Cryptocurrency exchanges abuse the inflated trading volumes. This means that really fewer cryptocurrencies are actually traded on exchanges and the market as a whole than stated.

The problem with determining the actual trading volumes was recognized by CoinMarketCap and announced that it would work on its algorithms to provide more accurate information about trading volumes. The material on market liquidity was prepared by Viktor Kochetov, CEO of Kyrrex cryptocurrency exchange.

According to Bitwise Asset Management, 95% of the BTC trading volume was created by exchanges “from the air”:

Source: Presentation to the U.S. Securities and Exchange Commission / Bitwise Asset Management

There are several reasons for this. All of them are related to marketing and attracting new customers. Firstly, ordinary users tend to trust large exchanges more than small ones. They primarily pay attention to the volume of trade on a particular exchange. In addition, exchanges are inflating volumes in order to increase commissions from projects for listing new tokens and cryptocurrencies.

According to Bitwise Asset Management, only 10 of the more than 80 top exchanges provide real data. And most of the sites are adjustable. At the exchanges from this dozen, the spikes and drops in volumes on the chart are almost identical. This corresponds to the real bursts of activity of cryptocurrency traders at round price values and other behavioral factors. At the other exchanges, histograms of volumes “walk” according to their own laws, which indicates their artificial origin.

Similar reports for the SEC are designed to support the course on the universal regulation of the cryptocurrency market. Even the most honest cryptocurrency exchanges may inflate their volumes, but this is not able to catch a surface analysis.

The fragmentation of the cryptocurrency market

Cryptocurrency platforms, using algorithmic bots, “shovel” mountains of cryptocurrencies both inside exchanges and between partner platforms. Behind every real bitcoin there is a dozen twisted ones – they do not get out of the general trend of the market, but create the appearance of a large trading volume.

A huge number of exchanges leads to fragmentation of trading volumes, which becomes an obstacle to entry of institutional investors into the market.

The average daily trading volume of only 3 exchanges from the top 10 over the past 30 days exceeds 2% of the total trading volume on the market:

| Stock exchange | Volume for 30d ($) | Daily average volume bid for 30d ($) | Market share |

|---|---|---|---|

| OKEx | 27 595 393 489 | 919 846 450 | 2.23% |

| Binance | 26 996 791 651 | 899 893 055 | 2.18% |

| Coinbene | 25 118 397 981 | 837 279 933 | 2.03% |

| Digifinex | 25,053,552,800 | 835 118 427 | 2.02% |

| Latoken | 23,688,465,515 | 789 615 517 | 1.91% |

| Cointiger | 23,654,377,786 | 788 479 260 | 1.91% |

| Bibox | 23,272,482,319 | 775 749 411 | 1.88% |

| Fatbtc | 23,134,797,988 | 771 159 933 | 1.87% |

| Lbank | 22 943 898 793 | 764 796 626 | 1.85% |

| Bitforex | 22 876 092 585 | 762 536 420 | 1.85% |

The indicators of the other exchanges are much lower, but they also draw a portion of the total liquidity onto themselves, spraying the already modest volume of the cryptocurrency market. This state of affairs is unusual for players in classic markets, where a low level of liquidity is a sign of asset instability.

Institutional investors do not plan to buy the necessary asset bit by bit at different sites. Physically, they will not have to do this – almost all exchanges use overlapping positions on competing sites. But this leads to an increase in the cost of the asset due to the resale to the client of the missing volume from other exchanges.

A large client, buying out the entire asset at a certain price on one site, pushes the price up. This includes the arbitration algorithms of either the exchange itself or traders who buy this asset at other sites at a specified price and sell it to a client at a higher cost, aligning the price of the asset in the market. But all this happens at the expense of a major buyer on the first exchange, which acquires a large amount of the asset.

In a situation where the entire volume of the required asset for the client is on the same site, he does not overpay the arbitrageurs for providing liquidity from other exchanges. This is another obstacle for large players to enter the market.

Low trading activity on second-tier cryptocurrencies

The first 5 cryptocurrencies (based on the average daily trading volume) account for 80% of the exchange of assets in the market, with 64% of all trading in two currencies: BTC and USDT. The top 10 is closed by currencies with a trading volume of less than 1% of the average daily market volume.

| Currency | Average daily volume in 30 days ($) | Volume from the market |

|---|---|---|

| USDT | 17 142 499 776 | 33.30% |

| Bitcoin | 15 870 823 103 | 30.83% |

| Ethereum | 6 256 460 078 | 12.15% |

| Litecoin | 2 617 894 181 | 5.08% |

| Eos | 1 372 078 619 | 2.66% |

| Bitcoin cash | 1,279,001,089 | 2.48% |

| Xrp | 1,030,528,255 | 2.00% |

| TRON | 439 398 454 | 0.85% |

| Ethereum classic | 640 390 650 | 1.24% |

| TrueUSD | 344 558 251 | 0.67% |

USDT, in fact, is the dollar, in relation to which cryptocurrencies are wrapped. Therefore, BTC, ETH and LTC are the locomotives of the cryptocurrency market trade turnover.

A similar situation is observed in the capitalization of the crypto market, where about 65% is occupied by bitcoin, and the first five currencies account for 80% of all volumes. This means that the excitement and speculative actions in the market are aimed only at first-tier cryptocurrencies.

This situation confirms that in the future, the development of the market and the involvement of cryptocurrencies and blockchain in the real sector of the economy will lead to the “withering away” of weak cryptocurrencies, which even now, in the speculative era of the crypto industry, cannot increase liquidity.

It is difficult to assume that the major players in the classic market will come for “second-class” crypto assets. When a lot of money enters the market, the balance of power will change even more, as investors will be focused on strengthened cryptocurrencies or tokenized assets from the classical financial world.

It can be assumed that, following the current illiquid assets, cryptocurrencies and tokens will enter the market, which will have a strong foundation due to business from the classical market (Facebook’s Libra) or to benefit the economy and society.

Insufficient legislative framework for the entry of “big money” into the cryptocurrency market

Now institutional clients do not want to invest in crypto assets. This is due to distrust of both the cryptocurrencies themselves and the sites on which they are traded. A weak regulatory framework cannot ensure the reliability and security of large investments. The lack of a single regulatory body reduces the confidence of major players in the market. Those institutions that establish rules for regulating the cryptocurrency industry have a narrow range of influence. Often these are representatives of individual states that regulate the market within their borders.

Some authoritative world-class institutions, including the SEC (US Securities and Exchange Commission), have not yet developed comprehensive measures to regulate the cryptocurrency market.

This level of security does not suit holders of large capital. This is one of the main reasons why the cryptocurrency market is not filled with institutional liquidity.

Institutional capital is needed to stabilize the crypto industry, and it still lacks stability and security to enter the big money market.

Like any era of change, the current period of transformation of the crypto industry from a chaotic volatile testing ground for speculators into a liquid, stable, professional market is slow and difficult, reorienting the values of all participants in the process.

Narrow market – the reason for the large-scale volatility of cryptocurrency rates

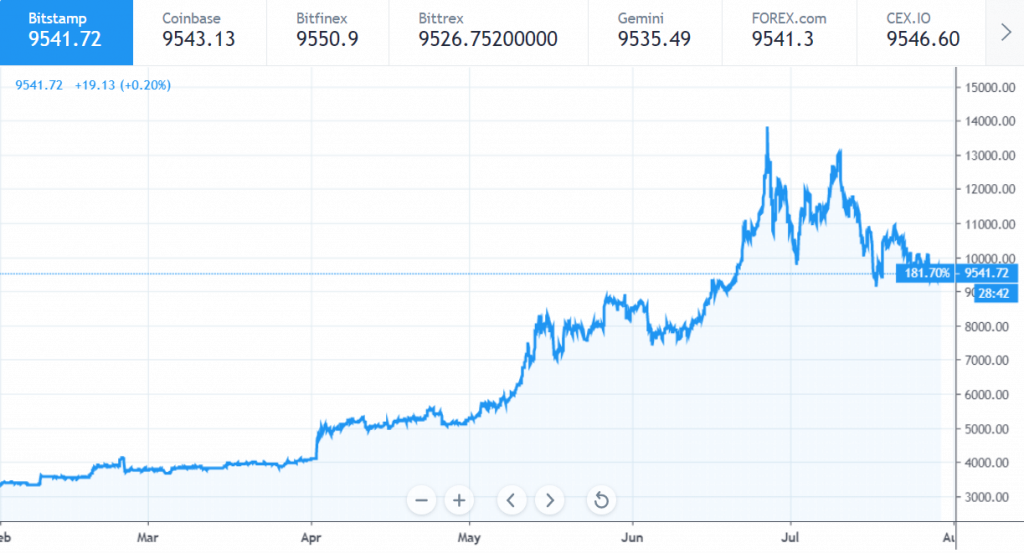

The cryptocurrency market is extremely volatile. To illustrate this, we compare the movement of bitcoin and euro prices against the US dollar over the past six months (from February to August 2019).

The bitcoin price chart on the Bitstamp exchange showed the minimum value for this period at around $ 3362, and the maximum – $ 13789. So, the maximum price increase was 310%.

Source: TradingView

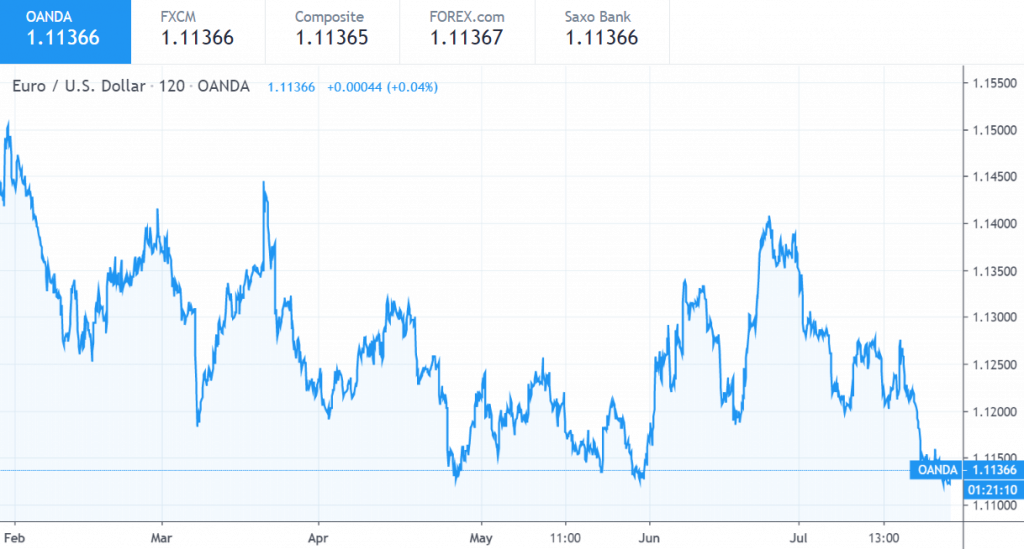

The graph of the euro value for the same period showed a maximum at 1.15050, and a minimum at 1.11218. This means that the maximum change in the price of the euro against the US dollar for six months amounted to 3.33% of the initial position.

For the period from 07/07/2019 to 08/07/2019, the price of bitcoin also showed high volatility, not comparable to the level of movement of classic fiat instruments.

Source: TradingView

The reasons are insufficient liquidity and the lack of market makers of the classic financial market. High volatility, along with the ability to hit the jackpot, carries great risks. Current cryptocurrency trading is more like a casino game, where a tempting reward attracts more and more naive customers who are losing money in the pursuit of profit.

Professional financial funds are gradually moving to the bitcoin market. This is indicated by the rather “faceted” movement of the Bitcoin chart with a very clear absorption of price levels, where, as in the textbook, most traders set stop-loss orders.

The market is not yet institutional investors, but professional traders who will accumulate cryptocurrency capital in one hand while continuing to “shake out” ordinary small crypto enthusiasts. There is a “primary accumulation of capital” for the further play of “big money” in the cryptocurrency market.

The lack of liquidity and the large fragmentation of the market indicate its instability. This is due to the reluctance of large players to go out on it. The lack of a powerful legislative framework does not yet favor blockchain development as part of the real economy.

But the blockchain has already begun to develop as a technology that can solve pressing problems. In parallel with the entry of institutional investors into the cryptocurrency market, their level of confidence in blockchain projects useful to society will increase. The stage of chaotic formation of a new sphere of speculative relations is passing. Soon, blockchain and cryptocurrencies (as a recognized means of calculation) will enter everyday life.