Decentralized Finance (DeFi) is helping to create a next generation financial services system where people do not need to rely on intermediaries and all transactions are carried out instantly and cheaply. In this article, the editors of Bitcoinminershashrate.com reviewed the best DeFi platforms, distributing them in different areas of use. Each project deserves attention and makes life much easier – transferring funds, obtaining loans or additional income, trading becomes more accessible and does not require a violation of confidentiality.

The content of the article

Advantages of DeFi platforms over traditional finance

DeFi is blockchain-based financial products and services that are inherently similar to those we use in everyday life. But with a few key differences:

- Lack of centralized authority . For lending, deposits, and other functions, various strategies are used that do not include a centralized authority that sets interest rates, repayment conditions, etc. Everything works on the blockchain and smart contracts in a fully automated manner.

- The ability to work without revealing your identity . Decentralized platforms do not require a passport or other documents. In addition, the services are available to absolutely anyone with an Internet connection. Relevant for those who, for one reason or another, do not have access to the bank.

- Perspective . Over the past year, DeFi has become perhaps the main player in the crypto market. Interest in them is growing not only from ordinary users, but also from traditional financial institutions and investors.

Defi’s realm includes many different directions. These are credit services, decentralized trading exchanges, stablecoins, insurance services, wallets. Protocols are gradually adapting to new conditions, evolving. All of them are open source, so you can freely take and build your application based on an existing one.

Top 10 DeFi by capitalization

Introducing the Top 10 Decentralized Financial Services (DeFi) Tokens by Market Cap as of 09/21/2020:

- Chainlink.

- Wrapped Bitcoin.

- DAI.

- yearn.finance

- Aave.

- ONE.

- Uniswap.

- Synthetix Network Token.

- Compound.

- Maker.

Up-to-date information on monitoring: https://coinmarketcap.com/ru/defi/ and https://www.coingecko.com/ru/defi.

Review of the best De-Fi platforms

Below we will consider the demanded projects from different sectors of decentralized finance.

Decentralized lending

Decentralized loans are an opportunity for any individual or legal entity to take (or provide) a loan, and no third party is involved in this process. Popular cryptocurrencies (like bitcoin, Ethereum) are usually used as collateral, and the loan itself is issued in stablecoins (DAI, USDC). Interest rates are programmed to change every few seconds based on the supply and demand ratio in the protocol. DeFi yield aggregators (such as https://defiyield.info/ , https://yieldfarmingtools.com/pools , https://www.coingecko.com/en/yield-farming ) will help you choose the best options at any given time.

Today lending is the leading direction of using Defi.

- Aave. A lending protocol that allows users to deposit and borrow a wide range of cryptocurrencies using both more stable and variable interest rates. Offers the possibility of unsecured “flash credit”, instant rate switching for an existing deposit / loan and other unique features.

- Compound. One of the most requested credit protocols in the industry. Uses smart contracts responsible for storing, managing and distributing total capital. The native COMP token does not provide economic benefits, but allows voting on a wide range of platform changes. To access the markets, you can use the Web3 wallets Metamask, Argent, Coinbase Wallet.

- Curve. Curve Finance leverages liquidity pools to provide highly efficient stablecoin trading and minimize risk for liquidity providers. The site allows you to exchange assets and choose the most profitable options for managing funds. Thanks to the support of a large number of different pools, a participant can at any time move funds to where it seems more profitable to him.

- DFI.Money. A liquidity aggregator that provides an automated strategy to grow profits across a range of credit pools. Provides several different options – loans, deposits, exchange, as well as insurance against financial losses. For all of the above, integration with external credit pools is used. There is a native YFII token for managing changes in the ecosystem.

- Bella Protocol. Bella’s decentralized platform provides crypto-landing functionality with a focus on maximizing process automation. In one click, the user can distribute his assets in the most profitable way in order to make a profit. The robot advisor analyzes the assets of the participant and the current market situation. Although the platform token is already in circulation, the project itself will be launched roughly in the fourth quarter of 2020 (some of the functions – in 2021). Today you can familiarize yourself with the site, blog, documentation.

- Wing. The Wing credit pool gives you the ability to decentralize your funds, taking advantage of the interaction between blockchains. The platform is developed based on Ontology. ONT ID (Ontology Decentralized Identity Mechanism) and DDXF decentralized data structure, support self-validation and information management. This allows you to automate credit assessment using smart contracts. The peculiarity of Wing is the ability to check the full value of the user’s assets and his financial history, without showing the full list of these assets.

Decentralized trade

DEX are decentralized exchanges that give users the ability to exchange assets without trusting a third party to store them. It is a secure and powerful trading type. If earlier it seemed that, compared to centralized sites, DEX were too complicated and not suitable for beginners, now the situation is much better. Projects are becoming more and more friendly to novice traders. They also often offer additional bonuses for depositing liquidity.

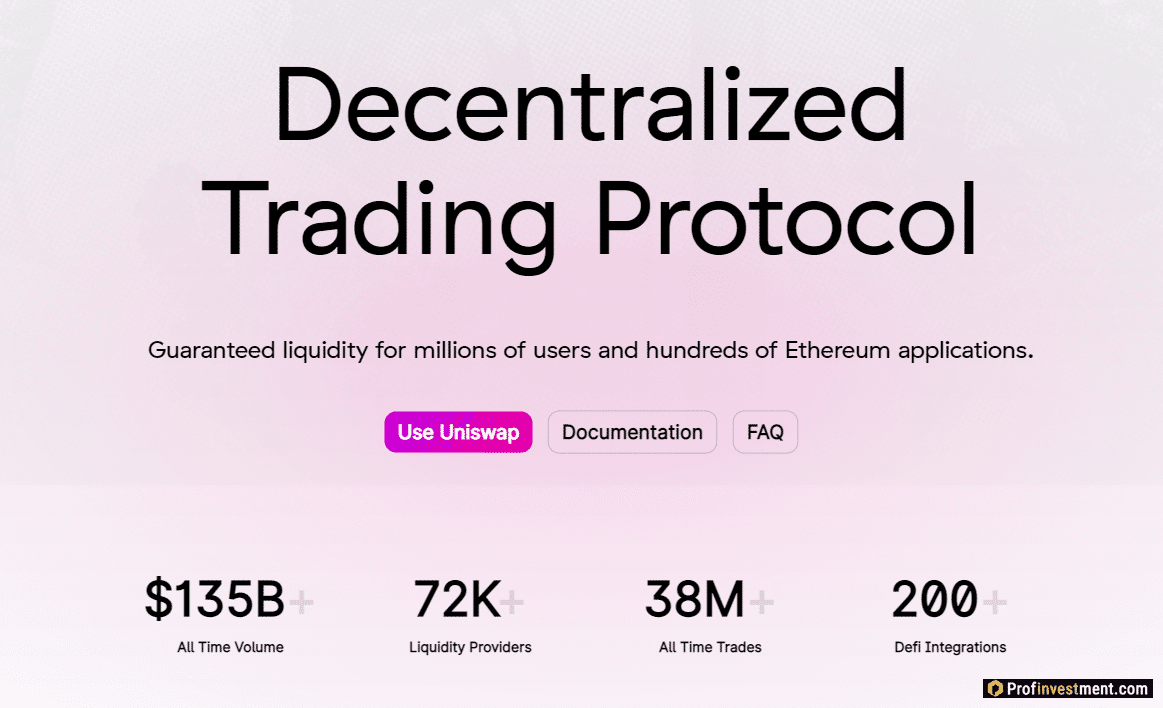

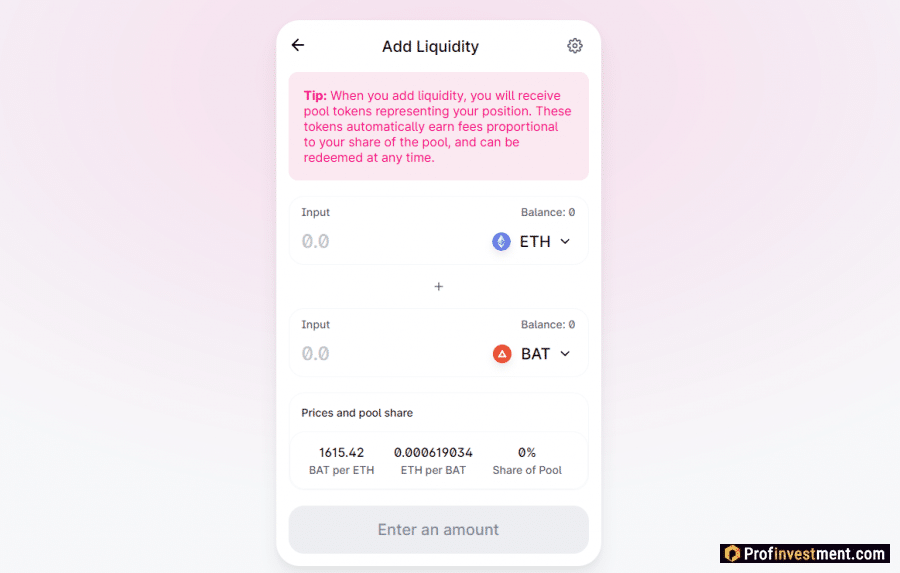

- Uniswap is a platform for trading ERC-20 tokens using liquidity pools; users are financially incentivized for providing liquidity. The AMM (Automated Market Maker) system underlies the work of the site. Orders are not created here in their usual sense, and all exchange operations take place instantly using the funds of the pool. Trading commission – 0.3%, is used to reward liquidity providers. The recently released UNI token serves to enhance platform autonomy and gives members additional governance options.

- SushiSwap. The successor platform of the Uniswap exchange, which inherited liquidity from it and additionally acquired new capabilities. The key difference is that liquidity providers are rewarded indefinitely, even after they have withdrawn the money. However, if liquidity is no longer supplied, then over time, revenues will be greatly diluted and become insignificant.

- Synthetix Network. A platform for creating synthetic assets, which can then be quickly, easily and without intermediaries exchanged for each other. By trading synths, the user avoids high commissions, censorship or restrictions on access to certain assets. Synths can be based on real goods, fiat currencies, cryptocurrencies.

- UMA. This protocol also works with synthetic assets and creates global financial markets on Ethereum. It is based on decentralized oracles and self-sustaining contracts. The protocol is actively used by various external platforms, as it helps tokenize almost anything – stocks, insurance products, futures, market shares, and many others.

Decentralized asset management

These De-Fi platforms offer the best options for controlling your assets, creating them, managing them, tracking statistics. This is an important part of the ecosystem, which helps to avoid confusion and to match the sector’s defaults as closely as possible to their preferences.

- DeFi Saver. A versatile asset management tool for many Ethereum-based financial applications and protocols. With seamless transactions, the user can instantly move funds between protocols, access the best interest rates, manage leverage or liquidation ratios.

- Polkadot. A platform for cross-chain operations, that is, the transfer of any assets (not only crypto-tokens) between different blockchains. Opens up wide opportunities for managing savings, not limited to the framework of the Ethereum blockchain alone.

- Balancer. A multifunctional platform for asset management, which includes an investment portfolio manager, detailed information on user liquidity, information on savings prices, etc. Key aspects also include the ability to create automatically balancing pools.

Decentralized wallets

DeFi is not storage related – none of the projects store user funds, all keys and finances are located directly on each member’s device. To use the functionality, you need a wallet that manages them. Examples of wallets relevant to the Web 3.0 environment:

- Coinbase Wallet. Coinbase wallet (not to be confused with the main Coinbase app). Available in the iOS and Android app stores. Opens access to the decentralized acquisition and storage of cryptocurrency, ERC-20 tokens and other assets, as well as the collection of collectible digital items and other dApps.

- Metamask. A highly sought after Ethereum wallet, usually used as a browser extension, although a mobile app has also recently been launched. Supports all tokens on the Ethereum blockchain, they can be added and removed manually. The wallet is actively used for making transactions in dApps, and much less often for private manual transfers between people.

Decentralized stablecoins

Stablecoins are cryptocurrencies created to eliminate the volatility of digital token prices by pegging to the value of fiat currencies, cryptocurrencies, or other assets.

The best platforms that release and support DeFi stablecoins:

- Wrapped Bitcoin. The WBTC token is pegged to the bitcoin price, but runs on the Ethereum blockchain. The launch of such a platform was initiated by Kyber, Ren and BitGo. Tokenized bitcoin is actively used for trading and lending. For example, WBTC is present in the pools

- pTokens. A platform where anyone can convert their tokens into an equal number of pTokens and easily move liquidity between blockchains while maintaining full collateral in the form of the original underlying token. Fully transparent decentralized mechanism.

- Dai. A stablecoin issued by the MakerDAO system and equated to the price of the US dollar. It works on the Ethereum blockchain, can be used like any other cryptocurrency – it is sent, received, used in lending and insurance.

DeFi earning opportunities

The best DeFi platforms always give the user the opportunity to generate additional income. The main ways to do this are:

- Yield farming . In fact, this is receiving a reward from the protocol in its native tokens for various activities: providing or taking loans, supplying liquidity, voting. You can make money in this way quite well, so this path is now very popular.

- Borrowing funds for margin trading on decentralized exchanges . The user lends his assets as a loan at interest to a trader who is about to enter a long or short position. This is a risk-free method because even if the trade fails, the DEX protocol will automatically return the money to the lender with interest.

- Peer-to-peer lending (credit pools) . Most decentralized financial projects are tied to pools and smart contracts, which makes it possible for some participants to place deposits, while others take loans. Interest in both cases is determined algorithmically, taking into account supply and demand for specific assets.

- Staking . The user’s assets are blocked on his wallet, forming a staking pool. This increases the demand for coins, since there are fewer of them in circulation, and helps to organize transactions on the network.

- Supply of liquidity . Protocols and decentralized applications pay rewards to those who deposit their funds in them. These funds are further used for exchange, trading and other purposes, and part of the commissions from operations is paid to the investor.

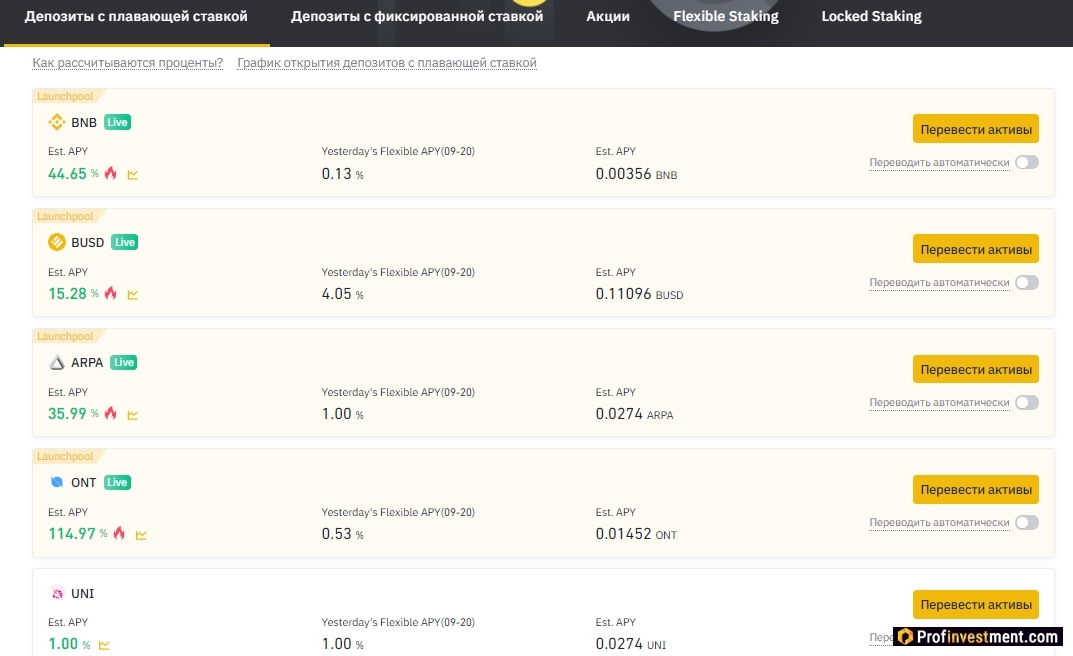

Binance Launchpool

The service from the Binance exchange allows you to receive a certain amount of DeFi tokens as a reward for cryptocurrency deposits. To be eligible for the reward, you must keep a deposit for the specified period (pictures of balances are taken by the exchange daily). The tokens will then be distributed equitably based on the total volume and duration of the holding.

The first “bonus” tokens on Binance Launchpool were WING and BEL. They can be obtained by making a deposit in BNB, BUSD, ARPA, ONT cryptocurrencies.

Conclusion

The potential of the best DeFi platforms is hard to overestimate. Already today, billions of dollars are blocked in the protocols, and the indicators are growing at an enormous pace. New projects are also actively emerging – both created from scratch and based on existing sites – after all, one of the key features of the sphere is open source code. Any specialist can absolutely legally take the code and adjust it for himself. So there are still many new original solutions awaiting us.