MOSCOW, 7 Oct — PRIME, Oleg Krivoshapov. Saudi Arabia, having barely agreed to reduce oil production in the OPEC+ format, increased its selling price for this raw material for the US market, clearly ignoring the aggressive rhetoric of the White House about its unwillingness to follow American “oil” interests. What would follow, Prime figured out.

Europe is not afraid for nothing. Whose “ears” are sticking out because of the sabotage at Nord Stream

AMERICANS ARE EXPENSIVE

Saudi Aramco, the world’s largest oil exporter, raised its November official selling price for its US volumes by $0.2 per barrel. At the same time, the cost of a barrel for Asia, where the bulk of Saudi volumes go, remained almost unchanged (although analysts expected a rise in price by $0.4), and even decreased for Europe, Bloomberg noted. The Arab Extra Light variety fell in price by $0.1, the Medium and Heavy varieties went up by $0.25. However, prices for the key Saudi variety, Arab Light, as well as Super Light, remained unchanged.

In the world oil market, when forming the value of volumes, the practice of following special guidelines is common. Most often, you can find a mention of Brent and a discount or markup for this variety. In Saudi Arabia, which is an absolute monarchy, the oil industry (like many other things) is tightly centralized. The export of hydrocarbons is also carried out exclusively by specialized divisions of the giant Saudi Aramco, which, due to the volume of production and export, as well as the quality of the extracted raw materials, is able to work with its customers without focusing on the standards set in other regions. The current policy of oil supplies – the main source of income for the country’s budget – takes into account the monthly revision of the cost of volumes in certain export directions.

If we look back a month, it is easy to see that in early September, the Saudis revised the prices for exported oil. Significantly, by almost $4, the cost of volumes with delivery to Asia and Europe decreased, Oilprice reported. However, this happened for the first time in four months in a row. At the same time, Saudi oil with delivery to the United States rose in price by $0.5.

TAKE EXACTLY HALF

Thus, the price of “black gold” from Saudi Arabia for the US market has increased twice in two months, while the cost of volumes in Asian and European directions has been declining for two months in a row. However, the main direction of Saudi oil supplies is still Asia. And the share of Saudi oil in total US consumption is small: in 2021, supplies from Saudi Arabia amounted to 356,000 barrels per day, with a total daily oil consumption by Americans of 18.684 million barrels. Thus, the increase in the cost of Saudi volumes is unlikely to significantly affect the cost of oil in US ports.

However, the appreciation of the November Arabian volumes, which became known the day before, occurred almost immediately after the announcement on October 5 in Vienna during the regular meeting of OPEC + about the intention of the oil alliance to reduce production. The key stakeholders of this decision – Russia and the same Saudi Arabia – were pointed out by the Western media before the October meeting. In fact, half of the reduction will fall on them: two quotas have been reduced by 526,000 barrels per day, to 10.48 million barrels per day, respectively. However, the total OPEC+ production quota will end up at 41.86 million barrels per day, which is approximately the same as in April, 41.7 million barrels per day.

TOTAL FAILURE OF BIDEN

Probably, neither the increase in the price of oil delivered to the United States by the Saudis, nor even the decision of the alliance of exporters in Vienna, would have attracted much attention of observers, if not for the peculiar background created by the efforts of the current Washington administration. The US authorities have been sending unambiguous signals for quite a long time, in fact demanding from OPEC + a noticeable increase in oil production. They need this on the eve of the congressional elections, but the alliance, whose members are interested in maintaining the current price level, had other plans.

After OPEC +, with its decision to cut production, actually “rolled” the administration of President Joe Biden, the latter had only to express indignation at these circumstances, politicizing it and accusing the Saudis of supporting Russia. US Secretary of State Anthony Blinken called the decision “disappointing and short-sighted” and threatened retaliatory measures, including in the plane of relations with Riyadh. The owner of the Oval Office himself spoke of the event as a manifestation of “myopia.” Support for Washington’s political assessment was voiced by the notorious head of European diplomacy, Josep Borrell, who also said that energy has become “the main geostrategic issue related to war and the balance of power in the world.”

“Pour in cheap oil”: OPEC + put an end to the plans of the West

A new, albeit insignificant, increase in the cost of Saudi volumes for the US market in this regard may also look like a purely political signal to Washington. The alliance’s actions complicate Biden’s attempts to reduce the cost of fuel and deter his intentions to limit Russia’s oil revenues, The New York Times stated.

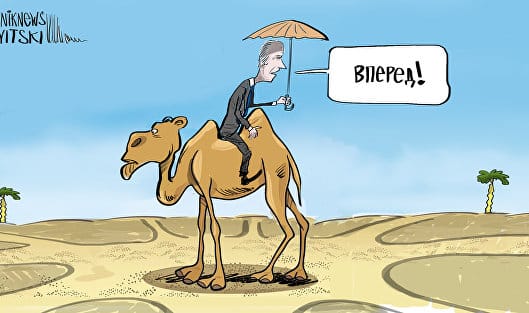

In the summer, Biden paid an official visit to Saudi Arabia, the purpose of which was obvious in advance: to get Riyadh to change its vector to limit production. Experts doubted the effectiveness of this visit even before it began. And now it became completely clear: the mission failed.

In this situation, the current administration has no choice but to once again “open” strategic oil reserves, which, judging by the information of the US Department of Energy, have already reached record low levels. Moreover, an increase in supply by 10 million barrels is unlikely to put long-term pressure on prices. But before the congressional elections, with rising fuel prices, almost half of which is the cost of oil, something must be done. It is possible that the White House will try to punish countries that export “black gold”, but this will not fundamentally change the balance of power in the oil market.