UNI cryptocurrency from the Uniswap exchange is among the ten most capitalized coins, showing good growth in the rate and capitalization in recent weeks. The editorial staff of Bitcoinminershashrate.com will tell you how to make money and get Uniswap in 2021, since the asset, according to experts, has prospects for further growth, and can be a successful long-term investment.

The content of the article

Features and distribution of the UNI token

The Uniswap token complies with the ERC-20 standard and is hosted on the Ethereum blockchain. Contract address: https://etherscan.io/token/0x1f9840a85d5aF5bf1D1762F925BDADdC4201F984.

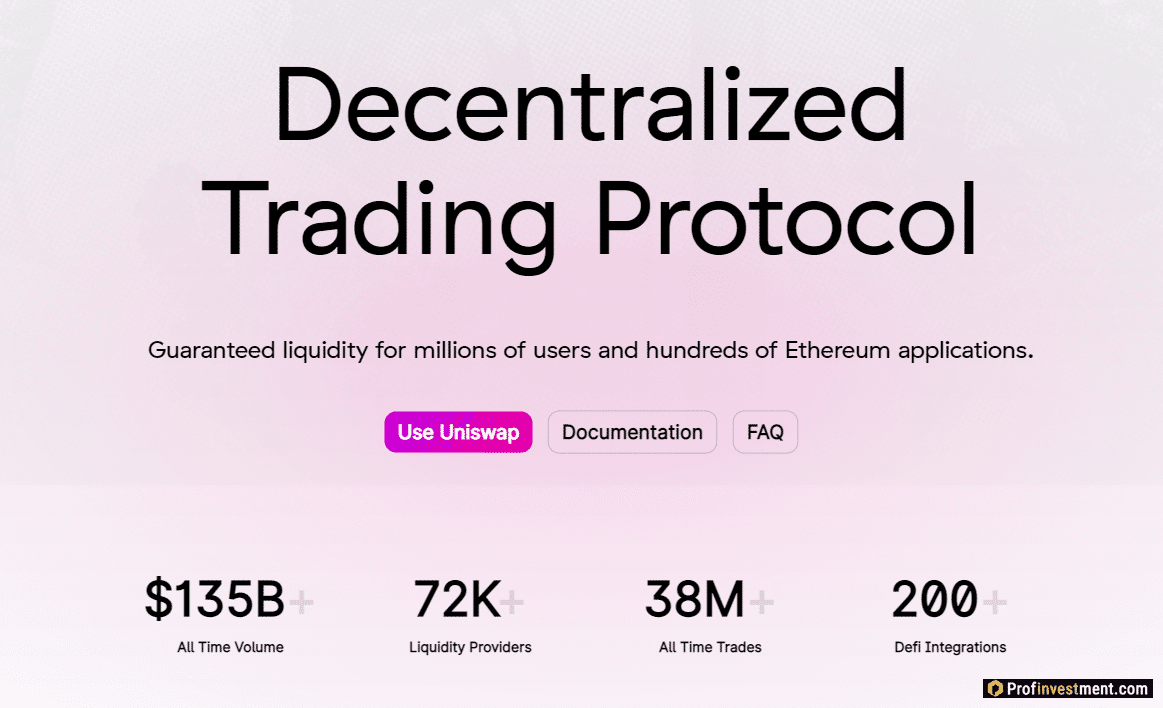

The success of Uniswap as one of the first full-fledged DeFi exchanges has shown that there is a strong demand for financial services that do not require anyone to trust their assets and data. In less than two years after the launch, the number of unique active addresses in the protocol has grown to 250,000, and the total trading volume to $ 20 billion. The introduction of its own UNI token aims to accelerate the future development of the protocol by decentralizing governance.

UNI holders have the right to participate in the governance system by voting – create proposals for the development of the protocol and vote for those that they approve. UNI officially makes Uniswap a self-contained infrastructure without compromising reliability.

In the genesis block, 1 billion UNI was minted. For four years, they will be distributed as follows:

- 600,000,000 UNI – to the community;

- 212 660 000 UNI – current and future member of the development team;

- 180,440,000 UNI – for investors;

- 6,900,000 UNI – advisors.

To stimulate investment in Uniswap at the expense of passive holders, inflation of 2% per year will be launched four years later.

How to earn UNI using the Uniswap exchange

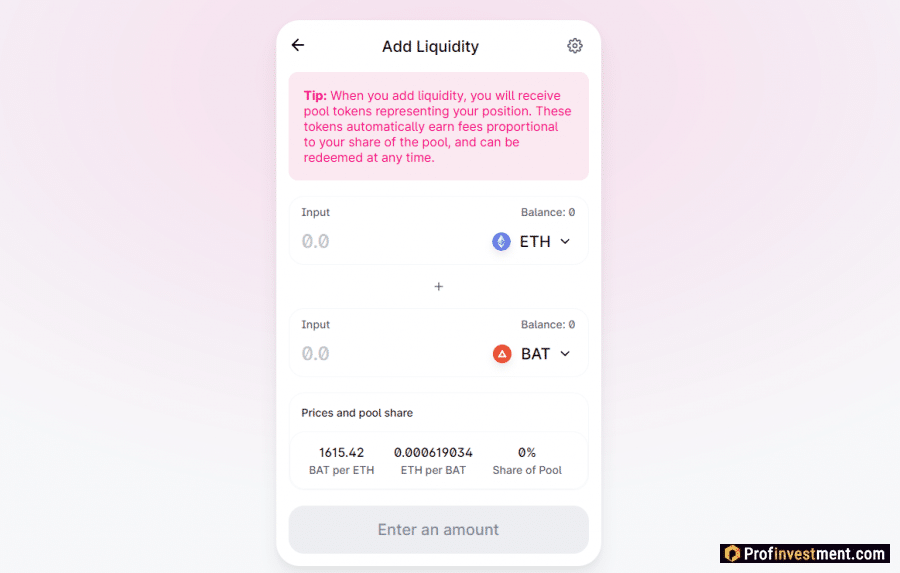

Members can earn tokens, supplying liquidity to trading pools.

You will first need to buy ETH or some ERC-20 tokens. This is done using any wallet convenient for you. Then connect to Uniswap using a wallet, for example, Metamask, and choose a pool in which you think it is most reasonable to invest your assets. It is logical that the more liquidity a certain pool receives, the more competition there is. UNI token is as volatile as any other cryptocurrency, so all investments should be based on technical analysis or personal experience.

Each of the pools, to some extent, pays off the investment the question is which of them is the most profitable to invest in right now. Analysts are of the opinion that investing in any of the pools will pay off, and here’s why:

- If you invest in a highly liquid pool, you will receive a small but frequent profit, because many transactions are carried out in this pool every minute, and part of the commissions from each transaction goes to liquidity providers.

- If you invest in a low-liquid pool, you will receive less profit, but due to lower competition, it will be higher.

Income depends on how much the user has invested in the pool and how much you own it. If, according to your calculations, the operation will bring income, then now we will tell you what to do. Also, when calculating potential payments that are due for the supply of liquidity, be sure to consider transaction costs.

Step by step guide:

Pay close attention to network transaction fees. In the Ethereum network, they are now quite high, so that this expense item can “eat” a significant part of the profit.

Earning UNI on Binance Earn

The Binance exchange provides an opportunity for passive earnings on the UNI token deposit.

The asset is available through the Binance Earn section in the flexible deposits category. This means that you can withdraw your savings at any time without any penalties. Interest rate at the moment – 0.67% per annum (Average Annual Return (APR) refers to the average daily interest rate over the last 7 days multiplied by 365). Interest calculation starts on the second day and the profit is distributed to the user’s exchange wallet. Interest accrual is guaranteed, no matter which way the market moves.

How to get Uniswap

You can also buy an asset in the following ways:

Cryptocurrency exchanges

UNI token is traded on centralized platforms:

And on decentralized ones:

In the first case, you will need to create an exchange account, replenish it with fiat or digital assets, and then exchange them for UNI through a trading terminal or an instant exchange service provided by some exchanges. Depending on the rules of the site, it may also be required to verify the identity and (in some cases) the bank card, if the purchase is made from it.

In the second case, registration or verification is not required, all actions are completely anonymous. You need to connect to the protocol using a web3 wallet, for example: Metamask, Portis, Fortmatic, Coinbase Wallet. Then, each operation is carried out using a smart contract directly on the network, by means of transfers from wallet to wallet. Most of the actions are automated in the blockchain protocol.

Exchangers

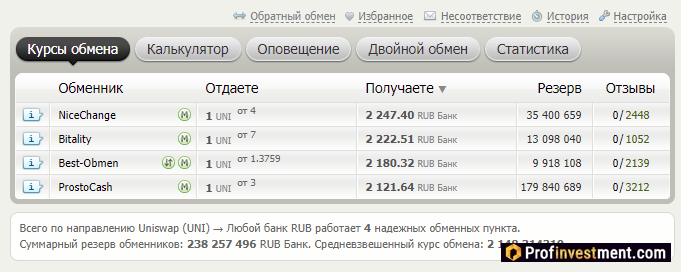

There are not many exchangers with Uniswap support yet, but they are. You can find such with the help of monitoring.

Telegram bots

NiceChange exchanger, ProstoCash and some others have an additional feature in the form of bots for the Telegram messenger. Add such a bot to your contact list and buy / sell cryptocurrency by following the instructions and clicking the corresponding buttons in the chat.

Examples of Telegram bots with Uniswap:

- @Prostocash_bot

- @NiceChange_bot

Where to store Uniswap

Any wallet that supports ERC-20 tokens will do, for example:

- Ledger.

- Safe.

- Metamask.

- Trust Wallet.

- Atomic Wallet.

- Myetherwallet.

The choice of wallet depends on your personal needs. For example, Metamask is the most convenient for interacting with dApps, while Ledger Nano X is ideal for long-term safekeeping of investments.

Conclusion

Since its inception, Uniswap has been helping to promote and popularize decentralized financial services. At the moment, there are many DEXs that have copied the strategy of this platform. However, none of them can compare with the leader in terms of success. For this reason, the Uniswap Token (UNI) is expected to continue to hold more value in the market over the coming years. We talked about how to earn UNI or get it in other ways, and you should choose a reliable and safe storage option.