This week, the crypto market has experienced a lot of volatility, but in the short term the signals are positive.

The indicator of fear and tiredness reaches the level of fatigue!

For example, Bitcoin fluctuated in the range of $ 9,100- $ 9,800, managing to stay above $ 9700 over the past few days. At this price, cryptocurrency seems to be taking a break from stabilization, but there are signs that it has the potential to reach higher values.

The “fear and greed” indicator has reached the level of “greed” for the first time in recent months, as the $ 10,000 psychological threshold seems closer.

Active futures markets

Even the rise of Tesla stock prices (TSLA), with over $ 900, has increased optimism in crypto markets. In addition, the futures markets suggest that the BTC may be preparing for more agitated movements.

The Bakkt trading platform was again animated, with another record in the open interest, as the BTC enters a more interesting price path. Bakkt activity was cautious in January, despite gains from Bitcoin.

Bakkt’s BTC Futures Open Interest reaches a new all-time high. pic.twitter.com/9ve3pdqCtT

– skew (@skewdotcom) February 6, 2020

But the largest hub of activity remains BitMEX futures, which reached $ 1 billion in open interest. Critical price levels for BTC can translate into dramatic short-term movements, as well as a battle of positions to test the real power of optimistic attitudes.

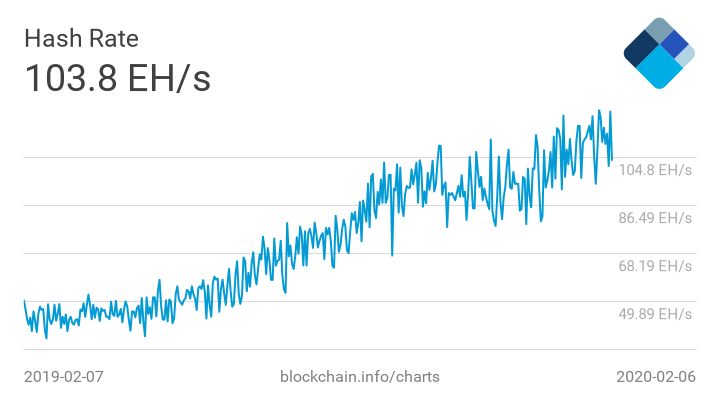

Hash rate and increasing number of transactions

There are also more subtle indicators on the medium-term evolution of Bitcoin. Mining has reached new maximum values, with increasing difficulties. For this reason, the half of the block reward has been delayed, estimated to take place on May 12, not on 15.

Network transactions have multiplied since the price increase over $ 9,600. Last day, the Bitcoin blockchain carried out over 346,000 transactions. Usually, a high transaction rate signals an increased trading activity.

According to Thomas Lee, chief of Fundstrat Global Advisors, Bitcoin has recently surpassed its 200-day average. This is an incredibly powerful indicator that tells us that crypto markets will record growth again. The last time this phenomenon happened. Bitcoin has grown by almost 100%, from $ 7,200 to $ 13,880.

Lee adjusted one of his predictions for the $ 27,000 end-of-year price and told Yahoo Finance:

“So we are really optimistic about crypto and Bitcoin this year. You know, last year, Bitcoin grew by almost 90% – so the highest performing asset class with a factor of three. And we think this year’s profitability will be even stronger, because we have some catalysts, such as halving … I think … coronavirus and geopolitical tensions will contribute to the positive evolution. “