It is the end of the year, and that is always a good time to look back. But also to look far ahead. What do we expect from the bitcoin course in 2020?

Bitcoin always goes on

While everyone is at the Christmas dinner, bitcoin will continue. Bitcoins are traded day and night, 24 hours a day, 7 days a week. But it may well be that many traders took a break in recent days. Apart from an outlier on Boxing Day, the rate moved in a margin of less than a hundred euros. And that is nice and quiet for bitcoin concepts.

Since November the bitcoin rate has been moving in a wide margin, between 6,000 euros (support) and 6,900 euros (resistance).

The price moves mainly in the upper half. Bitcoin plunged twice to 6,000 euros, but managed to recover quickly. At the time of writing, bitcoin moves between 6,400 euros and 6,500 euros. You can now see this zone as a kind of support.

Trend line from 2019 is coming back

Time to look back! Because no matter how you look at it, 2019 was a good year for bitcoin.

The rate has almost doubled compared to January. But especially from April it went fast, the course shot up. We therefore return to the trend line that was important at the time. The circle is round, because bitcoin has again found support on this line:

Bitcoin found support on the trend line three times in March, before the price flew to 12,200 euros. Since that summit, bitcoin has lost almost half in value, but the support on the trend line is now a bright spot.

Does the price touch the trend line more often? That forms the basis for a more calm growth towards the bitcoin block halving in May 2020.

2020 can also be a good year for bitcoin

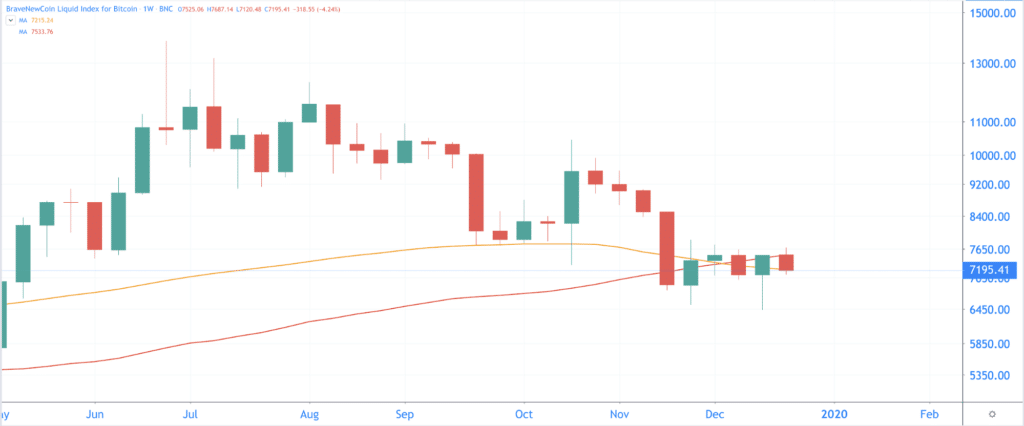

But what does 2020 have in store for bitcoin? To give an answer to that, we zoom out a long way on the graph. You now look at the end of 2014 until now, each candle represents a week.

Shown on the graph are the 50-week Moving Average (red) and the 100-week Moving Average (orange). The line of the short term, the 50-week MA, rises above the 100-week MA. You call that a golden cross, and that is very positive for the course. And especially for the long term, because this golden cross occurs at the weekly level.

But there is a little snag under the grass. In 2016 the price was already in a rising trend. At the time of the golden cross, the rate was more than 25 percent higher than both MA lines:

The situation now is different. The price now moves between the 50-week and 100-week Moving Average. If history repeats itself, the rate should not fall below the 100-week Moving Average for too long. That level is now around 6,300 euros:

Bitcoin was perhaps a little too enthusiastic at the start of 2019

Perhaps bitcoin had risen a little too fast in the beginning of 2019 to be on schedule. And then it is not surprising that the second half was less positive.

What’s up with that? The rate is currently testing the 100-week MA. The rate was broken by the 100-week MA in May, and is now looking for the trend line again.

You also saw that testing in 2016. At that time, the value of bitcoin at the top was 22 percent higher than the 100-week MA. Then the course searched the line again.

Now the movements are more intense. At the 2019 summit, bitcoin was worth almost 110 percent more than the 100-week MA. This includes a correction, the price fell from 12,200 euros to the provisional low of under 6,000 euros.

Is the test successful? Then we can look up again, just like in 2016.

What do we expect from bitcoin in 2020?

That remains a difficult question, there is no one who can give you the answer exactly. What we do know is that the bitcoin block halving will take place in 2020. With the bitcoin block halving, the supply of new bitcoin is halved. Does the demand remain the same but the supply is decreasing? Then the price rises.

In the preceding two bitcoin block halvings, this event also caused a considerable upward movement. For example, from the previous bitcoin block halving to the top at the end of 2017, the bitcoin rate has risen by more than 3,000 percent!

And as Mark Twain said: “History does not repeat itself, but it often rhymes.” That is why we compare the price movement in the run-up to the previous block halving with that of 2020.

- In the week of the bitcoin block halving of 2016, bitcoin reached a rate of 756 dollars, converted to 678 euros. We have indicated that level with a horizontal dotted line. That price is almost as high as the previous summit at the end of 2014.

- The course in the run-up to the block halving of 2016 also found support for the 100-week MA, as we discussed earlier.

Will the same happen in 2020? Then we see a gradual rise to 12,200 euros in the first months of 2020. We indicate that price with the second horizontal dotted line. Just like with the previous block halving, this value is just below the previous record.

And talking about the record, it can take a while before it is broken. After the previous block halving, this only happened after seven months, in February 2017. If the price is exactly the same, then the highest price of 2017 will be exceeded in December 2020.

Again, do not consider this a certainty. The circumstances change every day. Still, 2020 can just be a good year for bitcoin. On the new year!