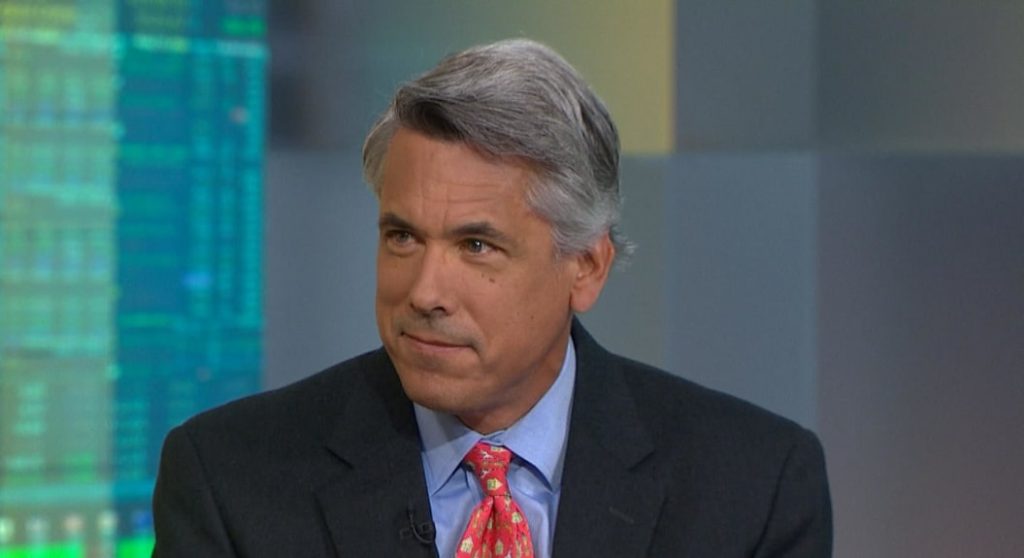

Agecroft Partners founder and CEO Don Steinbrugge recently claimed that Bitcoin will become an important part of investment fund portfolios.

In an interview with CNBC on August 6, 2019, Steinbrugge described cryptocurrencies as “fantastic technology”. He also praised Bitcoin for its inflation protection function.

Bitcoin has been on an “amazing run” lately – So amazing that one CEO argues it will become part of a lot of hedge funds’ portfolios. https://t.co/JZSCDVwzbb pic.twitter.com/88zHiQJ8F5

– CNBC (@CNBC) August 6, 2019

Steinbrugge also made a forecast:

“Bitcoin is here to stay. In the long term, Bitcoin will become part of a lot of investment portfolios. ”

Investor interest is growing against the backdrop of economic uncertainty

Steinbrugge said he was impressed by the recent evolution of Bitcoin and that investor interest is growing worldwide. This is also stimulated by the uncertainty resulting from ongoing trade wars and the impending monetary wars.

Many analysts have argued that the recent evolution of the price of Bitcoin was due to persistent concerns about the current US-China trade war. Now, trade war is threatening to spread in monetary policies, further fueling uncertainty.

In times of financial uncertainty, both gold and Bitcoin values have been heightened by escalating trade war.

Bitcoin is becoming a favorite of hedge fund managers

Steinbrugge joins a number of hedge fund managers and investors who are already taking steps to integrate Bitcoin into their portfolios.

An example of this is Bill Miller, founder of Miller Value Partners. In 2017, he allocated half of his hedge fund to the BTC. As a result, Miller reported, it achieved profits of 46 percent in the first half of 2019.

More recently, in July 2019, London-based Prime Factor Capital became the first financial firm to obtain approval from the UK Financial Conduct Authority to launch an investment fund dedicated to cryptocurrencies.

According to the report published by the audit firm PwC in 2019, there are approximately 150 active funds dedicated to cryptocurrencies. They manage a total of $ 1 billion in managed assets (AuM).