The crypto market suffered a similar shock to the stock markets due to the coronavirus pandemic. Many were pleasantly surprised when Bitcoin went through a sell-off period. The evolution seemed to contradict the idea that the digital asset is a safe haven in times of crisis.

Stock exchanges seem to be still facing major problems, while Bitcoin is showing signs of decoupling from this phenomenon.

Analyst Willy Woo noted that the separation of Bitcon from the S&P 500 began three days ago. Then again, gold, another security asset. began to show unexpected developments.

Currently, cryptocurrency now seems to show signs of accumulation. If true, crypto investors may have outgrown the panic caused by the current global health crisis.

“The next key event is the confirmation of BTC decoupling from traditional markets. Here are a lot of charts, many are positive. I will point out that I do not expect a V-shaped evolution, I think it will follow a period of accumulation before the Bitcoin price rises ”

Willy Woo explained Twitter.

The analyst also showed that the Bitcoin RSI index is in a very favorable position. Specifically, long-term investments at this level have always been profitable.

Bitcoin is enjoying a considerable recovery

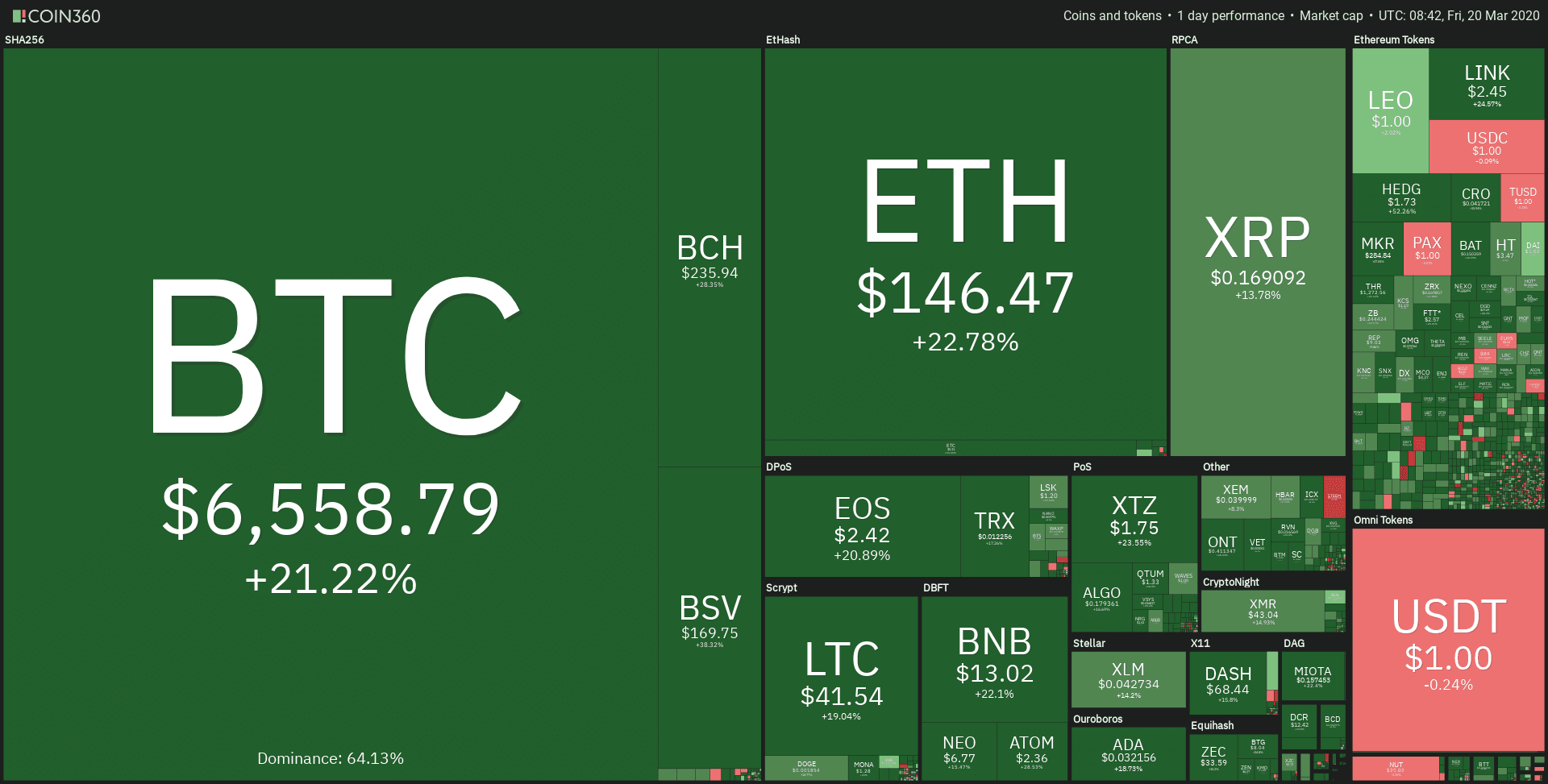

Bitcoin has enjoyed a strong recovery in the last twenty-four hours. After the major correction last week, it has now exceeded the $ 7,000 threshold. This represents an increase of 20% in a single day.

Even if a new slight decrease will occur over the weekend, recent developments are positive.

Despite the current conditions, Bitcoin remains one of the best investments of the last few months. Its price increased by almost $ 2,000 compared to the same period last year. Most altcoins are also growing substantially.

However, the crypto market will maintain its volatility as the global economy goes through a period of chaos. Financial measures taken by authorities around the world will certainly have an effect on Bitcoin as well.

For example, the US government plans to provide $ 500 billion in cash to citizens to offset quarantine losses. This news has also sparked optimism in the crypto market, because at present the population cannot buy gold (jewelry stores are closed in the US). This causes some to argue that people will point to the “other digital”, Bitcoin.

What’s next?

Before the COVID-19 crisis, all the technical aspects indicated a major recovery of the market, and the situation did not change on this front. The halving of the block resumption is still planned in May, and development and adoption are healthy.

The period of volatility also demonstrated the significant risk associated with the speculative trading. Those passionate about margin trading have suffered huge losses in recent days. The best strategy for most investors is therefore HODL.