Bitcoin and the global economy are inextricably linked. The crypto coin has been developed as a counter-reaction to the economic crisis of 2008. For many, bitcoin therefore serves as a Plan ₿.

At the moment it seems to be going well economically, but more and more signs indicate a new recession. We therefore explain a topic from the macro-economy every Tuesday. So we don’t forget why bitcoin was developed.

Last week we discussed the ever-falling savings rates. We continue this series with the bond bubble. Bonds sound like a far-away-from-your-bed show, but can easily predict another crisis. In this article you can read why.

More from this series?

What are (government) bonds, and why do they exist?

If you buy a government bond, you lend money to a government. In exchange, you receive a fixed interest per year on the value of the bond. Government bonds differ in duration. Long-term bonds (for example, thirty years) often have a higher interest rate. You take a risk if you hold your money longer.

How does it work? Imagine you buy a government bond of a thousand euros for a ten-year period. The interest on that bond is 3 percent. Then you get 30 euros interest every year. You call the nominal value the price at which the government issues the bond. You get interest on that. Simple right?

Bonds are freely negotiable

But it is not that simple. You do not always buy a bond directly from the government. Bonds are freely negotiable, via the so-called secondary market. The value of bonds there reflects supply and demand, and confidence in the market. For example, you may pay more or less for a bond than the nominal value.

That is difficult to imagine, and that is why we can best explain this on the basis of an example. In this example we assume three types of bonds: short term (1 year), medium term (3 years) and long term (10 years). Short-term interest rates are three percent, medium-term rates are five percent and long-term rates are ten percent.

In normal times, the yield looks like a rising line. The longer the duration of the bond, the more return you have. By return, we do not only mean interest, but also the return if you resell a bond.

That then looks something like this (fictional example):

Bond market is changing in the run-up to recession

But in times of crisis, short-term bonds are much less in demand. You will then get your money back in times of a recession. At that time there are fewer opportunities to reinvest your money. The demand for this type of bond is falling, and with it the market price. This market price is often (much) lower than the nominal value.

At the same time, long-term bonds are more in demand. Investors expect that the economy will not improve after one year, but perhaps after ten years. Speculators therefore expect more demand for these types of bonds to come, and sell these bonds for a higher price. Investors are so willing to pay more for the nominal bond value.

It is important that you receive interest on this nominal value, and not on the amount that you have paid for it. That makes for a crazy situation. Short-term bonds then suddenly yield more than long-term bonds. Long-term bonds are traded for a higher price. You also call that the inverted yield curve.

This is a real example from America. Short-term bonds (1-6 months) now yield more than long-term bonds (1-10 years). The blue lines represent the old situation, the brown line the new situation:

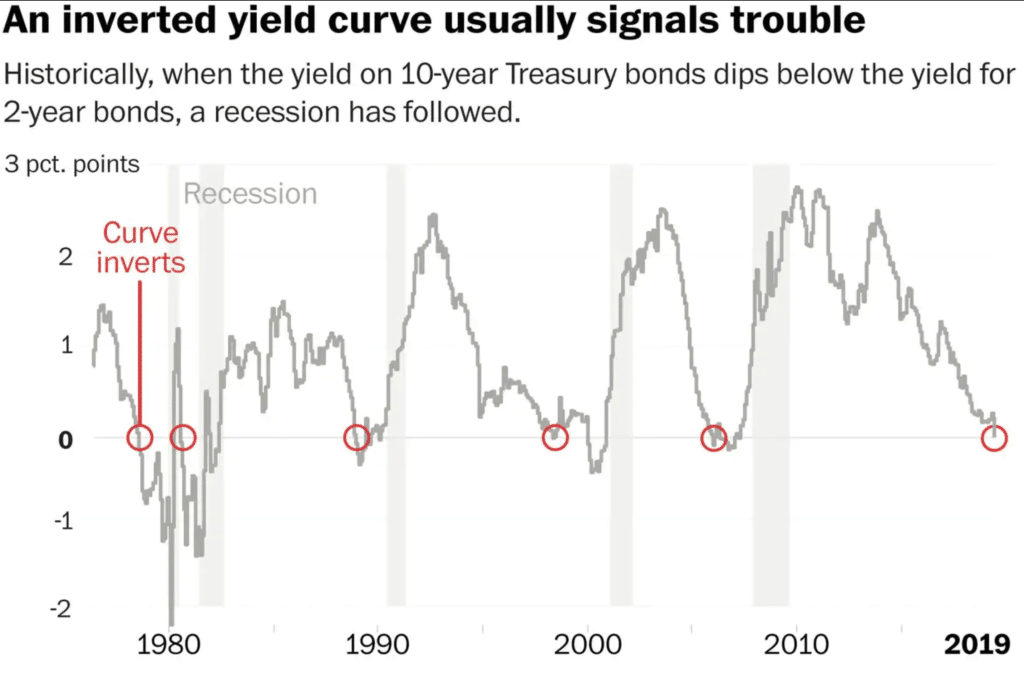

Such an inverted yield curve is often on the rise for a new recession. You saw that, for example, before the dotcom bubble in 2001, and just before the financial crisis of 2008. The inverted yield curve is now also a fact. Will there be a new recession soon?

This is made clearer by the graph below. The line shows the difference between the ten-year bonds and the two-year bonds of America. A value above zero is normal. Long-term bonds yield more than short-term bonds. But every time the value falls below zero (red circles), we get into a recession. On the graph the recessions are indicated by the gray area:

Bond rates fall, but investors continue to earn

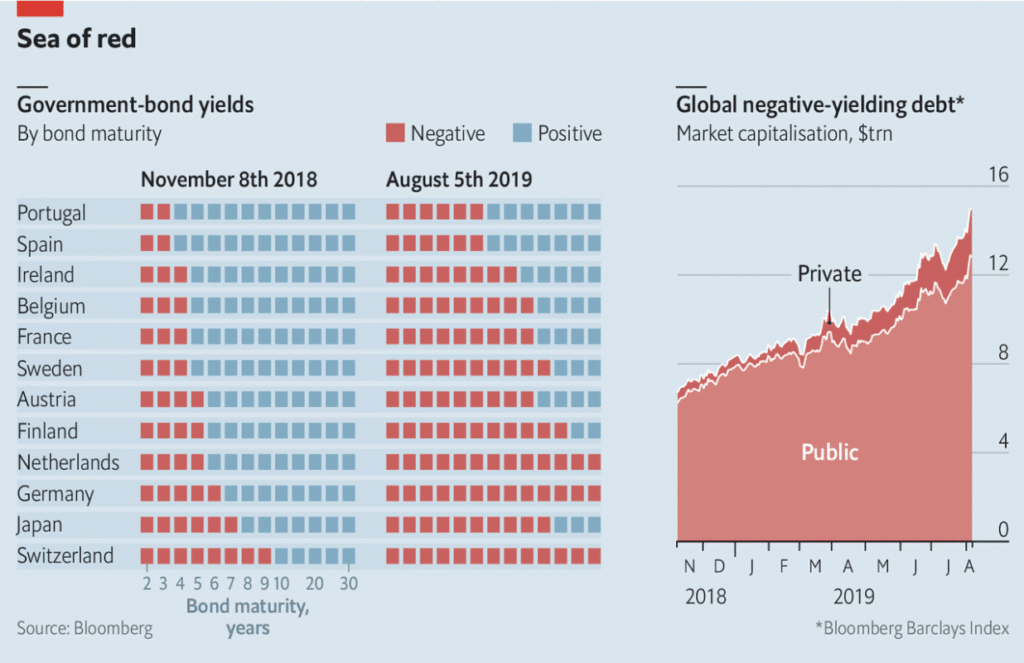

At the moment the interest rates of new bonds are getting lower. So low that the interest is even negative. According to data from IEX, no less than 17 trillion dollars has been invested in bonds with a negative interest rate. That has been written out $ 17,000,000,000,000.

Why are bonds still popular? This is because investors often see government bonds as a safe haven. In times of economic hardship, they see bonds as a better option than shares. That is because a state does not fall over so quickly. And that certainly does not happen with “safe countries”, such as the Netherlands, Germany and Switzerland. Investors are now even willing to buy bonds with a negative interest rate.

The figure below, originating from Bloomberg, shows that almost every government bond produces a negative return (yield):

Speculation is also involved. Market and savings rates continue to fall, so the demand for bonds continues to rise. This also increases the price of bonds. Investors do not buy bonds to take interest, but to take advantage of selling bonds.

A recent calculation example. On May 7, a German government bond with a ten-year term (repayment in 2029) had an interest rate of -0.49 percent. The market value of that bond was 1,028.30 euros at the time. In mid-September you could sell that bond for a market value of 1,070.52 euros. That is an increase of 4.7 percent.

ECB buys government bonds

But who buys government bonds? These are, for example, managers of pension funds, investment institutions and insurers.

But the European Central Bank (ECB) is also making a substantial contribution. From 2015 to 1 January 2019, the ECB bought up 50 billion euros per month in government bonds.

In September 2019, the ECB announced that it would again be buying government bonds. With effect from 1 November, the ECB buys € 20 billion worth of government bonds per month.

Partly due to the interference of the ECB, the value of bonds keeps increasing. But that cannot always go on. Analysts also speak of the bond bubble. A bubble that is about to burst, just like the dotcom bubble in early 2000.

Insure yourself with a bond bubble with bitcoin

Last week you read that saving alone no longer pays. The stock market can also be a risky investment on the verge of a recession. Government bonds seem safe, but the value is being pumped up considerably by the ECB. And how long does that take?

Then bitcoin remains. An independent, decentralized money system that enables you to manage your equity. Without interference from a party such as the ECB. You are as it were your own bank.

It is also not surprising that the plan for bitcoin was published in 2008. It is time for an alternative, a plan ₿.