Bitcoin and the global economy are inextricably linked. The crypto coin has been developed as a counter-reaction to the economic crisis of 2008. For many, bitcoin therefore serves as a Plan ₿.

At the moment it seems to be going well economically, but more and more signs point to a new recession. We therefore explain a topic from the macro-economy every Tuesday. So we don’t forget why bitcoin was developed.

Last week we discussed the bond bubble. You can’t actually see this bubble separately from Quantitative Easing (QE). In this article you can read what it means and what the consequences are. Can this be a chance for bitcoin?

More from this series:

What is Quantitative Easing?

Quantitative Easing (QE) means quantitative easing. You can probably still do very little with that. Broadening also means the creation of money. So QE means the creation of money by central banks.

But central banks don’t just create money. They use this money to buy securities, such as government bonds. And buying up securities can have various reasons.

Japan was the first with this. They have been using Quantitative Easing for more than 15 years to combat deflation (price reductions). Buying assets brings more money into the economy. The money will then be worth less, so that prices will rise.

After that QE was used as an emergency measure to guarantee financial stability after the 2008 economic crisis. First by the Federal Reserve in America from 2008, and from 2014 also by the European Central Bank.

These central banks promised to stop the QE program earlier. But it was recently announced that the FED and the ECB will continue with QE. Starting in the coming months, central banks around the world will again be buying billions of dollars and euros in bonds.

What is the purpose of QE?

The idea behind QE is to monitor price stability. And central banks do that by buying up assets such as bonds. That way more money enters the economy. Banks then have more money to lend, and that lowers interest rates. This makes borrowing and spending more attractive.

But QE also has other effects. If more money comes into circulation, it also flows to other markets. This can lead to huge bubbles, for example in the stock market, the housing market and the bond market. And that can be a risk. In the worst case, it can even cause a new crisis if the bubble bursts.

In America there have been several rounds of QE. The graph below clearly shows the effect of QE on the stock market:

But that is not everything. Because more money comes into circulation, currency is worth less. In other words, you can buy less with the same money. As a result, prices are rising. You call that price inflation. Then, for example, a beer suddenly no longer costs 2 euros, but 2.50 euros.

QE is also controversial in the political field. Opponents of QE are afraid that “weak” countries such as Italy and Spain will do the trick, at the expense of the “stronger” countries. The national debt is ultimately bought up by the ECB.

QE is therefore more of an emergency measure for the short term, a drop in the ocean. And yet central banks around the world continue to continue.

New rounds, new opportunities

Up to June 2017, the FED has already purchased 4.500 billion dollars (4.035 billion euros) in assets. And at the beginning of October this year, the US Federal Reserve (FED) announced that it would continue to buy up government bonds. As of October 15, the US central bank buys $ 60 billion a month in government bonds.

The European Central Bank (ECB) is also continuing to buy up government bonds. From November, the ECB buys 20 billion euros worth of debt every month. The ECB will only stop this if interest rates rise again. So far, the ECB has already purchased € 2.650 billion worth of government bonds. Unsubscribed? 2,650,000,000,000 euros.

For the ECB this means the second QE round, for the US market it is already the fourth round. Together they are astronomical amounts. In comparison, the gross domestic product of the Netherlands in 2017 is 725 billion euros. The ECB’s buying program is more than 3.5 times larger.

With bitcoin you protect yourself against QE

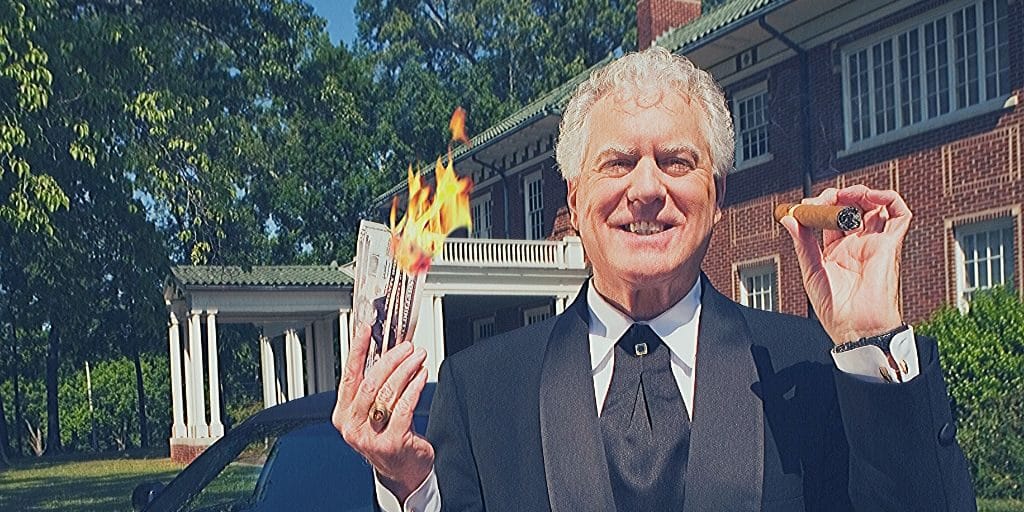

The buy-out program of central banks is causing a monetary mess. QE creates bubbles in all kinds of financial markets. And because money continues to be pumped into the economy, your money gets worth little by little.

And you can’t help it at all. Or is it? Bitcoin is an independent currency without any involvement of central banks. With bitcoin it is possible to protect yourself against depreciation of your money by QE.

Bitcoin’s monetary policy is transparent, you can just find it in the code. And the rules are simple. A maximum of 21 million bitcoins will come into circulation. In addition, the influx of new bitcoin is predictable. Unlimited bitcoin printing does not exist.

Want to know more about bitcoin? Then view this page.