Traditionally, reducing block rewards for Bitcoin has led to significant price increases for cryptocurrencies. This time, however, analysts are no longer so sure about the halving effect that will occur in 54 days.

The economic consequences of the coronavirus pandemic severely affected the price of BTC. Cryptocurrency fell 50%, from $ 9,000 to $ 4500 last week. Since then, it has shown an increased volatility. The evolution cast doubt on the concept that Bitcoin can act as a security asset in times of crisis.

“The third half of Bitcoin rewards will take place in the context of a catastrophic drop in prices, not to mention huge damage to theories that Bitcoin is an asset that is not correlated with the rest of the economy or a security asset,”

said Matthew Graham, CEO of investment firm Sino Global Capital for Decrypt.

Bitcoin is currently trading around $ 5,400.

The halving effect could lead to the capitulation of the miners

Half the rewards of Bitcoin will have a major impact on Bitcoin miners, reducing their revenue streams by half. But the sharp drop in Bitcoin price means that things will be four times worse.

“The price of Bitcoin has dropped to a level where only the most efficient miners are still profitable. If the price of Bitcoin does not increase, then there could be another collapse of prices, because inefficient miners capitulate and sell inventory on the market ”

believes Ross Middleton, CFO of the DeversiFi exchange.

“The miners were picking up Bitcoin because they expected the price to rise after halving. This accumulation started from the third quarter of last year, “

said Delta Exchange CEO Decrypt Pankaj Balani.

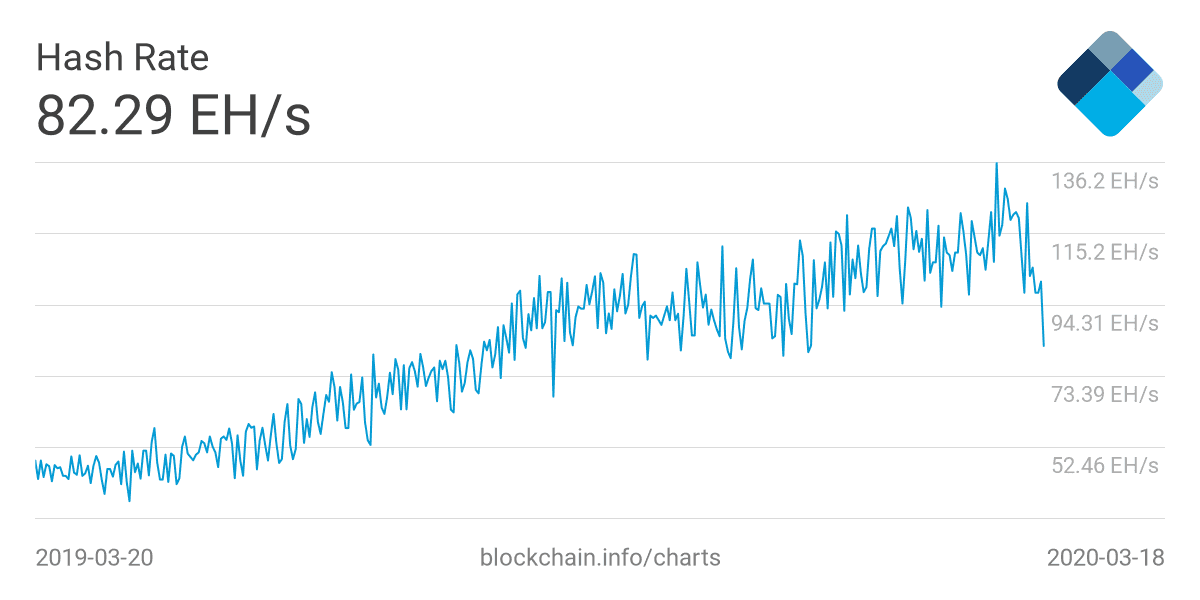

The network hash rate has dropped by 40% since the beginning of March, from 136 ETH / s to 82 ETH / s. This shows that some of the miners surrendered and most likely sold Bitcoin held, contributing to lower prices.

But Mati Greenspan believes that this capitulation of miners will make room for new players in the market.

The effects of the pandemic mimic the reasons that led to the onset of BTC

The coronavirus outbreak caused the conditions that led to the creation of Bitcoin. A decrease in confidence in public institutions, an increase in decentralization, a decrease in the hegemony of the US dollar and the monetary incentives of central banks.

“We see the reasons and conditions of Bitcoin existence, repeated in news headlines, literally every day. Thus, despite the recent uproar, it is difficult to conceive of any better conditions for the third half of Bitcoin rewards. We expect not only extreme volatility, but also an ideal climate for cryptocurrencies ”,

believes Matthew Graham.

Other analysts are less enthusiastic:

“The May halving will demonstrate whether Bitcoin is truly a security asset following the collapse of the banking system caused by the coronavirus pandemic. It is difficult to say now what will happen ”,

said Harry Halpin, co-founder and CEO of Nym Technologies for Decrypt.

Barry Silbert, CEO of Digital Currency Group, which has investments in the entire cryptosphere, a said simply:

“I buy. This is why Bitcoin was invented. ”