These are unprecedented exciting times for the bitcoin course. The opinions of analysts on the internet vary widely. Some believe that this is a breathing space for a new wave up, others think that this may well be the start of a new bear market.

That is why we have split our analysis of this week into two. Are you positive and do you believe in the bull market? Then read on!

But if you believe that the decline is not yet over, check our other article:

Looking back: bitcoin course breaks out from bottom of triangle

In recent months you could not open a price analysis from us without talking about “the triangle”. But we call it in again for a look back.

On Tuesday, the course broke through the bottom of the triangle with a lot of force. This led to a fall of more than twenty percent in total.

Now the rate seems to be stabilizing at around 7,300 euros. We have indicated this zone with the green bar. This price level corresponds to a number of tops and bottoms in May and June. It may well be that this level provides support in the short term.

Divergence causes the price to rise in the short term

The falling trend of bitcoin may soon be over. If we look at the hour chart of bitcoin, we see negative divergence. The price makes lower bottoms, but an indicator (here the RSI) shows higher bottoms.

We indicate this difference in both graphs with blue trend lines. In many cases this variant of divergence leads to a price rise in the short term.

And that change to a rise is not a bad idea at all. The Relative Strength Index (RSI) indicates that bitcoin has been oversold for a while. The RSI displays the momentum of the price, comparing today’s closing price with yesterday. This yields an index between zero and one hundred.

A value below thirty (under the purple band) means that bitcoin is sold a lot in a short time. And that is a positive signal, it can mean that the trend is reversing soon.

Does the bitcoin rate now find support?

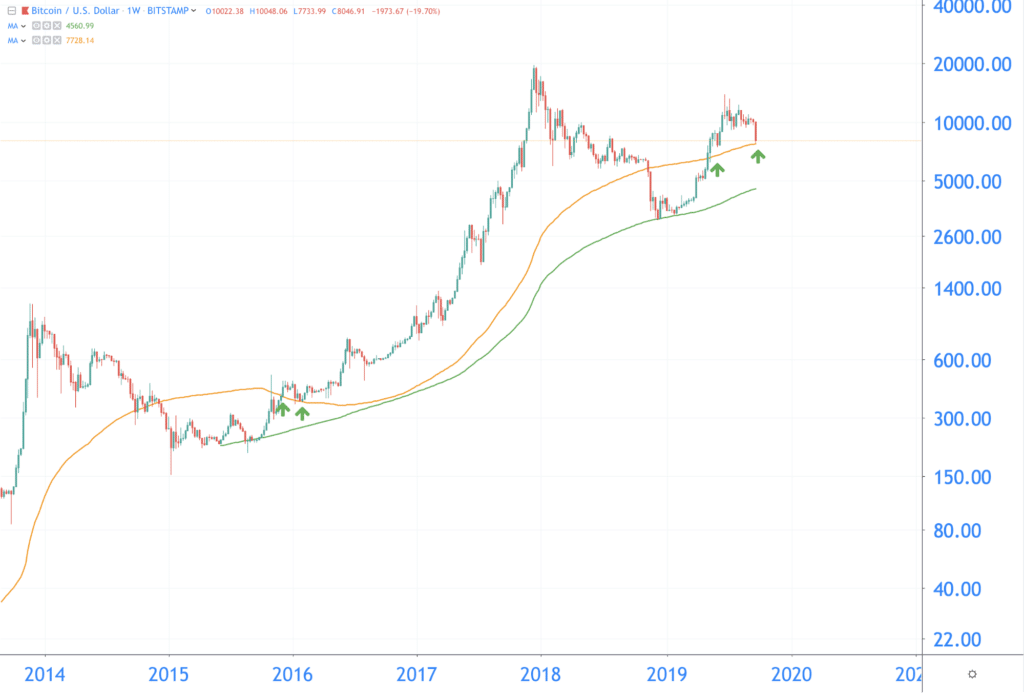

How bad is the decline in the long term? If we zoom out the graph we see something that can give hope.

Below you can see the bitcoin rate at the weekly level. The green line is the 200-week MA and the orange line is the 100-week MA.

In 2016, the bitcoin rate exceeded the 100-week MA. But the price did not pass immediately afterwards. First the line was tested. That means the course touched the line before it found its way up. We have indicated this moment of testing on the graph with the green arrows.

It is possible that the price must now also test the 100-week MA. In that case, the price of bitcoin will rise steadily again in the coming weeks.

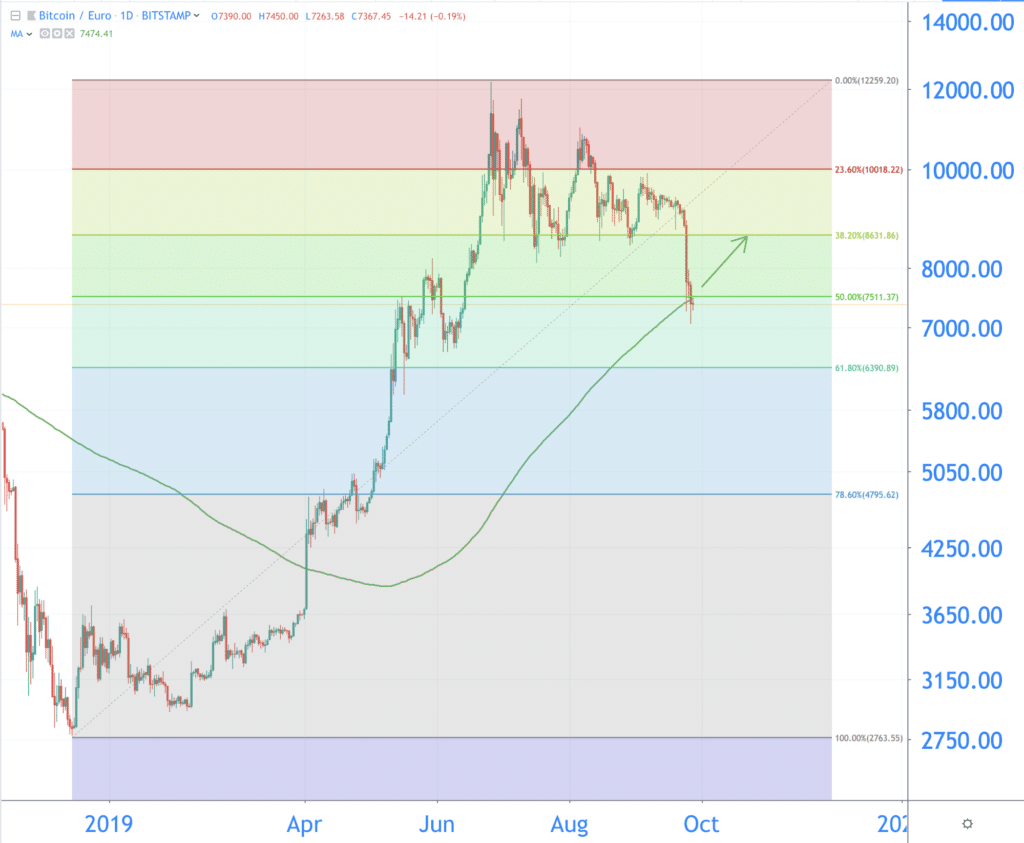

Where is the course going?

To get an answer to this question, we combine two things in the graph below. The 200-day Moving Average (MA) is the green line and the Fibonacci series are the surfaces with different colors.

Bitcoin must first rise above the 200-day MA. In that case the bull market remains intact. The next goal is the next level of Fibonacci. That is now around 8,600 euros. We expect that the bitcoin rate may encounter some resistance there.

Do you find this too optimistic? Then check out our bear article:

Bitcoin price analysis: What if bitcoin price continues to fall? The bear scenario

Header image by Eva K., edited