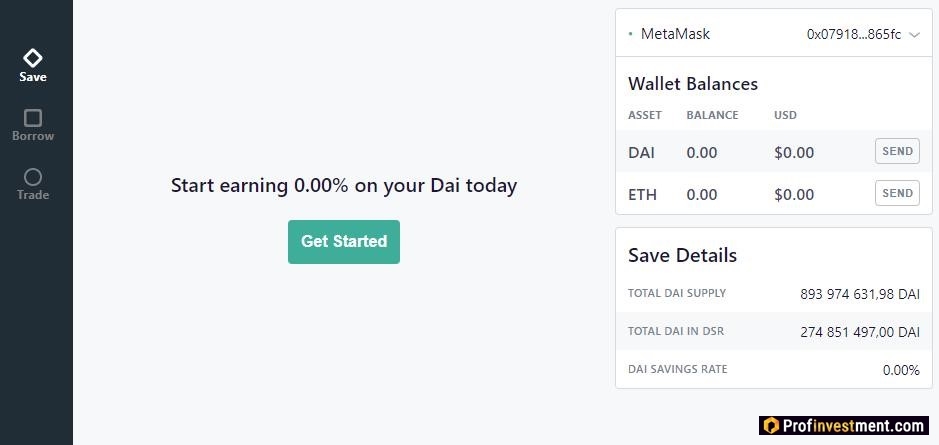

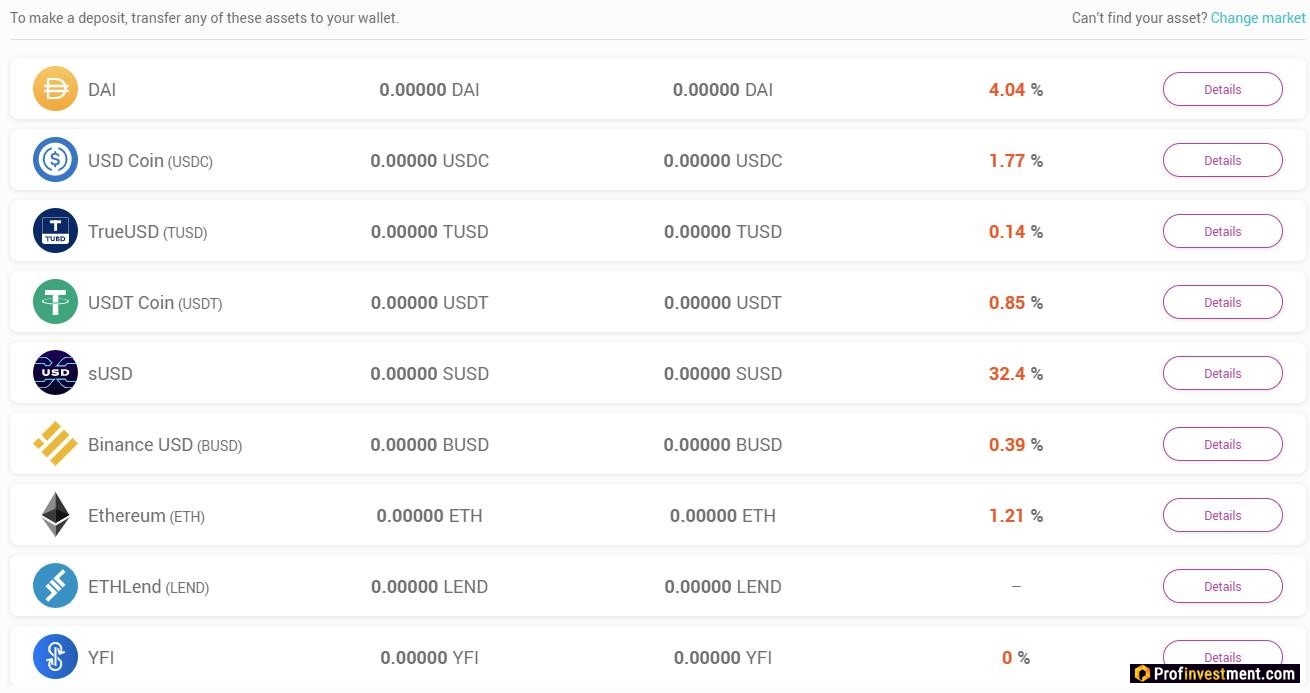

Earnings on P2P lending (landing page)

DeFi lending plays the same role as any traditional bank providing loans to users or businesses. However, the area of decentralized assets offers significantly more interesting earning opportunities. P2P lending platforms offer loans to anyone without checking their credit history and without ID. The only condition is a deposit.

On the other hand, participants who have unused cryptocurrency can give it to borrowers at interest. At the same time, a special automatic liquidation procedure ensures that the lender will return his funds with interest even in the event of a fall in the value of cryptocurrencies or non-repayment of the loan by the borrower.

According to research firm Messari, P2P lending in DeFi is the most effective direction in terms of ROI (return on investment).

Examples of platforms where you can give funds at interest:

- Maker. The minimum collateral for the borrower is 150% of the loan amount. Only the DAI token can be borrowed. ETH, BAT are accepted as collateral. 0x (ZRX), DigixDAO (DGD), Golem (GNT), Omise Go (OMG), Augur (REP) will also be added soon.

- Aave. The minimum collateral for the borrower is 133% of the loan amount. The protocol supports 16 coins, of which 13 can be used as collateral. Assets such as TUSD, DAI, USDC, BUSD, WBTC, ETH, etc. are present.

Advantages and disadvantages

Pros:

- Large selection of supported protocols and assets.

- Some assets are offered high interest rates.

- Low risks thanks to well-thought-out collateral liquidation procedures.

Minuses

- Profits are unpredictable as interest rates are constantly adjusted based on market conditions.

- Technical risks of smart contracts.

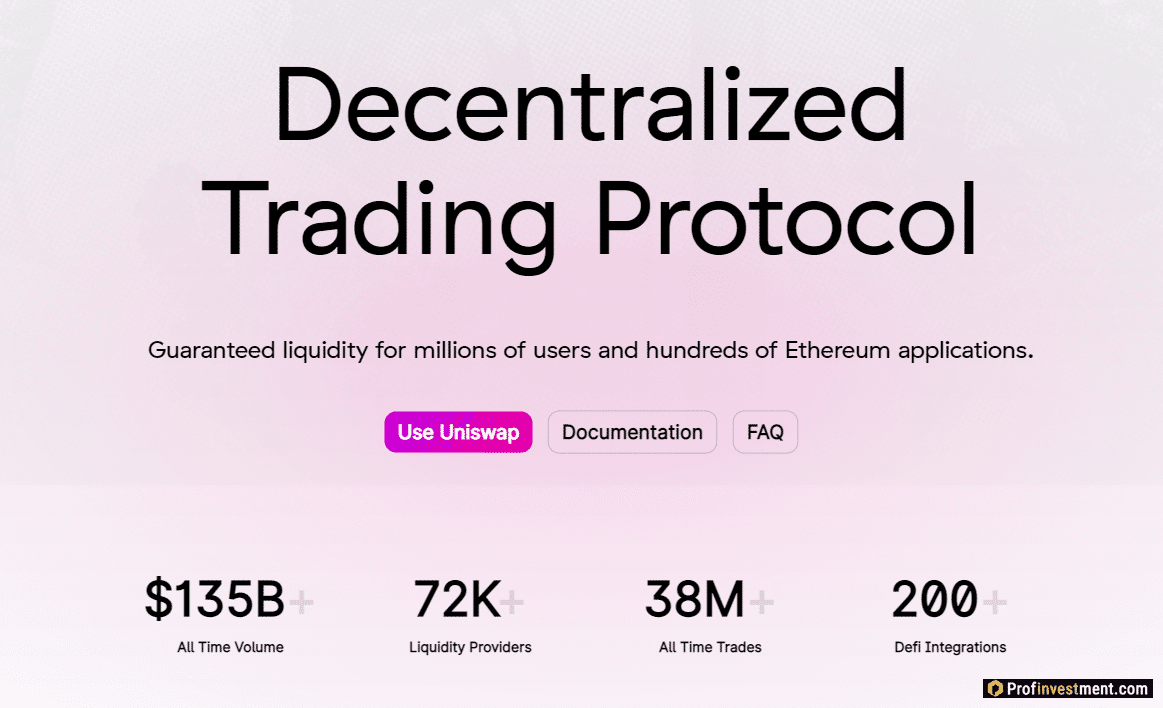

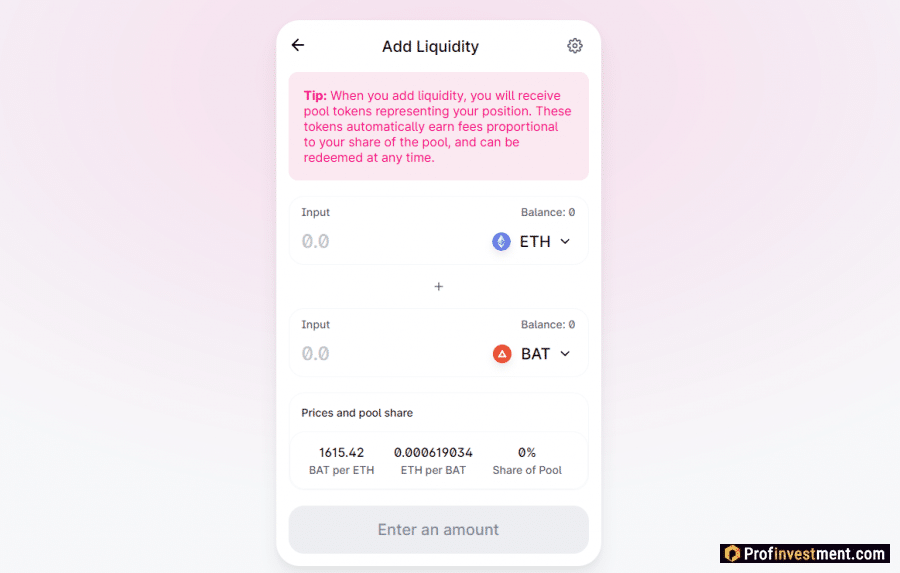

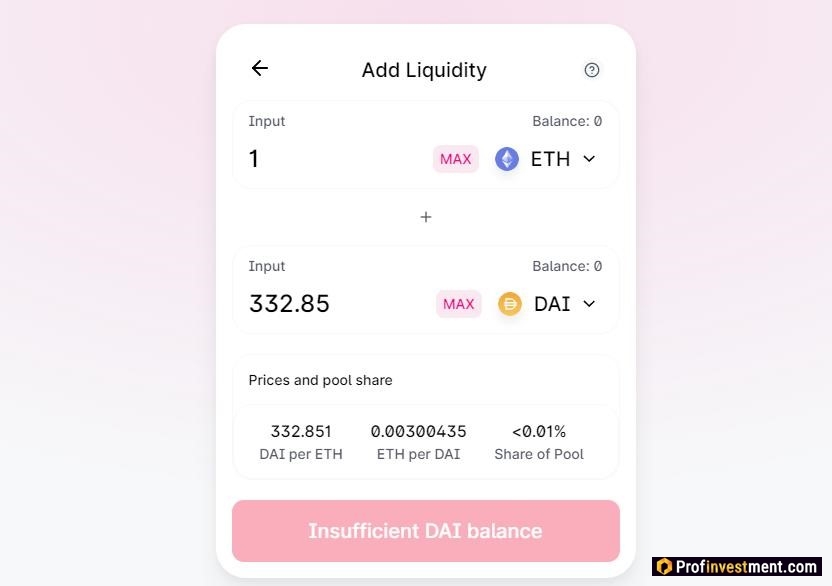

Earnings on liquidity supply

Many of the DeFi protocols operate on what are known as liquidity pools – pools of tokens locked in a smart contract. They are used to facilitate trading by providing liquidity and are widely adopted by the next generation of decentralized exchanges. This mechanic became popular after the launch of Uniswap.

In classic crypto exchanges like Coinbase or Binance, trading is based on an order book. Traditional stock exchanges work in the same way. Sellers try to sell the asset at the highest possible price, and buyers try to buy at the lowest possible price. When the buyer and seller agreed on a price, the deal went through.

In decentralized finance, trade is reproduced differently. Each liquidity pool contains two tokens and creates a market for that particular pair. For example, the popular liquidity pool on Uniswap is DAI / ETH.

Now about how to make money on it. To ensure that pools always have assets, platforms encourage users to deposit funds. The liquidity provider (LP) receives special tokens, called LP tokens, in proportion to the amount of liquidity provided to the pool. LP receive a certain percentage of the commission for each transaction in the pool where they deposited funds

Advantages and disadvantages

Pros:

- Large selection of platforms and assets.

- A fairly simple operation available for beginners.

Minuses

- The profitability depends on the trading volume on a particular site.

- Liquidity must be deposited regularly, otherwise income will decrease over time.

We earn on leverage on DEX

Margin trading (leveraged trading) is a method of trading using borrowed funds, thanks to which you can use many times more amount to exchange than the user has. In the DeFi realm, margin traders borrow cryptocurrencies from decentralized credit protocols powered by smart contracts.

Those who wish can make money on this – give their unused cryptocurrency at a percentage. It is possible to receive 5-20% from lending to margin traders.

Examples of DeFi platforms offering this earning opportunity:

- dYdX is a trading platform primarily aimed at experienced traders. Supports ETH-DAI, ETH-USDC and DAI-USDC pairs. Offers deals with up to 5x leverage. dYdX is one of the largest margin trading platforms in DeFi; at the moment, over $ 1.2 billion are locked in its smart contracts.

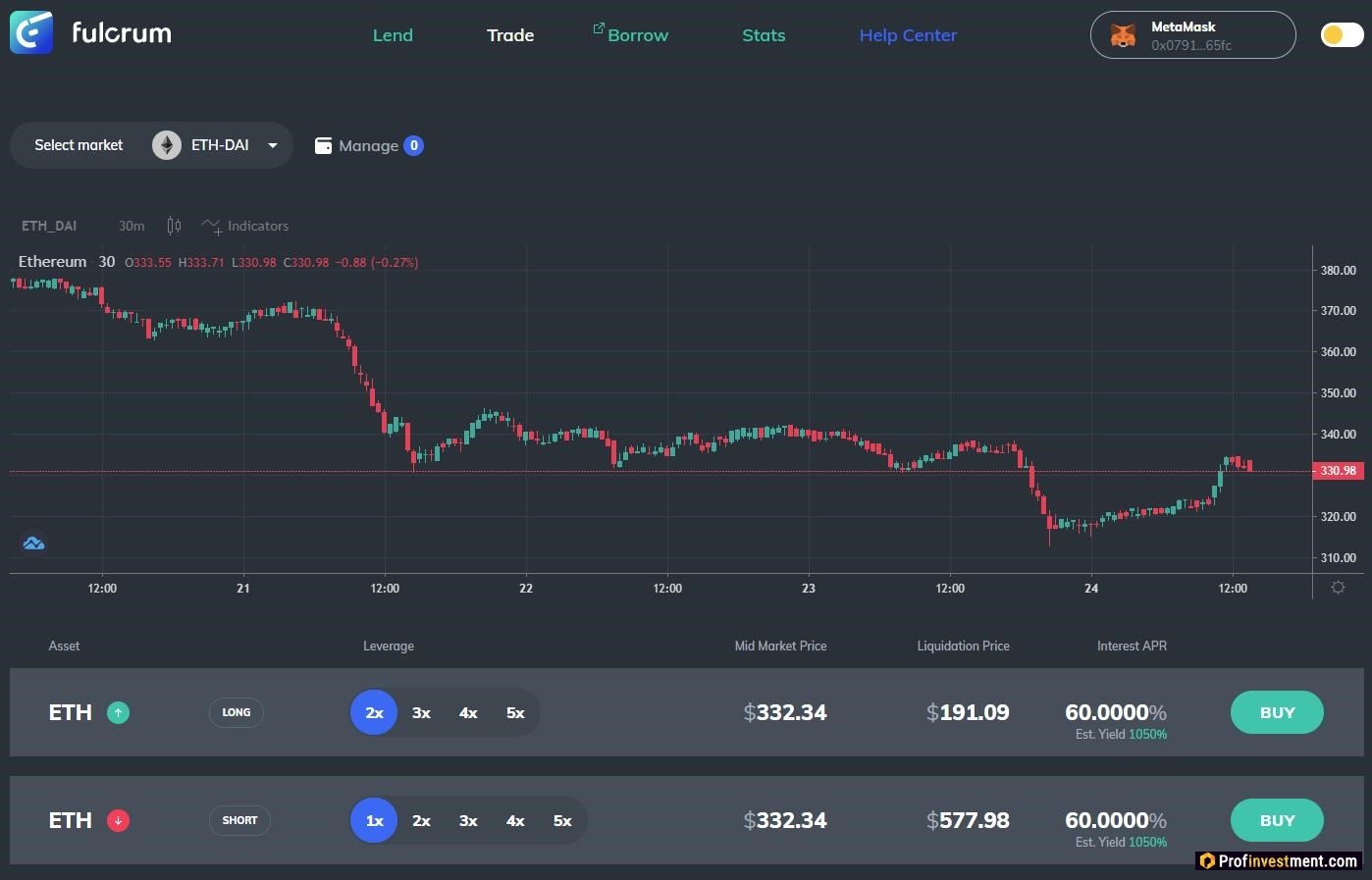

- Fulcrum is another non-custodian trading platform built on top of the Kyber network and the bZx protocol. Supports LINK, ZRX, WBTC, ETH, DAI, REP, KNC tokens. When a user opens a position, the smart contract takes a loan on his behalf through bZx, and then exchanges it for the selected token. Fulcrum allows clients to enter long or short positions up to 4x leverage.

Advantages and disadvantages

Pros:

- Margin trading always uses automatic liquidation if the trader is trading at a loss so that the lender does not lose his investment.

- Transparency and anonymity of all operations, resistance to censorship.

Minuses

- Low interest rates.

- The risk of vulnerability of the used platform.

Useful Resources

With the help of the listed DeFi profitability aggregators, you can choose the most profitable protocols at the moment:

- https://defiyield.info/,

- https://coinmarketcap.com/beta/yield-farming/,

- https://www.coingecko.com/ru/yield-farming,

- https://yieldfarmingtools.com/pools.

Here you can track the total value of DeFi locked assets: https://defipulse.com/.

Conclusion

To choose the appropriate way to make money on DeFi assets, it is best to try everything – fortunately, the threshold for entering them is minimal. The protocols work even with the smallest amounts. And thanks to their transparency, at any time, you can monitor the state of the market and your own assets in order not to miss the right moment to deposit or withdraw funds.