On Bitfinex, the number of bitcoin in long positions is at a historically high level. What does that say about the price of bitcoin? And the British elections had been yesterday, does that affect the bitcoin price?

Brits can buy bitcoin for less

This morning most of the votes in the British elections were counted. The Boris Johnson party won 362 seats in the Lower House, the Labor Party lost no fewer than 42 seats. This makes the Brexit closer than ever.

When the results became known, the British pound rose enormously compared to the US dollar and other currencies. There is more certainty about the future, and that gives confidence. The rate of the pound is rising:

A side effect of a rising pound is that Britons can buy bitcoin cheaper. To make a fair comparison, we look at the bitcoin rate on the Coinbase crypto exchange. There you can buy bitcoin with dollars, but also with British pounds.

On the graph you can see that the courses follow the same path for a long time. But from yesterday evening at 11 p.m., the difference between the US dollar and the British pound is much bigger.

Trend line is now being tested

We go back to the bitcoin graph in euros. The graph is rather broad, because the same trend line has been important for a long time. Until Friday, December 6, the course will not succeed in breaking out of this trend line. That is now successful, but not yet with conviction.

The bitcoin course now searches the trend line again, you can see that the course has touched the line twice. You also call this touching the trend line testing. And that can be positive, certainly in combination with another indicator.

The RSI shows a rising movement. And that while the price is falling lower. You call this divergence, and that may mean that the rate will rise again soon.

Longs at a historically high level

It is also striking that the number of bitcoins in long contracts on Bitfinex is higher than ever. If you go long, you bet on a bitcoin price rise. The opposite of long is short, then you believe that the course will fall. You can use bitcoin and earn in the event of a price rise or fall.

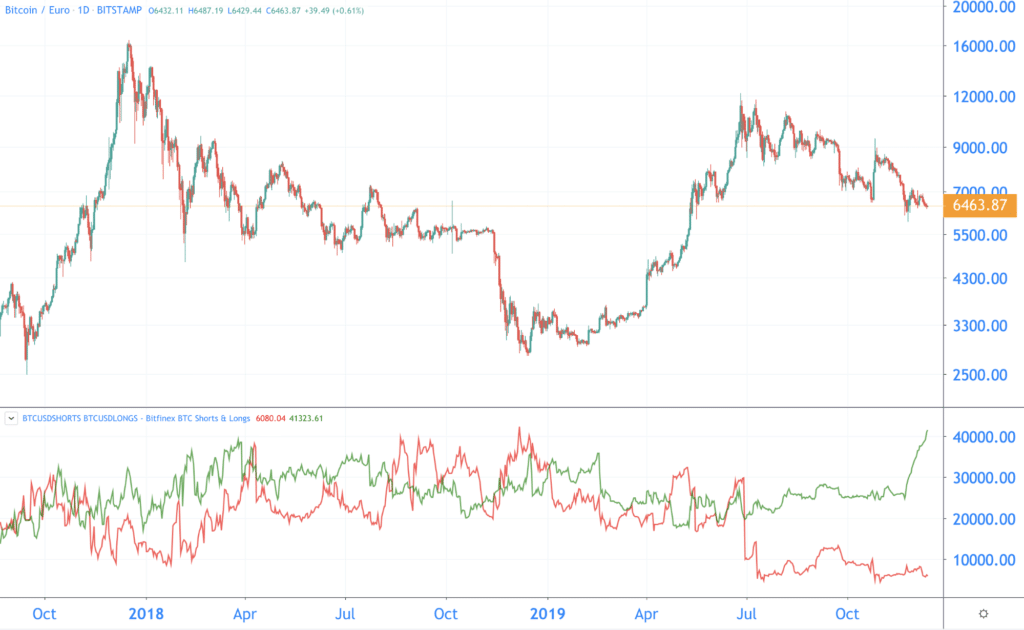

The ratio between long and short can be seen on the graph below. In green the number of bitcoin in long contracts, in red the number of bitcoin in short contracts.

Three things stand out:

- The number of BTC in long contracts is historically high

- The number of BTC in short contracts is lower than ever

- The difference between long and short is greater than ever

What does that say? That’s hard to say. You could say that investors are confident that this price level is the bottom of bitcoin. It indicates a more positive sentiment on the market. That is at least what you may read on other websites.

But don’t draw your conclusions too quickly. The figures indicate how many bitcoin there are in long and short contracts. In addition, it only concerns investors who go long or short with borrowed bitcoins. The figures say nothing about:

- how many traders go long or short;

- how many contracts are involved;

You must therefore view this data critically. Who knows, there might be one whale or a group of investors with a large wallet. That can disrupt the data considerably. Nevertheless, the graph can give you an impression of sentiment. Bitfinex is a big party when it comes to long and short contracts on bitcoin. Over the past seven days, trade volume was nearly half a billion dollars.

Use long and short to predict the rate

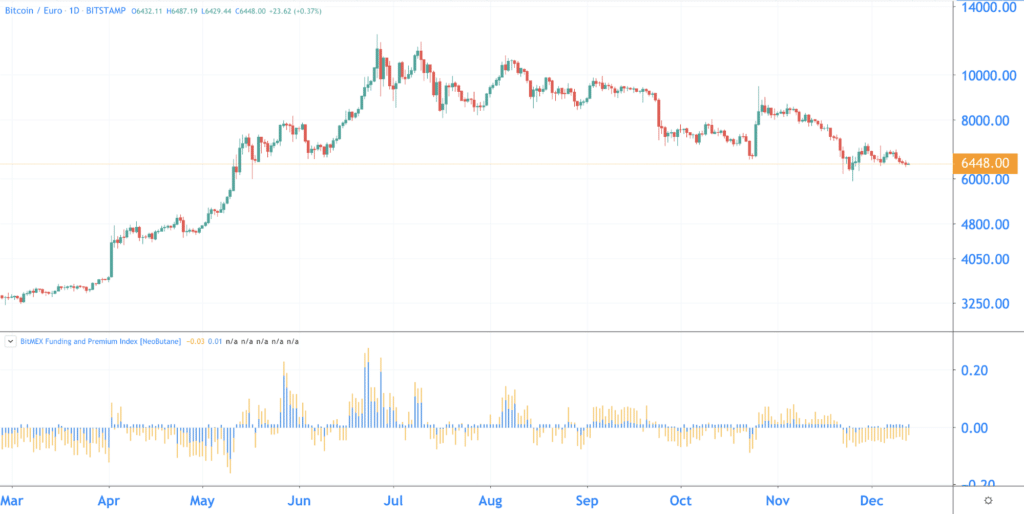

At Bitmex you can also gamble on the bitcoin rate. Bitmex is a larger party than Bitfinex, and data from this party also gives you a good idea of the bitcoin market.

Just like with Bitfinex you do not buy bitcoin directly. You can use a Bitmex mechanism to predict the rate. It’s about funding. That sounds complicated (and it is a bit), but it is interesting to know how this works.

Bitmex strives to keep the price on their platform equal to the bitcoin price on other exchanges. To achieve this, investors with longs and shorts pay each other some sort of interest. This is called funding. Funding therefore acts as a kind of mechanism to keep the price on Bitmex the same.

Funding works like this on Bitmex:

- Is the price on Bitmex higher than the price of bitcoin on other exchanges? Then the longs pay the shorts. You call that positive funding.

- Is the price on Bitmex lower than the price of bitcoin on other exchanges? Then the shorts pay the longs. You call that negative funding.

The ratio of funding is shown on the bottom graph. Above zero means positive funding, and below zero means negative funding:

How do you use this to predict the rate? This is possible:

- Is the ratio positive for a long time and is the interest rate high? Then have to longs a lot of shorts Pay. If that takes too long they close their position. You can see that for example at the end of June. Extreme optimism soon came to an end and the rate fell.

- But you see that in December shorts especially on longs Pay. Will it stay that way for a long time? Then it may be that shorts close their position. And maybe go for long. You can now see that with Bitfinex, there is more bitcoin in longs than ever. Perhaps good for the bitcoin course in the long term!