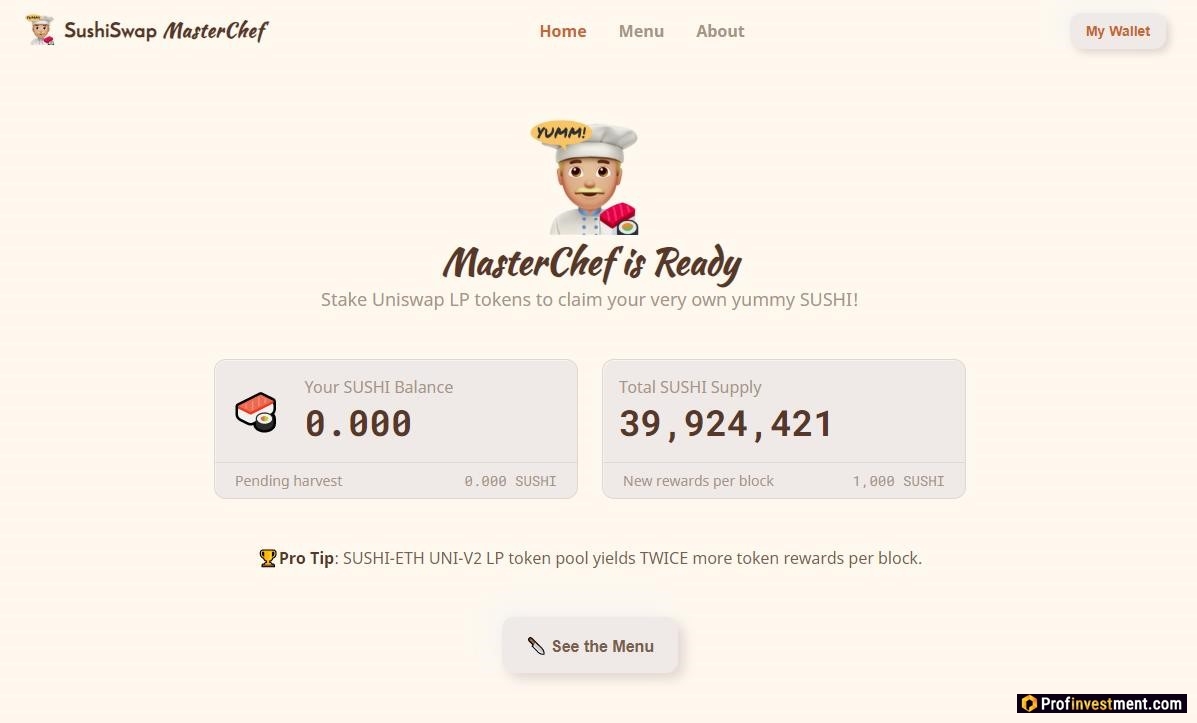

Overview of the token and the DeFi project, course chart, features, prospects, trading and storage – SushiSwap – a project from the creators of the Uniswap decentralized exchange, in fact, its improved version with extended functionality. The user can add liquidity to the pool and receive a reward in the form of SUSHI tokens. This process is similar to what happens in Uniswap, but the key difference is that SUSHI tokens allow you to continue to earn a portion of the protocol’s profits even if you no longer provide liquidity.

It is planned to transfer liquidity from Uniswap to SushiSwap. After the first hundred thousand blocks since the protocol was created (which will take about two weeks), the creators will transfer all liquidity tokens to the SushiSwap contracts. The migration will include redeeming all Uniswap LP tokens on SushiSwap and initializing new liquidity pools. The new pools will be almost identical to the standard Uniswap pool, but with added features, and any fees charged will be distributed to SUSHI token holders. Bitcoinminershashrate.com editorial staff offers an overview of the new SushiSwap project.

The content of the article

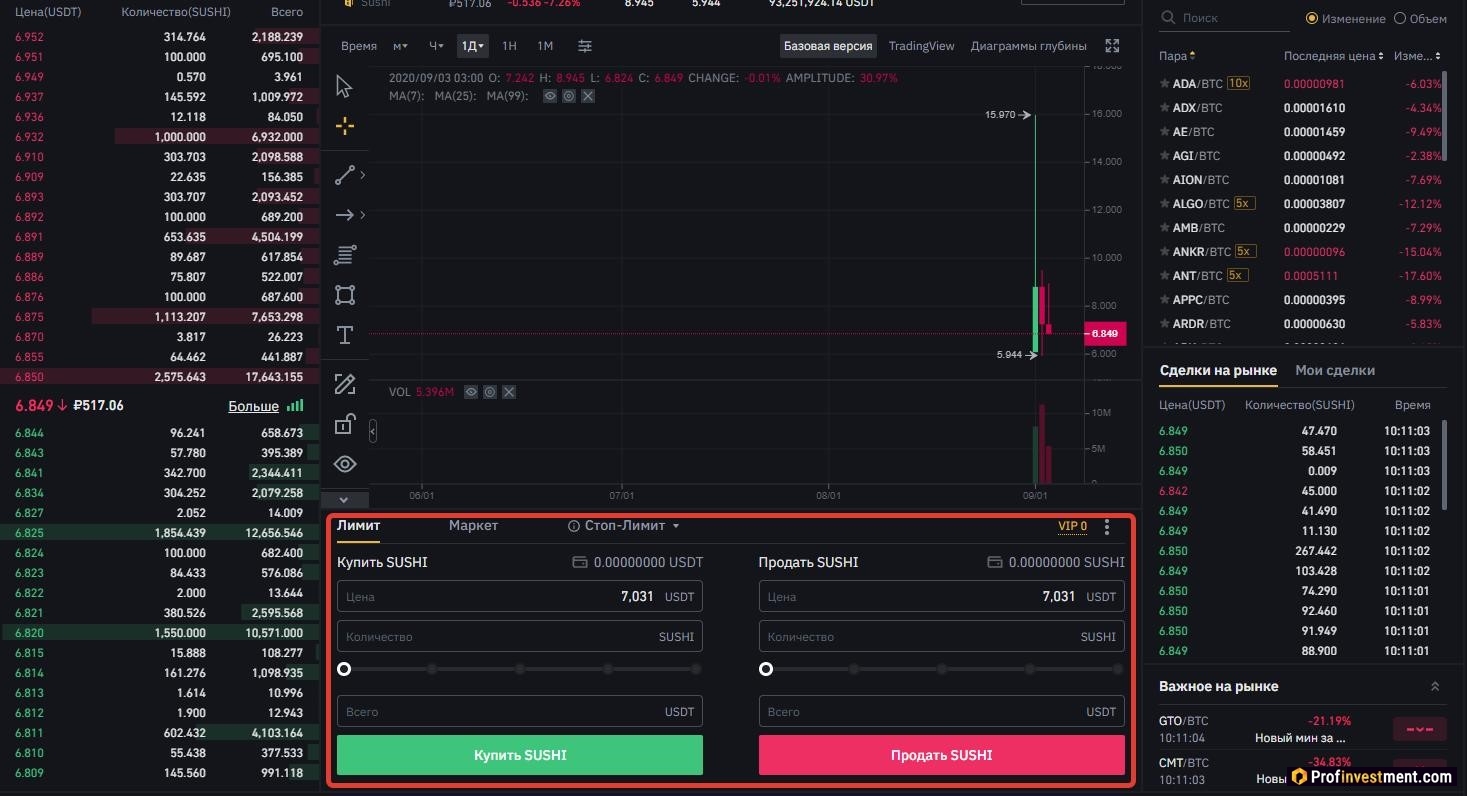

SushiSwap token price chart (SUSHI)

SUSHI / USTD price chart (you can choose another pair) on the Binance trading platform:

general information

| Name | SushiSwap |

|---|---|

| Ticker | SUSHI |

| Blockchain | Ethereum |

| Current issue (as of 03.09.2020) | 39 213 742 SUSHI |

| Course (as of 03.09.2020) | 8,15 $ |

| Market capitalization (as of 03/09/2020) | 341 930 204 $ |

| Official site | https://sushiswap.org/ |

| DEX exchange | https://exchange.sushi.com/#/swap |

| https://twitter.com/sushiswap | |

| Source | https://github.com/sushiswap |

| Exchanges | Binance, Uniswap, Gate.io |

Ways to stimulate liquidity on SushiSwap

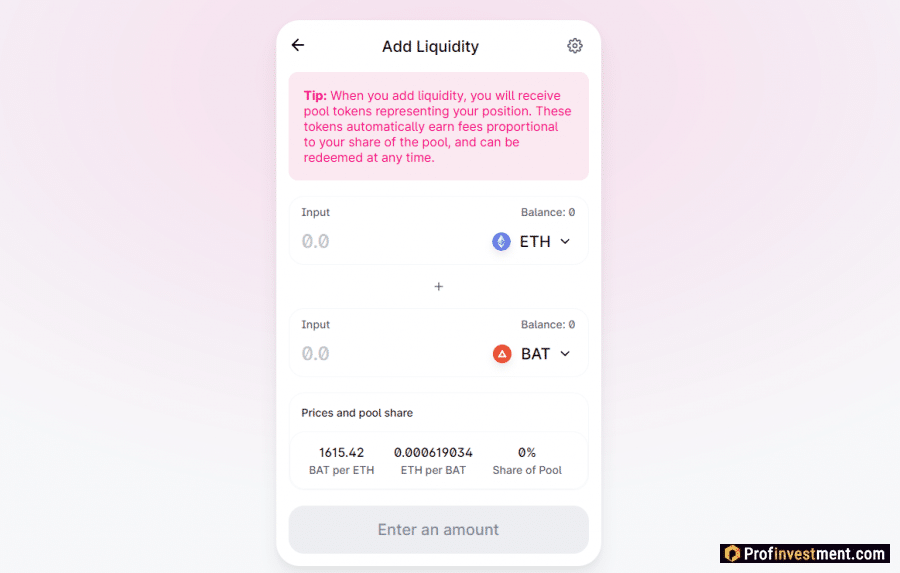

In order to encourage users to create liquidity on SushiSwap rather than Uniswap, an incentive scheme has been developed.

In the case of Uniswap, vendors only receive pool trading fees when their funds are in the pool. But as soon as they take it away, passive income stops. In addition, as the protocol develops and trading volumes increase, the income becomes more diluted, as large investors, mining pools, venture funds, etc. join the project.

You can also add liquidity to the SushiSwap pool and receive a reward (SUSHI tokens). However, unlike Uniswap, early adopters are considered the most significant contributors to the protocol, so even with a withdrawal of funds, they will continue to receive rewards. However, it should be understood that this reward will also be gradually watered down if liquidity is not continued to be supplied.

Those who already use Uniswap and have funds there can transfer them to any of the SushiSwap pools and start earning SUSHI tokens. The reward will start from block number 10,750,000. Each block gives 100 SUSHI, which are distributed among the members of each of the supported pools. Although for the first couple of weeks (100,000 blocks), the reward will be delivered in the amount of 10x to stimulate early participants.

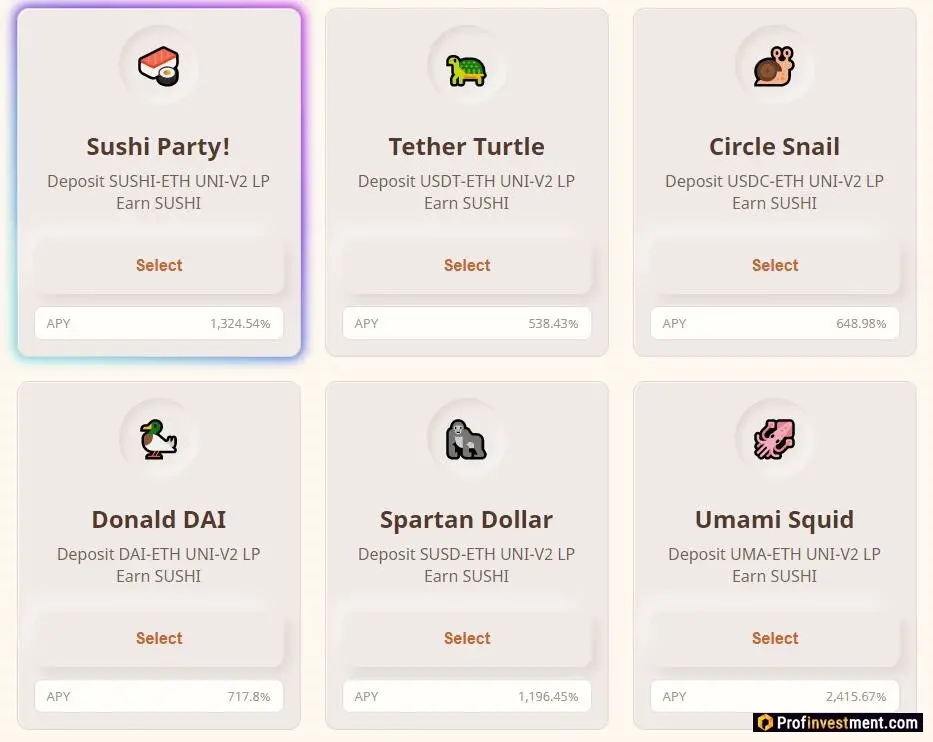

Pools available initially:

- DAI-ETH, sUSD-ETH (DeFi stablecoins)

- USDT-ETH, USDC-ETH (centralized stablecoins)

- SNX-ETH, UMA-ETH (synthetic assets)

- COMP-ETH, LEND-ETH (lending protocols)

- AMPL-ETH, YFI-ETH (pocinomy)

- LINK-ETH, BAND-ETH

- as well as SUSHI-ETH

The latter provides a double reward for users to try to invest in it in the first place. In the future, if the project develops successfully, the community can vote to launch new pools or change the significance of any of them.

How rewards are distributed

In SushiSwap, 0.25% of trading fees are currently going directly to active liquidity providers, while the remaining 0.05% is converted to SUSHI (via SushiSwap of course) and distributed to SUSHI token holders. In comparison, in Uniswap, 0.3% of all trading fees from any pool are allocated to the current liquidity providers of that pool.

The integration of SushiSwap and Uniswap should be relatively easy due to the full protocol compatibility. In addition, work is planned with other DeFi tools and ecosystems.

To make the project more stable and viable, 10% of each SUSHI distribution is donated to the fund. The funds from the fund are used to pay developers, conduct safety audits and future innovations.

SushiSwap DeFi project security

Before launch, SushiSwap was tested on a test network. At the moment, the developers invite large audit companies (Quantstamp, OpenZeppelin, Trail of Bits, Certik, etc.) to audit the open source code. The first company to do so will receive 5 ETH from the creators’ personal holdings.

WT WTFPL licensed contracts are available at https://github.com/sushiswap/sushiswap… Often the code is borrowed from other projects: Compound, OpenZeppelin, Yam and, of course, Uniswap. These sections of code are subject to the licenses of the listed projects.

Where to store SushiSwap (SUSHI)

Currently, the SUSHI token is supported by decentralized wallets such as Metamask and WalletConnect. The most convenient way in this case is to use Metamask, since it is installed directly into the browser in a few seconds, allows you to log in to SushiSwap, and also instantly transfer funds to a pool or withdraw funds.

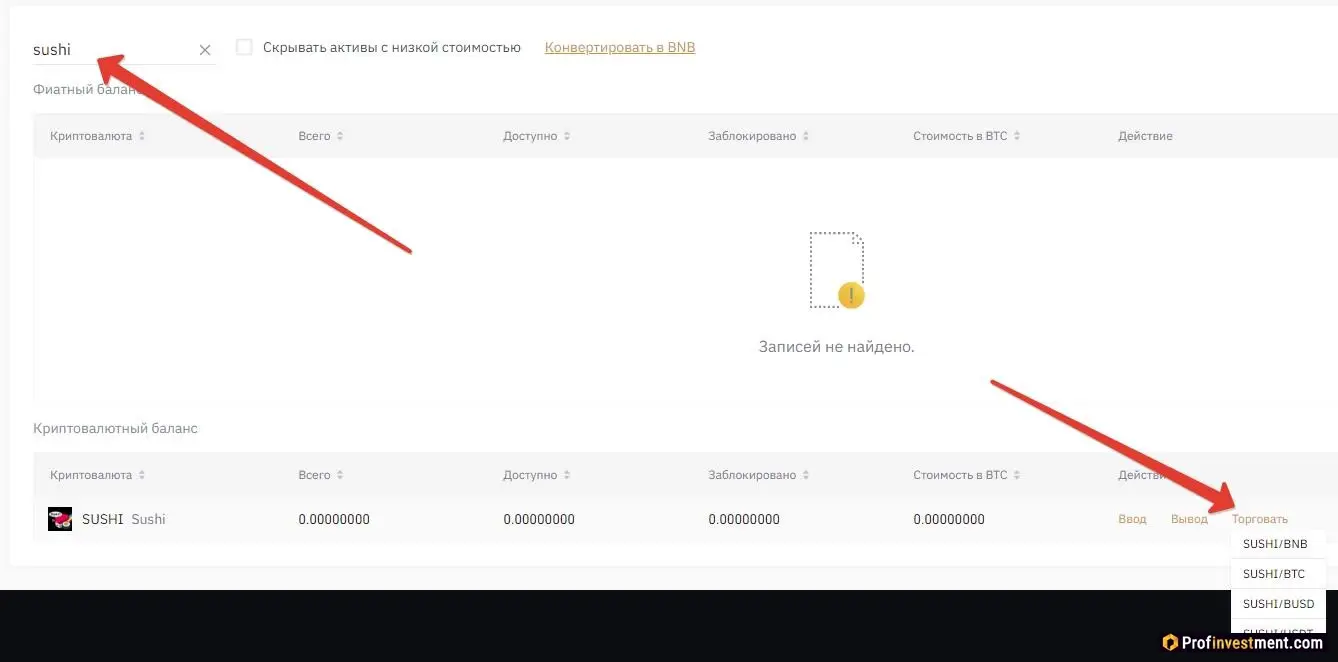

For short-term storage of the token, you can use trading platforms, for example, Binance.

Where to buy, sell, trade the SUSHI token

Since the asset has been listed on Binance from September 1, 2020, you can use this particular crypto exchange to buy.

Create an account on the site https://www.binance.com/ru and go to the “Spot Wallet” section. If necessary, top up your account with cryptocurrency or fiat money (for the second, identity verification is required).

Find the required token through the search. Click “Trade”.

Choose a currency pair from the following:

- SUSHI / BNB,

- SUSHI / BTC,

- SUSHI/BUSD,

- SUSHI / USDT

Going to the trading terminal, you will need to select the type of order – market (then the asset will be bought at the current market rate) or limit (you can specify the desired rate and, if it reaches this level, the order will be immediately executed automatically).

Advantages and disadvantages

Perspectives

Like all DeFi projects, SushiSwap has generated interest from users. Literally five days after the launch, the capitalization of the token has already exceeded $ 250,000,000. The Uniswap fork is good mainly because it does not raise funds for development from third-party organizations, but completely relies on the community, which meets the principles of decentralization.