DeFi – Main ways of investing and buying decentralized finance tokens – Buying DeFi tokens today can be a very good investment if you choose the right and promising project. It is also important to choose the best buying method, which will be safe and fast – the rates sometimes change in a matter of minutes, so delays are undesirable if you want to maximize the benefits.

The Bitcoinminershashrate.com editors reviewed the main resources where you can buy DeFi tokens as profitably and reliably as possible.

Most promising DeFi tokens are available for trading on the Binance exchange.

The content of the article

What are DeFi project tokens

Defi-tokens refer to decentralized financial projects and can act as a tool that gives the right to manage the protocol, or as a reward that provides active users with additional income, etc. Some tokens are highly specialized assets, while others are in demand as functional and investment instruments …

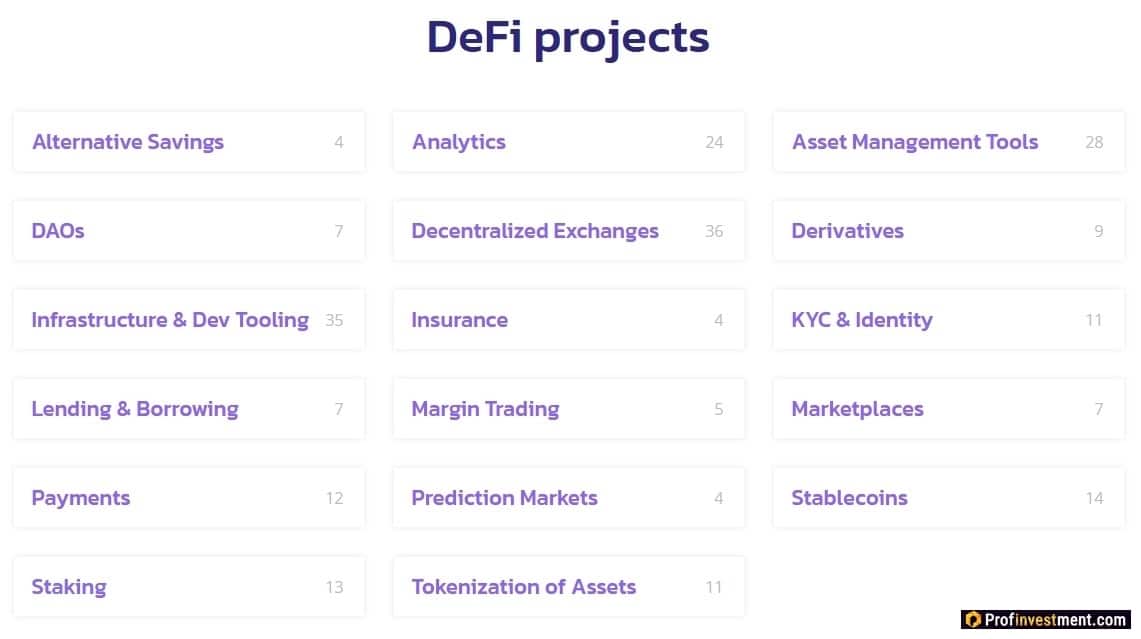

The main directions of Defi projects that use tokens:

- Credit platforms. While some users contribute their cryptocurrency to the liquidity pool, others can borrow it against collateral from the same pool. Typically, the liquidity providers on which such platforms are based are rewarded with tokens.

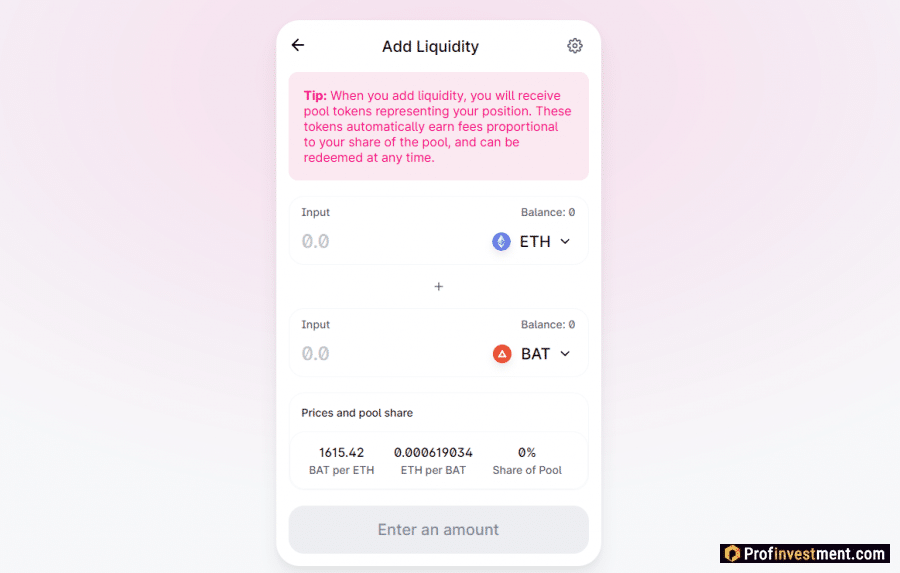

- Decentralized crypto exchanges. They also work with liquidity pools. Two types of assets are added to each pool, and in the future, clients can instantly exchange one asset for another in accordance with the rate formed on the basis of supply and demand. Liquidity providers also receive an incentive in the form of DeFi tokens.

- Synthetic assets. Platforms of this kind use tokens to create tokenized counterparts for any currencies, cryptocurrencies and other assets / goods to facilitate exchange between them.

- Issuing stablecoins, stable exchangeable assets that simplify financial management.

There are a number of aggregators that track the arrival of new tokens on the market. For example, DefiPrime, where you can see the existing decentralized financial projects, divided into categories.

How to choose a promising token

To buy a DeFi token that will skyrocket and generate significant profits, there are a number of factors to consider. Dozens of new projects appear in the industry every day, but at best 10% of them are not scams, they continue to develop and be useful. We bring to your attention some tips and warnings from experts that will increase the likelihood of choosing a truly promising asset.

- Do not confuse pharming with staking, these concepts are fundamentally different – when staking, users own a certain share of the cryptocurrency and help confirm transactions on the network, receiving rewards for this. Farming, on the other hand, implies receiving platform tokens for supplying liquidity to it. The value of these tokens is based only on the value of the project.

- Many new projects are initially released for pharming and pre-mining for developers. Most of the tokens initially go into the hands of the founders, after which they artificially inflate their value, and then sell and receive a large profit. Then the project is closed. The advice is to choose projects aimed at really useful functionality, and not just at farming.

- Like any other asset, DeFi tokens should be selected based on what goals you are pursuing (medium or long-term investing, speculative trading, portfolio diversification). The rest of the selection criteria are similar to those that apply to other cryptocurrencies, and the main one is the quality of the product behind the asset.

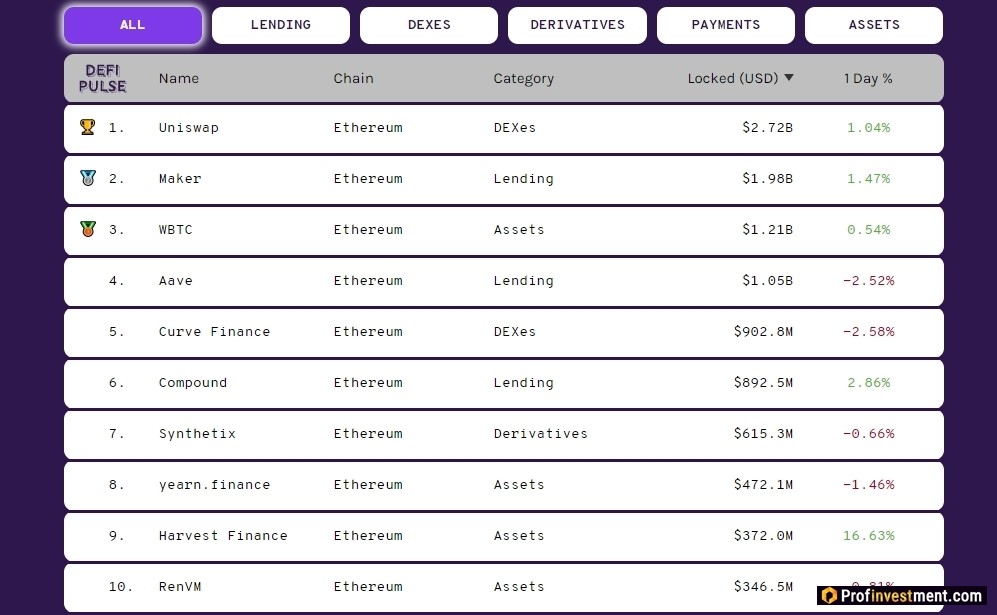

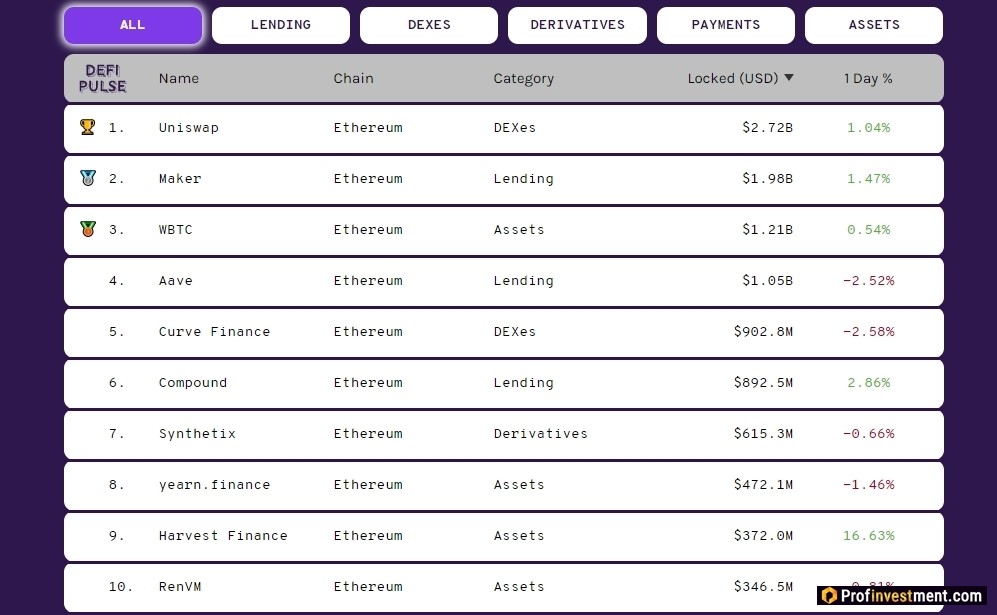

On the DeFi Pulse website, you can view all the popular DeFi projects today – information about their functionality, the blockchain used, the current token rate, the total amount of funds blocked in the protocol and its dynamics, the percentage of issued assets, etc.

Where to buy DeFi tokens

There are three main ways to buy Defi projects tokens: these are centralized exchanges, decentralized exchanges and crypto wallets. Before listing on crypto exchanges, as a rule, they cannot be purchased – decentralized financial platforms rarely conduct ICOs. It also happens that at first a token appears on a little-known exchange, and then when it enters a popular platform, its value increases several times at once – this possibility of earning should not be ruled out either, although for this it is necessary to carefully monitor all movements in the Defi-sphere.

Centralized crypto exchanges

Some centralized sites actively support the DeFi sphere, since it is very promising, and exchanges do not want to miss such opportunities. For example, Binance representatives regularly speak out in favor of Defi-tokens, host them, and in addition, the company launched the Binance Smart Chain blockchain specifically for this kind of tokens.

Centralized trading platforms where DeFi tokens are sold:

- Binance. Binance pays great attention to user sentiment, and as soon as it became clear that the field of decentralized finance was gaining popularity, then this site was one of the first to activate. To date, almost all the top DeFi assets are listed, there is a Binance Launchpool for the pharming of new coins, and new protocols are regularly deployed on the BSC blockchain. Works with FLM, YFI, YFII, DOT, etc.

- Huobi Global. Huobi is investing millions of dollars in the DeFi sector, and a special fund has been established for this purpose. A department has also been formed that will work on research, investment and development of projects in this industry. Although the department’s management notes that the region is still poorly developed and has many problems, no one doubts its prospects. Work with FIL, BTT, DOT, etc. is possible.

- Coinbase. Coinbase is working to bring increased security to the DeFi ecosystem as well as reduce systemic risks. To do this, the exchange has implemented BTC and Ethereum price oracles for Defi projects. The official Coinbase Wallet allows you to earn interest on decentralized finance apps. Work with YFI, UNI, REN, COMP, etc.

- Gate.io. Like other platforms, Gate is actively involved in the ongoing development of the DeFi space and regularly announces the start of trading in new tokens. In August 2020, the exchange announced the creation of the highly secure DeFi ecosystem GateChain, which includes the USDG stablecoin, a decentralized exchange, a lending platform and a liquidity mining tool.

Decentralized crypto exchanges

DEX (Decentralized Exchanges) have evolved significantly since their first appearance. If earlier their shortcomings were slow and expensive transactions, low liquidity, difficulty of development, now the situation is much better due to the active influx of new users. In addition, platforms have appeared based on liquidity pools and thereby remove a number of disadvantages.

Decentralized trading platforms where DeFi tokens are sold:

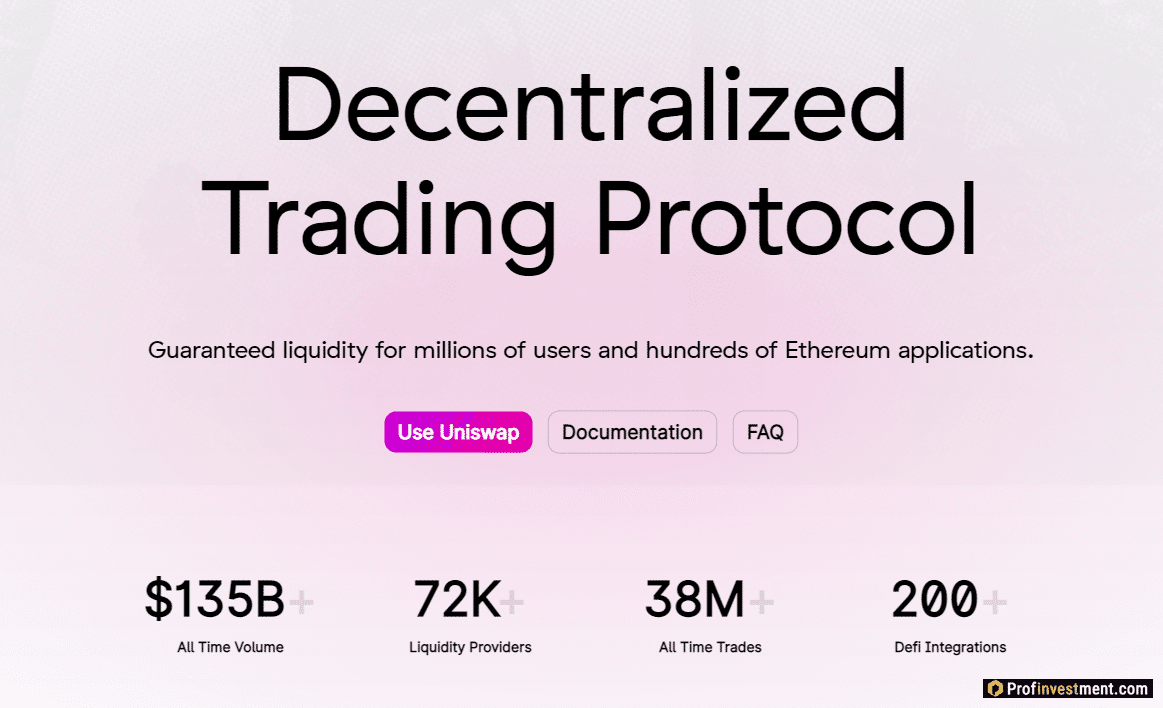

- Uniswap. Uniswap is considered one of the most promising projects in the Defi industry. This is largely due to the fact that the project belongs to infrastructure – that is, it is through it that many new tokens enter the market. At the moment, the demand for such financial instruments is growing steadily. Work with WBTC, COMP, UMA, SNX, etc.

- Binance DEX. The trading platform from the exchange of the same name provides distributed trading services and also supports a large number of new and promising Defi-projects tokens. To work, you will need to create a wallet, but not like on a conventional centralized platform – here the keys and access to funds are exclusively with the user himself. Works with TWT, DAI, UNI, YFII, etc.

- Curve Finance. Protocol for exchanging tokens on the Ethereum blockchain. The liquidity pool is focused on maximizing the benefits of trading stablecoins. The platform features both dollar stablecoins and pegged to BTC. Each supported pool has its own ERC-20 token. Work with WBTC, DAI, renBTC, etc.

Crypto wallets

Some wallets allow you to buy Defi tokens with Bitcoin or other cryptocurrencies. This can be convenient if you use this wallet in one way or another. Examples of services:

- Trust Wallet. The wallet supports many assets located on the Ethereum blockchain (ERC-20). In the application, you can exchange assets using KyberSwap and Binance DEX (while all those tokens that support the designated sites are supported).

- Coinbase Wallet in March, he acquired a full-fledged functionality for working with DeFi, for example, you can allocate funds for lending in protocols and track interest charges on them directly from the wallet. Almost all ERC-20 tokens are supported.

- Silver… Supports over 80 assets on the Ethereum blockchain, including all promising Defi tokens – WBTC, DAI, MKR, etc.). This decentralized wallet is also capable of integrating with credit protocols to use lending / escrow services.

Additional ways to get DeFi tokens

New and promising DeFi tokens can be purchased as a reward for placing currencies on the Binance Launchpool. The user places certain coins and must hold them for a maximum of thirty days (or less) after the start of the countdown. Then the exchange calculates the results and fairly distributes the Defi-tokens among the participants. All tokens distributed in this way also end up on the Binance listing, where they can be bought.

Individual projects prefer distribution via IEO, for example on Binance Launchpad. To participate, the user must hold as many BNB coins as possible, after which he receives a certain number of “lottery tickets”. Then, IEO is held in the lottery format, and ticket holders win the number of tokens that meet the criteria for their participation.

Conclusion

Investing in DeFi tokens can be incredibly profitable, because there are cases when a freshly released token soared thousands of times in a few hours. However, reverse situations are also enough. This market is very volatile and dangerous for inexperienced participants, therefore, if you are not sure, then it is better not to act at random, but to buy tokens only for the amount that will not be critical to lose.