Since the heavy fall of Wednesday, October 23, the exchange rate has become a bit more stable. Stable for bitcoin terms then. In recent days, the value has fluctuated between 6,600 euros (7,335 dollars) and 6,775 euros (7,530 dollars).

But that doesn’t stop bitcoin from continuing. From the beginning of bitcoin to now, 11 billion dollars worth of value has been sent over the bitcoin network. It looks more impressive when you unsubscribe: $ 11,000,000,000,000 in value. Quite a nice statistic!

#bitcoin transferred $ 11 trillion in wealth (2009-2019)

Still going strong at $ 10 billion each day pic.twitter.com/jAphbfYUzh

– PlanB (@ 100trillionUSD) October 24, 2019

Looking back: the course breaks due to support

This month, the bitcoin exchange rate seemed to have found strong support between 7,000 euros (7,780 dollars) and 7,100 euros (7,780 dollars). The price did not fall below this level for a month.

Many analysts therefore thought that bitcoin had found the bottom here. But on October 23 the opposite was proven. The support broke out with great violence. And that happened very quickly. In just four minutes the rate fell by almost six percent.

Analysts still guess at the reason behind the decline. Last Wednesday, Facebook CEO Mark Zuckerberg had to appear before the US Congress. There he had to explain about Libra, the cryptocurrency that Facebook wants to launch.

The decrease in bitcoin was on the same day. Many mainstream media also write about the influence of the session on Facebook on the course of bitcoin. But that may seem like far-fetched.

Another possibility is the bitcoin futures contracts that expire at the end of the month. Large investors on the futures market can also influence the cryptomarket. You saw that last month too. The price of bitcoin fell sharply on 24 September, just before the conclusion of bitcoin futures contracts. And now, a month later, we see almost the same pattern. 400 bitcoin was sold in just four minutes, at the Bitstamp crypto fair alone.

Chances of rising in the short term

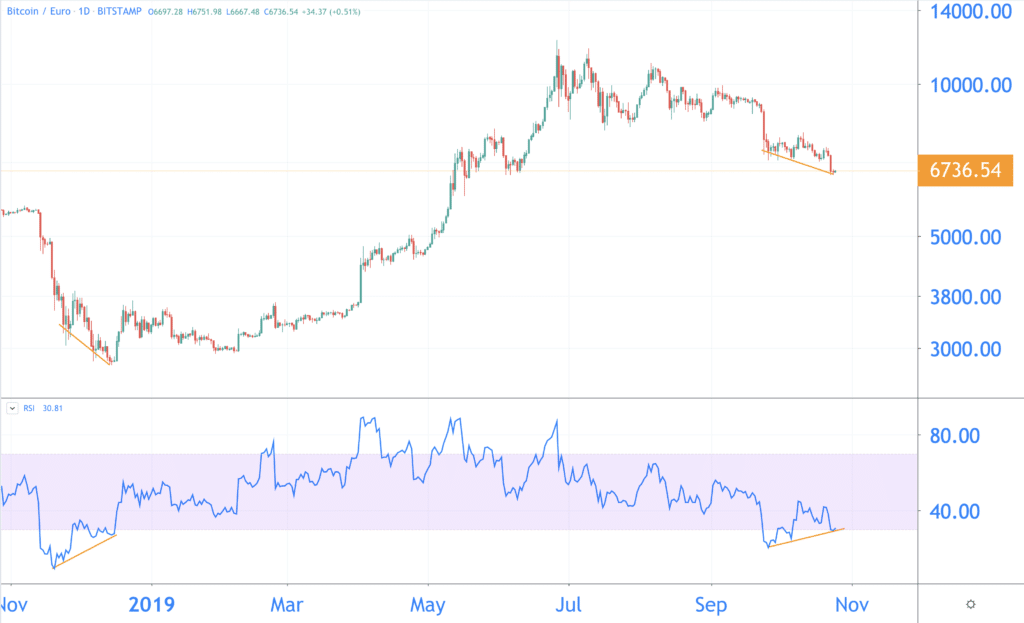

We leave the news for what it is and look at the graphs again. The graph below shows the bitcoin graph in euros at day level. So every candle on the chart represents a day:

If we look at the price (above) and the RSI (below), we see something that can be positive for the price of bitcoin. There is indeed divergence to be seen.

That is a difficult word, but it can be recognized by the difference between the price and the RSI. The price makes lower bottoms, you can see that in the falling trend line. The RSI makes higher soils, you can see that from the rising trend line on the bottom graph.

The RSI shows the momentum of the course. At the moment the price of bitcoin is under the purple band. That means that bitcoin is oversold. Or in normal Dutch, too much bitcoin has been sold in too short a time. The chance of an increase is then greater to restore the balance.

Situation is similar to November 2018

This divergence is reminiscent of November 2018. On November 14, 2018, the bitcoin course made a dive. The price of bitcoin dropped from 5,500 euros to 2,800 euros.

Bitcoin is also making a major leap into the deep now. Bitcoin fell from 9,135 euros to 6,605 euros from the end of September.

Just as in November, the RSI is considerably oversold and there is divergence. Results from the past offer no guarantee for the future, but can give you a good idea. Or as Mark Twain says: “History does not repeat itself, but it often rhymes.”

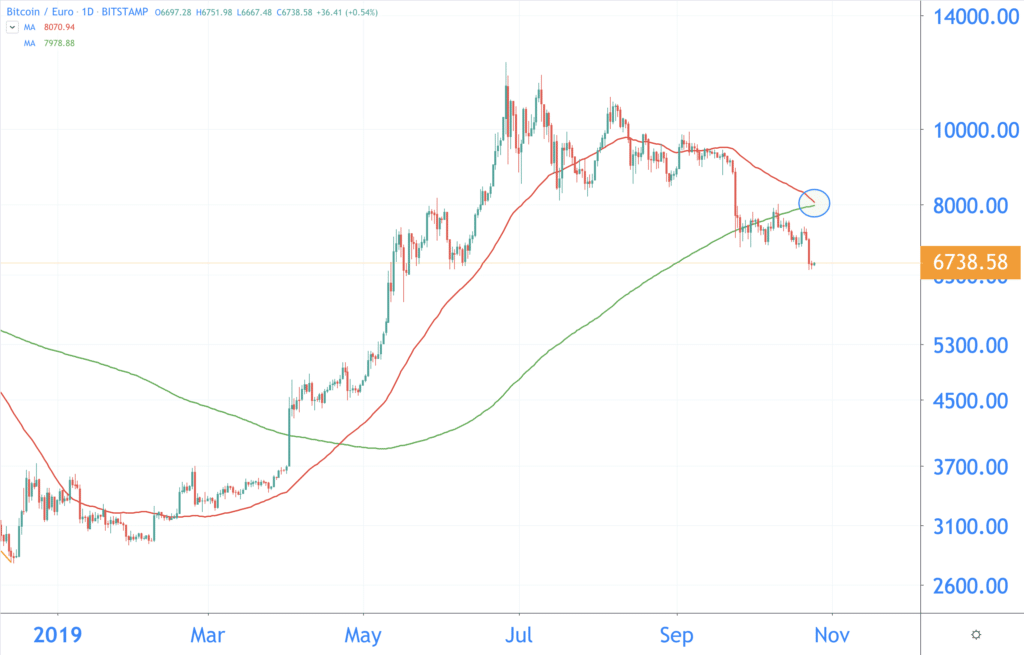

Bitcoin balances on the edge

This is not the first time we have mentioned it, but it is still exciting. There is almost a death cross. A death cross occurs when the 50-day Moving Average crosses with the 200-day Moving Average. And that is usually not a good sign. This may indicate a prolonged period of decline. We will come back to that in a moment.

Striking, by the way, if you change the graph to dollars, then there is already a death cross:

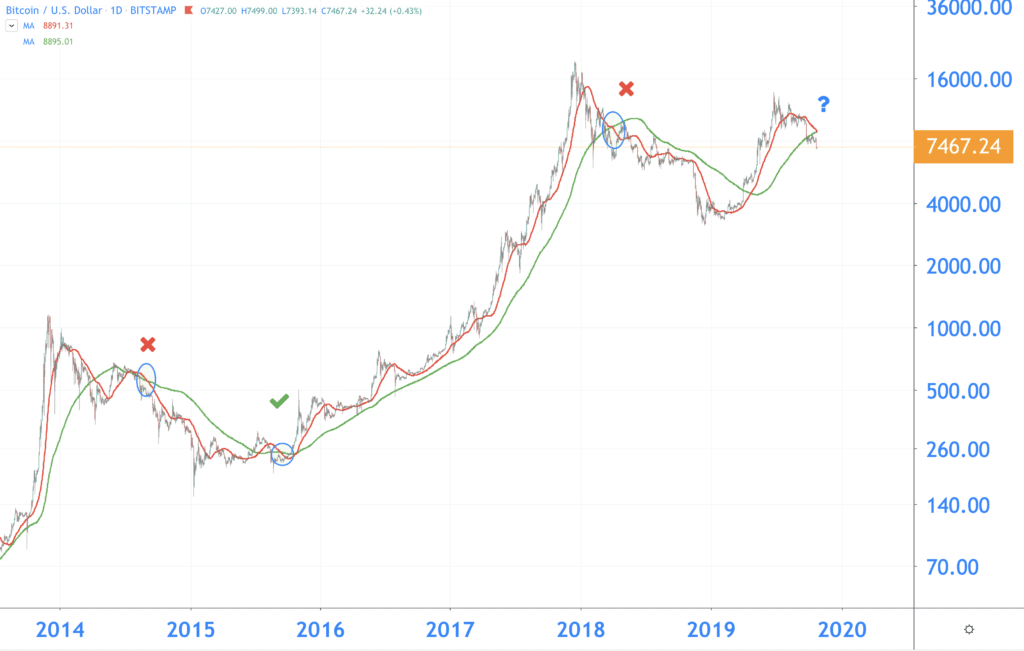

But what does a death cross say? Reason for panic?

That’s not necessary. With bitcoin, a cross between these two lines gives rather mixed signals. Let’s look at the past:

- On 4 September 2014, the signal was for a decline. The rate then fell by more than 67 percent.

- But on September 13, 2015, the death cross indicated a bottom. The rate then rose by 8,514 percent to the top of 2017. A bit of a shame if you had sold then!

- On March 21, 2018, the death cross again gave a clear signal. The rate then fell by more than 54 percent to the low of 2,800 euros.

- And now? To use just one cliché: time will tell.

What will the bitcoin course do now?

Bitcoin seems to find support on this point. But yes, we said that last week and see where we are now. That is why we describe two scenarios, because anything can happen in bitcoin! We express the resistors in red and the supports in green.

Bullish

Will there be a recovery? Then we first have to overcome the zone around 8,000 euros. This was the support of last week, which can now serve as resistance. Suppose that succeeds, then 9,500 euros becomes interesting again. That was the support between June and September.

Bearish

But is bitcoin falling? Then it can sometimes go fast. The next support of interest is 6,200 euros. This was an important support throughout 2018.