Yield Farming: what is it, how to make money on it, features and risks of Yield Farming – Yield farming in DeFi, it is a way of using cryptocurrencies, tokens, stablecoins in decentralized financial projects that give passive income in the form of a certain interest rate.

At the same time, profits from DeFi lending or staking are not guaranteed, the actual profitability depends on the approach of each individual protocol. The volatility of the crypto market or slow confirmation of transactions creates the risk of lost profits.

Farming is becoming an increasingly popular way of earning money. On September 7, 2020, the popular Binance exchange announced the launch of the profitable farming platform Binance Launchpool, which will allow you to receive rewards in the form of new Defi tokens.

The editorial staff of Bitcoinminershashrate.com invites you to familiarize yourself with the question of what is profitable farming in DeFi and how to make money on it.

The content of the article

General concepts

Profitable farming in DeFi is one of the ways to earn cryptocurrency on cryptocurrency. In most cases, it means investing your funds in protocols based on smart contracts that distribute them by issuing loans to other people at interest. As a result, the provider of funds (called the liquidity provider) receives a portion of the interest income.

In profitable farming, there are already many strategies of varying degrees of complexity. Professionals constantly move assets between different markets to maximize profits. This is a real competition, where everyone is looking for the most profitable way and hides it from the rest.

By using a decentralized ecosystem powered by the Ethereum blockchain, anyone can earn passive income instead of keeping assets dormant.

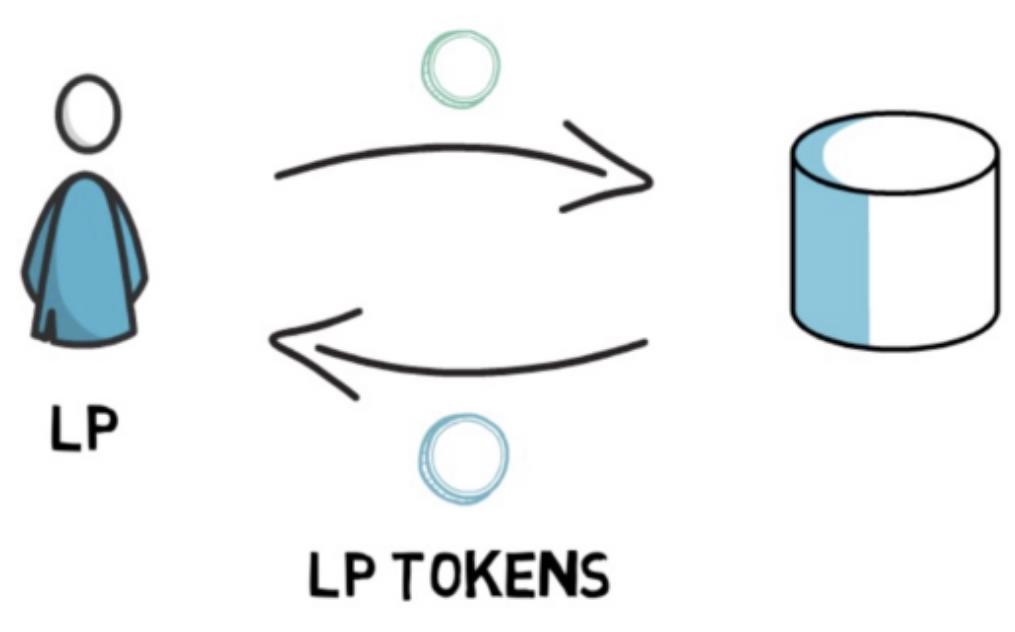

Profitable farming in DeFi can be compared to staking in some ways – the user blocks his funds and the longer he holds them and the larger their volume, the more he receives the final reward. However, from a technical point of view, everything is arranged differently. It is based on the so-called liquidity pools. Liquidity Providers (LP) deposit funds into them, others can use them under certain conditions.

Liquidity pool Is a smart contract holding funds. It pays rewards to users for providing liquidity. The reward can come from various sources, such as commission fees. This is the main idea. Then there are the subtleties – what kind of tokens the pool pays the reward with and what can be done with it later. Hence, there are different strategies for making money.

Several nuances:

- Profitable farming in DeFi usually means working with ERC-20 tokens on the Ethereum network. The awards are also ERC-20 tokens.

- While all activity is currently focused on the Ethereum blockchain, this may change in the future. For example, we recently launched the new Avalanche blockchain, which is also focused on the development of DeFi projects and offers an increased degree of scalability.

- Typically, “farmers” actively move funds between protocols in search of high returns. Therefore, DeFi platforms are beginning to provide additional incentives so that liquidity is withdrawn from them as little as possible.

The sudden interest in this way of making money is associated with the launch of the COMP token from the Compound Finance system. This token provides holders with control rights, which makes the network as decentralized as possible. Algorithmic distribution of governance tokens as incentives for the supply of liquidity is the most common way of decentralizing protocols right now. Thus, while Compound did not invent the principle of profitable farming itself, it definitely provided an incentive to spread it.

A little about what DeFi tokens are. In the crypto environment, tokens usually serve as a confirmation of the right to own something or a method of access to any service. For example, using the base BAT token, you can buy ads in the Brave browser. Since tokens have a certain value, operations can be performed with them. This is where decentralized finance is used.

ERC-20 tokens refer to a software standard that allows developers to write their own rules for them. Governance tokens work much like certificates, giving holders the right to vote on protocol changes in an ever-changing environment. For example, at MakerDAO, MKR token holders vote almost weekly on various protocol adjustments.

Resources

How much can you earn from profitable farming in DeFi

Even before projects started distributing governance tokens, there was much more money to be made in DeFi than if you put funds in a traditional bank. However, in return, you will have to take into account certain risks, more on which below.

Ultimately, earnings depend on the conditions and capabilities of a particular protocol, as well as on which strategy to choose and how accurately to follow it. Before you start working with DeFi, you should study the details of decentralized liquidity protocols in detail. The basic rule is to always keep your finger on the pulse and not lose the opportunity to control investments.

Risks of Profitable Farming in DeFi

Profitable farming cannot be called an easy way to earn money. The most complex strategies are suitable only for advanced users, or for whales (owners of large capital). What other risks are worth knowing about:

- Errors and vulnerabilities are constantly discovered even in large and authoritative protocols. Some of them can lead to the loss of user funds, and it is impossible to return them due to the technical features of the blockchain – all transactions are irreversible.

- High risk of errors in smart contracts. Especially when you consider that many projects are developed by small teams with limited budgets.

- The entire DeFi ecosystem is made up of “building blocks”. This is its advantage and disadvantage at the same time. While the underlying protocol may not have vulnerabilities, those with which it is associated may have. As a result, due to errors in one block, the user may lose his funds.

- Variability of earnings. The profitability changes every few seconds depending on the market conditions. You can never know in advance what it will be and how much you will earn. The rate may be very high today, but very low tomorrow.

In addition, from a legal point of view, DeFi platforms are not the safest place to invest money. They are not regulated by anyone and usually do not provide insurance against loss of funds.

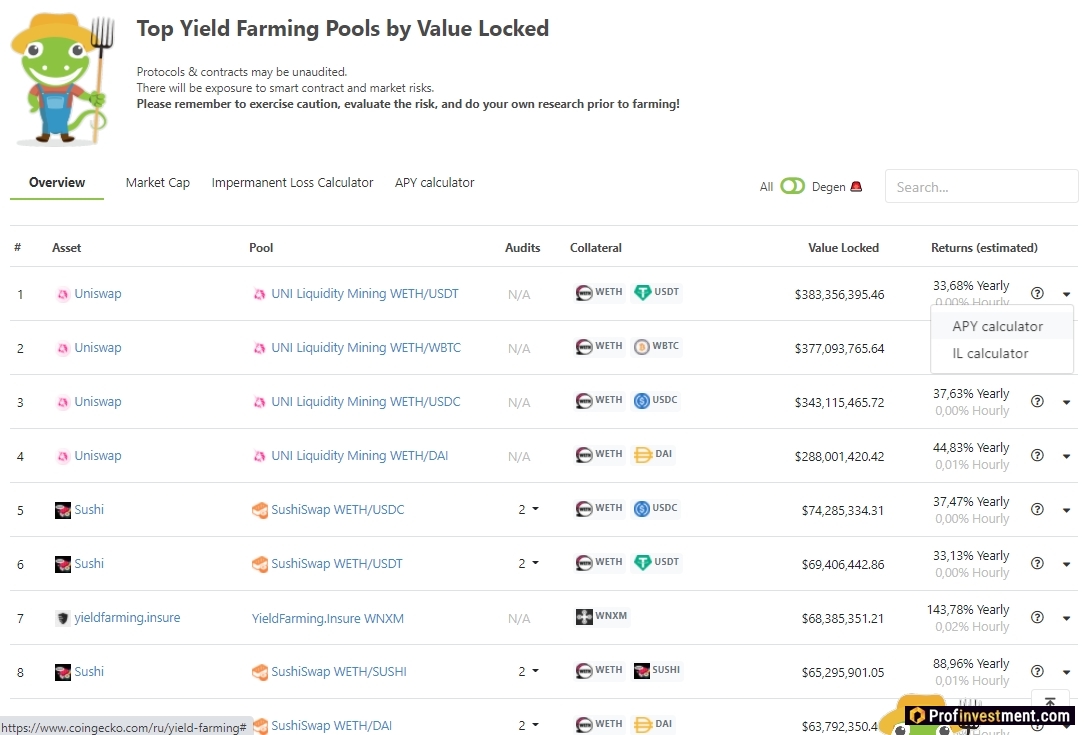

DeFi platforms for earning money from farming

Let’s talk about the main DeFi protocols that are currently suitable for profitable farming. New options appear every day.

yearn.finance

yearn.finance – Aggregator of credit protocols (Compound, Aave, etc.). In addition, it provides a whole range of other financial services, from trade to insurance. One of the features is profit optimization due to the automatic search for the most profitable credit protocol at any given time. After the deposit, the funds are converted into yTokens, and they, in turn, are redistributed to different pools based on their profitability.

Video about staking ETH through the Yearn Vault:

https://www.youtube.com/watch?v=nfO95icmSG0

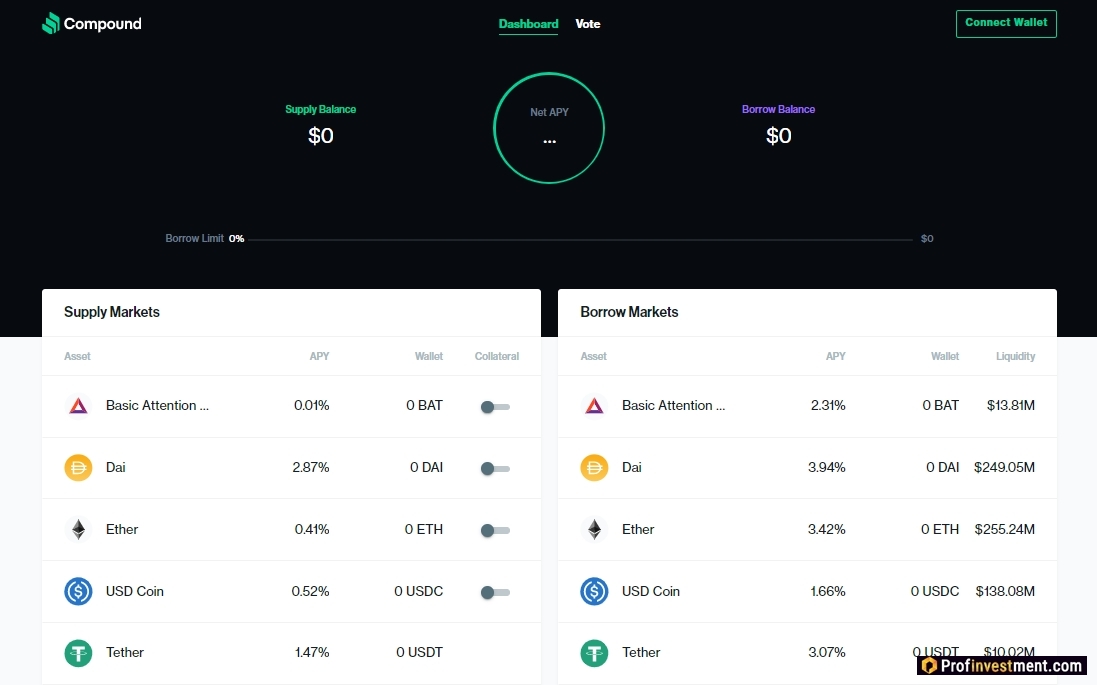

Compound Finance

Compound is one of the largest and most sought-after money markets in the entire DeFi ecosystem. Used in many other projects as an auxiliary tool. It helps users to give away their cryptocurrency at interest or borrow some assets against the security of others. Anyone with an Ethereum wallet can supply liquidity to the pool. Interest rates, as in other similar protocols, are adjusted independently depending on the supply and demand for specific assets.

Curve Finance

Curve Finance is a decentralized exchange protocol designed primarily for stablecoins. It makes it possible to make much more profitable exchange operations with stablecoins than on the same Uniswap. As elsewhere, liquidity providers are rewarded. The native CRV token is used as a reward.

Farming with stablecoins with Curve Finance:

https://www.youtube.com/watch?v=fGxTwm-rf1s[/emed]

Synthetix

Synthetix is a protocol for creating synthetic assets. Any user can block their cryptocurrencies (or other assets from the list of supported ones) in a smart contract and create an equal number of synths (synthetic assets). The auxiliary token is SNX. Synths are convenient in that they can even tokenize fiat currencies or precious metals in order to manage them on a decentralized basis.

Maker

The Maker platform allows you to create a stablecoin DAI, the rate of which is algorithmically pegged to the US dollar. The user can open their own vault on a decentralized credit platform, then lock assets there as collateral (many ERC-20 tokens are supported, including the tokenized bitcoin wBTC). Based on the blocked collateral, the participant generates DAI, and over time this debt brings interest. The specific rate is set by the participants – holders of MKR tokens.

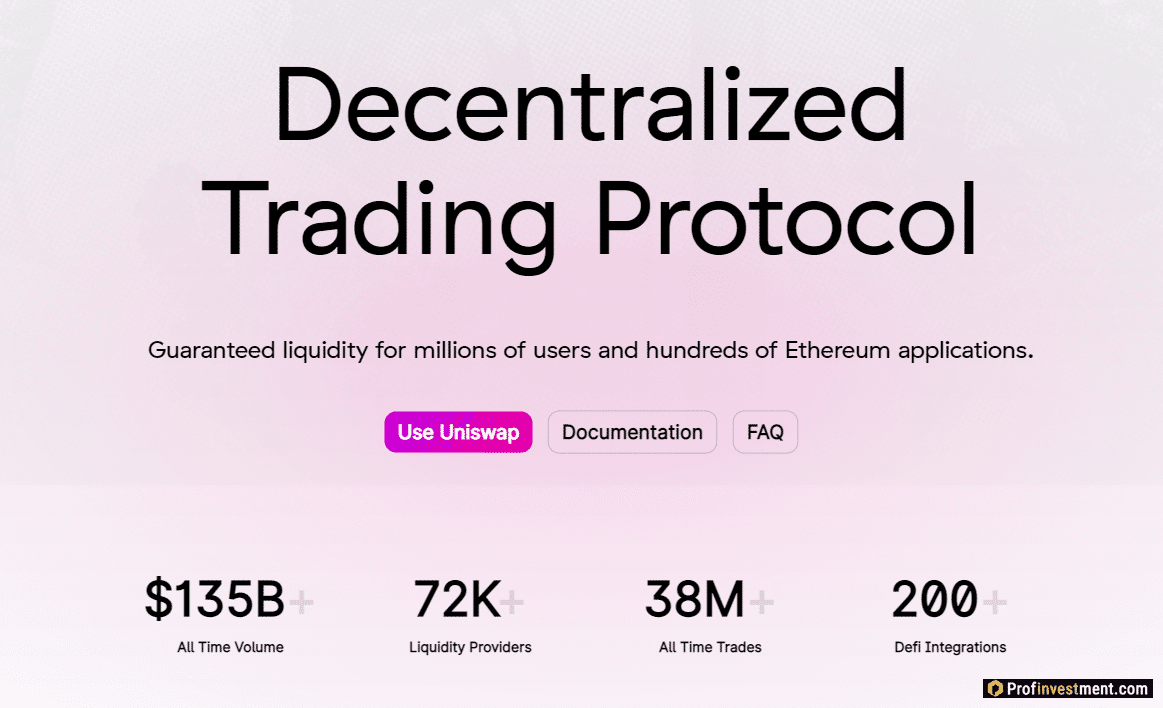

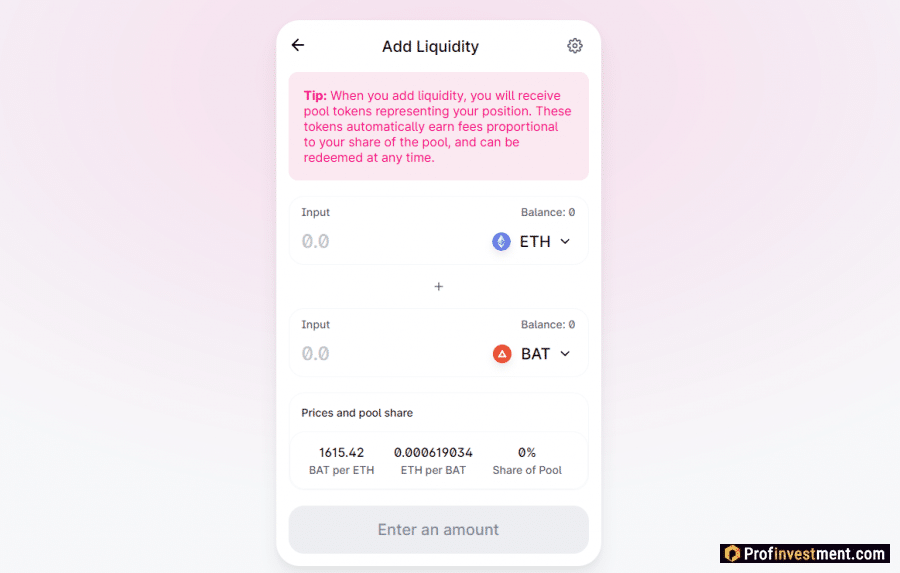

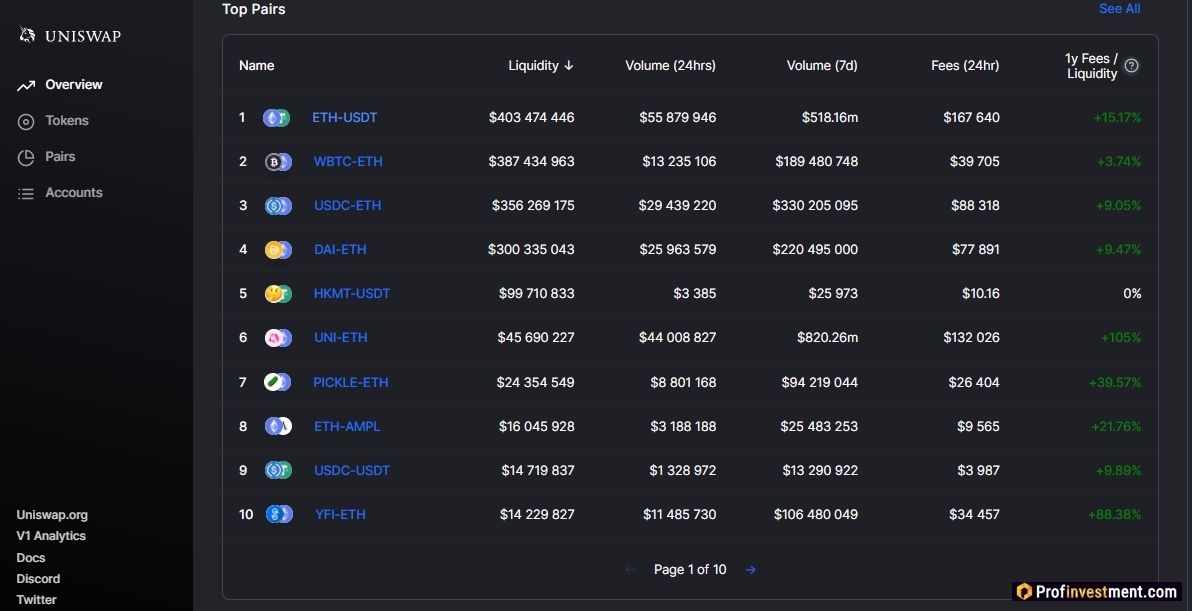

Uniswap

Uniswap is a DEX (Decentralized Exchange Protocol). Allows users to exchange tokens without trusting anyone to store them. The exchange pool is formed by liquidity providers, and then traders trade based on the assets available in it. Liquidity providers receive commissions on all trades in the pool they have invested in. Each pool is a specific trading pair.

Instructions: https://uniswap.org/blog/uni/

Aave

Aave is a protocol for decentralized loans and deposits. Supports automatic correction of interest rates. In exchange for his deposit, the participant receives aTokens, which immediately begin to generate interest income. Also Aave is one of the first projects to introduce the technology of unsecured flash loans.

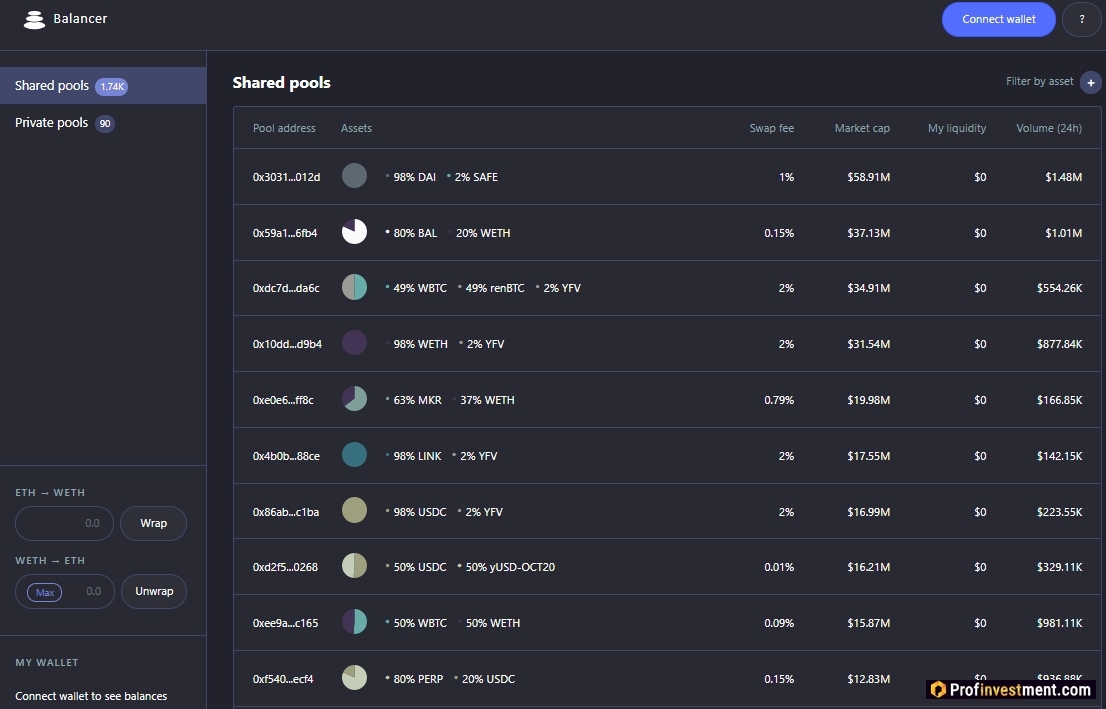

Balancer

Balancer – a protocol similar in functionality to Uniswap, based on the concept of a liquidity pool. It differs in that with its help, users can manage the distribution of tokens in the pool themselves, while Uniswap independently divides investments on a 50-50 basis. Liquidity providers receive commission fees from exchange transactions for their work.

Advantages and disadvantages

Pros:

- The possibility of passive earnings on cryptocurrency.

- A promising high-tech area with great potential.

- Profitability is significantly higher than in banks.

- Large selection of DeFi products with different features.

Minuses

- Risks associated with vulnerabilities in smart contracts.

- Unpredictable profits.

Output

Most likely, the direction of profitable farming in DeFi is just beginning to develop. Over the next few months, the number of passive earning opportunities for users will only grow. Moreover, among these opportunities there are relevant not only for experienced enthusiasts, but also for beginners in the DeFi world.

At the same time, one should not forget about the serious risks that accompany any new technology in general. Invest in capital that you can afford to lose.