The most influential region in the cryptocurrency market with the maximum turnover of exchanges and mining capacities is undoubtedly East Asia. At the same time, the cryptocurrency regulation policy has its own characteristics in each country.

Material prepared by Viktor Kochetov, CEO of the cryptocurrency exchange Kyrrex.

The regulatory framework of Asian countries is more open to cryptocurrencies and blockchain than the laws of Western countries, but in general it is at a very low level. Cryptocurrency is not recognized as legal tender in any Asian country, and investment projects are fully or partially regulated only in Japan, Thailand and Singapore. The regulation of some countries is in the “gray zone” – cryptocurrency business is regulated by separate legislative acts, decrees or not regulated at all.

Due to the active actions of the regulatory authorities of some countries of the Asian region aimed at tightening regulatory measures against individuals and companies working in the cryptocurrency market, and the ban on investment projects using the blockchain, the total market capitalization decreased from 2018 to 2019 87% (according to Coinmarketcap).

Cryptocurrency market trading volumes have also fallen since mid-2017. BTC trading volume with various currencies fell along with a decrease in the number of BTC / CNY transactions in 2017.

BTC trading volume in various currencies after a sharp decline in the share of BTC / CNY in 2017.

Global investors may lose interest in the cryptocurrency market, as new projects run the risk of not getting government approval.

We have developed a methodology for calculating the country’s investment attractiveness index for blockchain projects. The index takes into account indicators of the economic situation in the country, the risk component for doing business and investment activities. As well as the coefficient of openness of the economic and legal system, which includes a number of indicators reflecting the degree of readiness of the country to accept cryptocurrencies and blockchain.

Characteristics of regulatory systems in Asia

Japan

Japan is one of the main Asian markets that has taken active steps to recognize and regulate cryptocurrencies at the legislative level. They were made after in 2014, the MtGOX exchange lost about 850,000 BTC. The exchange declared itself unable to cover obligations to customers and closed.

Between 2014 and 2015, the Japan Financial Services Agency (FSA), the country’s financial sector regulator, created a group of specialists who developed a document containing recommendations on working with cryptocurrencies:

- registration of companies engaged in cryptocurrency activities;

- conducting transactions and other operations with cryptocurrency;

- security of exchanges and preservation of customer funds.

In 2017, the Japanese government amended the provisions of the Payment Services Act. The changes took effect in the same year and secured the special status of cryptocurrencies at the official level.

The amendments amended the legislative document and did not provide Bitcoin with legal tender status, but defined Bitcoin and cryptocurrency as a “digital payment token”, which has a certain value and can be used to purchase goods and services. In fact, cryptocurrency has been defined as a digital service of a certain value that can be transmitted through an electronic distributed registry.

Since April 2017, activities in the cryptocurrency market in Japan are regulated by the above Payment Services Law. Cryptocurrency exchanges must be registered, keep records, take information security measures and ensure the protection of customer funds, conduct AML and KYC procedures, and other operations prescribed by law.

According to a Reuters report, the Central Bank of Japan said that cryptocurrency cannot be considered a “monetary unit” or “paper currency,” and it is not going to support cryptocurrencies. According to the regulator, the creation of a new cryptocurrency payment structure is not advisable, since the newly created payment system will have a similar structure to the one that is now used to provide traditional payments in fiat.

Despite this, two large financial groups – Mizuho and Mitsubishi – are working to create and issue their own digital currencies: J-coin (from Mizuho), digital coin MUFG (from Mitsubishi). Japanese banks are very interested in developing their own blockchain-based projects and are striving to create a digital currency that can be used together with the yen at the national level. This will allow banks not only to increase profitability and use liquidity more efficiently, but also to improve their ability to store, process and protect personal data of customers.

In 2018, the Japanese government developed a core regulatory sandbox policy. The policy provides for a significant reduction in tax pressure (from 55% to 20%) on income received from trading activities in the field of digital currencies. This can provide the cryptocurrency market with a positive incentive aimed at strengthening the importance of digital innovative technologies for the economy of the country and society as a whole.

Japanese regulators are working to create their own international blockchain-based network aimed at strengthening measures against money laundering. It is anticipated that the new network will be able to operate in accordance with principles and requirements similar to those used by the SWIFT system.

The need for compliance with such requirements was stated in an interview with CNBC on August 20, 2019 by US Secretary of State Mike Pompeo.

Singapore

Singapore does not prohibit the use of cryptocurrencies, but also does not take active regulatory measures to fully control the digital asset market. The legislative framework for cryptocurrencies in this country is still far from perfect, but remains more or less balanced and favorable for companies operating in the field of virtual assets.

Singaporean government authorities have amended legislation to require cryptocurrency exchanges and cryptocurrency financial services providers to register with local authorities.

The Monetary Authority of Singapore (MAS) has developed a regulatory sandbox that allows financial institutions to experiment with innovative financial products in the real sector. Depending on the purpose and the project itself, the regulator can provide appropriate regulatory support, individually weakening individual regulatory requirements.

In July 2019, the Singapore Internal Revenue Office (IRAS) introduced the “Electronic Tax Guide”, which explains the procedure for taxing cryptocurrency transactions. According to this document, Bitcoin and other cryptocurrencies do not have the status of an official means of payment and are considered as a digital payment asset that can be used to pay for goods and services.

Despite the fact that Singapore has rather convenient and flexible legislation governing operations with digital assets, all cryptocurrency projects in this country should be very balanced and reasonable. AML’s anti-money laundering and terrorist financing laws are uncompromising and tough.

When making several cryptocurrency exchange transactions, the parties to the transaction must be prepared for the fact that the bank has the right to block your account in fiat currency and require the provision of clarifications and necessary documents confirming the legitimacy of such operations.

China

In 2013-2017, China managed to become the hottest cryptocurrency market in the world. But already in 2017, the Chinese government took a series of regulatory measures prohibiting activities related to cryptocurrencies. Such actions were aimed at achieving the following goals:

- minimization of financial risks;

- protection of own investors;

- prevention of capital flight from the country.

On September 4, 2017, the government regulatory authorities of China approved official documents containing ICO regulations and rules. In fact, the Chinese authorities declared this type of investment activity illegal and imposed a ban on cryptocurrency attracted through ICOs. Projects that violate these rules are criminally liable. Throughout 2017, the Chinese authorities actively took steps to stop funding for the above projects.

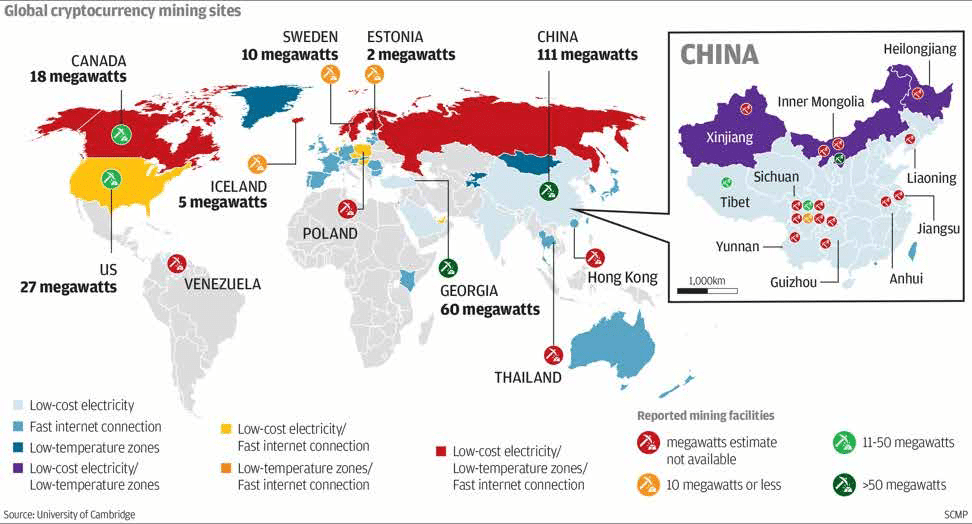

But the Chinese market has not ceased to be one of the largest for trading and cryptocurrency mining. Beijing, Hangzhou, Shanghai and Shenzhen are the cities with the most popular projects and exchanges. Here are based Huobi, DDEX, Bitmain, NEO, MakerDao, ImToken, Nervos and other large projects and companies associated with the blockchain. Mining equipment sales figures in this country show steady growth. According to a study by Cambridge University, China is one of the leading places in the list of world cryptocurrency mining sites.

It is known that large mining facilities are located in Hong Kong. Some regulatory requirements may not apply to this area. But, if the Chinese authorities completely ban mining throughout the country, this could have a negative impact on the development of the cryptocurrency business, which in turn will push the rates of the main cryptocurrencies to another decline.

The ambiguous and controversial state of the Chinese cryptocurrency market is the result of the intersection of several factors:

- closed regulators for any new, especially foreign, projects;

- the regulator’s understanding of the importance of blockchain as a technology;

- openness of citizens to new digital currencies and willingness to use cryptocurrencies in everyday life.

The measures of Chinese regulators and the inability to receive legal income in national currency in this industry significantly affected the trading volumes of the BTC / CNY pair. The global volume of bitcoin traded for the Chinese yuan decreased from 90% to 1% of the world.

Philippines

In 2017, the Central Bank of the Philippines issued a circular according to which digital currencies are not an official means of payment, their issuance and turnover are not recognized and not supported by the state. But digital currencies are recognized as a virtual unit that has a decentralized database and is created by mathematical computer calculations. Such a unit has a certain value and can participate for storing digital assets and exchanging them for other digital assets, including fiat currencies, as well as for paying for goods and services, only within a certain platform.

The legislation provides and allows activities to create and maintain platforms and provide exchange services in cryptocurrency. But such services must receive permission for their activities and clearly comply with the requirements of the Regulation on the regulation of non-banking financial institutions.

The Securities and Exchange Commission (SEC) at the end of 2017 issued instructions in which the virtual currency is classified as “securities” and “investment contracts”, which requires market participants working with virtual currency to fully comply with strict requirements and rules, regulating the work of subjects of stock market participants. These rules provide for the registration and licensing of market participants, tight control of operations and the provision of strict reporting on their operations.

The Philippine regulators adopted the experience of their American counterparts regarding the regulation of virtual assets, obliging market participants to consider them as “securities”, taking active steps to tighten the regulation of cryptocurrency assets in the country.

Philippine free zones support soft cryptocurrency policies. The Cagayan Economic Zone Authority (CEZA) with a special economic status and tax regime, which is located in the north-east of the country, has a regulatory policy that allows the activities of cryptocurrency companies.

In addition, CEZA authorized the ABACA, as a self-regulatory organization, a self-regulatory organization (SRO), to support the implementation and provision of regulatory and supervisory functions in relation to participants in the cryptocurrency market and ICO market.

In 2018, CEZA announced its intention to license several cryptocurrency exchanges and funds. A prerequisite for obtaining a license is compliance with the requirements of AML and CFT.

In order to protect the interests of its citizens, CEZA requirements allowed companies to provide services related to virtual assets only to foreign customers. The license term is 25 years, after which the company is obliged to provide the necessary documents to obtain a new license. Regulators reserve the right to revoke a license on the grounds provided by law.

The Philippine government is closely monitoring the situation around the cryptocurrency market in the country and the global fundamental trends regarding virtual assets.

The economic system of the Philippines increases the investment attractiveness of cryptocurrencies in the region.

South Korea

In 2017, South Korea completely closed the holding of ICOs and the participation of Korean companies in them. The Financial Supervision Authority (FSS) has issued the Financial Investment Services and Capital Markets Act (FISCMA), which prohibited cryptocurrency activities that do not meet or violate legal requirements and standards. Thus, the FSS almost completely banned the implementation of investment projects in crypto assets. According to FISCMA, virtual tokens are considered as “securities”.

In early 2018, the Korean authorities issued Regulations on the activities of exchanges, which obliged cryptocurrency exchanges and their customers to carry out their activities through banks, using the virtual account service.

Requirements oblige exchanges to operate through banks, which in turn do not depart from the requirements of regulatory acts and establish strict rules for exchange services. Particularly tight regulation is in the rules and procedures regarding AML and CFT. The rules clearly limit the amount of operations of replenishment, withdrawal and exchange of funds for customers. Clients are required to undergo verification procedures, and banks generate and provide strict reporting on customer transactions.

In mid-2018, banks tightened exchange requirements according to FATF requirements. These requirements do not oblige market participants to comply with them, but violations or suspicious activity may lead to the exchange getting into the FATF black list and being blocked by the regulator.

Tight legal conditions have jeopardized the existence of most Korean exchanges. And Korean investment projects are forced to submit applications for listing their tokens on foreign exchanges.

Investment attractiveness of Asian countries

The highest value of the indicator of investment attractiveness for cryptocurrency projects belongs to Japan. Despite the ambiguous attitude of other countries to cryptocurrencies and the blockchain, the Financial Services Agency (FSA) of Japan has developed laws and regulations governing the business and areas related to virtual assets. This allowed Japan to take a dominant position as the leading center of cryptocurrencies in Asia and improved the status of this country as one of the main financial centers in the world.

Singapore has created fairly comfortable legislative conditions for doing business in Asia, since there is no bureaucracy in this country, and its legislative base is based on the principles of an open economy. Therefore, Singapore ranks second in the study.

The indicators of other countries indicate the presence of tightly regulated markets, the legal norms of which are not yet ready to be loyal to cryptocurrency as an investment tool. Separately, it should be noted the SEZ of the Philippines, which are ready to open their cryptocurrency markets and use blockchain in the real sector.

All legislative measures should be taken to create a solid legal basis for monitoring business activity, the level of cybersecurity, security of customer funds and the necessary market conditions, in particular minimizing market and currency risks, reducing volatility and reducing the speculative variable in price, to create stable financial and investment tools.