DeFi (decentralized finance) is an ecosystem of applications that provide financial services without a central authority, using cryptocurrency. It is based on distributed networks, the most common of which is the Ethereum blockchain, ideal for deploying applications. This area of digital technologies is now rapidly developing and includes a variety of services – lending, insurance, stablecoins, derivatives, cryptocurrency exchanges. The editors of Bitcoinminershashrate.com invites you to get acquainted with a detailed overview of the features and components of DeFi.

The content of the article

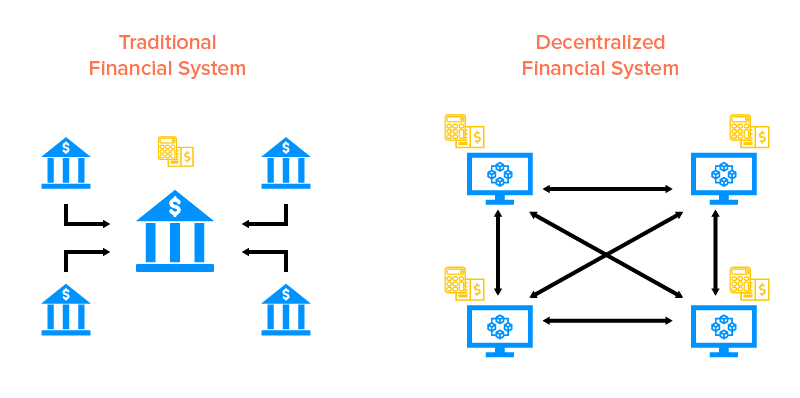

Difference between decentralized and traditional finance

DeFi can perform all the same functions as traditional banks, but much more efficient and convenient… The movement of decentralized finance makes it possible to use loans, open interest-bearing accounts, trade without the need to trust centralized companies. Services are provided through decentralized applications (dApps), usually deployed on the Ethereum platform. At the same time, it is absolutely not necessary to be an Ethereum specialist to use them, although for a deeper understanding of the process it does not hurt.

If we compare traditional and decentralized finance according to the main criteria:

- System of payments and transfers . A bank transfer from one country to another can take several days and involves significant fees. Moreover, there is a complete lack of privacy. The cryptocurrencies that underlie the work of DeFi do not need intermediaries, transfers are carried out as quickly as possible (on the Ethereum network – from 15 seconds, with a commission of about $ 0.02). The benefits are clear.

- Availability . Banks impose strict restrictions on who can open an account, and even more so on the use of financial services such as lending. There are now more than one and a half billion people in the world who do not have access to banking services, and DeFe is guaranteed to make their life easier. To use them, you only need the Internet.

- Centralization . Banks are quite safe in terms of storing funds, but not 100%. And the fall of a large bank necessarily entails a large-scale financial crisis. DeFi protocols are managed by decentralized organizations, and this gives confidence that some people will not be able to make decisions on their own.

- Transparency . The average investor has no idea how his bank account is used. As far as DeFi is concerned, the source code of the protocols developed on the basis of public blockchains is completely transparent to all users and open to audits.

DeFi protocols are code, and it is always executed exactly as programmed, and the same for each participant, without exception. Any vulnerabilities or flaws in the code are immediately apparent.

DeFee’s movement is aimed at solving the main problems of traditional finance: low transaction speed, regulatory control, high fees, limited availability. It is able to eliminate these differences and provide access to financial transactions for every person without any type of censorship.

MonolithosDAO platform experts have identified three of the most important advantages of Decentralized Finances . The first is decentralization, thanks to which control over the ecosystem belongs to all participants at once, transactions are fast and transparent, there are no intermediaries. The second is smart contract management. And the third is open source code, which can be checked and modified at any time, as well as used to form other services based on them.

How DeFi is used

Decentralized finance has found its way into more than ten mainstreams – and there is no doubt that the list will continue to grow. Let’s take a closer look at each of them and you will see why exactly the principles of DePhee in them fell into place as much as possible.

Stablecoins (stablecoins)

Stablecoins are cryptocurrencies, the rate of which is always equated to fiat currency. They were created to mitigate the high volatility of digital currencies, which can reach 10% in a single day. One of the first centralized stablecoins was Tether (USDT) pegged to the US dollar. It is very popular, and yet it has one major drawback – the owners are forced to trust the company that issues the coins in the fact that dollar reserves do exist in the corresponding volume.

Decentralized stablecoins are issued by overcollateralization by decentralized autonomous organizations. They work in public registries, and anyone can check their stock absolutely freely. Stablecoin cannot be called an application, but it is an important component of most applications from other categories, so it was considered at the very beginning.

An example of a decentralized stablecoin is Maker ( https://makerdao.com/ru/ ). Maker Dao

Deposits and Loans (Landing Platforms)

Loans and deposits using cryptocurrency are not news, but initially such platforms were only centralized, they are still in demand today. Of course, decentralization was able to bring a lot of new and useful things into this area.

Traditional financial systems require a person to have a bank account in order to use credit or deposit money at interest. At the same time, a significant part of the world’s population does not have an account, just as there is no way to open one. This is not the only problem. Obtaining a loan from a bank is also accompanied by other obstacles: you need a good credit history and a stable official income.

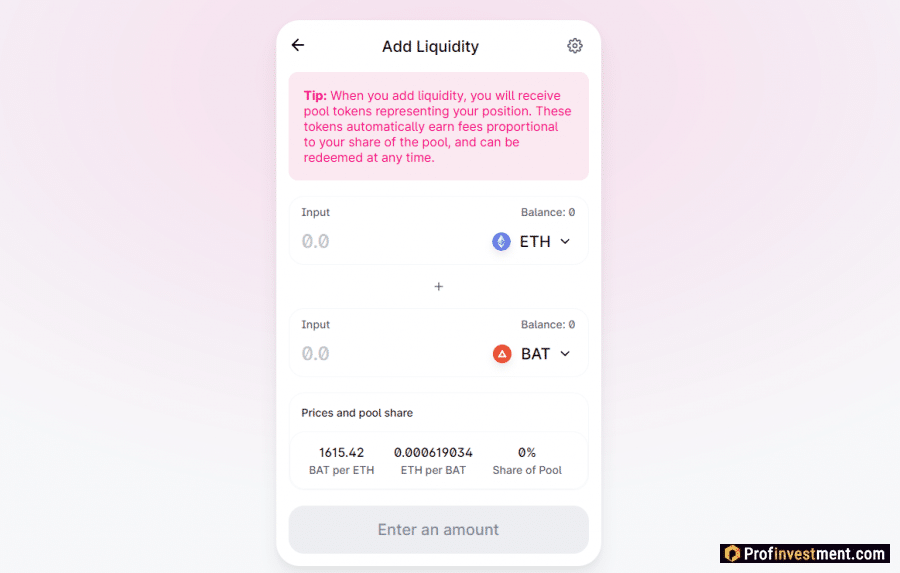

DeFi lending is based on the concept of credit pools – some users invest cryptocurrency there in order to earn interest, while others can take out a loan secured by cryptocurrency, and with very loyal interest rates and without any credit checks. The pledge itself is evidence of collateral.

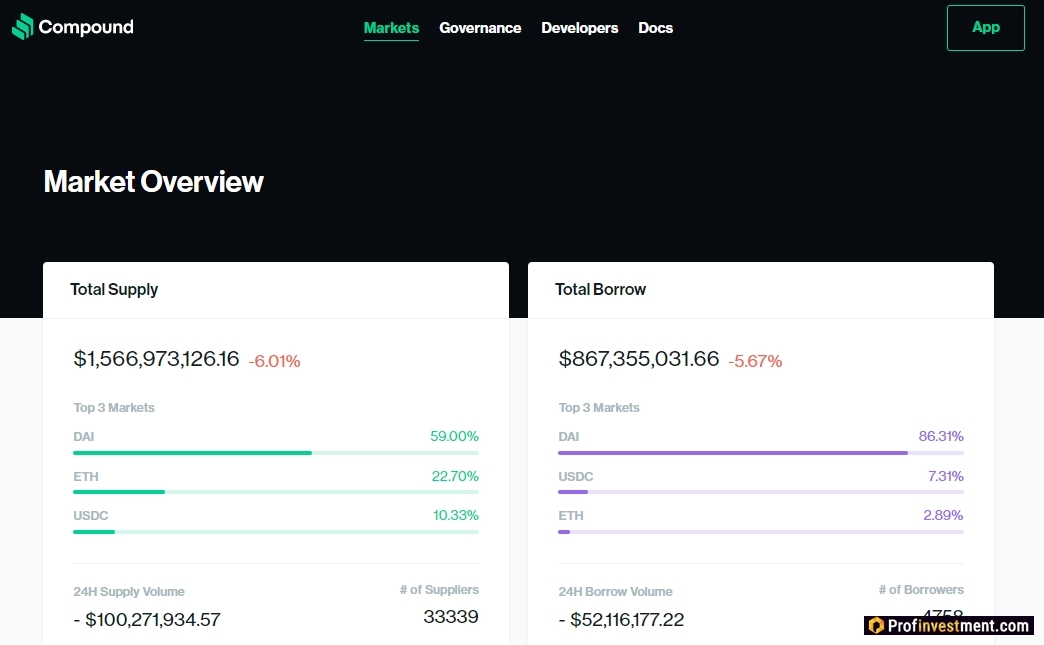

The largest credit pools are Compound ( https://compound.finance/ ) .

Insurance

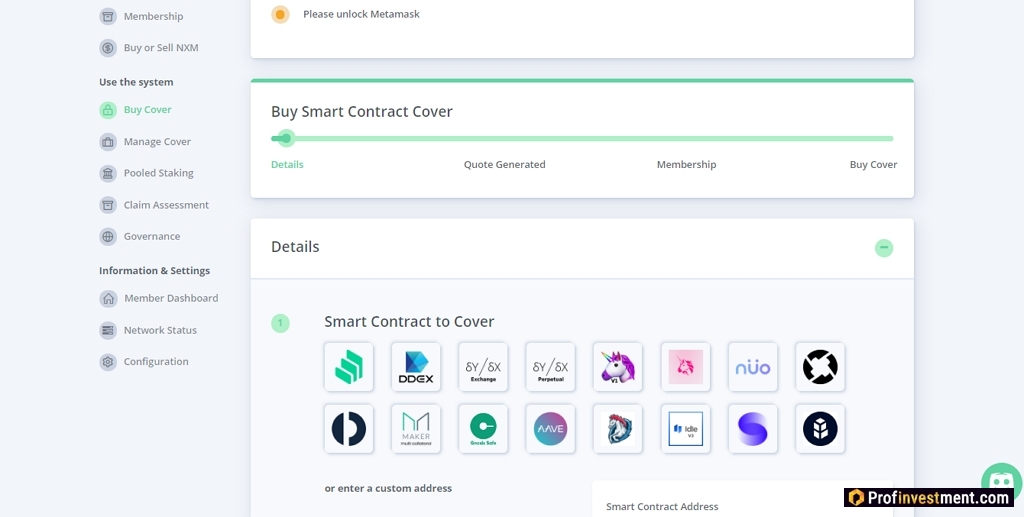

The tokens used in smart contracts are potentially vulnerable – hackers want to gain access to them. Of course, the code of most of the demanded projects has been checked for vulnerabilities, but the risk always remains.

Insurance is required to cover damages in the event of unauthorized hacking, especially when it comes to large amounts. Developed a decentralized insurance protocol Nexus Mutual ( https://nexusmutual.io/ ), which offers insurance for any smart contract running on the Ethereum blockchain.

Derivative contracts / synthetic assets

We are talking about derivatives – contracts, the value of which is determined by the value of underlying assets – cryptocurrencies, indices, stocks, commodities, bonds, etc. Derivatives are used by traders to hedge the risks of transactions.

Derivatives are now traded mainly on centralized exchanges, but DeFi platforms are emerging for this purpose. They are protocols for synthetic assets that track the value of the underlying assets and allow access to them without the need for acquisition.

The largest DeFi derivative protocol is Synthetix ( https://www.synthetix.io/ ).

Decentralized Crypto Exchanges (DEX)

Centralized exchanges like Binance or EXMO both mediate trading and store user assets. Clients have no control over their funds, and if the exchange is hacked, there is a risk of financial loss.

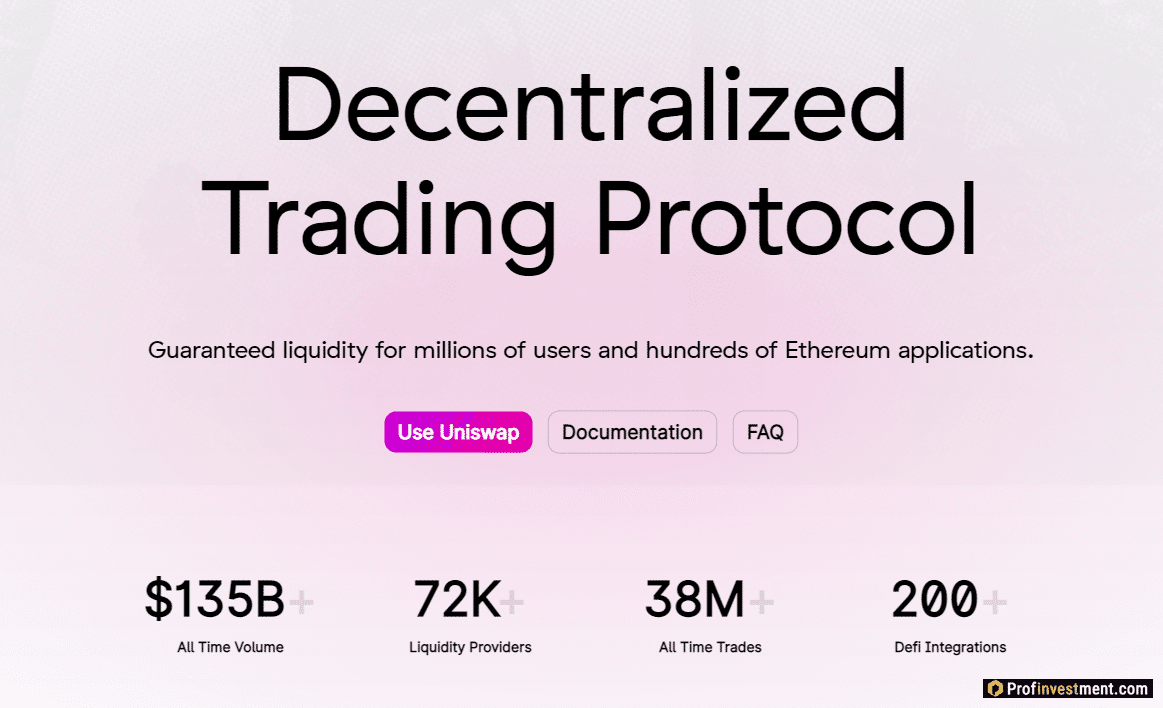

To solve this problem, decentralized exchanges DEX have been created. Through them, users can exchange assets directly without trusting anyone to store them. Examples of such exchanges: dYdX, Binance DEX, Uniswap . They operate on the blockchain, do not store confidential customer data on servers, and only provide a service for matching orders for the purchase and sale of assets.

Transactions

One of the main values of cryptocurrencies and decentralized systems is the direct transfer of assets from user to user without the participation of intermediaries, which means without delays and overpayments. With the advent of DeFe projects, there are even more opportunities for implementing various interesting solutions.

We can cite as an example the Sablier project (https://sablier.finance/) , which changes the configuration of payments – now, instead of the usual transactions, these are peculiar flows. This gives quite a lot of potential opportunities that are highly accurate.

Issue of tokenized securities

Such DeFi projects decentralize the issue or creation of securities in order to avoid turning to any intermediaries (in traditional financial structures, these intermediaries are usually played by investment banks). The market for tokenized securities implies the issuance of tokens with the properties of securities (they are called security tokens). It is noteworthy that they fully comply with the legislation on securities.

Usually, security tokens are backed by assets or give the right to a share of the issuer’s profits. They can also be:

- debt instruments;

- investment instruments;

- digital shares of an asset;

- derivatives.

One of the advantages of security tokens over standard shares is the increased liquidity – they can be split into smaller units. Thus, even despite the low liquidity of the underlying asset, the tokens related to it can be quite liquid.

Securitize, Polymath are examples of platforms that provide functionality for the issuance of tokenized securities and their further management, up to communication with investors.

Lottery

A non-standard, but quite reasonable use case for DeFi is the transfer of control over the lottery prize fund to a smart contract on the blockchain. That being said, it is easy to link the lottery app with other dApps to create a truly complete structure.

Participants pool their funds into a single pool, then the total capital is transferred to the DeFi lending application. The resulting interest is transferred to a random winner at a certain interval. As soon as the winner is determined, the smart contract returns to everyone his contribution – thus, the lottery is a win-win.

An example of such a protocol is PoolTogether.

Investment portfolio management

Portfolio management implies the control of existing financial assets and their redistribution in order to maximize income. It happens:

- Active – when the goal is to get a specific profit not less than a given benchmark.

- Passive – when the goal is simply to make a possible profit without specific requirements.

Some DeFi projects help implement decentralized passive portfolio management. Thanks to transparency, the user always sees how his funds are being managed and what income and expenses may be incurred.

An example of a service for managing an investment portfolio: TokenSets (https://www.pooltogether.com/) .

Peer-to-peer prediction markets

Many jurisdictions prohibit gambling and the event betting industry (sports matches, elections, or other events). Therefore, a kind of decentralized prediction market has formed. An example of such a platform is Augur , where anyone can place bets on certain events, as well as sell or buy shares of potential profit. And the Numerai platform uses artificial intelligence and algorithms to predict transactions. You can bet on any of the predictions, and the amount of reward depends on the initial amount and the accuracy of the prediction.

Is it difficult to use DeFi services?

Despite the fact that applications are open and accessible to absolutely everyone, one of the main problems can be called their mastery by users. Blockchain developers are now primarily working on this. For instance:

- The Argent wallet eliminates the need for a seed phrase to restore access to the wallet, allows free transactions on the Ethereum network, is equipped with integration with Compound and other DeFi projects.

- Gelato Finance allows clients to program actions, for example, set the algorithm to “buy ETH at a price of $ 210” or “send 0.5 ETH to such and such an address on August 27th”.

- The DeFiZap app also removes many of the complexities and issues associated with DeFi products and allows you to access multiple services on the basis of a single transaction.

- Cryptocurrency insurance applications have already been mentioned. This is a good way to increase the safety of keeping savings in credit protocols, although it slightly lowers the profitability.

- There are DeFi profitability optimizers that remove the need to switch between different projects in order to find the best profitability. iEarn, idle.finance , etc. distribute assets independently between applications on the Ethereum blockchain.

- Paraswap, DEX.AG and a number of other services solve the same problem, but with regard to liquidity – instead of looking for the best decentralized exchange for trading, the client can trust these services, which aggregate the liquidity of all popular sites and automatically distribute orders.

- Some DeFi protocols provide the ability to mine as you work with them. Thus, Compound distributes COMP tokens among all lenders and borrowers. Synthetix distributes SNX for collateral. Balancer distributes BAL among users who participate in the creation of liquidity pools. There are a lot of such projects. Thus, using the main functionality, you can also receive passive income.

The developments are emerging very actively, and there are already answers to all the common difficulties encountered by users. There is no doubt that over time there will be an application that combines all the user-friendly features at once.

Risks of using DeFi

Despite all the advantages, there are also dangerous sides to decentralized finance. This is understandable, because the technologies used are relatively new. The main risks include:

- Hacking smart contracts . The code is written by a person, and it is human nature to make mistakes. It makes sense to use only those platforms that have been verified by well-known auditors (OpenZeppelin, Quantstamp, ZK Labs, etc.), although even then there is a small chance that you missed an important mistake.

- Liquidity and credit risks . Cryptocurrency is volatile, and the system may collapse when the underlying asset falls sharply. DeFi protocols try to combat this problem by over-collateralizing loans.

- Lack of funds for lending . With a specific collateral in DeFi you can get a loan much more modestly than in a traditional financial institution.

- Fake oracles . Blockchain protocols receive data (cryptocurrency rates, etc.) from external systems, often centralized. If the source is unreliable, then the smart contract will be executed incorrectly. To eliminate this risk, decentralized source alternatives are being developed.

- Centralized control over development . Whatever one may say, but one team is engaged in the creation of the code. In more cases, developers involve users in the process, but this can also cause problems due to incompetent intervention.

- It is difficult to find a responsible person . The principle of decentralized governance does not always work the way it was originally intended. All users are equal, but among them there are those who aim to collapse the ecosystem, or are simply passive and not going to participate in the process (which often causes no less harm than the actions of intruders).

There is a lot of buzz around DeFi at the moment, so some believe that this is all a bubble, as it was in 2017 with the ICO boom. But the direction seems so promising that it must be assumed that soon the HYIP will calm down and the technologies will begin to be systematically applied in practice.

Advantages and disadvantages

pros

- The speed and low cost of operations in decentralized networks.

- Immutability of information recorded in the blockchain.

- Transparency and openness to audit.

- Lack of centralized management, everything works on pre-programmed smart contracts.

- No one can, unnoticed by others, edit the contract in their favor.

- The DeFe market is available to anyone with an Internet connection, regardless of country of residence or other factors.

Minuses

- Centralized development, as a result of which the quality of smart contracts depends on one team.

- The risk of hacking smart contracts.

- A smart contract may contain an error, and after it is triggered, it is technically impossible to reverse the erroneous operation.

- Open source allows hackers to study the contract and find loopholes for attacks.

- The scalability of DeFi applications depends on the characteristics of the blockchain on which they are located.

Conclusion

The topic of decentralized finance is almost endless, we just went to the top and covered the main aspects. Today, hundreds of applications in this area have been created and are successfully working. Some have become quite popular in a matter of months, like Compound or Uniswap . The potential of DeFi has not been ignored by large companies, for example, the Binance exchange found it necessary to launch a decentralized platform Binance DEX.

DeFi applications and projects can be extremely useful to residents of countries with weak or unstable economies. For example, in Argentina, it was even proposed to give people a salary in DAI in connection with the horrific inflation of the national currency. Services are in demand in developed countries as well, since they offer a more profitable and affordable lending system and open up new opportunities for interest income from investments.