For the first time in more than fifteen months, Bitcoin has exceeded the $ 10,000 threshold. This weekend, its value has risen to nearly $ 11,250 and is currently traded at around $ 10,850.

As Bitcoin reaches record values this year, analysts point out that the present situation is different from the one in 2017.

Many experts are of the opinion that exceeding the $ 10,000 psychological threshold will trigger the “FOMO” phenomenon (fear of missing the opportunity). One of these is Tom Lee, Fundstrat analyst, who pointed out that once the BTC threshold is reached, BTC will reach new historical records.

Institutions are behind price increases

In 2017, the record value of Bitcoin was triggered by retail investors, who have entered a large number on the market. This time growth is supported by institutional investors, as demonstrated by CME reports. The number of Bitcoin futures contracts on this stock have reached record values of more than 25,000 BTC per day.

Other indicators such as the GBTC premium price and BitMEX Bitcox’s record volumes also suggest that “smart money” enters the crypto market.

The scene is much more mature this time and there is much more information, research and even warnings for new entrants on the market. People can make more informed decisions as space has developed. There are also reasons for well-defined and sustainable Bitcoin growth.

Exchanges offer increased consumer protection, such as the Binance SAFU Fund. It consists of trading commissions and is used to cover losses in case of compromising security.

At the same time, there is no explosion of ICOs, which means that Ethereum and altcoins have been severely affected. ETH still has a lower 80% than its record (ATH) value.

Currently Bitcoin is seen as a value deposit rather than a usable currency.

The foundations of the network are better than ever

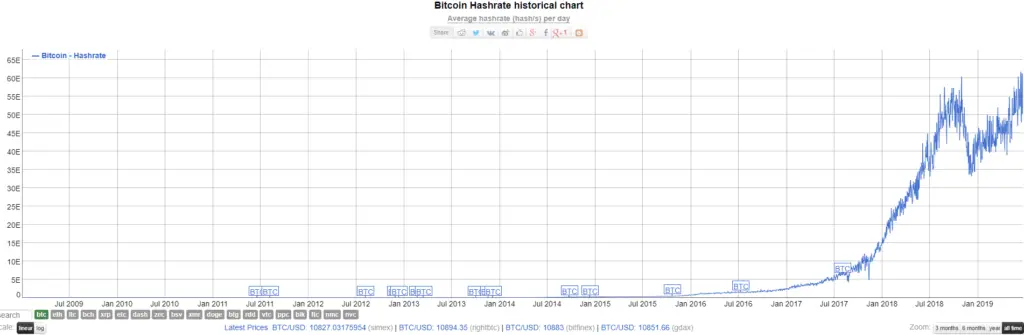

The hash rate in the network has reached a record high of more than 65,000,000 TH / s. In other words, Bitcoin is safer than ever because it would require an enormous amount of computing power to affect the network.

Along with the hash rate, other fundamentals have increased as well. The daily volume of blockchain transactions, block size and other statistics confirm that more people are using Bitcoin.

In addition, network trading fees have remained relatively low compared to 2017. This is due to optimizations such as SegWit and off-scale scaling solutions, such as the Lightning Network. This is a measure that prevents network congestion and facilitates transactions.

Only 11 months until the half-block reward for Bitcoin

The $ 10,000 price increase takes place less than a year before Bitcoin’s half. It will be held in May 2020 and will reduce the block reward from 12.5 to 6.25 BTC. That means miners, natural sellers on the market, will sell Bitcoin less. Probably one of the most important reasons for Bitcoin growth.

The last half of the reward took place in the summer of 2016, more than a year before the price rises to record value. This time, the price increase takes place 11 months before Bitcoin half.

Crypto PlanB analyst suggests that investors are not willing to wait for the expected decline in supply:

“Interested investors are following the market economy assumption: if I believe the BTC will reach 50k in May 2020, why wait until then?”

Yeah that tweet was on Jan 9, 2 months before stock-to-flow was published. I really think the markets are front running the half. If you think S2F and that BTC will be $ 50k May 2020, why wait? Https: //t.co/Uaow6ClmXd

– Plan (@ 100 trillionUSD) June 22, 2019

The macroeconomic scene is favorable Bitcoin

HODLERS are already of the opinion that the Bitcoin price will increase in the long run, as cryptomoneda is not affected by inflation. On the other hand, currencies are issued continuously, which leads to lower purchasing power.

On June 18, the head of the European Central Bank, Mario Draghi, suggested that if the economy does not improve, a monetary stimulus may be launched.

At the same time, Draghi was criticized by US President Donald Trump. Trump argued that such a move would give rise to unfair European competition against the US. On the other hand, the Federal Reserve also suggests that it considers maintaining interest rates at the current level.

Morgan Creek co-founder, Anthony Pompliano, said that these decisions will trigger the issue of several coins. By comparison, Bitcoin has a fixed maximum quantity, which leads to a natural increase in its long-term value.

Therefore, at a macroeconomic level, the situation is favorable for Bitcoin. Many investors in the traditional financial market have also begun to convey that BTC is neutral, open access, which no authority can control.

In other words, what the Internet has done with the information, Bitcoin begins to do for money – DECENTRALIZING

Bitcoin has had a steep upward trend over the past three months. Its dominance is nearly 60% and has grown by 185% since the beginning of the year. All analysts say there is a good chance that the record value of 2017 will be overcome.

I invite you to study the four reasons for Bitcoin’s growth listed in this article, and if there are others, the comment box is all yours.